Social media platforms are the perfect place to connect with your audience, boost brand awareness, and drive shoppers to your website. But, without a plan, it can feel like you’re throwing spaghetti at the wall and seeing what sticks. This is why it’s important to have a social media strategy.

Even a simple strategy can help you define your target audience, decide what content to develop and share with them, and establish the content types best aligned with your business goals.

Here’s how to create a social media marketing strategy to boost your brand awareness and there’s even a template you can download to get you started.

What is social media marketing?

Social media marketing is the use of social media channels to promote and sell products or services. Any kind of marketing activity that takes place on social media and can be tied to an objective is considered social media marketing.

Platforms like Instagram, TikTok, YouTube, and Facebook offer a direct way to reach out and connect with your customers on a personal level. More importantly, you can reach them where they’re already hanging out.

What is a social media marketing strategy?

A social media marketing strategy brings together your business’ social media marketing goals and plan of action. It can help you uncover what to post on different channels and what tactics you can use to achieve your business objectives.

Whether it’s TikTok ads or influencer marketing, social media lets brands access cost-effective marketing. Like a Swiss Army knife, a social media marketing plan can serve various marketing functions, including:

- Driving traffic and sales

- Tapping into influencer networks

- Building brand awareness

- Amassing an engaged audience

- Connecting with customers and prospects

- Providing customer support

Types of social media strategies

The variety and versatility of social media platforms in 2024 means there are numerous strategies you can try.

- Viral strategies. Jump on trends to explode your reach and increase brand awareness.

- Nurturing strategies. Build deeper connections with customers by sharing behind-the-scenes content and engaging with your community.

- Trust-building strategies. Cement your expertise and credibility with reviews and user-generated content.

- Influencer marketing strategies. Partner with relevant accounts in your industry to spread the word about your brand and products.

- Launch campaigns. Promote your latest product line and create a buzz around your brand.

The importance of creating a social media strategy

If you regularly find yourself thinking “What shall we post today?” you need a social media strategy. Having a plan in place will help you come up with ideas and share content that complements your business goals.

A thought-out social media strategy can help your business:

- Boost website traffic by driving visitors to your online store

- Increase brand awareness by exposing your brand and products to new audiences

- Engage with your customers to learn more about their wants and needs

- Establish authority and credibility by showing up regularly

- Nurture customer loyalty by regularly communicating with existing buyers

- Reduce marketing costs by growing organically

- Tell your brand story to differentiate yourself from your competitors

- Increase revenue by promoting your products to a warm audience

How to create a social media strategy

- Define your goals

- Know your target audience

- Conduct a competitive analysis

- Content a social media audit

- Choose the right social media platforms

- Develop a content strategy

- Create a content calendar

- Use the right social media tools

- Engage with your audience

- Make a plan for customer service

- Leverage influencer marketing

- Explore social media advertising

- Incorporate ecommerce into your social strategy/a>

- Monitor and analyze performance

- Iterate and refine

1. Define your goals

Identify and define what you want to achieve with your social media strategy plan. This will depend on your business, your audience, and your wider marketing strategy.

Examples of social media marketing goals include:

- Increase brand awareness

- Drive website traffic

- Generate leads

- Grow your audience

- Increase engagement

Your goals will guide your strategy and serve as the benchmark for tracking your performance. Avoid generic goals and instead focus on objectives, such as percentage increases or revenue boosts. For example, rather than having a goal of driving more website traffic, you should aim to increase website traffic by 5% every month, or reach 10,000 website visits a month by December.

Create SMART goals

It helps to create SMART goals:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Using the SMART framework means you can track your goals, ensure they aren’t out of the realms of possibility, and make sure they’re relevant to your overall business objectives. Most importantly, they are bound by a time limit. This will increase the likelihood of you achieving your goals.

“I like to start by putting together a list of goals for each platform,” says Mac Steer, owner and director at Simify. “What do I want my audience to walk away from this post thinking? Do I need them to take action? How can I make that happen? Then, once I’ve got some ideas in mind and know what my goal is for each platform, I’ll figure out how best to execute those goals on each platform.”

Choose the most relevant metrics

Measure your progress against your SMART goals by mapping them to metrics.

Your social media strategy should always be data-driven. Aligning your goals to the most relevant metrics will help you track the performance of your strategy and ensure you’re meeting your targets.

Here’s a quick overview of the metrics you might choose:

- Reach. The number of users who see your post.

- Clicks. The number of clicks through to your website.

- Engagement. The number or rate of users who like, comment, or share your posts.

- Sentiment. How users react to your brand.

- Video views. The number of times a video is watched.

- Follower count. The number of followers you gain from your campaign.

- Impressions. The number of times your content is shown to users.

- Brand mentions. The number of times users mention your brand.

- Conversion rate. The percentage rate of users who take a desired action, like making a purchase or signing up to your email list.

2. Know your target audience

An effective social media strategy starts with understanding your customer. Building context on your target audience takes time, but there are steps you can take that will provide lasting value.

