Illustration by Diego Blanco

The CPG industry was hit hard throughout the pandemic. Some companies experienced massive sales hits and layoffs, while others saw wild spikes in demand, with US household spending on CPG items totaling $1.62 trillion in 2021.

Meanwhile, trends have accelerated at unimaginable rates, pushing CPG players into unknown territories. But as consumer goods manufacturers, they reinvented and reimagined themselves, expanding into digital sales and relevance-led marketing, and making heavy investments in ecommerce.

Research also indicates that consumers are ready to order food and beverages online—about 28% of US respondents said they’d ordered groceries online for pickup or delivery services at least once a month this year.

- What is food ecommerce?

- How big is the food and beverage ecommerce industry?

- 11 food and beverage industry trends

- Small brands are eating up CPG market share

What is food ecommerce?

Food ecommerce is the business of selling food and beverage products using an online store instead of (or as well as) a brick-and-mortar store.

However, unlike ecommerce in other verticals, there are a few more considerations to bear in mind. You must be vigilant about transparency, processing, and labeling of ingredients and allergens.

According to the AAFA, about 32 million Americans have food-based allergies, which means mistakes in this area can cause great harm to your potential customers—not to mention laws from the FDA regarding correct nutrition labeling.

How big is the food and beverage ecommerce industry?

The global CPG packaged food market was valued at $2 trillion in 2021 and is expected to generate a compound annual growth rate (CAGR) of 2.9% from 2022 to 2028. The market is also expected to reach $2.5 trillion by 2028.

Grocery was the top online CPG category in 2020, according to the Food Industry Association and NielsenIQ, accounting for 44% of all CPG ecommerce.

That trend continued through 2021, with online grocery shopping totaling $97.7 billion in sales via pickup, delivery, and ship-to-home channels, as more than 70% of US households received one or more orders during the year, according to strategic advisory firm Brick Meets Click.

11 food and beverage industry trends

With the ever-growing demand for food ecommerce creating new business opportunities, it also lends itself to changing trends over time.

- Sustainability

- Transparency and emotional connection

- Buy now, pay later (BNPL)

- Subscriptions

- Better checkout options

- Prime Day sales

- Investment in automated systems

- Going direct to consumer (DTC)

- Social commerce

- Omnichannel experiences

- Ecommerce investments and partnerships

1. Sustainability

One of the biggest challenges of our generation is building and creating a sustainable future. In the world of CPG, this means sustainable products and packaging.

