Whether it’s day one or year 10 of your e-Commerce business, managing cash flow is mission-critical.

You’ve probably heard the sobering statistic from the U.S. Bank study revealing how 82% of small businesses fail due to mismanagement of cash flow. What you may not have heard of is a story of a successful e-Commerce business that drove itself into a pit by turning a blind eye to cash flow.

Matt Tomkin reveals in an interview how VO2, a custom performance sports-clothing brand, failed as a result of poorly managed cash flow. He cites an under-diversified product portfolio and taking on excessive operating leverage as two of the most prominent reasons for VO2’s failure.

Note that VO2 was by all definitions a successful business, and had they managed their cash flow well, they could have sailed through. So, how do you ensure you don’t put yourself in a similar situation?

By taking control of your cash flow.

In this guide, we’ll embolden you to exercise better control over how cash flows in and out of your business.

Read the Current Cash Flow Statement

To optimize, you must read, understand, and interpret. Reading your current cash flow statement is a good starting point to get clarity on where your business stands cash-wise.1. Find Your Cash Flow Statement

If you’re a small business, there’s a good chance you’re not required to adhere to the full disclosure requirements, which means it’s not compulsory for you to file your cash flow statement. In such cases, you should call your accountant and ask them for a cash flow statement.2. Read Your Cash Flow Statement

There are two methods of preparing a cash flow statement:A. Direct method

The direct method is, well, a more direct method where you’ll only see cash transactions on your cash flow statement. Under the direct method, the cash flow is calculated as:Cash at the Beginning of the Period + Cash Received - Cash Paid = Current Cash Balance

B. Indirect method

The indirect method takes a backdoor approach. Instead of directly relying on cash transactions, it starts with the Net Income for the current year and compares the balances of assets and liabilities of the past and current years to calculate the cash received or paid.

Sounds complex?

Well, here’s the good news: you don’t need to learn how to prepare a cash flow statement yourself. Nevertheless, you should be able to interpret the data you see on a cash flow statement prepared using the indirect method.

Your accountant will consider whether you prepare books on cash or accrual basis. If you’re a small business, it’s likely that your books are maintained on cash basis, and that makes the direct method an easier choice for the accountant.

On the contrary, if you prepare books on accrual basis, you’re more likely to see the cash flow statement prepared using the indirect method.

Let’s use the indirect method as an example in the next step, so in case your accountant uses the indirect method, you can read cash flow statements with confidence.

3. Interpret the Cash Flow

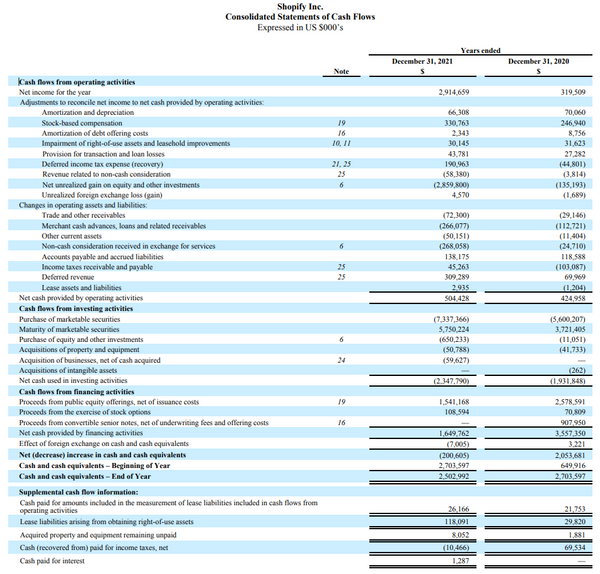

A large company’s cash flow statement can look intimidating. For instance, here’s how Shopify’s cash flow statement looks:

Source: Shopify

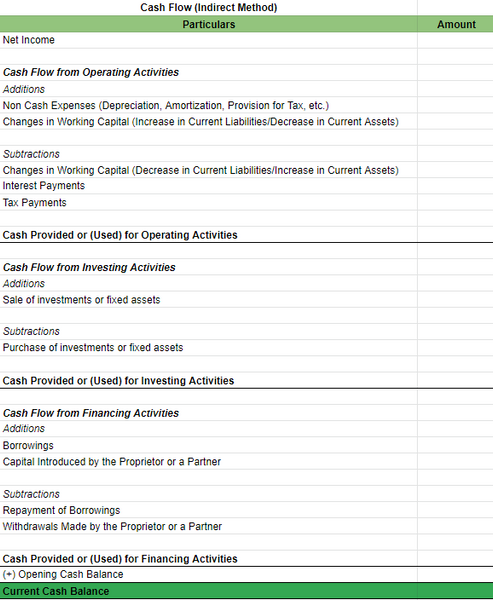

Shopify’s cash flow statement looks fairly complex, but here’s how your cash flow statement is more likely to look:

Looks more manageable, right?