Research your customers

Narrow in on your target audience by looking for demographic and psychographic data or observable patterns that help you form an image of who is likely to buy from you. This exercise won’t only inform your initial strategy but also help you develop a voice and tone for your brand that resonates.

Here are some methods to get to know your target audience:

- Run a survey. Collect quantitative data about your audience, such as their age, location, job role, and core interests.

- Conduct interviews. Ask to speak to a handful of your customers to get qualitative data, such as their values, challenges, goals, and pain points.

- Research the competition. See who’s following your biggest competitors. Identify what characteristics they share, what other content they follow and engage with, and any other information you can glean from their social media profiles.

- Check support tickets. Your customer service team has a wealth of information about your customers via support tickets. You can often find pain points and challenges here.

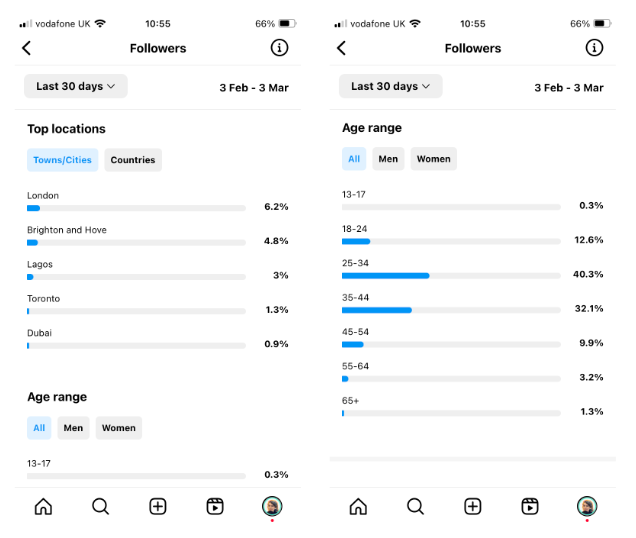

- Dig into your analytics. Most social media platforms have in-built insights that show you information like the age and location of your followers.

Create customer personas

Once you’ve carried out this research, you can create customer personas that match each audience segment. This should include demographic information, like age and location, as well as psychographic data, like interests, buying concerns, and motivation to buy.

You can use this information to build up a picture of your audience and tailor your content so that it resonates with them.

Here’s an example of some of the demographic and psychographic information you can use to get to know your audience.

- Location. Where do your ideal customers typically live? Even knowing just the countries can help, but if you’re a local business or focus on one region, then it should be the cities you can realistically cater to.

- Age. What is the age range of your customers?

- Gender. What gender do they identify as? This might not be as important depending on your brand.

- Interests. What are their interests, hobbies, or passions? These make for effective targeting options.

- Career/industry. What industry do they work in and what job titles have they held? This may not be relevant, depending on your brand.

- Income level. What is the income range of this buyer persona? Are they price-sensitive or are they willing to spend more money for premium products?

- Relationship status. Are they single, actively dating, or married? This may be relevant if you’re in the wedding industry, for example.

- Favorite websites. What type of websites do they keep bookmarked? Do they browse Instagram or TikTok daily?

- Motivation to buy. What reasons would they have for buying your product? Do they want to sport a status symbol or make time to work out despite a busy schedule?

- Buying concerns. Why might they choose not to buy your product? Are they worried about the quality?

- Other info. Anything else that isn’t covered above but would be worth mentioning, such as education, stage in life (parents with newborn kids), or events they attend.

3. Conduct competitive analysis

A competitive analysis will show you what your competitors are doing well on social media and give you an idea of where your brand sits in the market. It can also inspire—but remember to put your own spin on your content.

How to conduct a competitor analysis

- Identify your top five competitors (these can be brands with the same products as you, the same audience, or who share a similar space in the market).

- Research which social media platforms they’re using and how they’re using them (for example, do they predominantly share Stories on Instagram?).

- Explore their top posts and make a note of what those posts include (this can inspire your own content).

- Use social media listening to keep an eye on what your competitors are up to on social media.

- Make competitor research a quarterly task to stay on top of industry trends and to inform your own social media strategy.

4. Conduct a social media audit

Running an audit on your existing social media content activity will help you see what works and what doesn’t. It will give you a better understanding of what content formats and messaging styles your audience prefers, but it will also provide insight into when your audience is online and the best time to post.

How to run a social media audit

- Analyze engagement. Check your insights on each social media channel you use to identify your top-performing posts based on the number of likes, comments, and shares.

- Identify patterns. See if any patterns show up in your insights. For example, you might find that people prefer to engage with videos on your Instagram account or that your followers are most active on the weekend.

- Run audits on each channel. Every social media platform is different—what works on Facebook might not work on Instagram and vice versa, so run an audit on each channel you use.

When you’ve run your audit, assess the effectiveness of each top-performing piece of content in reaching your goals. For example, if followers are engaging wildly with meme-style videos that have nothing to do with your product, you might not hit the product sales targets you were hoping for.

5. Choose the right social media platforms

The social media content audit will shed some light on your best-performing platforms based on your goals, which will help you decide where to focus your efforts. It can be tempting to spread yourself thin across every new channel that pops up, but it’s better to excel on two or three than be inconsistent on six different channels.

