Being your own boss starts with the decision to make the big leap.

If you’ve found us here, you’ve already taken that crucial first step. Congratulations! Now you’re ready to learn how to start a business from scratch. But where do you begin?

Whether you already have a brilliant product idea or you’re just looking to build a future on your own terms, you’re in the right place. This guide will walk you through starting a business from pre-launch marketing to first sale.

Browse hundreds of business ideas. Explore helpful tools to manage your day to day when opening an online store. And bookmark this guide as a reference to return to as you build.

Let’s get started.

How to start a business in 11 steps

- Discover your big idea

- Research your product and audience

- Calculate your startup costs

- Source products

- Figure out your shipping strategy

- Develop a brand strategy and brand identity

- Build and launch your website

- Register your business

- Manage your money

- Market your business

- Grow your business

1. Discover your big idea

It all begins with an idea. To narrow in on that idea, it’s important to know what kind of business and lifestyle you want to have. Are you looking to sell existing products as a low-lift side gig? Do you want to go all in on an invention that will change the world? Or is your social media audience the perfect place to launch your personal brand’s merch? Try fleshing out your idea to see how engaged you are with the idea. You can use a free business plan template to help you.

If you’re stuck, start with our big lists of low investment, small business ideas, online business ideas, and popular business opportunities to get inspired. Next you’ll decide how to bring that new business idea to life: make, manufacture, or resell?

Developing your own product

You may decide to make a product with your own hands or develop one in partnership with a manufacturer, print-on-demand company, or private label partner.

🦘Want to sell something that’s ready to go? Jump to: Selling an existing product

Products to make or manufacture

Mine these lists of unique business ideas to discover items you can make or manufacture from scratch.

- How To Start a Small Business at Home: 30 Ideas for 2023

- Things to Make and Sell: The Business of DIY

- Product Ideas: Places to Find Profitable Products

- Easy and Profitable Crafts to Make and Sell

- The Most Profitable Digital Products to Sell

- Things To Sell on Shopify (Other Than Physical Products)

Print-on-demand ideas

Print on demand is the process of working with a company to turn your designs into merchandise like t-shirts, jewelry, or mugs and shipping them directly to your customers. This is a quick and low investment way to start a business. Research print-on-demand companies to find the right fit for your business idea.

Private label (or white label) ideas

If you have a solid idea and no experience with manufacturing, private label or white label models allow you to work with an experienced manufacturer. They can customize generic products to your brand and specifications. There are a number of private label and white label product ideas to consider, from fitness equipment to cosmetics.

Selling an existing product

If you’re looking to get up and running quickly, selling an existing product is a great option. You can decide to dropship or curate and resell products from other brands.

Product ideas to dropship

Dropshipping is a business model that involves selling existing products on your own online store without handling inventory or shipping. An order from your customer will be fulfilled and shipped by the vendor or manufacturer, skipping you as a middleman. You can get started with dropshipping by finding a product and dropshipping partner.

💡 Tip: You can also dropship white label products, giving you the benefits of both a branded product and a low-lift business model.

Curation or resale ideas

Another way to start a business without your own products is through curation or resale. Some lifestyle and fashion brands will curate collections from a number of vendors or designers, buying inventory upfront. In this case, you will be responsible for inventory management and shipping. To find brands to work with, browse wholesale marketplaces. Resale business models are popular with antiques, collectibles, or vintage clothing.

Starting a side business

What if you just want to dip a toe into entrepreneurship? Starting a side hustle—that is, running your own business alongside your full-time job—is a low-risk way to test the waters and make supplementary income. Don’t quit your day job. Instead, browse our lists of passive income ideas and businesses that let you make money from home.

Monetizing your social media followingBuilding an audience can be one of the most challenging parts of starting a business. If you have already grown your fan base on social media channels, the hard part is already done! Online tools make it easier than ever to monetize that audience. Drill down to your platform of choice for creator-friendly business ideas.

-

Instagram: Best Ways to Make Money on Instagram

-

TikTok: Easy Ideas How to Make Money on TikTok

-

YouTube: Make Money as a Full-Time YouTuber or Make Merch for YouTube

- Twitch: How to Make Money on Twitch: The Ultimate Guide

💡 Tip: The Shopify Starter Plan is perfect for creators who want to get selling fast without building a website. Or, you can also use a tool like Linkpop to superpower your social bio and push fans to your store.

Starting in a specific industry

If you’ve already honed in on a product of interest, it’s important to understand the nuances of that industry. If yours is below, click through to the corresponding guide to get tailored advice for how to start a business in your market of choice.

👗 Clothing: How to Start a Clothing Line

👕 T-shirts: How to Start a Successful T-Shirt Business Online

💍 Jewelry: Start a Jewelry Business: Step-by-Step Guide

🕯️ Candles: How to Start a Candle Business (with Examples)

🥝 Food and Drink: How to Sell Food Online (Step-by-Step Business Guide)

🙂 Stickers: How to Make and Sell Stickers Online

🛋️ Home: Sell Furniture and Home Décor Online: The Ultimate Guide

🌱 Plants: Fronds with Benefits: A Beginner’s Guide to Selling Plants Online

🎨 Art: How to Sell Art Online: A Complete Guide

📚 Books: Sell Books Online: Page-Turning Advice From the Pros

🐶 Pets: How to Start a Pet Business

🧴 Skin care: Start a Skin Care Line: Lessons From a Serial Beauty Entrepreneur

🦘 Ensure that you understand any legal constraints or requirements specific to your industry before going all in. Jump to: Operations

🦘 Jump back to: Table of contents

2. Research your product and audience

Now that you have a killer idea, it’s time to validate it! Your product or business idea may excite you, but it’s only worth pursuing if there’s an audience (a.k.a. future customers) looking for it.

There are many ways to do your research upfront before you start investing. You can look for gaps in the market, find an underserved audience, run a focus group, and investigate your competition.

Finding a target audience

Your target audience or target market refers to a group of potential customers for your brand. This is the group you’ll eventually aim all your marketing efforts and dollars toward. As a result, it’s critical to define them as thoroughly as possible.