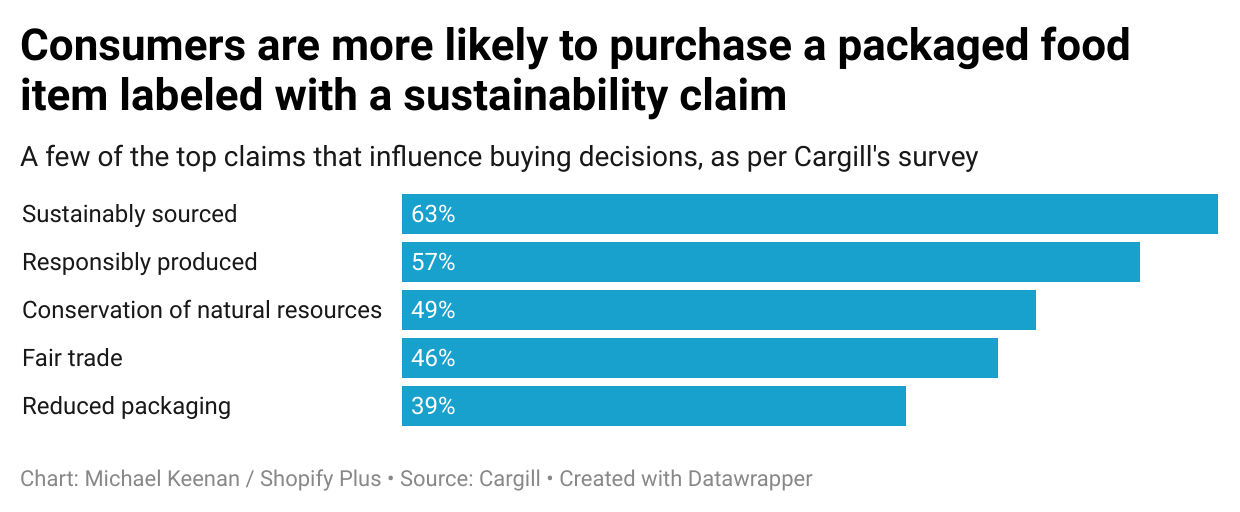

New findings from Cargill says 55% of customers are more likely to purchase a packaged food item if it includes a sustainability claim.

And it’s easy to see why—customers have positive associations with sustainable products, according to the National Retail Federation. Those include:

- Price is comparable to other products/trends (35%)

- Quality is better than other products/brands (32%)

- Better product availability (21%)

- A better understanding of health and wellness benefits (21%)

- A better understanding of how purchasing will contribute to social responsibility (21%)

- More information on how to re-use, return or recycle the product (21%)

- More information on where the products are sourced, produced, and/or manufactured (20%)

Other than making product packaging using sustainable materials such as cardboard or biodegradable plastic, CPG brands can also become more sustainable by using local suppliers. While many customers are deciding to support local businesses (as many as 70%), this option has the added benefit of being less likely to suffer supply chain disruptions.

“Consumers will continue to care more and more about the brands they are buying from, and will choose to spend their dollars on authentic, purpose driven brands,” says Kate Flynn, CEO of Sun & Swell.

“Brands should ensure marketing efforts are genuine and use this as an opportunity to truly highlight all of the amazing things to happen behind the scenes, such as showcasing suppliers they are proud to support.”

2. Transparency and emotional connection

Related to sustainable practices in food ecommerce is ingredient transparency. Not only for environmental reasons but for personal health too. Most Americans (94%) say front-of-package (FOP) food labels influence their food purchasing decisions, with nutrition fact highlights and ingredient-specific FOP labels being the most frequently considered.

In addition to those factors, customers are actively searching for local businesses they support and trust, and those that offer same-day delivery or click-and-collect pickup.

“Customers are looking to support brands that they connect with on an emotional basis,” says Eli Weiss, Director of Customer Experience at healthy soda retailer Olipop.

Weiss says Olipop has found that when customers develop a deep relationship with the brand, it helps drive sales. He cites the case of a recent launch of a new Olipop flavor, in which existing customers were sent an SMS announcement. It resulted in $30,000 in revenue in just 15 minutes.

“This is a testament to the value of exclusivity and authentic community building via the many platforms available to brands,” says Weiss.

Even though people may struggle with budgets thanks to increasing costs of living, customers will still pay extra for what they feel are high-quality products. Another key example is organic food products.

“People think the average consumer doesn’t have the resources to buy organic because of the pandemic,” he says. “But it’s not true—the organic industry has been growing.”

Stephanie Hunter, Brand Manager at Egglife Foods, agrees. “Consumers are looking for CPG brands to be transparent about what their products are made of, as well as what the brand stands for,” she says.

“Having clear nutrition statements, clear brand stories, and clear values will be a must to win with the modern shopper. CPG brands must remember that consumers have countless options every time they enter a grocery store, and they will be looking to purchase brands they can feel good about.”

3. Buy now, pay later (BNPL)

The buy now, pay later market size is forecast to hit around $576 billion this year, a 380% increase in value from 2021 figures of $120 billion. However, the grocery/food vertical is one of the few remaining that hasn’t seen BNPL adopted en masse—but that’s likely to change very soon.