When choosing the best social media platforms for your brand, consider:

- Where your target audience is most active

- Your business goals and objectives

- Which platforms are easiest to promote your products on

- Where your content performs best

Which social media platforms should you choose?

Different social media platforms serve different purposes—not least because they each promote different types of content. The platforms you choose will depend on your audience, your products, and what’s most popular in your industry.

Here’s a breakdown of the top social media platforms and what they’re best for.

- TikTok. A short-form video app with a hyper-personalized algorithm that helps brands nurture deeper customer connections through raw, unedited videos and behind-the-scenes snapshots.

- X (formerly known as Twitter). A short-form text-based platform great for asking questions, responding to customer inquiries, and spotting upcoming trends.

- Facebook. A community-based platform with a ton of features for brick-and-mortar stores, including check-ins and reviews.

- Instagram. A visual platform with a suite of social commerce features perfect for brands that want to connect with customers and drive sales.

- Threads. Meta’s new channel helps brands connect on a deeper, text-based level with their customers.

- LinkedIn. A network-focused platform best for connecting with social media influencers and industry professionals and sharing your company wins.

- Pinterest. A visual pinning platform that promotes social selling. Great for beautiful brands with photogenic products.

- YouTube. A video platform perfect for growing a community, sharing long-form content, and driving traffic to your website.

Drinks brand Aura Bora regularly shares unedited Q&A videos from its social media manager.

Set up your social media profiles

Once you’ve decided which platforms to use, take some time to set up your profiles. You ideally want to create a cohesive look across platforms while making sure you provide all the information you need to include.

Here are some tips:

- Fill out all profile fields in as much detail as the character limits allow

- Incorporate relevant keywords so users can find you

- Use high-quality profile pictures and branding

- Include a call-to-action to guide users to your website or email list

Choose the purpose of each platform

Create a strategy for each platform that keeps your big-picture objectives in mind. Different platforms have different uses. For example, consumers use Pinterest to find products, but they use Facebook to connect with friends and family. Your social media strategy for each platform should consider these use cases to give your accounts the best chance of success.

Alex McIntosh, CEO and co-founder of Thrive Natural Care, finds choosing channels easy, as the company is focused on an omnichannel experience.

“We want to be present where our customers are, so we publish content on Facebook, Instagram, X, TikTok, Reddit, and YouTube,” Alex says. “We know that our customers and audience are using different platforms at different times, so however they prefer to consume content, we want ours to add value to their day.”

6. Develop a content strategy

Design a plan for the type of content you’ll create and share on each of your chosen social media channels. The content may vary depending on the platform and the audience you’re trying to reach, so it’s important to create a strategy that encompasses all of your customer personas and all of your social media channels.

Find content inspiration

One of the hardest and most time-consuming parts of creating a social media strategy is coming up with content ideas. But ideas are all around—you just have to know where to look.

Here are some ways to come up with content ideas:

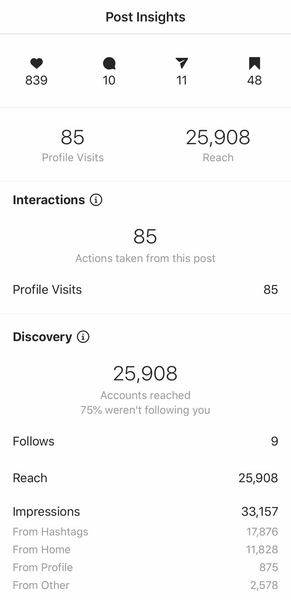

- Answer customer questions or spotlight previous comments.

- Check customer support tickets to find objections and hesitations.

- Jump on a trending topic and add your own spin.

- Browse relevant hashtags to see what content is getting the most love.

- Share reviews and customer testimonials.

- Create mini-guides for your products.