Identifying and getting to know your target audience is important because:

✅ It helps you make smart and cost-effective marketing decisions

✅ It influences your product development (because you have a direct line of feedback)

✅ It can increase revenue (by focusing your efforts on the most promising customers)

Building buyer personas is an effective method for drilling down into your ideal customers’ needs. How old are they? What do they love? On which social media platforms do they spend most of their time? What’s important to them?

Conducting market research

Market research is the process of gathering data about the potential customers (or “market”) for your brand. It can validate that you’re on the right track or inform you that you need to make a shift. You can conduct market research through surveys, focus groups, and interviews.

Market analysis is a similar concept but involves researching the industry as a whole, combining insights you get directly from your target audience with third-party sources like reports and industry publications.

Market research tools

There are several tools on the market that can help you conduct market research on starting a business. These include data aggregators such as Statista, survey tools like Typeform, social listening tools like Hootsuite, and other free and paid tools.

Using a combination of reports and data relevant to your industry, as well as your own research through potential customer surveys or focus groups, will give you a more holistic view of the market before you enter it.

Understanding market trends

Understanding market trends means looking holistically at your industry, competitors, customer preferences, and the general market. Some questions to ask include:

- What are the long-term consumer trends (i.e., sustainability)?

- What does search volume look like for your product or service? (Google Trends is a free tool that can show you interest over time.)

- Within your demographic, what buyer trends are emerging? For example, on which channels does your target customer prefer to shop?

- On which social channels does your target market hang out? What are the current and emerging trends on those platforms?

- Are there social and political factors that could impact the market?

- What trend forecasting is available for your industry to help you understand the direction of the market?

Estimating market size

To understand the market size, or how many potential customers there are for your business, follow these steps:

- Define your target audience and determine the total size or total addressable market (TAM). This is the maximum number of customers if you were to have 100% of the market share.

- Identify a segment of that market that you will focus on. For example, maybe your product is geared toward women or only potential customers in a particular geographical region. This is the serviceable addressable market (SAM).

- Calculate your market penetration rate within this segment. You can use industry benchmarks to make an estimate.

- Multiply SAM by the market penetration rate to get your market size.

Analyzing the competition

Understanding the competitive landscape can ensure that you’re setting your brand apart in the industry. This exercise will also help you clearly define your unique selling proposition (USP), which is the benefit that your product offers over that of your competitors. Explore the in-depth resources below to get started.

- How to Do a Competitive Analysis + Example Template

- How to Do a SWOT Analysis

- What Is Competitive Intelligence? Definition and Guide

🦘 Jump back to: Table of contents

3. Calculate your startup costs

Once you’ve validated that there’s an audience hungry for your product and you’ve nailed your value prop, it’s time to talk money. Your business will be viable if you have the funding to get it off the ground and you can identify a price that’ll turn a profit.

Writing a business plan

A business plan is a document you can use to help you secure funding from a bank or venture capital (VC) firm. But even if you’re not seeking outside funding, a business plan forces you to answer important questions about how you will run your business. It includes everything from your mission statement to your financials.

💡 7 business plan writing tips:

- Know your audience.

- Have a clear goal.

- Invest time in research.

- Keep it short and to the point.

- Keep the tone, style, and voice consistent.

- Use business plan software.

- Check out other business plan examples, like the ones here, to inspire your own.

Calculating startup costs

What does it really cost to start a business? It depends on many factors, such as whether or not you carry inventory or you need to lease space. Much of the money spent in the first year consists of reinvesting profits back into the business, not spending out of pocket. This is called “bootstrapping” and you can learn more about it later in this section.