There are two things that might require some explanation, though.

First, let’s talk about the non-cash expenses. They’re expenses that you don’t pay for explicitly. For instance, when you make a provision for tax on your income statement/Profit and Loss statement, you don’t pay that amount as tax, but only make a provision, and therefore doesn’t involve any cash outflow or inflow.

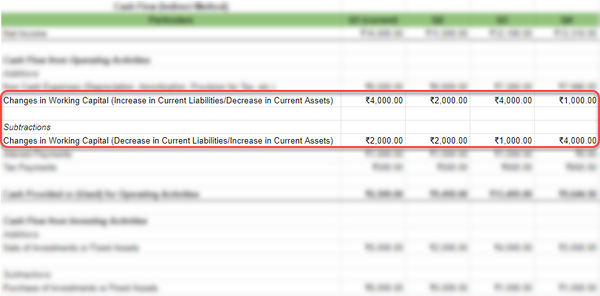

Second, changes in working capital could look like a curveball, but just follow this rule and you’ll never go wrong:

An increase in current liabilities and a decrease in current assets are added to Net Income.

A decrease in current assets and an increase in current liabilities are reduced from Net Income.

You can plug numbers into a cash flow template to quickly understand how your cash is flowing through the business. When your current cash balance tallies with the cash amount on your balance sheet, you’ll know you’ve done everything correctly.

Is Your e-Commerce Business Holding Enough Cash

You’ve probably been told that three to six months' worth of cash requirement is a good amount of cash to hold at any time. However, this is a general rule and can vary greatly depending on several factors.1. Current and Expected Growth

A business requires more money when it’s growing. You’ll need to hold more inventory, invest in new warehouses, and ramp up your customer support. You’ll need to pay your creditors, pay the monthly due amount towards the warehouses’ mortgage, and pay salaries to your customer support team, which means you’ll need to hold more cash.

2. Expected Working Capital Requirement

Working capital requirements can change based on what you’re selling. Seasonality is a good example. Say you sell custom-printed umbrellas. You’ll need more working capital during the monsoon months than during the rest of the year.

Another example can be a new, high-value product line. For instance, if you sell Bluetooth speakers, and are planning to add heavy-duty sound equipment soon, you’ll require more working capital, and therefore, more cash.

3. Reinvestment Needs

To grow a business, you need to put money back into it. If you’re also manufacturing the goods you sell, you might consider investing in a machine that makes production more efficient or helps reduce the manufacturing cost.

If you source products from elsewhere, you might need another storage unit to store more of the same product or add more products to your portfolio. If you’re expecting to make such investments, you’ll need more cash.

How to Forecast Your Cash Flow

You don’t need a crystal ball when you have a forecasting spreadsheet to ensure you’re always holding enough cash. Now that you know the possible things that can influence your cash requirements, let’s talk about how those requirements will manifest in your cash flow.Getting too much into the weeds can be detrimental and make the process overly complex. You only need a fair estimate and not an exact amount, but you can still ensure that all expected cash requirements are reflected in your forecast.

If you’re trying to forecast eCommerce cash flows, use the forecasting template and follow the steps illustrated below.

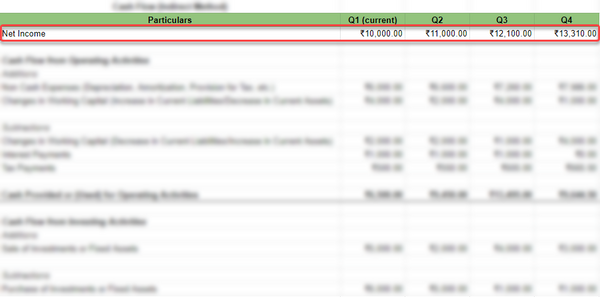

Step 1: Estimate the net income.

You don’t need any accounting knowledge to estimate Net Income. Grab the income statements for the previous three to five years. Calculate the yearly growth rate for each year and average it out. To calculate the growth rate for each year:

[(Year 2 Net Income - Year 1 Net Income) ÷ Year 1 Net Income] x 100If you do this for 5 years, add all growth rates and divide it by 5 to get the average.

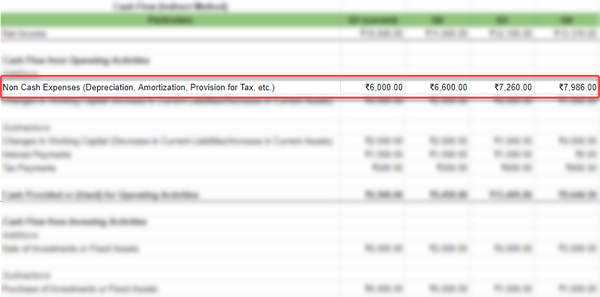

Step 2: Estimate Non Cash Expenses

You can take non-cash expenses as a percentage of the net income. For instance, if the net income is ₹10,000 and non-cash expenses are ₹6,000 for a certain quarter, you multiply the net income by 60% to estimate non-cash expenses.