The BNPL option has started to crop up thanks to the increasing popularity in providers such as Klarna, Shop Pay Installments, Affirm, and Afterpay, as well as major stores (both in-store and online) now offering the option, including:

- Costco

- Wholefoods

- Walmart

- Target

- Kroger

- Amazon Fresh

Consumer’s, particularly younger consumers, are ready for BNPL to be a regular offering from food and beverage services—40% of millennial shoppers are “very” or “extremely” interested in BNPL, as well as 37% of “bridge millennials” (mobile-centric 30- to 40-year-olds).

While physical grocers play catch-up, food ecommerce stores have the advantage of already being digital, with BNPL options relatively easy to implement in your checkout.

4. Subscriptions

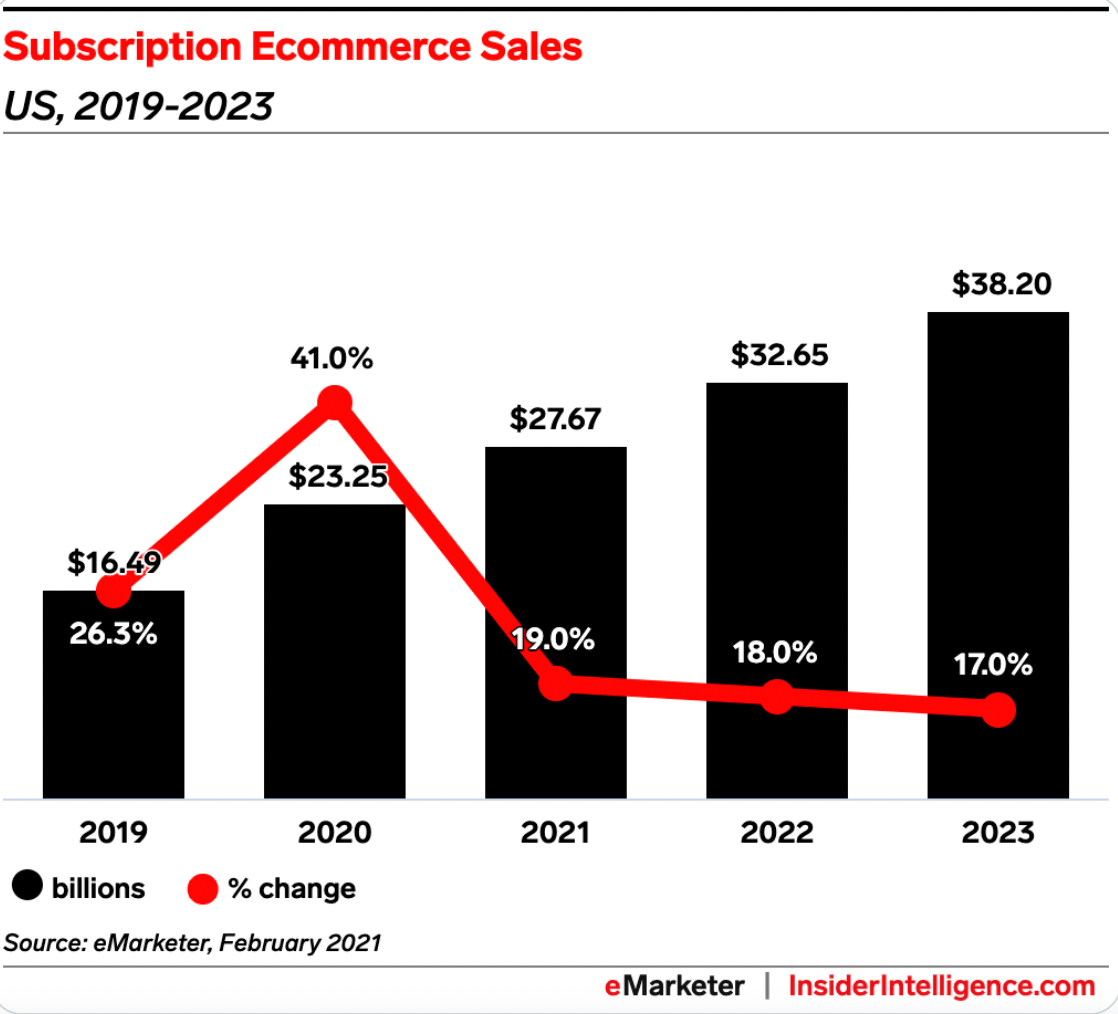

The concept of subscriptions isn’t new—the global subscription economy is projected to grow at a CAGR of 71.45% from 2020 to 2025, taking the total market size from $51 billion to an estimated $442 billion. However, ecommerce subscriptions in the US are expected to make up $38.2 billion of that total figure in 2023, according to eMarketer.