Accounting for all business costs

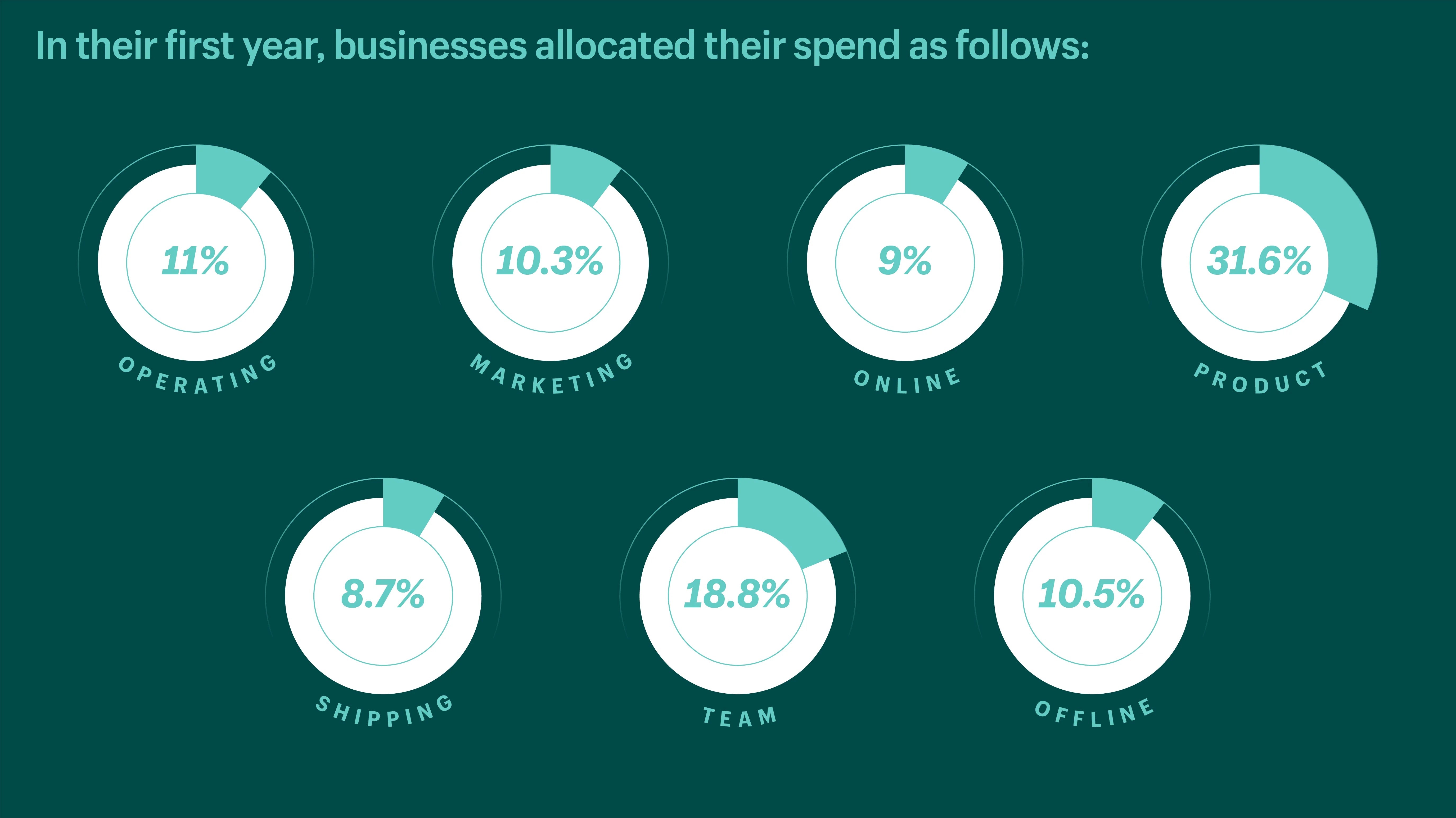

Your startup costs in the first year will help you cover everything from setting up a website to buying inventory to running your first paid ads. Here’s what business owners reported as the breakdown of their spending in the first year:

🚨 Tip: Don’t forget to consider unexpected costs like business insurance, taxes, legal fees, and shipping costs.

Conducting a break-even analysis

A break-even analysis is the process of determining at what point your business (or product) becomes profitable. It’s a financial calculation used to determine the number of products you need to sell to cover your production costs.

There are several benefits to conducting a break-even analysis:

✅ It helps you make smart decisions about product pricing.

✅ It can mitigate risk and eliminate surprise.

✅ It sets informed targets for your business.

✅ It can identify any missing expenses.

Determining profit margins

A profit margin is the measure of a business’ profitability expressed as a percentage. Your profit margin will depend on the industry you’re in, the retail price ranges set by the market, and your costs. You may have a lower profit margin if you’re selling a high volume of goods (say, selling digital art prints) or a high profit margin if you sell luxury products.

Pricing your products

Knowing how to price your products can be tricky, but with a few basic calculations, you can confidently set prices that make sense. In a nutshell, there are three steps to setting prices:

- Add up your variable costs, or the costs that change depending on the amount of product you produce.

- Add a profit margin.

- Don’t forget about fixed costs, or the consistent costs to do business that aren’t affected by how much you produce (think office space lease or utilities).

As you’re setting your prices, consider common pricing strategies like competitive pricing, value-based pricing, or keystone pricing. Note: Each strategy has its pros and cons and not all will be right for your unique business.

Bootstrapping your business

Bootstrapping is the process of starting a business with little or no money and investing the profits back into the business as it grows. This method of funding a business may mean slower growth, but it also minimizes risk and debt.

Some businesses are easier to bootstrap than others. Low investment ideas like dropshipping or print on demand require no inventory and are great candidates for this method. Other small business owners use personal savings to cover startup costs before bootstrapping growth. It’s still important to have a solid business plan in case you decide to seek additional funding later.

🦘 Looking to grow more quickly? Jump to: Getting funded 2.0

🦘 Jump back to: Table of contents

4. Source products

By now, you’ve validated your product idea, your business plan is locked, and you’re ready to bring it to life. It’s time to get creative. In this section we’ll take you through the options to make, manufacture, or source your product as you get ready to start a business.

Making or manufacturing a product

If your product is a handmade item, you can get up and running by setting up an appropriate space in your home, a rented studio or office, or a co-op. Be sure to check the legal requirements for setting up a home-based business, especially if you’re selling food or cosmetic items. There are generally rules around ventilation and other safety protocols.

🦘 Ensure that you understand any legal requirements for setting up a home-based business. Jump to: Operations

If your product is designed to be produced in a third-party facility, you’ll likely need to source a manufacturing partner. A good manufacturer is one who understands your industry, knows packaging and labeling laws specific to your product or market, and can be a true partner in your business.

Some manufacturers will be part of the product development process, advising you on best practices to get to your finished product.

Finding a supplier

If you’ve opted to sell existing products, you’ll need to research suppliers or other brands that you can source them from. Find the business model that applies to you below and click through for a deep dive on how to find products for each, along with some examples:

- Dropshipping: Best Dropshipping Suppliers

- Print on demand: Best Print on Demand Companies and Sites

- Wholesale: How to Find the Right Wholesale Supplier for Your Business

🦘 Jump back to: Table of contents

5. Figure out your shipping strategy

Shipping is often cited by small business owners as one of the most challenging aspects of getting started. Luckily, the tools aimed at simplifying this task keep getting better. Ecommerce platforms like Shopify consolidate rates to help you make informed shipping decisions. And app integrations can solve specific shipping issues or help you more easily manage inventory.

Setting up shipping and fulfillment

When deciding on a shipping strategy for your business, you’ll first need to decide how you will handle order fulfillment. For many new business owners, that means personally packaging and shipping orders one by one. Unless you choose a dropshipping or print-on-demand model, managing your own fulfillment in the early days helps you better understand all aspects of your business.

As you grow, you may decide to outsource shipping and fulfillment to a third-party logistics (3PL) company. Research different fulfillment services to see which is right for your growing business.

Shipping cost is often a factor in a customer’s decision to buy from your business. You can decide to offer free shipping and build that cost into retail prices or, if you’re passing on the cost, take steps to keep those costs as low as possible.

