Editor's Note: This post was originally published in October 2018 by Aaron Orendorff and has been updated for accuracy and comprehensiveness.

Plan for the holidays like 50 of the world’s top brands.

They’ve generously agreed to share their holiday marketing plans and strategies—when they begin planning, what concerns them, and how they engage new and existing customers—to help you position your brand for your best holiday yet.

When to start holiday marketing planning

More than 25% of the high-growth brands we surveyed start planning their holiday marketing campaigns months in advance.

Top five months to begin holiday planning

- September: 25.5%

- October: 19.6%

- June: 15.7%

- July: 9.8%

- August: 7.8%

While nearly half begin planning in the third quarter, notice the 26.6% who begin as early as Q1 or Q2:

Quarterly breakdown

- Q3: 43.1%

- Q4: 25.5%

- Q2: 21.6%

- Q1: 6%

Top holiday ecommerce concerns

Worrying only about what matters also separates high performers from the rest.

Top five concerns for holiday ecommerce

- Rising ad spend: 80.4%

- Customer service needs: 74.5%

- Inventory: 72.5%

- Shipping and fulfillment: 64.7%

- Returns: 56.9%

Rising ad spend is an even greater concern when you consider average order value (AOV) doesn’t generally rise commensurately.

Flat holiday AOV is likely the result of:

- Increased competition for holiday shoppers

- Bargain hunters taking advantage of deep discounts.

To boost AOV, consider these three holiday marketing strategies:

#1: New customer acquisition

Begin paid advertising to build your audience before costs soar (i.e., a delayed-attribution model and heavy emphasis on retargeting).

#2: Engagement with existing customers

Use behavioral data like past-purchases and real-time personalization to segment your users for email marketing before and during Black Friday Cyber Monday.

#3: Offers and deal structures

Experiment with product bundling, tiered discounts, and shipping based on spending thresholds.

New customer acquisition

You already have something in common with top-performing brands; you’re likely targeting the same channels to acquire new holiday customers. Over time, the quality of all click-throughs will deteriorate and your marketing performance will suffer.

Top five channels for new customers

- Facebook paid: 72.5%

- Instagram paid: 58.8%

- Search paid: 56.9%

- Instagram organic: 41.2%

- Search organic (SEO): 35.3%

But it’s the unique ways top brands use these channels that differentiates their results. Other brands are targeting the same consumers on the same channels. It’s crucial that your approach to these consumers and channels be different. Remember, ad spend increases during the holidays while AOV holds steady. To combat this margin crimping phenomena, high-growth brands execute differently in several key ways:

A) Buy traffic early to build social audiences

Run engagement ads during the weeks leading up to Black Friday to create product-aware audiences that are primed for your holiday ecommerce campaigns. You can also do this by running click-through ads to build retargeting audiences.

The objective is to generate interest early so new customers return and purchase from you during the holiday. Get soon-to-be customers excited with online gift guides that preview your offer. Remain top-of-mind by remarketing routinely.

Investing in PPC several weeks prior to the holidays will negatively impact your return on ad spend (ROAS) initially as you’re spending more money earlier. But starting earlier, when paired with an offer that lifts your AOV, can lift conversion rates and maximize paid traffic profitability.

For example, handcrafted sunglass brand DIFF, uses tiered discounts to increase AOV. The discounts increase as shoppers add more to their carts:

- Buy 1, get 30% off

- Buy 2, get 40% off

- Buy 3, get 50% off

The more a customer purchases the more they save. The result was a 17% increase in AOV and 150% increase in ROAS.

Discover how you can replicate Slick Products holiday bundling strategy that increased sales 397% in our Black Friday Facebook Ads Guide.

B) Focus on high-intent keywords

Narrow your AdWords ads to phrases that indicate intent to purchase like:

- “buy [blank product]”

- “best deal on [blank product]”

- detailed product queries: branded terms for you and your competitors

- product-specific searches (e.g., women’s red canvas flats)

C) Customize your holiday offer

Offer customers a holiday deal they can’t get any other time of year. Uniquely bundle products and highlight the the package with custom Black Friday branding. This can increase several key performance metrics even if the products you offer aren’t necessarily in-season.