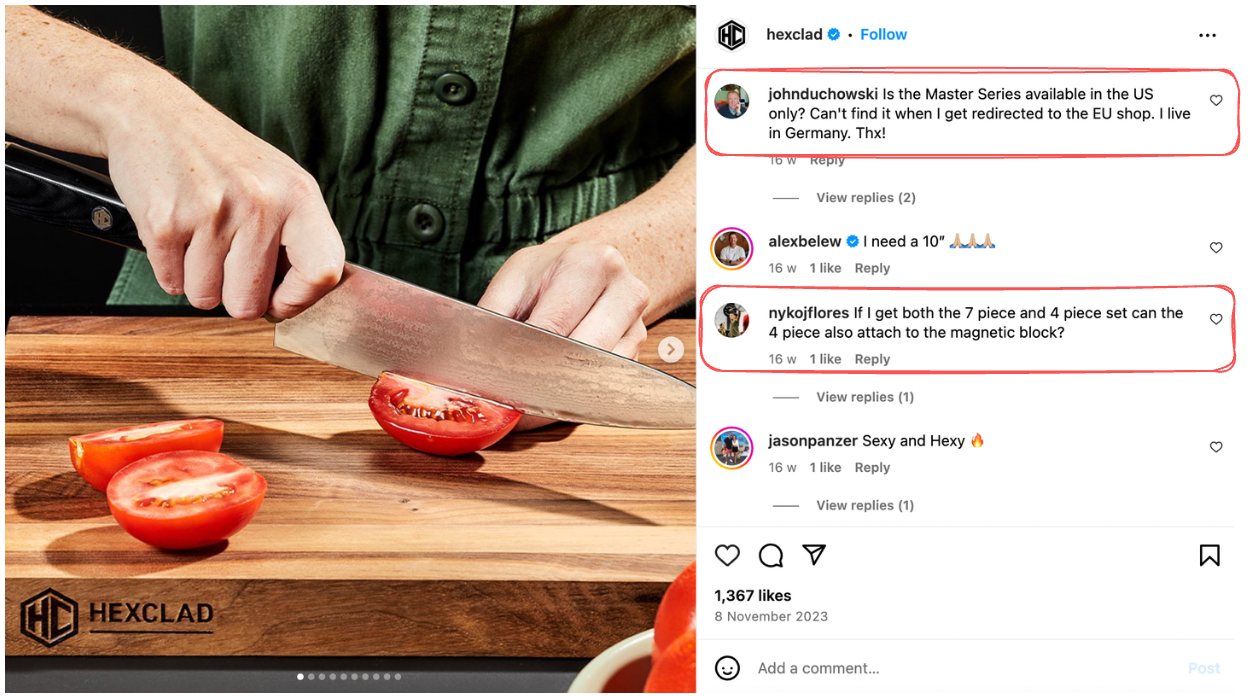

Define your content mix

Defining your content mix—recurring formats and post types—makes it easier to produce social content while adding a rhythm to your posting schedule. This offers your audience both variety and consistency at the same time.

Within your content mix, you want to have ideas you can plan for in advance, reproduce, and schedule to go out regularly. For example, you might feature a customer testimonial every Tuesday and share a quote graphic every Wednesday and Friday.

Pieces that are easy to create can keep your social media calendar full while you build out more elaborate assets, such as a promotional video or a blog post.

“For a content plan, we try to focus on both timeliness and value for our customers and followers,” says Alex. “One core value of our business is “Leave it better,” and this is a guiding principle for our team. This means we want our social content to be something people feel good about. Whether it is a post about our regenerative farming efforts in Costa Rica or we are showcasing a new skin care product, we want our social media content to be valuable for anyone who sees it.”

Choose your content archetypes

Content archetypes are different content formats or topics included in your strategy. They should relate to your business objectives and resonate with your audience. For example, a lifestyle brand might have “inspirational quotes” as a content archetype.

Here are some archetypes to consider:

- News. Information about what’s happening in your industry or posts based on what’s trending at the moment.

- Inspiration. Motivation to use your products or pursue a certain lifestyle, such as quote graphics or photos from around the world.

- Education. Share fun stats and facts or how-to posts from your blog or YouTube channel.

- Product/promotional posts. High-quality product shots of your products being used, demo videos, testimonials, or feature explanations can help you achieve your ultimate goal of getting sales. You can often run these as ads after you create them.

- Contests and giveaways. A contest or free download in exchange for an email is a great way to promote something of value to both you and your audience other than your products.

- Customer/influencer features. Shots or videos featuring your customers or the people they follow.

- Community events. Share meetups, fundraisers, or learning opportunities, especially if you’re a local business.

- Q&A. Ask your audience a question or make a request to elicit responses, such as, “Tag a friend who’s always late.” Answer a common question that you get from customers.

- Tips and tricks. Share useful information and tutorials about your products.

- Behind the scenes. Share how your product is made or what you’re doing to grow your business to offer some transparency that your audience can relate to. Giving your audience a look into the humans behind your business can go a long way in creating trust or building your personal brand as a founder.

- Repurposed blog posts. Leverage your existing content on your Shopify blog and repurpose it into engaging social media content, such as snippets, images, or teasers.

Aim for five to seven content archetypes to start. Balance your content mix with post formats you can create quickly and those more labor intensive, as well as posts that aim for sales and posts that just seek to delight and grow your audience.

Snack brand Oh Snap! Pickling Co. finds the right mix of engaging content by publishing a mix of product shots, trending Reels, engagement posts, and even a tarot card series on its Instagram to keep customers entertained and engaged.

Developing a mix of different content types will ensure you have a social media lead generation strategy that provides customers with the information they need at every stage of the purchasing funnel.

7. Create a content calendar

Establish a schedule for when and how often you’ll post on each social media platform. This will help you maintain consistency and ensure a steady flow of content.

Start slow and then ramp up to a higher frequency as you develop your routine and figure out what works.

Set your posting schedule

Decide how much time you can dedicate to social media, even if you can only post once every few days in the beginning. You can build up to one post a day and then test to see if a higher frequency nets you better results on specific platforms.

The amount you post will vary on the platforms you’re using. For example, it’s more acceptable to post multiple times a day on X or Threads than it is to post to your Instagram feed.