Ways to reduce shipping costs include:

✅ Reducing weight of packages (by, say, using poly mailers instead of cardboard, if applicable)

✅ Choosing the right-sized packaging for the product

✅ Using flat-rate shipping when possible

✅ Using Shopify Shipping to cut carrier costs

✅ Knowing when rates change so you can adjust accordingly

✅ Offering local delivery or pickup as an alternative for in-town customers

💡 Tip: Take advantage of free tools and templates to create a shipping policy, generate shipping labels, and complete a bill of lading form.

Understanding international shipping

If you plan to ship internationally, keep in mind that there are a few more steps involved. First, be sure that your products are legal in their country of destination, that you adhere to labeling and packaging requirements in those places, and that you know how to complete customs paperwork.

Duties and taxes are often the responsibility of the customer upon the arrival of the package. You can elect to make those fees transparent at checkout by collecting them upfront.

Managing inventory

If you’re working with a fulfillment service, or using a dropshipping or print-on-demand model, inventory management is usually handled entirely by this partner. Otherwise, keeping inventory organized ensures that you can make informed decisions about production and stock reorders—and avoid customer disappointment.

Here are a few top-rated inventory apps in the Shopify App Store. These apps integrate with your ecommerce store to automate tasks and send low-stock notifications.

👀 Forecasting: CartBite

⏩ Optimization: Realtime Stock Sync & Bundling

✉️ Tracking: Notify Me! Back in Stock Alert

🤝 Syncing: Stock Sync

🚰 Replenishment: SUPLIFUL

🔔 Stock alerts: Back in Stock - Out of Stock

🦘 Jump back to: Table of contents

6. Develop a brand strategy and brand identity

Aside from a unique product or exemplary service, your brand is the driving force behind a customer’s decision to buy from you. Your brand is more than a business name or a logo. It is a guiding set of principles and design specifications that tell your story, create consistency, and build trust. A branding exercise will create the foundation upon which you make creative decisions for your brand as you grow.

As you build your brand, be sure to consider all its components:

✅ The basics (who you are and what you sell)

✅ What you stand for (mission statement, brand values, and brand promise)

✅ Your unique selling proposition (why customers should choose you over the competition)

✅ Your brand story (sometimes one and the same with your personal story)

✅ Brand voice (the tone and language used consistently in brand communication)

✅ Your visual brand identity (logo, style guide, and brand name)

To develop your brand strategy, answer questions like: How do you want customers to feel when they interact with your brand? What’s important to you (such as giving back, excellent customer service, fair wages for staff)? What colors and design styles appeal to you and represent the mood you’re trying to achieve? The answers to these will help inform the rest of the branding exercise.

Next, brainstorm business names and domain names. It’s important that you research any potential business name to see if it is already used (and therefore could cause confusion or legal issues) and if the social handles and domain are available. Once you’ve landed on a name, secure it by setting up social profiles and registering the domain.

💡 Tip: If you’re stuck coming up with a name to represent your brand, try these free business name generator and domain name generator tools.

Establishing brand voice and story

Brand voice is how your business speaks to customers and the world. It incorporates decisions around tone, personality, brand vocabulary, and slang. Defining your distinct brand voice is important as it can:

✨ Spark recognition

👓 Influence perception

🤝 Build trust

🔌 Create connection

👨🏽🤝👨🏻 Ensure consistency (no matter who’s writing brand copy)

Create and maintain a style guide, a document that sets out clear dos and don’ts for your brand voice (as well as your visual brand requirements—more on those below). For example: “Our brand voice is confident. Our brand voice is not condescending.” This will ensure that as you hire for or outsource marketing tasks, your brand voice will remain consistent.

💡 Tip: Your brand voice will inform brand storytelling on your About page as well as other copywriting throughout your website and marketing.

Designing a visual identity

Your visual identity encompasses anything that impacts how your customers, and the general public, see your brand out in the world. This includes your logo, fonts you use on your website, photography, and color choices.

These design decisions and assets will all be captured within your brand guidelines or style guide. If you’re not a designer, it’s still possible to DIY your visual brand and design a logo with some free tools and a few tips from the pros:

✅ Keep it simple. A simple logo will be the most versatile, allowing it to work on everything from a website favicon to a billboard ad.

✅ Create variations. Variations—like a wordmark as well as an icon—will help your logo fit into different applications.

✅ Consider context. If using recognizable symbols or objects in your logos, consider what message those symbols mean in various contexts and cultures.

💡 Tip: If you’re struggling to DIY your visual identity, tap into Shopify Experts. These are vetted professionals who can help you build out brand elements like logos, color schemes, and social templates.

Bringing your brand to life

As part of branding design, you will make decisions about assets like photography, printed materials, and packaging. This will ensure a consistent experience across every customer touchpoint.

Shooting product photos

Photography is incredibly important for ecommerce brands that rely on 2D images to tell a story about a 3D product. Photography does a lot of heavy lifting as a stand-in for feeling or trying on the product in person. That’s why good ecommerce photography can increase buyer confidence—and conversion.

Most business benefit from having two types of photos for their collections:

- Product photos: These are generally detailed clear shots of the product itself, sometimes on a model, but almost always uncluttered and shot against a plain background. These are well-suited toward product and collection pages.

- Lifestyle photos: These are more aspirational shots that show your product in the context of an environment or action. They tell a story and inspire customers with ways to use or style a product within their own lives. These shots are useful for your home page, social media accounts, and digital lookbooks.

Using examples from Burst, a free stock photo resource for entrepreneurs, you can see the difference between the first product photo and the second lifestyle photo:

If you decide to go the DIY photography route due to budget constraints, you can still pull off professional looking photos with little more than a simple lighting kit and a smartphone.

📚 Read: DIY Guide to the Perfect Product Photography Setup

Your DIY photos may need a little editing to get them website-ready. You can access free and inexpensive design and photo editing tools online.

🛠️ Try: Shopify Image Resizer to optimize your product photos for the web.

In a pinch, stock photos are an excellent solution to fill in for photo needs until you can schedule a shoot. You can mine stock photo websites to find images that capture the lifestyle of your brand to use on collection pages, your homepage, or in marketing campaigns.

Designing product packaging

Your visual brand identity will also show up on product packaging, shipping materials, and other printed marketing assets (like packaging inserts). Customers should have a seamless experience from the initial interaction with your brand online to receiving their order.

