With the launch of your small business, you’ll need to get on top of the accounting tasks that come along with owning a store. While accounting may not be the most exciting part of growing your business, it’s crucial to start off on the right foot.

In this guide, we’ll cover everything you need to know about small-business accounting, as well as some of the best accounting software to consider so you can move to the next step on your small-business finance to-do list.

What is small business accounting?

Small-business accounting is a set of financial activities for the processing, measurement, and communication of a business’s finances. These activities include taxes, management, payroll, acquisition, and inventory.

12 Accounting basics for small businesses

- Open a small business bank account

- Track your small business expenses

- Develop a bookkeeping system

- Set up a small business payroll system

- Investigate import tax

- Determine how you'll get paid

- Establish sales tax procedures

- Determine your tax obligations

- Calculate gross margin

- Apply for small business funding

- Find high-quality accounting partners

- Periodically reevaluate your methods

1. Open a small-business bank account

A separate bank account for business protects your personal assets in the unfortunate case of bankruptcy, lawsuits, or audits. If you want funding down the line, from creditors or investors, strong business financial records can increase the likelihood of approvals.

Start by opening up a checking account, followed by any savings accounts that will help you organize cash flow funds and plan for taxes. For instance, you can set up a savings account and squirrel away a percentage of each payment as your self-employed tax withholding. A good rule of thumb is to put 25% of your income aside, though estimates for high earners might be closer to one-third.

Note that LLCs (See our state specific guides for California LLCs, Texas LLCs, and Florida LLCs), partnerships, and corporations are legally required to have a separate bank account for business. Sole proprietors don’t legally need a separate account, but it’s definitely recommended.

Next, as a new small business owner, you’ll want to consider a business credit card to start building credit. Credit is important for securing funding, as well as potentially financing large purchase orders in the future. Corporations and LLCs must use a separate credit card to avoid commingling personal and business assets.

Depending on the type of business transactions you’ll be making, different business credit cards have different perks. If you plan on spending a lot on travel, for example, a business credit card that offers miles may be ideal. Shopify Credit, for example, offers cash back on the category you spend on the most.

To open a business bank account, you’ll need a business name, and you may have to be registered with your state or province. Check with each bank to find out which documents are required.

2. Track your small business expenses

The foundation of solid business bookkeeping is effective and accurate expense tracking. It’s a crucial step that lets you monitor the growth of your business, build financial statements, keep track of deductible expenses, prepare tax returns, and legitimize your filings.

From the start, establish an accounting system for organizing receipts and other important records. This process can be simple and old school, or you can use a service like Shoeboxed. For US store owners, the IRS doesn’t require you to keep receipts for expenses under $75, but it’s a good habit, nonetheless.

There are five types of receipts to pay special attention to:

- Meals and entertainment. Conducting a business meeting in a café or restaurant is a great option—just be sure to document it. On the back of the receipt, record who attended and the purpose of the meal or outing.

- Out-of-town travel. The IRS and CRA are wary of people claiming personal activities as business expenses. Thankfully, your receipts provide a paper trail of your business activities while away.

- Vehicle-related expenses. Record where, when, and why you used a vehicle for business, and then apply the percentage of use to vehicle-related expenses.

- Receipts for gifts. For gifts like tickets to a concert, it matters whether the gift giver goes to the event with the recipient. If they do, then the expense would be categorized as entertainment rather than a gift. Note these details on the receipt.

- Home office receipts. Similar to vehicle expenses, you need to calculate what percentage of your home is used for business and then apply that percentage to home-related expenses.

Starting your business at home is a great way to keep overhead low. Plus, you'll qualify for unique tax breaks. You can deduct the portion of your home that's used for business, as well as your home internet, cellphone, and transportation to and from work and for business errands.

Any expense that's used partly for personal use and partly for business must reflect that mixed use. For instance, if you have one phone, you can deduct the percentage you use the device for business. Wi-Fi can often fall under this category as well. Gas mileage costs are 100% deductible, just be sure to hold on to all records and keep a log of your business miles (where you're going and the purpose of the trip).