Hootsuite experts recommend using these posting guidelines:

- Instagram feed: 3–5 times per week

- Instagram Stories: 2 times per day

- Facebook: 1–2 times per day

- X: 2–3 times per day

- LinkedIn: 1–2 times per day

- TikTok: 3–5 times per week

- Threads: 2–3 times per day

- YouTube: 1–2 times per week

Identify your best posting times

You need to focus your attention where it will have the most impact and when your audience is scrolling through their feeds.

Each platform has a different ideal posting time depending on when their followers are most engaged. You’ll find the best time to post on TikTok will be different from the best time to post on Instagram. If you aren’t sure where to start, think about when people check their feeds: in the morning, at lunch, during their commute, or before bed.

You’ll discover the best posting times for your particular audience through trial and error. Popular posting times will also vary depending on seasons and other variables.

What’s more important is that you schedule your posts in batches, at least a week in advance. Do it in one sitting, dedicating a few hours at a time so you can focus on other things while your social media publishing runs in the background. You can use an automated scheduling tool to load up your social media posts for the week.

8. Use the right social media tools

Juggling content for multiple social media channels at once is hard work, especially if you’re creating different types of content for each account.

This is where social media apps and tools can be a huge help. Tools that let you schedule content in advance, create beautiful graphics, and monitor comments and engagement can take a load off your plate and remove much of the manual work of social media posting.

Here are some social media tools you might consider using.

Scheduling tools

Use an app that lets you schedule your content calendar in advance so you don’t have to remember to post:

- Buffer. Distribute your content to multiple channels at once. The app also tells you when the best time to post is based on your audience metrics.

- Hootsuite. Design, schedule, and publish content across multiple networks from one central dashboard. See all your replies in one place, too.

- Later. Bulk schedule your content across your social platforms and use the tool’s analytics to decide the best time to post.

Content creation tools

Use a tool to create on-brand graphics and videos to keep your feeds looking fresh and memorable:

- Canva. Browse a library of hundreds of design templates you can drag and drop your fonts, logo, and graphics onto.

- Unsplash. Access thousands of royalty-free images you can edit or use in your social content.

- Venngage. Make beautiful infographics using hundreds of pre-made templates.

Content ideation tools

Use a tool to come up with fresh content ideas that are relevant to your business and audience:

- BuzzSumo. Discover what other brands are talking about and jump on trending discussions while they’re hot.

- Google Trends. Track what people are interested in and use it to create content that’s timely and relevant.

- AnswerThePublic. See what questions people are searching for about certain topics or products.

9. Engage with your audience

Develop strategies to actively engage with your audience, respond to comments and messages, and foster a sense of community. No one wants to feel like they’re shouting into the void, so make an effort to start discussions and encourage interactions around your content. Alex from Thrive Natural Care says the brand has put added importance on engaging with its audience.

“It is one thing to put out great content, but audiences want to feel like they are a part of something, and by engaging with our customers, we help them join us on our journey,” he says.

How to engage with your audience

- Reshare content. Post customer photos and reviews to your own feeds (remember to credit the original creator).

- Ask questions. Invite discussion by asking a question.

- Run a poll. Instagram, X, and Facebook all have a poll feature you can use to encourage engagement and learn more about your customers at the same time.

- Jump on trends. Join in with the latest TikTok trends or trending hashtags on other channels—just make sure it’s relevant to your brand and audience.

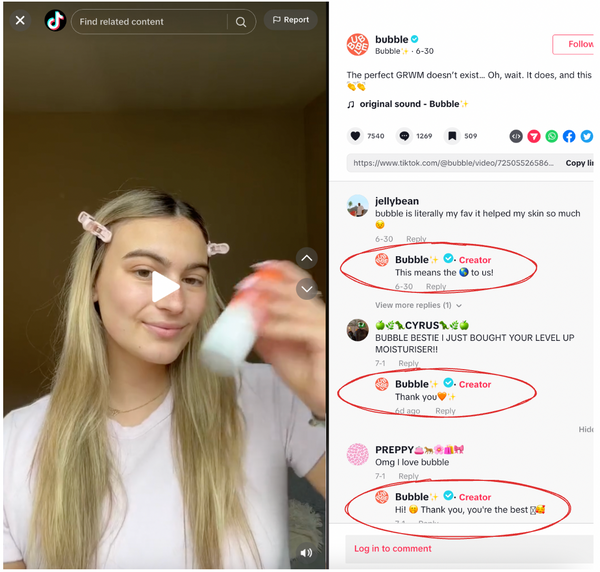

- Respond to comments. Engage your audience by replying to the comments they leave on your content.

Bubble Skincare does an excellent job of engaging with its followers. It consistently replies to fans and shows its appreciation for purchases and comments.

10. Make a plan for customer service

Customers use social media to engage with brands—and a lot of the time, that involves asking questions and seeking out customer support. It has made social media the go-to place for customer service requests.