💝 Browse these resources to help you design and choose the right packaging for your business:

- Ecommerce Product Packaging Guide & Tips for Memorable Unboxing Experiences

- 8 Eco-Friendly Packaging Ideas for Your Store

- Packaging Inserts Ideas: 7 Ways to Increase Customer Loyalty

🦘 Jump back to: Table of contents

7. Build and launch your website

At this stage, you’ve secured a product and committed to your brand. Now, it’s time to assemble all that hard work into a website and introduce it to the world. There are several ecommerce website builders on the market and you will need to weigh the options based on factors like available features, website cost, and ease of use.

Designing and building an ecommerce website

Once you’ve chosen a platform, you can build your website by uploading products and other brand assets. Consider browsing the Shopify App Store for apps to help you improve the functionality of your store. There are many free Shopify apps that can do everything from taking appointment bookings to automating the returns process.

Now, the fun part! Designing a professional looking website is simple, even if you have no design skills. That’s because there are several tools and templates that let you drag and drop design elements, with no code necessary.

Let’s start with themes. The Shopify Themes Store has over 100 themes to choose from—something for every taste and industry. For new business owners on a small budget, there are also several free Shopify themes.

💡 Tip: Unsure which theme is right for your business? Take our quiz.

Using your brand guidelines, you can:

🎨 Customize themes with your chosen fonts and colors

🎨 Rearrange the layout of your homepage to prioritize what’s important

🎨 Upload product and lifestyle images in web-optimized sizes

🎨 Add content to your About Us page, product pages, and landing pages

🆘 Need help? Check out free online courses to design a website with zero experience or tap into the Shopify Experts network to hire a pro.

Launching your business

You did it! While there are still a few steps left to get your business fully up and running, you’re at a place where you can soft launch your website to the world. This is a critical phase in your journey where you can stress test your website, gather customer feedback, and tweak before your big grand opening.

🛑 Before you launch your website, have you thought of everything? Bookmark this 14-point ecommerce checklist to be sure you’ve checked all the boxes.

🦘 Jump back to: Table of contents

8. Register your business

Depending on the countries or regions where you do business, you may be subject to a set of rules that govern how you manufacture, market, and ship your products.

First, you’ll need to decide on a business structure. In some cases, you will need to officially register your business. Check with your local government agency to ensure you’re doing business above board.

Deciding on a business structure

There are several types of business structures (or legal structures or business entities) to consider, but before you land on one, it’s important to understand the characteristics of each. For example, do you know the difference between a limited liability company (LLC) and a soleproprietorship? Is a C corp right for you?

Dive into the below resources to learn more:

- LLC: How to Start Limited Liability Company

- Sole proprietorship: A Guide to the Sole Proprietor Business Structure

- C Corporation: How to Form and Operate a C Corp

- B Corporation: How to Apply for B Corp Certification

- S Corporation: What is an S Corp? Learn the Benefits

- LLP: Limited Liability Partnerships: 4 Benefits

- DBA: What is Doing Business As? Definition and Guide

Whether you choose to be a sole proprietor or take on a business partner, be sure to clearly outline the business ownership details.

Registering a business with the government and IRS

In some cases, you may not need to officially register your business to get up and running. For example, in Canada, small businesses making under a certain threshold in revenue are not required to officially register or collect and submit sales tax. However, there are perks to registering your business with the CRA (Canada Revenue Agency) upfront, such as benefitting from certain protections.

In the US, the requirements to get a business license can vary state to state, and in some cases you may not need one. If you do need a business license, be sure you have the following before starting your application:

✅ Owner name and contact information

✅ Business name and contact information

✅ Your employer identification number (EIN) or equivalent

✅ Any required permits

✅ Any required forms or paperwork

✅ Associated fees with filing this paperwork

Depending on your business structure and size, you may also need to register with the IRS (Internal Revenue Service) in order to collect sales tax and submit it at tax time.

Securing business insurance

It’s important to protect yourself, your business, and your employees in the event of unexpected hardship. Consider all the possible scenarios that could grind your business to a halt, including: natural disasters, health issues among staff, a bad batch of product, or even a lawsuit. Purchasing an insurance policy is the best protection.

There are several types of business insurance to consider. These include: commercial property insurance, workers’ comp insurance, professional liability insurance, product liability insurance, and business interruption insurance, to name a few. Understand the features of each to see if they apply to you—you may also be interested in a business owner’s policy (BOP), which bundles many of the above types of coverage together.

🛑 Note: Depending on the business structure, you may or may not be subject to personal liability in legal matters pertaining to your business (this would be normally covered by professional liability insurance). However, before you purchase an insurance policy, talk to a pro to see if personal liability protection is necessary for you.

You may also want to implement other types of protections as you grow:

- Offering employee health insurance alongside fair and competitive wages is a great way to attract and retain talent.

- Registering a trademark or filing for a patent can legally protect your intellectual property, like an invention or your business name.

- Writing and posting a set of terms and conditions that protect your company by outlining to customers what is legally required of them if they use your service.

💡 Tip: An insurance adviser or lawyer can help you sort which types of business insurance are right for your business.

🦘 Jump back to: Table of contents

9. Manage your money

The key to a successful business can usually boil down to finding the right product for the right market at the right time. But sustaining that success depends on many other things happening behind the scenes. When you have a good handle on your finances, you’re ensuring that you’re not overspending and that you have a safety net if your luck changes.

Opening a business bank account

Setting up a business bank account is an important first step. At the very least, it allows you to separate your personal and business finances. At best, it allows you to build a good relationship with your bank as a partner in your long-term financial success.

Explore the various business banking products (like a business credit card) available on the market to determine which suits your needs. When choosing the right bank for your business, ask questions like:

💰 Is the bank small-business-friendly?

💰 What is the reputation of the bank in the market?

💰 Does it offer solutions and financial advice tailored to your industry?

💰 What is the fee structure offered by the bank?

💰 Does the bank have a hassle-free loan process?