🏁 How to start a business recommendations

- How to finance a small business with no money

- Small business ideas to get you started

- How to get money to start a business

- how to start a business at 16

- How to start a business as a kid

- How to start a clothing business online

- How to start a slime business

- How to start a scrub business

- How to start a hat business

- How to start a subscription box business

3. Develop a bookkeeping system

Bookkeeping is the day-to-day accounting process of recording business transactions, categorizing them, and reconciling bank statements.

Accounting is a high-level process that looks at business progress and makes sense of the data a bookkeeper compiles in financial statements. As a new entrepreneur, you’ll need to determine how you want to manage your books:

- Go the DIY route and use software like QuickBooks or Wave. Alternatively, you could use a simple Excel spreadsheet.

- Use an outsourced or part-time bookkeeper that’s either local or cloud-based.

- If your business is big enough, hire an in-house bookkeeper and/or accountant.

With many paid and free accounting software options out there, you’re sure to find a bookkeeping solution that will suit your business needs.

Small business owners also need to determine whether they’ll use the cash or accrual accounting methods. Let’s take a look at the difference between the two.

- Cash method: Revenues and expenses are recognized at the time they are actually received or paid.

- Accrual method: Revenues and expenses are recognized when the transaction occurs (even if the cash isn’t in or out of the bank yet). This requires tracking receivables and payables.

Technically, Canadians are required to use the accrual method. To simplify things, you can use the cash method throughout the year and then make a single adjusting entry at year end to account for outstanding receivables and payables for tax purposes.

US business owners can use cash-based accounting if revenues are less than $5 million, otherwise they must use the accrual method.

4. Set up a small business payroll system

Many online stores start out as a one-person show. But as a small business owner, there comes the time where it makes sense to hire outside help. To do this, you need to establish whether that individual is an employee or an independent contractor.

For employees, you'll have to set up a payroll schedule and ensure you're withholding the correct taxes. There are lots of services that can help with this, and many accounting software options offer payroll as a feature.

For independent contractors, be sure to track how much you're paying each person. US small business owners may be required to file 1099s for each contractor at year end (you'll also need to keep their name and address on file for this).

5. Investigate import tax

Depending on your business model, you may be planning to purchase and import goods from other countries to sell in your store. When importing products, you’ll likely be subject to taxes and duties, which is worth noting if you run a dropshipping business.

If you’re importing goods, a duty calculator can help you estimate the fees in your own business and plan for costs. For more about import taxes, visit the International Trade Administration (for US businesses) or the Canadian Border Services Agency.