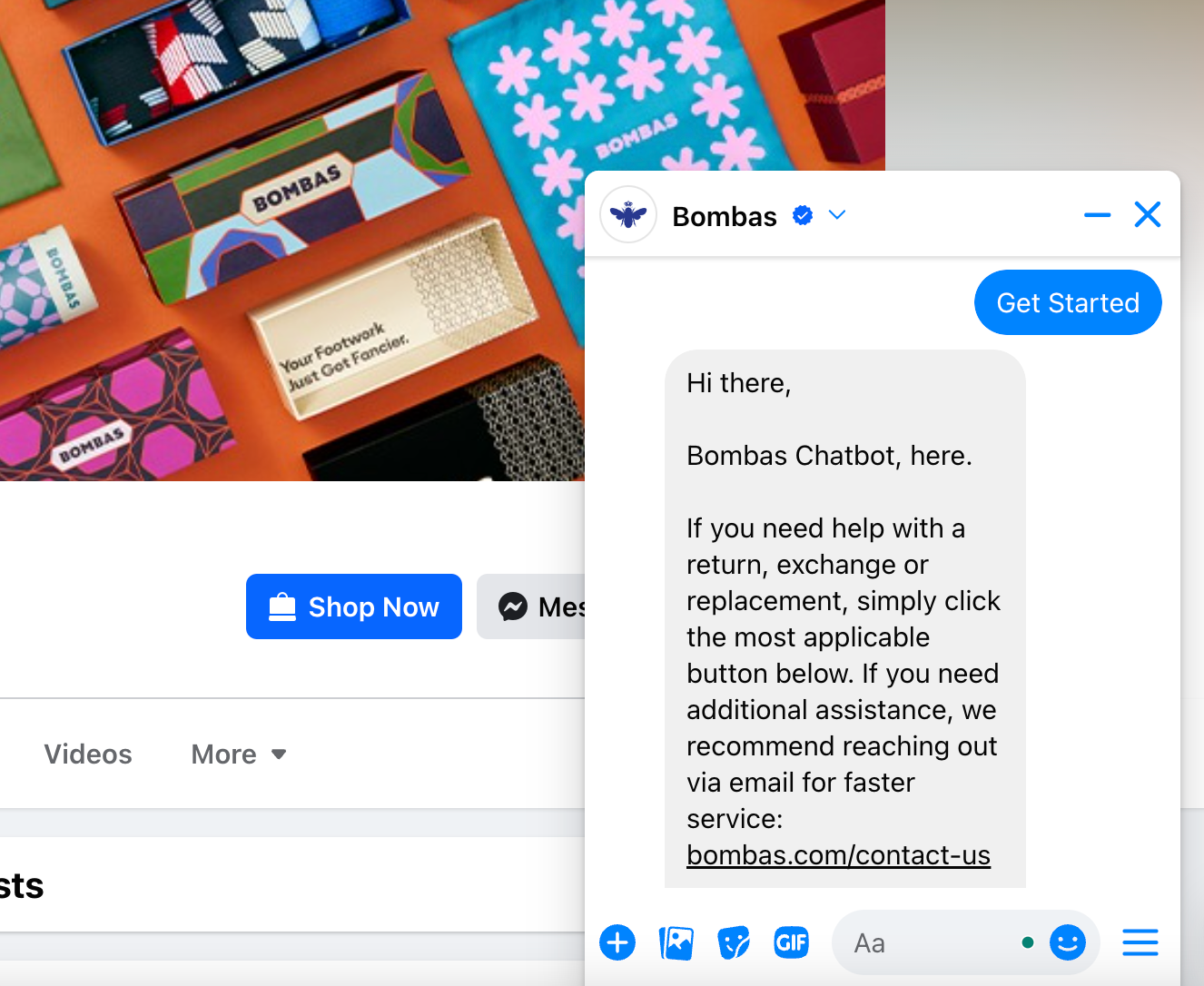

Channels like Facebook and X are ideal for tackling customer questions. Your social media customer service plan might include an automated chatbot that answers FAQs on autopilot—Facebook has a built-in app you can use—setting aside a dedicated time each week to go through customer questions, or directing users from social media to the community help pages on your website.

11. Leverage influencer marketing

Consider collaborating with influencers relevant to your industry or niche. They can help amplify your reach, increase brand awareness, and drive engagement.

How to get started with influencer marketing

- Find relevant influencers. Use apps like Shopify Collabs to find influencers that have an audience in your niche. Consider the platform they’re popular on and how that’s likely to impact your brand.

- Brainstorm content. Work together to come up with content ideas that will resonate with their audience. Make sure it’s relevant to your brand and products, too.

- Track and tweak. Measure what works and what doesn’t to see what content you can collaborate on in the future.

You don’t need to hire influencers with millions of followers to expand your brand reach. Skin care brand Plenaire works with niche and micro-influencers to reach highly engaged audiences. Not only does this help you grow your audience, it builds trust in your brand and encourages sales, for a relatively low cost.

You can work with influencers on a short-term, one-off basis or as an ongoing ambassadorship. Both have their pros and cons, but it will ultimately depend on your goal and your budget.

“We include influencers in our strategy as well, notifying them about monthly sales and products to advertise on their blogging channels,” says Nicky Miller, social media manager at Lion Brand Yarn.

“An example of a successful campaign was our 145th anniversary. We encouraged influencers to share videos about our brand’s history and products. The results were a success, we saw nice growth on Instagram, and were featured in several publications covering our brand.”