Managing your finances

Your business plan (that handy document you created in Step 2) should also include a financial plan. If you’ve already completed this step, it’s time to put it into action. If not, consult the resources below to get started.

You’ll possibly encounter some new terms as you make sense of your business finances. Here are a few financial statements and concepts explained.

Balance sheets

A balance sheet lists your business’s assets, liabilities, and shareholder equity. Balance sheets offer a quick glance at how much your business is worth after all liabilities or debts and shareholder payouts are accounted for.

Income statements

An income statement (or earnings statement or profit and loss) calculates revenue minus expenses to tell you how much money your business is earning. These are usually prepared monthly, quarterly, or annually, depending on your business.

Cash flow statements

A cash flow statement (CFS) is a financial statement that summarizes the in and out cash transactions during a given period. This statement gives founders a detailed picture of the cash position of the company. Managing cash flow is essential to its ongoing financial health.

Choosing small business accounting software

Many business owners swear by a simple spreadsheet to manage their small business accounting, and this method is perfectly fine for most small businesses just starting out. If you want more functionality and automation, or you have a more complex business structure, there are several small business accounting tools on the market.

💡 Tip: A professional accountant can help you navigate the ins and outs of business accounting, including advising you on accounting software and preparing you for tax time.

Paying business tax

Being ready for tax time means managing your finances all year long, not scrambling at the last minute. That’s because if your business owes taxes, you don’t want any surprises. Be sure you understand the business tax deadlines and the types of taxes you’re on the hook for, depending on your business structure.

Remember that you can offset many types of purchases as tax deductions as a small business owner. This is a non-exhaustive list of those items:

- Shipping costs

- Workspace rent and utility costs

- Fees for professional services (like accountants)

- Website fees

- Travel expenses

Check with your accountant before writing off any expense—rules around what qualifies as a business expense vary by industry and country.

Charging tax

Should your business be charging sales tax for online purchases? The answer isn’t that simple. This will depend on a number of factors including where you’re running your business, where your customer is located, the type of goods you sell (some products are non-taxable), and how much revenue you bring in.

Once you’ve determined that you should be charging sales tax, you’ll need to apply for a sales tax permit (or tax number or EIN), set tax rates in your online store, collect taxes from eligible purchases, and remit those taxes at tax time.

💡 Tip: Set collected taxes aside in a separate business bank account so that they remain untouched until tax time and do not get lumped in with earnings.

🦘 Jump back to: Table of contents

10. Market your business

Marketing is reported as one of the most challenging aspects of running your own business—but it’s also the area where you will spend much of your time and budget. Launching a successful website requires ongoing campaigns to actively drive traffic to it and convert those visitors into buyers.

Creating a marketing plan

Along with your financial plan, your business plan should also include your overall marketing plan. A marketing plan is the strategy your business uses to get products in front of your target audience. It's a roadmap that helps you set goals and have a back-up plan.

💡 Tip: If you’re stuck staring at a blank page, browse examples of marketing plans and best practice ideas for increasing traffic to get you inspired.

Now, let’s dive into each type of marketing tactic and channel and get ready to make your first sale!

Investing in organic marketing

Organic marketing refers to marketing efforts that don’t cost anything. With changing social media algorithms and more competition, organic traffic becomes increasingly harder to get. But there are still clever ways to attract customers on a small budget.

A few ideas include:

- Taking pre-orders

- Running giveaways to incentivize actions like social sharing or following

- Offering discount codes and coupons

- Hosting grand opening events to draw people to your brick-and-mortar location

- Doing content marketing (like creating blogs or videos)

- Understanding search engine optimization

- Offering affiliate programs

- Proactively engaging in social communities

- Even more low-cost and free ways to promote your business

We’ll take a closer look at many of these ideas in upcoming sections.

Exploring marketing channels

There are several channels you can use to market a product. But which is right for you? The best place to start is often the channel where you already feel most comfortable or the place where you know that most of your target audience is already spending time. Test each to see which gives you the best return on your efforts and spend.

Learn more about marketing channels below.

Email marketing can be a successful tool to convert leads to customers, encourage repeat business, and incentivize loyal customers to buy more. This is a cost-effective marketing tool, but it does require higher effort than some paid channels. Growing your email list and producing engaging content at the right cadence are the keys to winning at email marketing.

🔎 Explore more:

- Amazing Abandoned Cart Emails Tips

- Email Marketing Examples: Campaigns to Inspire You

- Awesome Welcome Email Examples that Work

Google offers up a goldmine of potential customers searching for the very thing you’re offering. But to be sure that they’re finding you, you’ll need to show up in search results. This can be achieved in a number of ways, including search engine optimization (SEO) and paid Google Ads (search engine marketing).

SEO is an organic marketing tactic that involves improving your website to rank higher in search engines. By sending signals to Google that your site offers value and matches the search intent of a user, it is more likely to appear higher in ranking.

🔎 Explore more:

- Ecommerce SEO: The Ultimate Beginner’s Guide

- The 18 Types of Google Ads and When to Use Them

- Beginner’s Guide to Google Shopping Ads

Instagram is a visual social media channel that can be an effective marketing tool for certain brands. Whether you run Instagram Ads to get your product in front of potential customers, organically grow your audience with engaging content, or use it as a sales channel, it’s a platform worth exploring.

🔎 Explore more:

- A Beginner’s Guide to Instagram Marketing

- Top Instagram Hashtags to Get More Likes

- How to Get More Followers on Instagram

- Instagram Bio Ideas (with Examples)

💡Did you know? You can sell directly to your audience using Instagram Shopping. Also check out LinkPop and the Shopify Starter Plan to get even more out of Instagram.

Facebook is still the largest social media platform in the world, with 2.9 billion users. And it’s an effective tool for many businesses that use it to engage with their community, run paid Facebook ads, and sell products directly.

✅ Understand your target audience.

✅ Diversify your content formats.

✅ Post when your audience is active.

✅ Share influencer or user-generated content.

✅ Encourage reviews.

✅ Get involved with Facebook groups.

✅ Track Facebook insights.