6. Determine how you’ll get paid

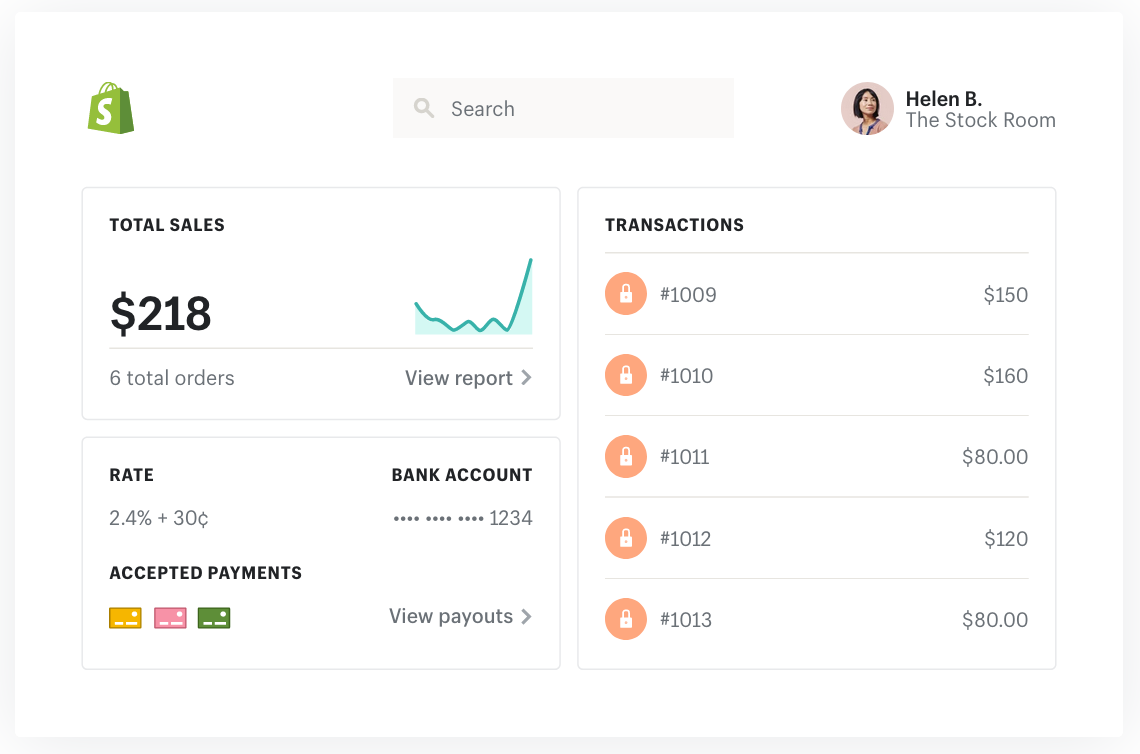

When sales start rolling in, you’ll need a way to accept payments. If you’re a North American store owner on Shopify, you can use Shopify Payments to accept debit or credit card orders. This saves you the hassle of setting up a merchant account or third-party payment gateway.

If you use a third-party payment processor, fees vary. Some processors charge an interchange plus rate, typically around 2.9%, and $0.30 per transaction. Others charge flat fees for each transaction, while some have a monthly membership model for unlimited financial transactions. You can consult this list to help you find a payment gateway that will work for your location.

7. Establish sales tax procedures

The world of ecommerce has made it easier than ever to sell to customers outside of your state and country. While this is a great opportunity for brands with growth goals, it introduces confusing sales tax regulations that can cause headaches down the line.

When a customer walks into a brick-and-mortar retail store, they pay the sales tax of whatever state or province they make the purchase in, no matter if they live there or visiting from somewhere else. However, when you sell online, customers may be located in different cities, states, provinces, and even countries.

Canadian store owners only need to start collecting Goods and Services Tax (GST) and Harmonized Sales Tax (HST) when they have revenues of $30,000 or more in a 12-month period. You can submit the GST/HST you collect in installments. If you want, you can collect GST/HST even if you don’t earn this much in revenue, and put it toward input tax credits.

Selling to international customers can be easier than domestic sales. Canadian store owners don’t need to charge GST/HST to customers who are outside of Canada.

For US small businesses, sales tax gets a bit trickier. You’ll need to determine if you operate your business in an origin-based state or a destination-based state. In the former, you must charge sales tax based on the state where you run your business. The latter requires sales tax to be applied based on the purchaser’s location.

International purchases are tax exempt for US-based businesses. This can all get a bit complicated, so check in with your accountant for detailed information about your specific state’s regulations regarding international sales tax.

8. Determine your tax obligations

Tax obligations vary depending on your business structure. If you’re self-employed (sole proprietorship, LLC, partnership), you’ll claim business income on your personal tax return. Corporations, on the other hand, are separate tax entities and are taxed independently from owners. Your income from the corporation is taxed as an employee.

If you’re ever in doubt about potential tax obligations, it’s wise to talk to a tax professional. Despite the cost, it can save you lots of time and money down the line.

9. Calculate gross margin

Improving your store’s gross margin is the first step toward earning more income overall. In order to calculate gross margin, you need to know the costs incurred to produce your product. To understand this better, let’s quickly define both cost of goods sold (COGS) and gross margin.

- Cost of goods sold (COGS) are the direct costs incurred in producing products sold by a company. This includes both materials and direct labor costs.

- Gross margin represents the total sales revenue that’s kept after the business incurs all direct costs to produce the product or service.