12. Explore social media advertising

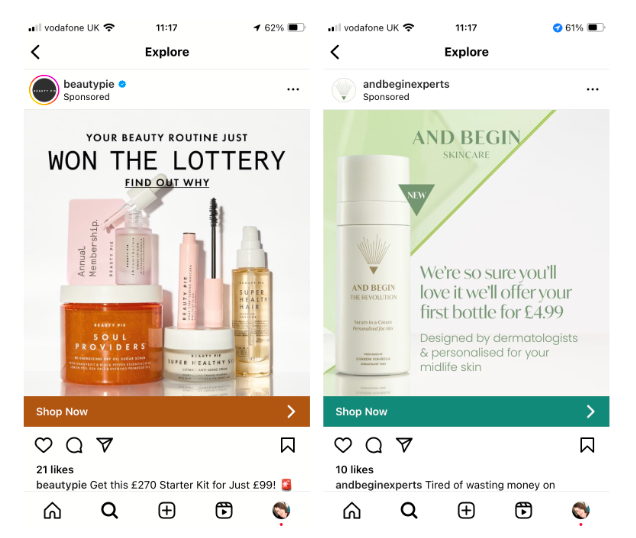

It’s hard to get traction when you’re just getting started on social media and it can feel like an endless uphill battle to get even a few likes on your post. You can give your accounts a boost by investing in social media advertising. Most advertising features have laser-focused targeting capabilities, which means you can choose exactly who you want to reach: Working moms aged 25 to 40? Yoga lovers who live in New York?

Choose your advertising methods

- Instagram Stories. Show up organically as users click through their friend's and family’s Stories.

- Instagram feed ads. Direct users to your website or offer an incentive when they click through.

- YouTube in-stream ads. Promote your brand to rapt video viewers either before, during, or at the end of a YouTube video.

- TikTok ads. Connect with users by showing up organically as they scroll through their highly personalized TikTok feed.

13. Incorporate ecommerce into your social strategy

Most social media platforms have native ecommerce features that either help promote your products or allow users to buy directly through the app. This creates a seamless selling process because customers can discover and purchase your products without ever leaving their feeds.

Make use of social selling features

Here are some of the social selling features to drive sales:

- Instagram Shopping. Upload your product catalog and encourage shoppers to buy directly through Instagram by tagging products in your feed posts.

- TikTok Shop. Create a shop where users can browse product tiles, read reviews, and purchase directly from your TikTok profile.

- Facebook Shop. Let visitors browse your products and purchase through Facebook. Manage your inventory and sales with the Commerce Manager tool.

- YouTube Shopping. Connect your online store to your YouTube account and tag products in your videos that users can buy directly through your profile.