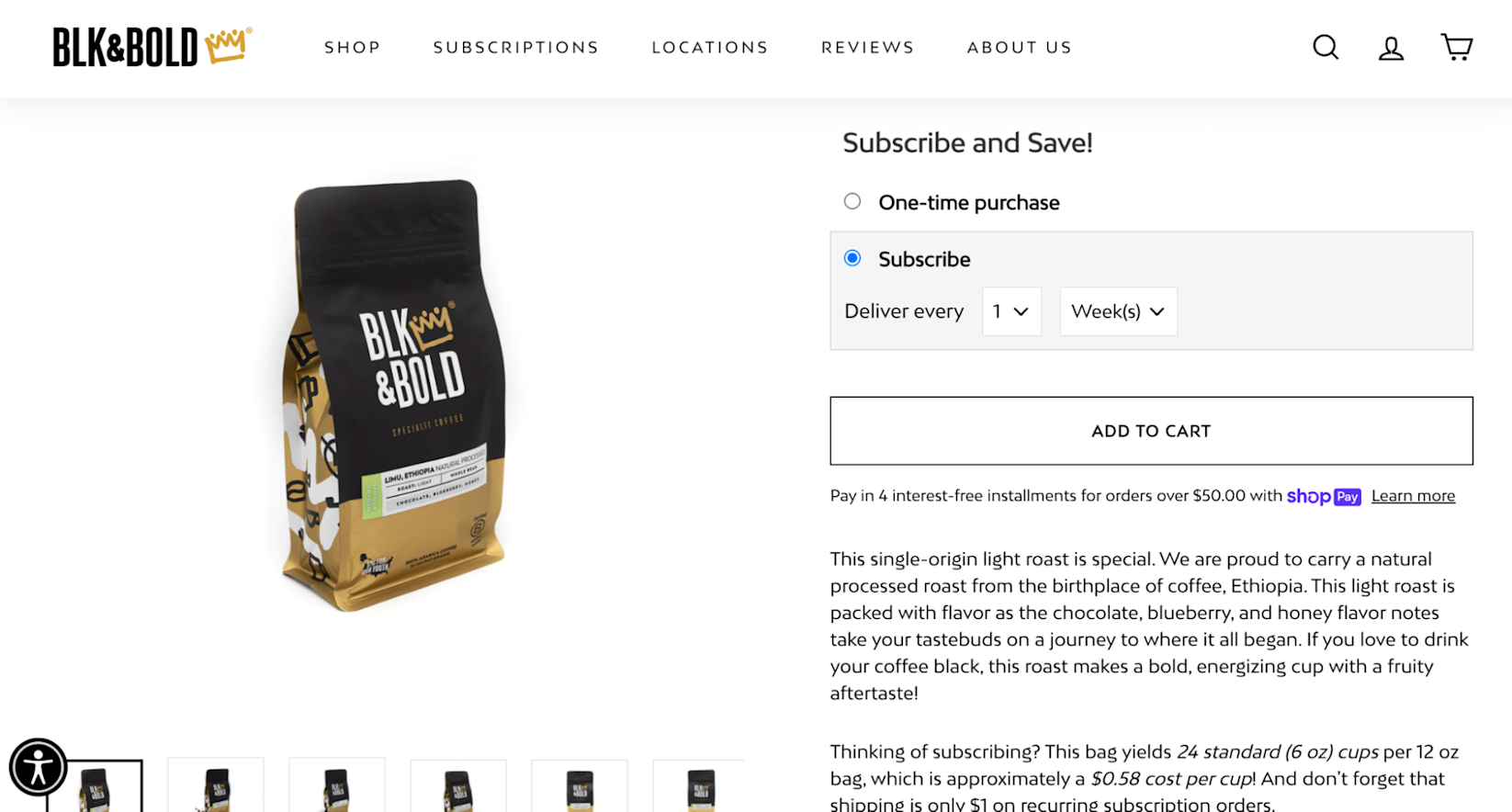

The subscription model for food and beverage brands offers customers flexibility in how they want to pay. A popular model variation is “subscribe and save,” which offers your customers a discount incentive for the regular subscription purchase.

A very popular food brand that has helped popularize this strategy is Hello Fresh, whose entire business model is subscription-based meal kits. However, smaller brands now get in on the action by offering subscribe and save alongside their one-time purchase options.

For example, coffee and tea brand BLK & Bold offer its customers the option to subscribe with various intervals, and save on recurring shipping costs:

A CPG brand can offer subscription services in a few different ways:

Product trials. A popular subscription type, these boxes include curated products with different levels of customization. Brands can let customers sample items or send seasonal food boxes based on their preferences and dietary requirements. Refills. Product refill subscriptions replenish items regularly for a set period of time, saving customers time and money. Membership subscriptions. This model gives customers access to exclusive products, discounts, or perks. Memberships like Thrive Market’s offer access to the best healthy products at guaranteed savings, for only $5 per month. If you don’t make back your membership in savings, Thrive Market will credit you the difference in Thrive Cash.

Fire Dept. Coffee, a veteran-owned coffee roaster in Rockford, Illinois, also saw a spike in sales after upgrading to Shopify Plus and offering subscription services. With a small but mighty team of 25 employees, the brand brought in nearly $10 million in revenue in 2021, with a 25% share of that money coming from subscriptions.

Shopify fit us when we had just one product. Shopify Plus fits us now as a $10 million business with multiple product lines. And it will fit us as a $100 million or $200 million business. That’s the beauty of it—there’s nothing we can’t do with Shopify.