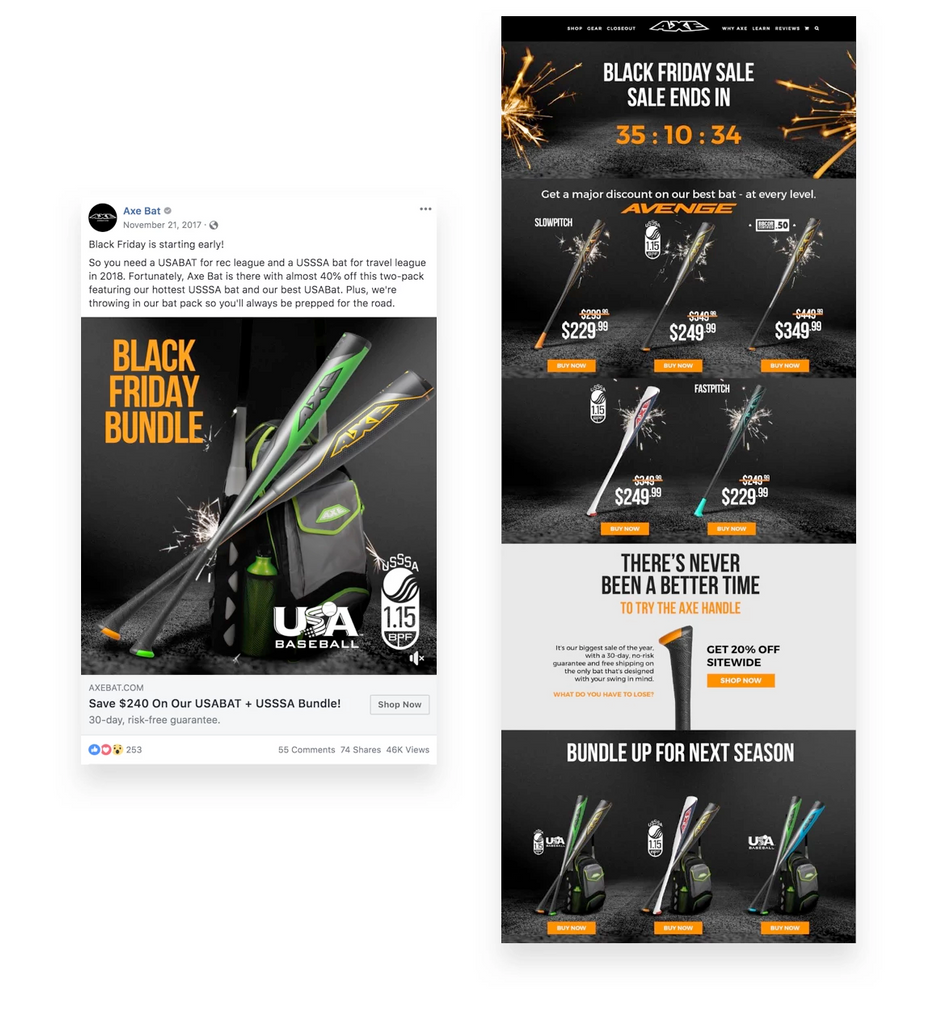

For example, Axe Bat, an online baseball bat brand, combined a unique bundle with a custom holiday landing page to achieve:

- 11.49 ROAS

- 18% increase in AOV

- 93% increase in conversions

Existing customer retention

Seventy-three percent of North American shoppers buy from brands with which they’re familiar. The relationships you’ve already forged with existing customers should be used to increase repeat holiday purchases.