Here’s how you can go about calculating gross margin:

Gross margin (%) = (revenue - COGS) / revenue

You can also use our free profit margin calculator to plug in your numbers for a quick calculation.

The difference between how much you sell a product for and how much the business actually takes home at the end of the day is what truly determines your ability to keep the doors open.

10. Apply for small-business funding

You might have an unexpected downturn in sales due to uncontrollable external circumstances, or maybe you need a financial boost during slow periods in a seasonal business. Brands with big growth goals often need to secure funding to make investments in new product developments, inventory, retail stores, hiring, and more.

Remember, to get a small business loan, you’ll likely have to provide financial statements—a balance sheet and income statement at the very least, possibly a cash flow statement, as well. Shopify Capital makes it simple for Shopify merchants to secure funding. Loans and advances are calculated based on a store’s previous sales, and repayments are made back through the store’s future sales.

Before you sign off on the debt, it’s important to calculate the return on investment (ROI) of the loan. Add up all the expenses you need the loan to cover, the expected new revenue you’ll get from the loan, and the total cost of interest. You can use our business loan calculator to find out the total cost.

11. Find high-quality accounting partners

As a small-business owner, you’ll want to have an understanding of generally accepted accounting principles (GAAP). It’s not a rule, but it helps you measure and understand your company’s finances.

If you need a little extra financial planning help or guidance, many small business accountants and financial professionals can help you get more control of your money. There are a few types of individuals you might want to consider enlisting:

- Certified public accountant (CPA). In case of an audit, a CPA is the only individual who can legally prepare an audited financial statement.

- Bookkeeper. The bookkeeper manages the day-to-day records, regularly reconciling accounts, categorizing expenses, and managing accounts receivable/accounts payable.

- Tax preparer. Your tax preparer fills out necessary forms and may file them on your behalf during tax season. Some will also set up your estimated tax payments.

- Tax planner. These professionals help optimize your taxes before you file them, helping you learn ways to lower your tax burden.

12. Periodically reevaluate your methods

When you first start out you may opt to use a simple spreadsheet to manage your books, but as you grow you’ll want to consider more advanced methods like QuickBooks or Bench. Business financial statements naturally get more complex as you grow.

It’s important to continually reassess the amount of time you’re spending on your books and how much that time is costing your business. This is why learning accounting basics is so important, even if you don’t intend on always doing the accounting yourself.

The right bookkeeping solution means you can invest more time in the business with bookkeeping no longer on your plate and potentially save the business money.

Best small business accounting software

Every business owner needs good accounting software to avoid wasting time with manual data entry. Small-business accounting software is something you use to access financial information quickly and easily. It lets you check bank balances, understand revenue and costs, estimate profitability, predict tax liabilities, and more.

Once you connect your business bank accounts and credit cards to a software, financial transactions show up in a queue and are grouped into categories. You can find all this information on your chart of accounts. Once you approve of the categories, transactions automatically settle in your financial statements.

Some features to look for in your account software include:

- Platform integrations. You want your accounting software to integrate with your ecommerce platform, as well as support third-party app integrations with tools for contract management and more.

- Broad reporting. Most accounting software provides basic reporting. You’ll want one that provides advanced reports, such as inventory and expenses, so you can monitor your business’s financial health quickly.

- Sales tax configuration. Knowing what sales tax you’re required to pay and how much to collect is confusing. The best accounting software makes it easy to account for sales tax.

- Excellent support. Check reviews and support ratings to see how a software company’s customer support is. Aim for 24/7 support and self-service centers.

There are many user-friendly accounting software options for small businesses, ranging from free to paid models. You can also browse the Shopify App store for an accounting software that will seamlessly integrate with your ecommerce store.

Check out the following accounting software you could use to manage your books.

Xero

Xero is a cloud-based accounting system designed for small and growing businesses. You can connect with a trusted adviser and gain visibility into your financial health. It can be accessed from any device. Plus, with Xero’s advanced accounting features, you can view your cash flow, transactions, and other financial information from anywhere.