Of course, this is only an estimate. If you’re going to buy fixed assets in a subsequent quarter, you should change this percentage to reflect the increase in depreciation (net of tax). For instance, if you expect depreciation to increase by ₹1,000 and the tax rate is 15%, increase the non-cash expenses by ₹850.

Step 3: Estimate changes in working capital

Again, you can simply extrapolate the numbers from the first quarter based on a percentage of net income. However, you might want to make relevant changes if you expect a change in the credit policy from your creditors, or if you plan to hold more or less inventory in the coming periods.

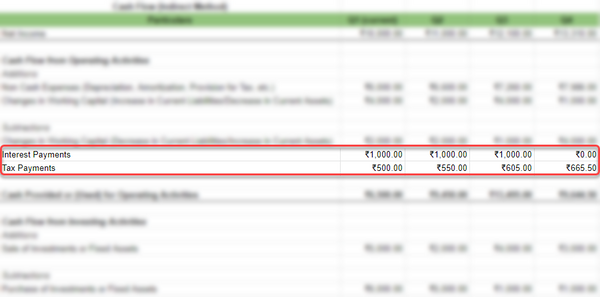

Step 4: Estimate interest and tax payments

Interest expense is directly tied to the amount of debt. If you expect to borrow the money, you should adjust the interest expense for future periods. Similarly, the tax payments are directly tied to net income. It’s best to compute these numbers manually to avoid making the spreadsheet overly complex.

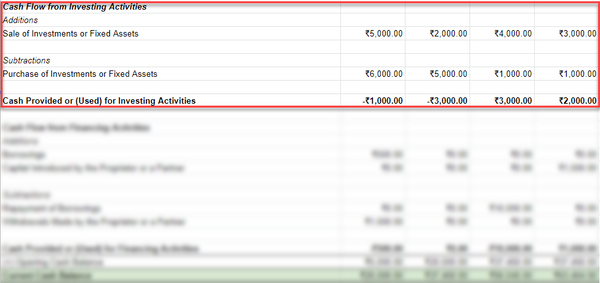

Step 5: Estimate the sale and purchase of investments and fixed assets

You should calculate these amounts manually since there’s no pattern to follow here. Most capital expenditures and receipts are planned, so estimating these numbers should be fairly straightforward.

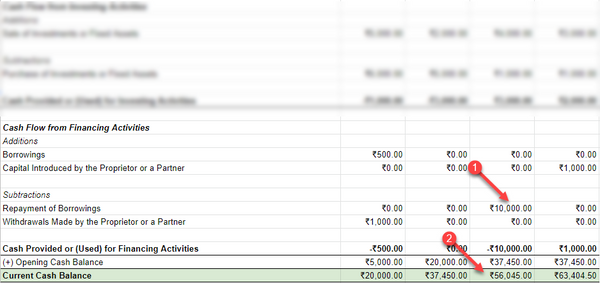

Step 6: Estimate addition or reduction of capital

This is where it gets interesting.You should start with loan repayments. In most cases, you can’t push back on repaying a loan when it’s due. Enter the amount of loan you need to pay. Then, look at your cash position (i.e., the current cash balance) after repayments.

If the number is positive (like in the example above), go ahead and fill in the spreadsheet for the subsequent periods. If the number is negative, your forecast says that you’ll need more cash coming for that quarter, or you could end up with a cash crunch.

So, how do you get more cash?

The quickest way is to get a loan or ask the partners for more capital. If you plan on using a loan or introducing capital, add that number to the relevant row in the spreadsheet. When you forecast for subsequent quarters, don’t forget to factor in the impact of the loan’s interest under the operating activities section.

However, if the quarter is still further away, you can use some other strategies to avoid the cash crunch. While a loan is a great way to sail through for the short-term, strategically improving your eCommerce cash flow will help you in the long term.

How to Improve Cash Flow

There are three broad ways in which you can improve your cash flow:- Increase cash inflows

- Decrease cash outflows

- Change working capital allocation

1. Increase Cash Inflows

Increasing cash inflows sounds like an obvious strategy, but we’re going to tell you how you can improve cash flows.Operations are where a large portion of your cash comes from in most businesses (you might also generate investments). Following are a few ways to increase your cash flow from operations over the medium to long term:

Diversify product portfolio

If you sell winter wear, your revenues will dip during the summer months. You can increase your cash flow by adding products that are relevant for the summer.Offer packaged products

If your product portfolio has products that can complement each other, offer packaged products. Packaging your products can help increase average order values and get more cash into the business.Offer more payment options

e-Commerce businesses now offer more payment options than ever. You're missing out if you’re only offering the most common ones like digital wallets and debit and credit cards. Consider adding payment options like Buy Now Pay Later (BNPL) to your eCommerce store.