Top five channels for existing customers

- Segmented email offers: 80.4%

- General email offers: 74.5%

- Facebook retargeting for general site visitors: 64.7%

- Facebook retargeting for pages or products: 62.7%

- Instagram retargeting: 51.0%

Not only is email the channel of choice, but it’s also most effective for existing customers. For Shopify-powered brands, email is the top converting source during the holidays:

Maximizing email during the holidays requires segmentation. Alicia Thomas at Klaviyo, which offers a growth marketing and email platform, recommends the following three:

“If I had to choose where a large organization should invest, I’d say that the first and by far most-profitable segment is VIP customers.

“Set a specific dollar amount or number of times purchased that’s 2–3 times your average and send that group an extra-special discount or offer. Make it exclusive and make it big.

“Second, focus on recent openers: subscribers who have opened an email from you in the last 30 days. They’re already engaged so just be clear and blunt about your holiday event.

“Third—and maybe I should have said this first—be sure to set up a cart recovery sequence that only includes the exact products somebody has left behind, your Black Friday Cyber Monday offer applied directly to those items, and a sale extended reminder for anybody that still hasn’t completed their purchase by Monday or Tuesday.”

Separately, Chase Fisher, founder and CEO of Blenders Eyewear, discussed how email segmentation helped him 10X Black Friday sales in a recent AMA webinar:

“As you grow, and your audience grows, they shouldn’t be getting the same messages as everybody else. You should segment certain messages to your VIP customers that are spending more each year. You should be segmenting messages differently to men and women.”

Fisher revealed the “Extended” email he used on Black Friday for email list segments that had opened previous emails but had not yet purchased:

Immediately after email, comes retargeting.

Because this channel commands positions three through five, we asked Shoelace’s Reza Khadjavi—who manages the retargeting ads for top brands—how to stand out:

“During the rush, consumers are going to be bombarded with repetitive retargeting ads.

“Stand out from the crowd by making your ad experiences engaging and relevant to each customer based on where they are in their buying journey with your brand.

“We are huge advocates of Customer Journey Retargeting, which is the strategy of telling your brand story and building emotional connections with your customers through more personalized (and less annoying) retargeting experiences.

“This holiday season, take advantage of the influx in traffic to create intent-based segmentation in your retargeting and tailor your ads to speak to customers at different stages of their lifecycle.

“To keep your audience warm and to stay top-of-mind leading up to Black Friday Cyber Monday, we recommend starting your retargeting early to get your audience moving progressively down the purchasing funnel.”

Importantly, it’s the channels top brands choose not to use that contributes to their holiday success:

Top five “will not use” existing customer channels

- Amazon remarketing: 84.3%

- SMS: 72.5%

- Direct mail: 70.6%

- Loyalty or rewards program: 58.8%

- Facebook Messenger: 52.9%

But be willing to test new channels. SMS and Facebook Messenger can be used to engage existing customers over the holidays but only by treating them as designed. Use them both sparingly to:

- Contact customers for whom you have strong behavioral profiles and can offer logical cross-sell opportunities

- Recover abandoned carts over Black Friday Cyber Monday

“ShopMessage has been a game changer for Pura Vida,” says co-founder Griffin Thall. “The abandoned cart flow through Messenger outperforms email and gives us a deeper relationship with our shoppers. I already recommend ShopMessage to every Shopify store owner I talk to.”

It’s proven that while top performing brands share many of the same strategies and tactics, your target market may react differently. Experimentation is key—you know your buyers best. Incorporate best practices proven by top performers, then tweak according to your target market.

Your holiday ecommerce marketing plan

The insights included here, courtesy of some of the holiday’s biggest achievers, can supplement what worked well for your last holiday season. Key takeaways to incorporate include:

- Plan your holiday marketing and strategy early

- Prime new customers with pre-holiday PPC advertising that highlights offers that lift AOV

- Intelligently segment your email list and target existing VIP customers to maximize holiday sales

There’s much to do and test. Remain customer-centric as you prepare. The holidays are about giving. So give your customers a memorable Black Friday experience. In return, they’ll give you the greatest gift of all; their loyalty and repeat business long after the holidays.