Shopify Payments

Start getting paid

Accept credit cards and other popular payment methods with a payment provider that’s ready to go when you are.

Don’t have a Shopify store? Start for free, then get your first 3 months for $1/mo.

Simple Setup

Begin accepting payments instantly

Skip lengthy third-party activations and go from setup to selling in one click. Shopify Payments comes with your account, all you need to do is turn it on.

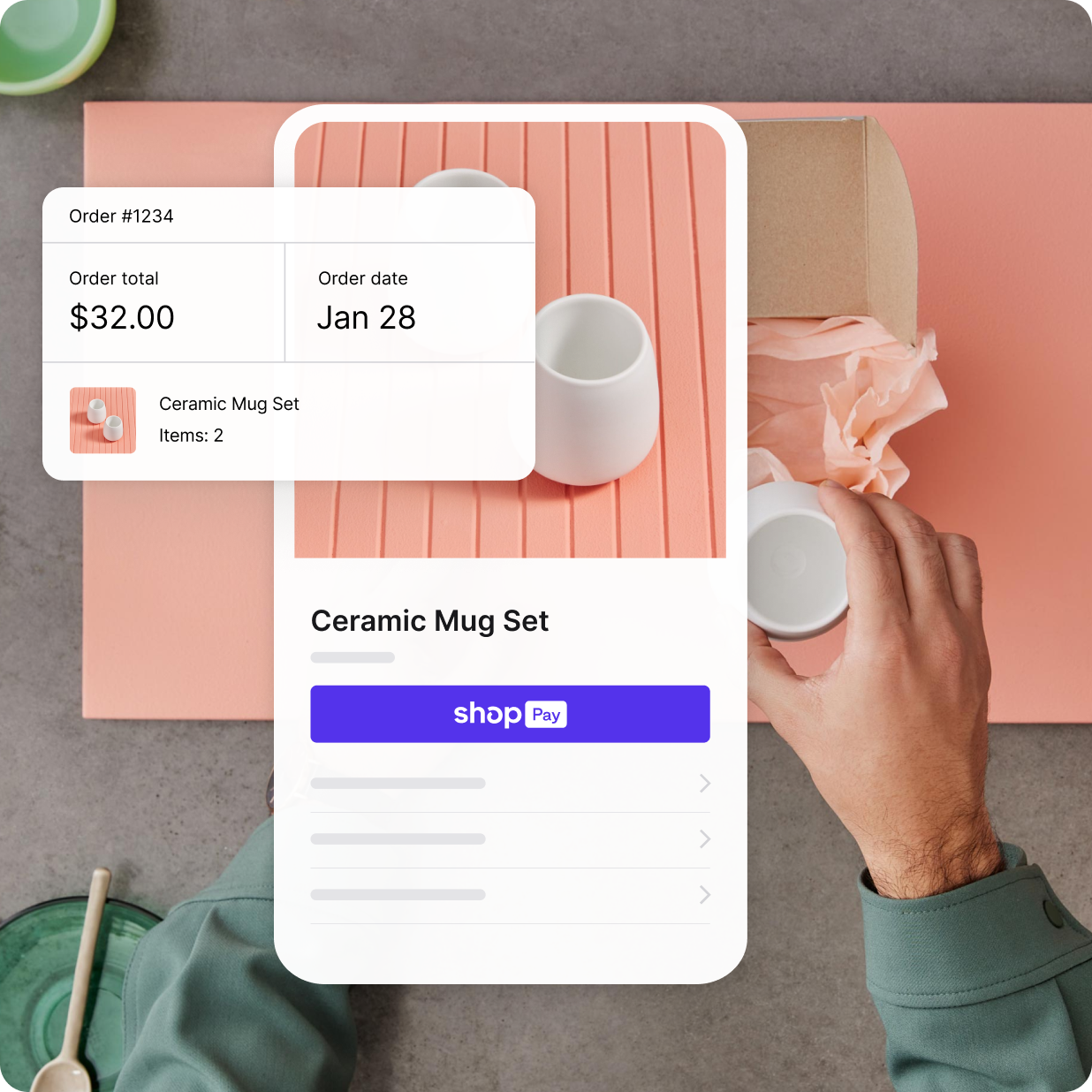

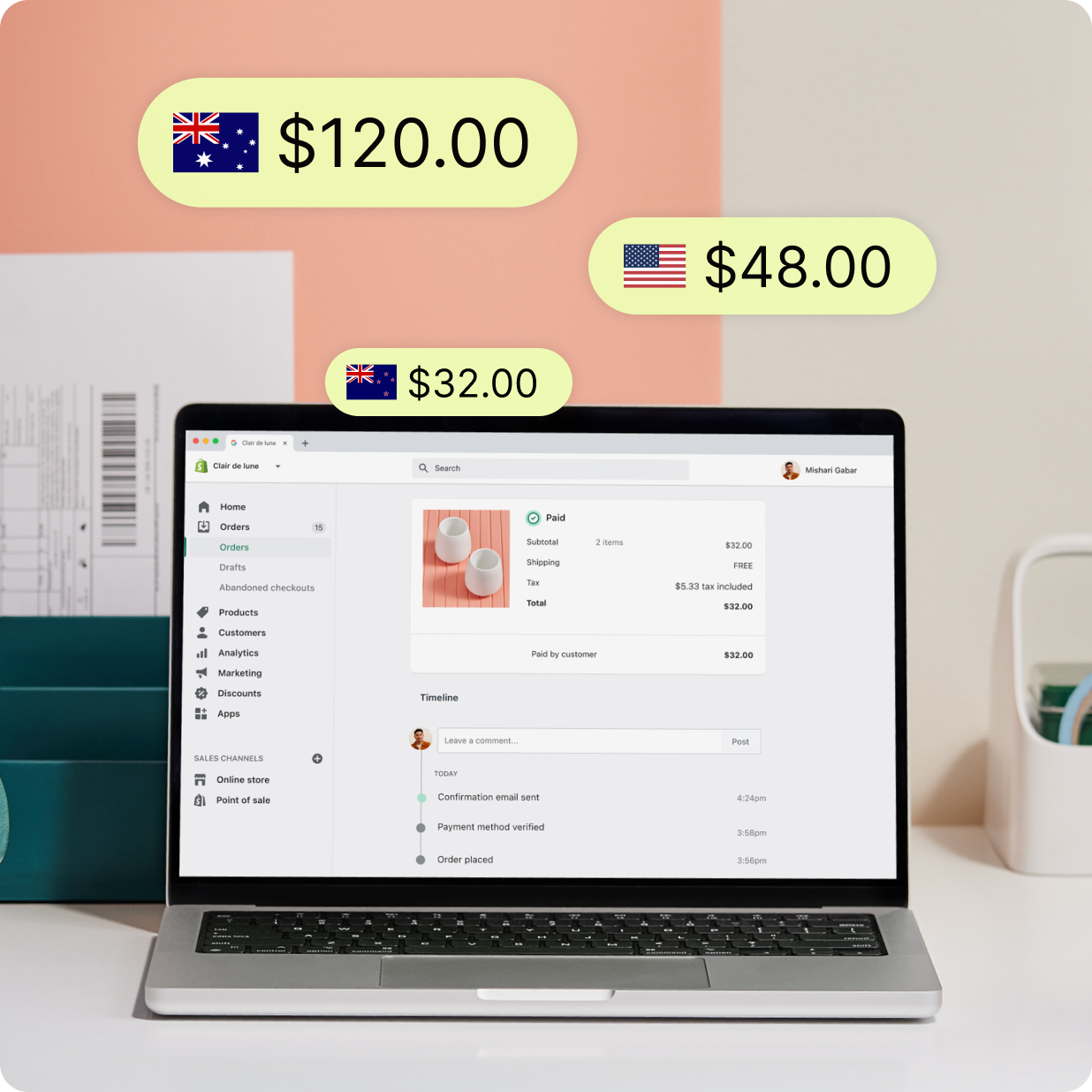

Convenient Checkouts

Let your customers pay their way

Boost conversions when you make shopping simple. Enable popular payment methods and local currencies for smooth checkout experiences.

Keep payment info and business data safe

Shopify Payments is PCI compliant and supports 3D Secure checkouts.