Benefits:

- Inventory and stock management

- Affordable pricing

- Connects to major banks

- Easy to view and customizable reports

- Contact database and segmentation

- Payroll

- Mobile app

- Bank reconciliation

QuickBooks Online

QuickBooks Online is a small business accounting software run by Intuit. You can use it to snap and store receipts for expenses, track your income and expenses, and more.

QuickBooks shows all your costs, such as inventory and maintenance costs, and every sale your business makes over a period of time. It also offers inventory automation using perpetual inventory tracking, so your sales and inventory cost are updated every time you make a sale. You can also integrate QuickBooks with Shopify to stay organized and up to date.

Benefits:

- Mobile app

- Cloud-based

- Mileage tracking

- Contractor management

- Inventory tracking

- Separating business and personal expenses

Wave

Wave is a web-based accounting solution built for small businesses. With its bank reconciliation feature, you can link your bank accounts, PayPal accounts, and other data sources to see real-time business transactions. You can also generate reports such as accounts receivable, balance sheets, sales tax reports, and accounts payable.

Benefits:

- Affordable

- Competitive credit card processing fees

- Free accounting and receipt scanning

- No transaction or billing limits

- Unlimited number of users

- Mobile app

FreshBooks

FreshBooks is a cloud-based accounting and invoice management software for small businesses. It offers expense management, core accounting, and everything you need to take care of basic bookkeeping.

Benefits:

- Easy to use

- Integrates with Shopify

- Simple pricing

- Customizable invoices

- Detailed self-service support

While there is no shortage of accounting and tax tools to choose from, ultimately you want to use a tool you feel comfortable using and intend to use for a long time. You can always switch tools of course, but that can be a timely process you want to avoid where possible.

Know your numbers to grow your business

Starting a business can be an overwhelming process. By doing your homework regarding banking, transaction management, fundraising, and other accounting topics, you’ll have your new store’s finances in order from the beginning. From opening the right type of business credit card to determining how much revenue you’ll bring in per product, these tasks will all contribute to your business’s success, now and as it grows.

Small business accounting FAQ

How do I do accounting for my small business?

You can set up basic small business accounting records in a spreadsheet, though this is more tedious, prone to manual errors, and time consuming than a comprehensive small-business accounting software. At the very least, you’ll want to track expenses and income in a secure cloud-based platform.

How much should I pay an accountant for my small business?

Small-business accountants range in price, depending on a number of factors. The Bureau of Labor Statistics estimates in-house accountants make an average annual salary of over $70,000. If you’re outsourcing to a contractor or accounting firm, costs vary from a few hundred dollars per month to thousands per month, depending on your needs.

What does an accountant do for a small business?

- Form your business

- Help write a business plan

- Audit your cash flow

- Find cost-cutting opportunities

- Advise on business strategy

- Manage debt

- Chase down payments

- Write and submit loan applications

- Plan budgets

- Set up your accounting software

- Manage inventory

- Recommend business tools

- Help open new bank accounts

- Oversee payroll

- Year-end financial reporting

- Prevent audits

- Advise on personal finances

What does a bookkeeper do for a small business?

- Reconcile accounts

- Record transactions

- Manage accounts receivable and accounts payable

- Adjust entries

- Prepare financial statements

- Send invoices

- Set up and manage technology and tools

- Stay up to date on laws and regulations

- Basic payroll

- Work with your accountant, tax preparer, and tax planner

Read more

- How to Start a Dropshipping Business- A Complete Playbook for 2023

- The Ultimate Guide To Dropshipping (2023)

- How To Source Products To Sell Online

- 6 Tips for How To Be a Successful Dropshipper (Full Playbook)

- 25+ Ideas for Online Businesses To Start Now (2023)

- Amazon Dropshipping Guide- How To Dropship on Amazon (2023)

- What Is Affiliate Marketing and How to Get Started

- The 13 Best Dropshipping Suppliers in 2023

- 8 Steps to Prepare Your Ecommerce Store for Tax Filing

- How to Prepare for Shipping Rate Changes in 2023