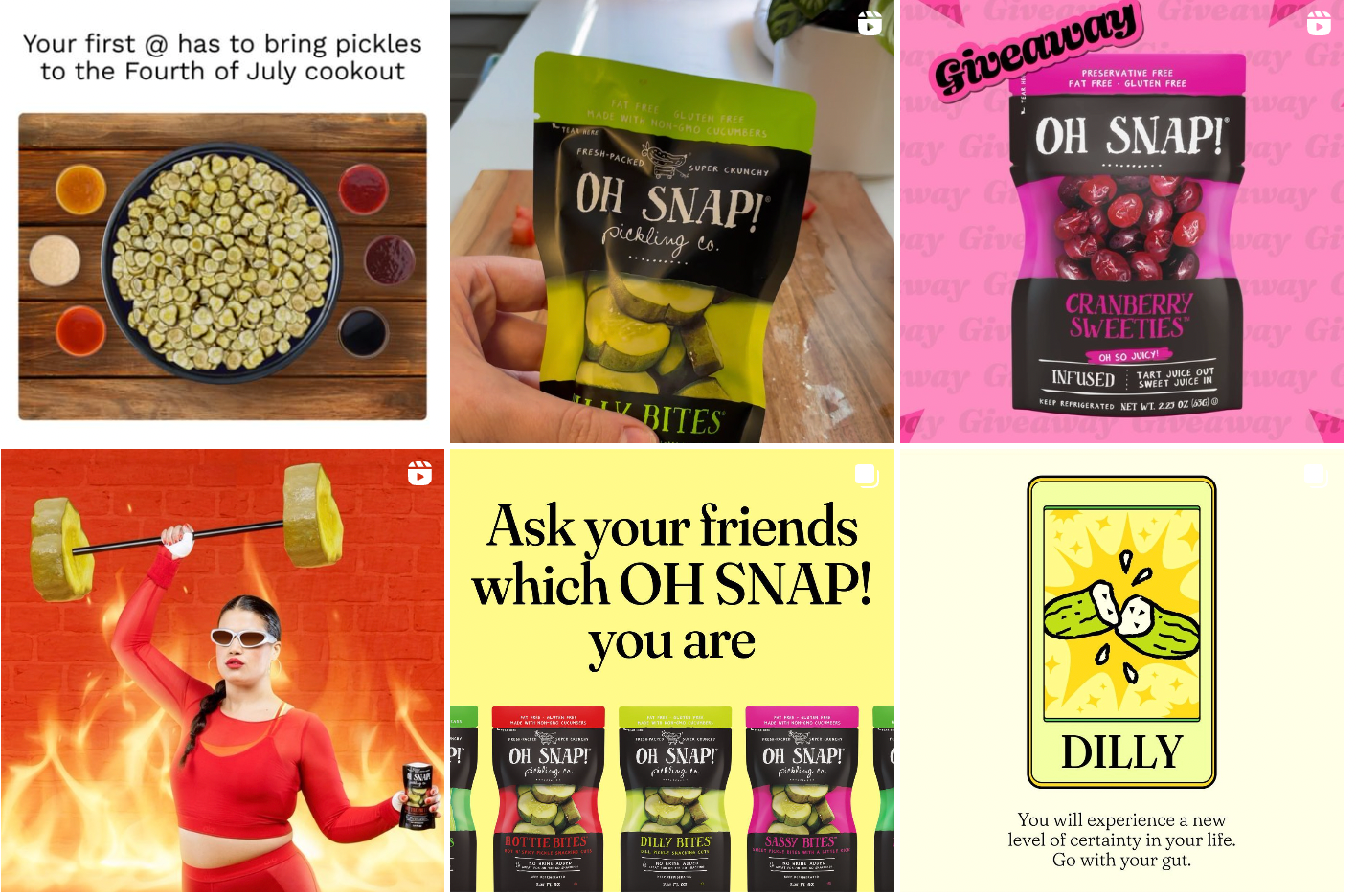

14. Monitor and analyze performance

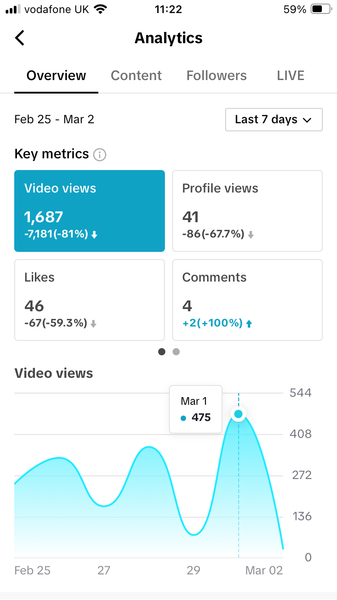

Use social media analytics tools to track the performance of your content and campaigns.

Top metrics to monitor

- Reach. How many people see your social media posts in their feeds.

- Engagement. How many people like, comment, and share your posts.

- Click-through rate. How many people click through from your social content to your website or product pages.

- Conversions. How many people buy something after seeing a social media post.

The metrics you track will depend on your goals. For example, if you aim to increase website traffic, you should closely track click-through rates. But if you want to boost sales, then conversions are your go-to metric.

Monitoring your metrics lets you make small changes to your strategy, rather than huge overhauls. You can be proactive in the short term and use those learnings to inform future campaigns.

15. Iterate and refine

You should evaluate and refine your social media marketing plan based on insights and data. Adapt your approach based on what works best for your audience and aligns with your goals.

Your aim now is to get a positive return on the time, money, and effort you spend marketing your business on social media. That requires deliberate action.

Your social media strategy is your plan of attack. But in a space like social media that changes by the day—with feed algorithm updates and audiences always ready for something new—you need to remain flexible and keep your finger on its pulse. It’s important to have goals to track and check in regularly to see what’s working. Use those insights to develop content ideas, build out your calendar, and grow your audience.

Social media strategy template

Social media strategy and planning templates

Ready to get started with your social media strategy? These free, customizable templates give you tools to plan and execute a strategy that connects you with your target audience while keeping your content calendar organized.

Get a better return on investment with social media

Developing a social media marketing strategy will give you purpose when connecting with your audience on platforms like Instagram, X, Facebook, and TikTok. It will help you determine the kind of content your audience likes to see and what they engage with the most. Ultimately, this will help you grow your audience, sell more products, and increase revenue.

Read more

- How To Source Products To Sell Online

- 25+ Ideas for Online Businesses To Start Now (2023)

- The Ultimate Guide To Dropshipping (2023)

- How to Start a Dropshipping Business- A Complete Playbook for 2023

- 20+ Online Selling Sites and Marketplaces To Sell

- How to Build a Business Website for Beginners

- How To Make Your First Ecommerce Sale—Fast (Tutorial 2023)

- A 14-Point Ecommerce Checklist to Launch Your Shopify Store

- How to Sell on Amazon- A 7 Step Beginner's Guide

- The Beginner's Guide to Selling on eBay- List, Manage, and Sell Your Products Through Shopify

Social media marketing strategy FAQ

Which social media platforms should I focus on in my strategy?

What type of content should I create for social media?

How can I measure the success of my social media marketing strategy?

Should I use paid advertising on social media?

How can I engage with my audience on social media?

- Ask questions.

- Reply to comments and shares.

- Start discussions and join in existing conversations.

- Jump on trends that are relevant to your brand.

- Reshare customer content.