3D Secure checkouts

PCI-compliant servers

Payment data encryption

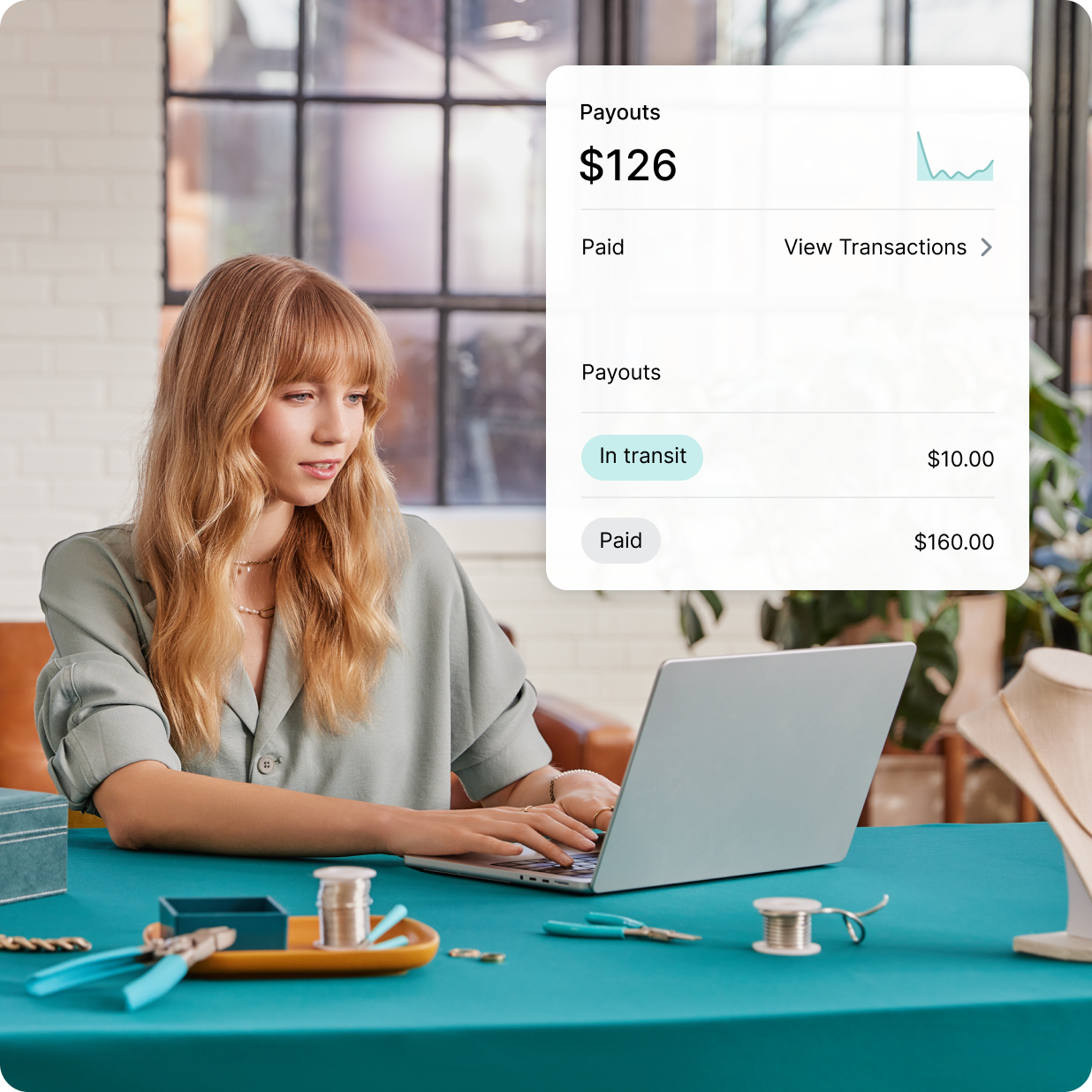

Integrated Back Office

Feel in control of your cash flow

Have a complete view of your finances. Only with Shopify Payments can you track your orders and payments all in one place.

Learn more about Shopify Payments

Browse articles and learn how to accept credit card payments with Shopify.

Browse pricing plans

Show Plan Prices as Pay yearly (save 25%) Subscription Rate

Basic

For solo entrepreneurs

Yearly subscription price $29 USD per month

Card rates starting at

- 2.9% + 30¢ USD online

- 2.6% + 10¢ USD in person

- 2% 3rd-party payment providers

- Fraud analysis

Grow

For small teams

Yearly subscription price $79 USD per month

Card rates starting at

- 2.7% + 30¢ USD online

- 2.5% + 10¢ USD in person

- 1% 3rd-party payment providers

- Fraud analysis

Advanced

As your business scales

Yearly subscription price $299 USD per month

Card rates starting at

- 2.5% + 30¢ USD online

- 2.4% + 10¢ USD in person

- 0.6% 3rd-party payment providers

- Fraud analysis

Try Shopify for free

Explore all the tools and services you need to start, run, and grow your business.

Start free then enjoy 3 months for $1/month