However, if you’re in the initial phase of starting your eCommerce business, cash on delivery (COD) can be a tempting option that requires some sincere consideration. A large portion of orders in India are COD, so not offering it means leaving money on the table. We asked Dharmik about his take on COD, and he admits that he was reluctant to offer it at first.

We didn’t offer COD earlier because it comes with a cost. The costs can quickly balloon up and spell bad news for your cash reserves, especially if you’re in your early days. Even once you’re fairly established, COD payments can take 7-30 or more days to reach your account, depending on the partner. If you’re growing quickly, the buffer can wipe out your cash. We recently started using aggregator platforms like Shiprocket to find the best partners based on the location. Such platforms also offer an option for quicker COD remittances to address the COD-cash flow problem.

2. Decrease Cash Outflow

This is another obvious strategy, but let’s dig a little deeper and see how you can reduce your cash outflows.Take on operating leverage

Operating leverage is a technical term for fixed operational costs. Increasing operating leverage can reduce your total operational expenses if you have a high sales volume.

For instance, say you’ve outsourced product packaging to a third party, and you pay ₹1 per unit. You pay that price whether you sell 1,000 units or 20,000 units each month.

If you’re selling 1,000 units, outsourcing makes sense. But if you’re selling 20,000 units, you might consider hiring someone in-house and paying them a monthly salary.

Dharmik’s team has grown to more than five members, but as a bootstrapped business, he tells us how he approached operating leverage.

I started my eCommerce business from home with one machine. Initially, I managed everything from manufacturing to packaging myself. Over time, though, as orders started rolling in I had to figure out a way to delegate responsibilities. I weighed my options and hiring someone in-house to work on multiple aspects made more sense than outsourcing individual aspects to a third party. Of course, for this to be financially viable, you need a big enough average order value.

Eliminate unnecessary expenses or overheads

If you’re sending a ‘Thank you’ card worth ₹2 with each unit, you might consider skipping them while you get your business’s cash flows in order.

While ₹2 seems like a meager amount, especially if your average order value is high, the total cost can quickly pile up. If you sell 20,000 units, you’ll end up spending ₹40,000 on just cards.

You should also consider cutting back on other overheads (such as a premium packaging material or freebies) that you believe won’t have an adverse impact on your product’s quality or sales volume.

Delay capital expenditure

In most cases, you should use this strategy as a last resort. Delaying capital expenditure, such as purchasing a new warehouse, essentially means that you’re putting a speed bump in your business’s growth trajectory.

However, a cash crunch can sometimes have dire consequences and cause the entire operation to shut down. If you’re in a similar situation, it makes sense to delay capital expenditure until you’ve got a good amount of cash flowing into the business.

3. Change Working Capital Allocation

Understanding the concept of working capital – at least at a basic level – is key to exercising more control over eCommerce cash flow.How to Calculate Working Capital

Working capital = Current Assets - Current LiabilitiesCurrent assets (i.e., assets that can be converted into cash in the short term) include:

- Cash and cash equivalents

- Inventory

- Accounts Receivable

- Other current assets (money market securities, prepaid expenses, etc.)

- Accounts Payable

- Short-term loans

- Other current liabilities (accrued liabilities, taxes payable, etc.)

- How to Change Working Capital Allocation

Think of current liabilities as sources of money and current assets as applications of money.

When you buy inventory on credit, you increase current assets and current liabilities. However, if you pay cash to your supplier, neither current assets nor current liabilities will change. You’ll just be converting one current asset (cash) into another (inventory). Get the idea?

You can use this concept for improving cash flow. Increasing current liabilities or decreasing current assets (except cash) will help you hold more cash. On the other hand, decreasing current liabilities and increasing current assets (except cash) will mean that you’re converting cash into a different asset, and therefore, holding less of it.

Another example of reallocating working capital can be converting inventory into cash. When you hold a lot of inventory, you’ll need to pay cash, which means it will then convert into inventory on your balance sheet. If you hold less inventory, less of your cash is tied up in inventory. This is how you can reallocate working capital to improve eCommerce cash flow.

Cash Flow is Key to Sustaining Growth

Managing cash flow isn’t just about survival, it’s also about sustaining growth. You’ll need to invest money in a range of things, including tangible assets and human capital. Not having enough cash to finance these activities can put you in a tough spot.Understanding your cash flows and monitoring them is a good starting point. However, you should take a proactive approach and forecast your cash flows to prepare yourself for a potential cash crunch well in advance.