Luke Schneider, Founder and CEO, Fire Dept. Coffee

5. Better checkout options

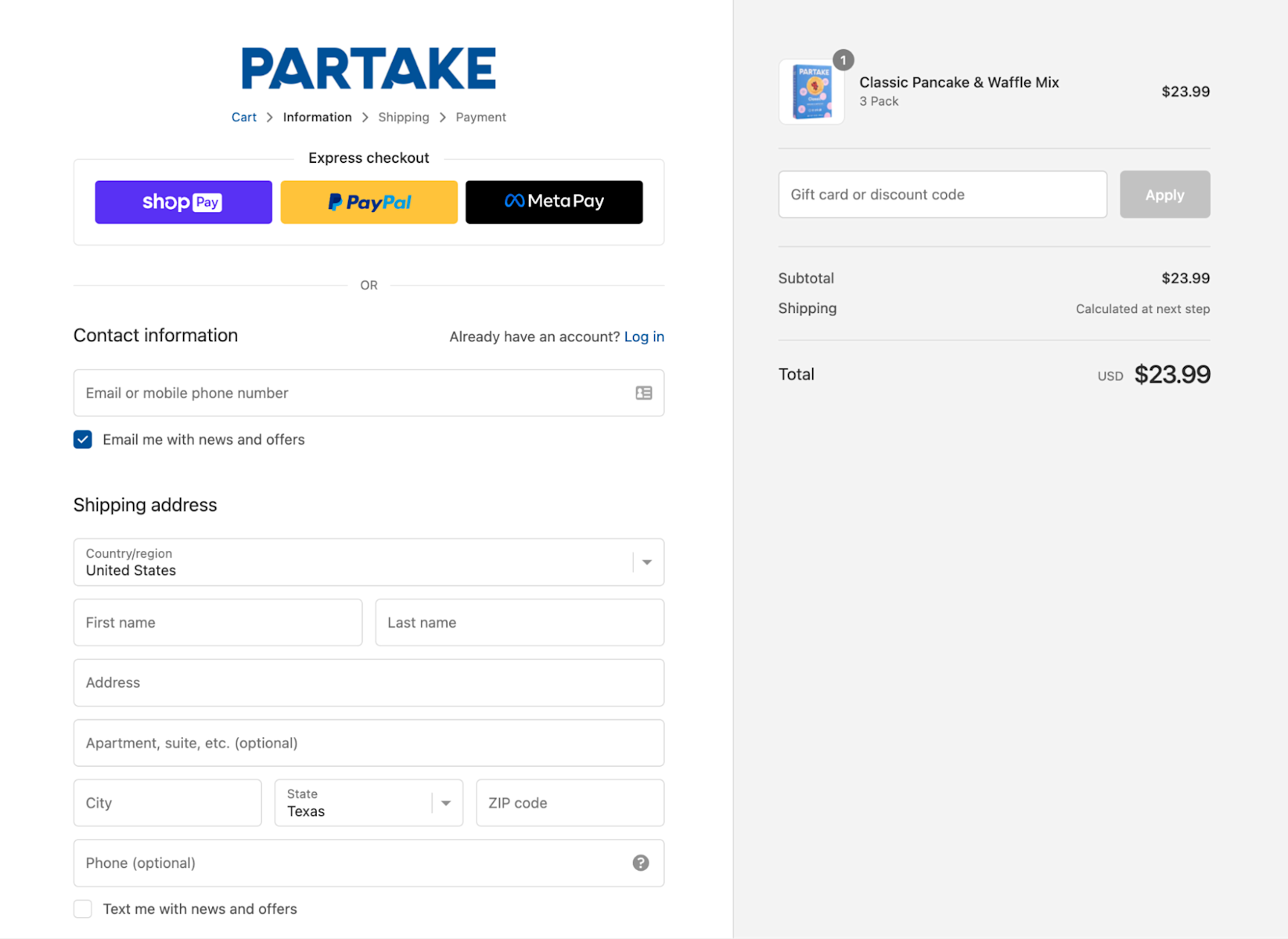

Both subscriptions and BNPL call for a wider trend in adopting better checkout options and technology. Conversion rate optimization (CRO) practices and research can help shed light on what makes for better options at checkout.

For example, Baymard Institute recently researched the top reasons for cart abandonment, and within its list were both “too long/complicated checkout process” (17%) and “there weren’t enough payment methods” (9%).

Partake Foods offers various express checkout options: Shop Pay, PayPal, and Meta Pay. The brand also lets customers pay by credit or debit card.

These simple options allow for a frictionless buying experience, and you can easily replicate this option with newer checkout technologies including:

- Shop Pay (Shop Pay Shopify integration)

- Apple Pay (Apple Shopify integration)

- Google Pay (Google Pay Shopify integration)