🔎 Explore more:

- Facebook Marketing: Step by Step Guide for Your Business

- Facebook Ad Sizes and Specs + Free Resizing Tool

- How Much Do Facebook Ads Cost?

- Facebook Ad Targeting Tips

💡 Did you know? You can sell your products on Facebook for a seamless experience for your social audience. Also explore Shopify Apps to use Facebook Messenger and keep the conversation going with customers post-purchase.

TikTok

As a newer platform on the market, there’s still opportunity to win with organic marketing on TikTok. Finding success on the platform means paying attention to trends and serving up catchy content that’s relevant to your target audience.

🔥 5 TikTok marketing tips:

- Create value with your content (what does your audience want?).

- Be relevant and relatable.

- Aim for substance over polish (production value isn’t important here).

- Don’t sell to people, move them.

- Engage in the TikTok community.

🔎 Explore more:

- A Step-By-Step Guide to Advertising on TikTok

- How to Find Trending Sounds on TikTok

- What’s the Best Time to Post on TikTok?

Other channels

There are many other platforms out there that might be perfect marketing channels for your business. Twitch, popular with gamers, might be the right place to find customers for your electronic business. And Pinterest, a go-to channel for DIY and style content, could be an effective place to market your home décor brand.

- Twitter: Twitter Marketing: A Beginner’s Guide

- YouTube: YouTube Ads for Beginners and Your YouTube Marketing Starter Guide

- Reddit: How to Use Reddit for Business

- Snapchat: How to Advertise on Snapchat Ads

- Pinterest: The Beginner’s Guide to Pinterest Ads

- Twitch: How to Make Money on Twitch

- WeChat: How to Sell on WeChat: Everything You Need to Know

💡 Tip: On whatever marketing channel you choose, you’ll want a strong call to action (CTA). This may be asking your audience to shop directly through the platform or to visit your website. Learn how to make the most of your link in bio to achieve your goals.

Building a content strategy

Whether it lives on your site as an SEO strategy or on another platform like YouTube, content marketing is a great way to grow traffic, build authority in your industry, and offer value to your customers.

🗒️ Content marketing formats include:

- Blogs and written content

- Video

- Podcasts

- Virtual courses and tutorials

- Social media content

- Infographics

- Visual content

- Ebooks

- PDF and digital downloads (templates, recipes, guides, free fonts)

Content that lives on your site can be used to increase traffic (using SEO) or it can be “gated” to help you build your email list. Free content, like short tutorials or recipes, can give your potential customers a taste of your offering and make them feel confident about purchasing paid content like a cookbook or full-length course.

Potential customers can also find your business organically through other platforms like YouTube. Offering relevant content on YouTube is another way to show up in search results and build a community.

🔎 Explore more:

- Brand Ecommerce Blog Examples for Better Content Marketing

- Video Marketing Guide: How to Build a Video Marketing Strategy

- The Best Free Video Editing Software Programs

- The Best Paid and Free Content Creation Tools for Online Businesses

- Cash In on Your Expertise: Create an Online Course That Sells

Understanding conversion rate optimization

Conversion rate optimization (CRO) is a set of marketing tactics for increasing conversion (the percentage of your traffic that makes a purchase) on your website. Through design choices, efficiency improvements, and testing, effective CRO can encourage more visitors to take action.

Ways to improve conversion rate on your site include:

✅ Simplifying the user experience

✅ Adding testimonials

✅ Using high-quality images

✅ Optimizing thank you email messages

✅ Offering free shipping

✅ Optimizing page load times

🔎 Explore more:

- Traffic But No sales? Diagnose and Improve Your Store

- A/B Testing: The Complete Guide with Expert Tips

- CRO and Growth: Top Conversion Rate Optimization Tips From 19 Experts

Setting up marketing analytics

Running ads without understanding ecommerce metrics likely means you’ll be wasting money and time. Take the time to learn analytics tools and get to know the terms. This will give you an accurate picture of your marketing spend and performance so you can double down on what works and stop what doesn’t.

Social platforms often have native analytics dashboards to help you track the effectiveness of content and campaigns. You can find marketing analytics for your website on your ecommerce platform’s built-in reports or through a tool like Google Analytics.

🔎 Explore more:

- How to Calculate and Increase Customer Lifetime Value (LTV)

- What is Customer Acquisition Cost (CAC)? Calculate and Reduce It

- Five Ways to Grow the Average Order Value (AOV) of Your Online Store

Building a community

Community is key for brands catering to niche markets. Both winning the hearts and trust of well-established communities and creating a new one of your own takes consistency, authenticity, and a personal touch.

Whether your target audience is breast cancer survivors, Indigenous communities, or drag queens, it’s important to understand the community you’re serving. Listen, engage, and ask for feedback as you grow.

Many new brands opt to build businesses that serve the communities they’re already part of. This way, they have a deep understanding of their customers’ needs and gaps in the market. If you’re not part of the community you hope to target, ask yourself if you’re the best person to build for that group.

Once you’ve built a community, it’s important to nurture it. Community management involves growing your relationship with your audience in public spaces. Effective community management has four parts:

👀 Monitoring: tracking conversations that relate to your brand

💬 Engaging: proactively engaging with customers, leads, and influencers

🚔 Moderating: removing comments and conversations that don’t add value or violate the terms of your brand or the platform

📐 Measuring: analyzing how your brand is perceived and getting real, unfiltered feedback

Customer service for marketing

While customer service will be part of your ongoing day-to-day operations to help keep customers happy, consider it a marketing tool, too. Great customer service inspires word-of-mouth referrals—people want to share positive experiences. You can also modify your typical customer service communications to inform customers about upcoming promotions or new product launches and drive future sales in the process.

🦘 Jump back to: Table of contents

11. Grow your business

By now, your small business should be a well-oiled machine. Your product photos are on point, you’re building online communities, you’ve nailed your fulfillment process, and you’re hopefully making regular sales.

Take a moment to celebrate your wins! If you’ve made it this far, you’ve successfully turned a kernel of an idea into a living, breathing small business. So what’s next? You may decide to stay small, dedicating yourself to building relationships with a loyal customer base and managing everything solo. Or, maybe you’re ready for the moon.

Here, we touch on the next steps for your growing business, from seeking additional funding to hiring and managing staff.

Monitoring and adjusting

Before you scale, assess the health of your business through a number of means. The results of this assessment will give you the confidence to scale your business and inform how you will do so. Some steps to take include:

- Check in on your key performance indicators (KPIs). When you started your business, you set KPIs—specific metrics that measure your performance toward your business goal. Setting these is important, but tracking them is even more so. How does your performance stack up?

- Get feedback from your customers. Your loyal customers are stakeholders in your business in the same way investors are—they’re betting on you with their money. Take a pulse on customer sentiment with surveys or analysis of your customer support load.

- Conduct a business review. You can take a bird’s-eye view of your business at any time or set quarterly or yearly reviews. Assess your financial health, progress toward goals, and position in the market.

Getting funded 2.0

You may have started your business with a personal investment and bootstrapping, but if your plans are bigger, you might need to seek business funding. Additional funding can help you open a brick-and-mortar business, hire employees, or develop new products.

Before you get started there are a few items to get in order:

✅ Update your business plan with your vision for growth

✅ Gather your financial statements

✅ Write and practice your elevator pitch

✅ Find a business mentor to help you prepare to pitch and polish your business plan

There are a number of sources for funding your business growth, including:

Business loans

Small business loans can be acquired from a number of sources, including major banks, credit unions, and alternative lenders. It’s important to review the options available from each to decide which type of loan best suits your business. A financial adviser can help you make an informed decision.

Small business grants are offered by many types of organizations. These organizations are looking to offer grants to small businesses that embody their organization’s purpose and add value to a particular community. With that in mind, the criteria for each grant varies widely.

Small business grants are not loans and you don’t have to pay back the money you’re granted. However, there may be some non-monetary expectations that you are required to meet.

Crowdfunding

Crowdfunding involves running a private campaign, usually through a crowdfunding provider, to raise money for your business in advance of its launch, a growth milestone, or a new product. These funds come from the general population. They do not need to be paid back, but brands often offer incentives like products, membership, or swag.

Growing your team

To meet your long-term business growth goals, you’ll likely not be able to wear every hat forever. As you grow, focus on the aspects of running the business that you like the most and the ones that best suit your skillset. For the rest: delegate. There are three main ways to get some tasks off your plate.

Initially, you can use bot apps to automate your processes. These apps can do everything from send customer communication to generate financial reports, freeing you up to do more.

But soon, you’ll likely need human help, especially if you need to offload manual tasks or hire employees for customer service. If your brand guidelines didn’t include any philosophy around hiring, it still serves as a great jumping off point to hone in on what qualities you’re looking for in new hires.

If you’re not ready to set up payroll or manage employees, outsourcing is another way to increase your humanpower without cloning yourself. Freelancers, virtual assistants, and contract employees are all options for growing businesses.

Selling in international markets

Another way to grow your brand is to expand into other markets. That might be finding new audiences within your existing sales markets or selling across borders. Before diving head first into global ecommerce, be sure to do your homework. Each country will have a specific set of regulations. Seek the advice of a lawyer before you sell in or open locations or warehouses abroad.

Start a business, design a life

You did it! You’ve achieved boss status and you’re already on your way to your next big goal. Along the way, you’ve gathered knowledge and learned from mistakes to help your business be the best it can be. The most exciting part? You’ve built a lifestyle around your passion. Enjoy the ride and remember: take care of yourself along the way.

How to start a business FAQ

Can you start a business with no money?

Yes, you can start a business with no money! A low-investment side gig such as a dropshipping store or a print on demand business is an easy way to get started while you’re still working. You can fund that business by bootstrapping as you grow or consider a small business loan or crowdfunding campaign. Tap into a skillset you already have and take advantage of free tools.

How can you start a business with just an idea?

Once you have a business idea, you’ve already completed the biggest step to starting your own business. Now it’s time to put that idea into action. The following steps will help you on your way to start a small business—or launching an empire.

- Research your idea, product, market, and audience

- Calculate your startup costs

- Source products, vendors, or raw materials

- Figure out your shipping strategy

- Develop a brand strategy and brand identity (pick a business name, design a logo, etc.)

- Build and launch your website

- Decide on a business structure and register your business with the government and IRS (get a business license)

- Purchase an insurance policy

- Manage your money

- Market your business (set up social media accounts, write a marketing plan, etc.)

- Scale your business

When should you start a business?

There’s never a “right” time to start a business. You should start a business when you have the time, attention, and funds to commit to it. Starting a business while you’re still working is a low-risk way to test the waters before making the leap to full-time entrepreneurship.

What do you need to start a business?

There are a few things you need to start a business, including:

- A business idea

- Startup funds (personal savings, a loan, or other capital)

- A viable market or audience for your idea

- A way to reach and sell to that market (like an online store)

- Passion and determination to build a business from scratch

What's the best way to start a business

The best way to start a business is to take the leap. Many businesses can be started by those with no experience and a low startup budget.

The most successful small businesses are those that match the right product with the right customer at the right time. They are run by founders who understand their market and have built a compelling brand to suit it. You can find success in any industry with any business model provided you do the work to assess your idea's viability. Determine what “success” means to you before you set out and map your business plan to that goal.

After you launch with a basic version of your idea, you can always tweak as you scale your business. Pay attention to customer feedback and market trends.

Read more

- How To Sell Online: A Step-by-Step Guide

- Know Your Customer: How To Build Buyer Personas (Free Template)

- How To Brand Your Business: A Guide for Entrepreneurs

- You’ve Met MrBeast, the YouTuber. Now Meet Jimmy, the Business Mogul.

- 9 Dropshipping Coffee Suppliers (2023)

- Pre-Orders Add to Your Bottom Line—How Do They Work?

- 6 Dropshipping Tips From the Ecom King

- How To Market Your Business on Social Media: 15 Effective Ways

- How To Print Your Own Book: 3 Places To Self Publish a Book

- What Is Warehousing? Definition and Guide