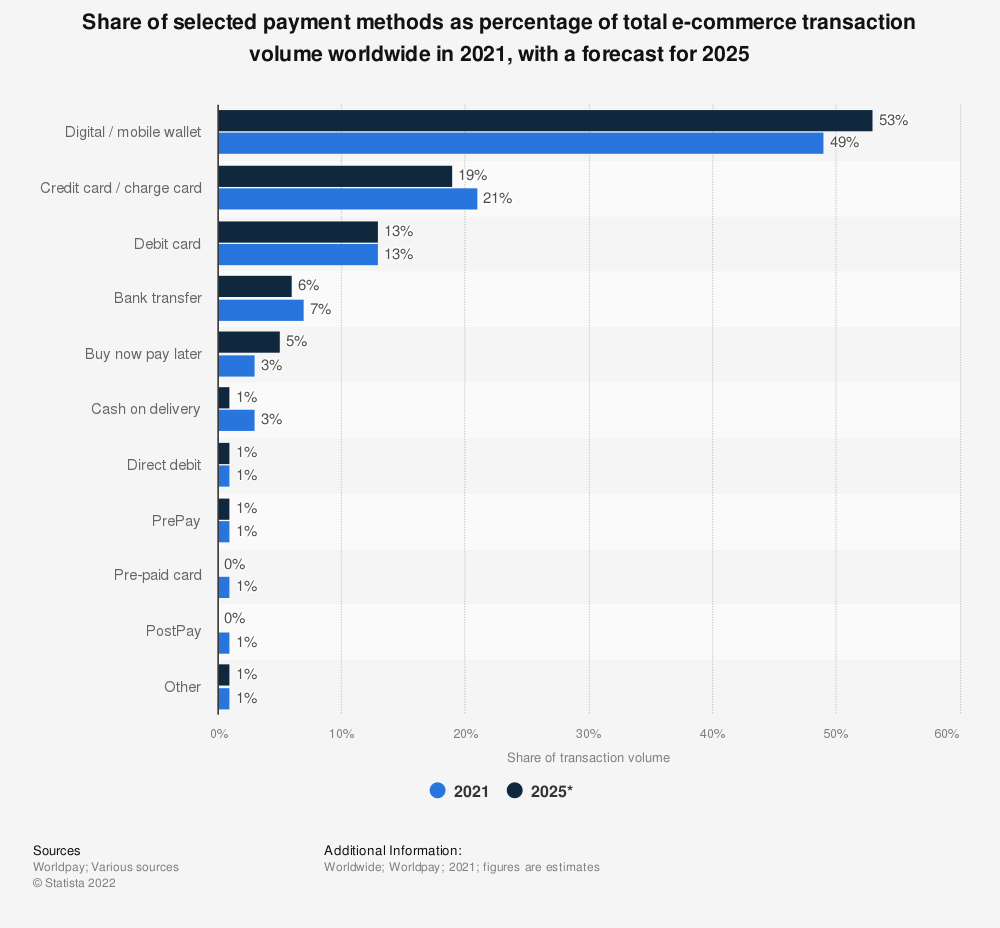

Each of these options can help your store facilitate single-click purchases. What’s more—digital wallet payment is the preferred method by far worldwide, and it’s set to outpace other methods even further:

With over half of customers set to be paying ecommerce stores through digital/mobile wallets, adding this option in your food ecommerce store will help keep up with the rest of the industry.

6. Prime Day sales

Amazon’s Prime Day generated over $12 billion in sales worldwide. CPG brands were some of the biggest winners during the two-day event. A shopping holiday focused on tech and gadgets, Prime Day is becoming increasingly more important for food and beverage retailers.

In 2022 alone:

- One in 10 shoppers added a home or grocery item to their cart

- The CPG category topped 20% of total Prime Day sales

Modern Retail reports that many food and beverage companies saw an overall spike in Amazon traffic, helping their brand gain awareness, kick off subscription plans, and increase digital sales.

Plant-based superfood mix brand Your Super saw a spike in sales during this year’s Prime Day, experiencing a 2.5 times increase in impressions, clicks, and conversions across all its sponsored campaigns.

7. Investment in automated systems

This long-term trend is true for most (if not all) ecommerce verticals—more investment in digital and physical automated systems.

Physical automation systems are not new. Since the Industrial Revolution, mass production has brought about automated systems, and they just keep getting more sophisticated. However, the technology involved has been getting cheaper, so more businesses can get in on the action.

An assessment conducted by McKinsey & Company suggests that retail grocery stores can run with 55% to 65% fewer hours with available automation technologies. With ecommerce food businesses not having to spend time on physical merchandising, many of the hours saved will be within the warehouse.

But the best improvements come from digital automation.

Remember the need to manage food and beverage stock more carefully because of perishable goods? Software such as Shopify’s easy inventory management system can help F&B-based businesses do their work.

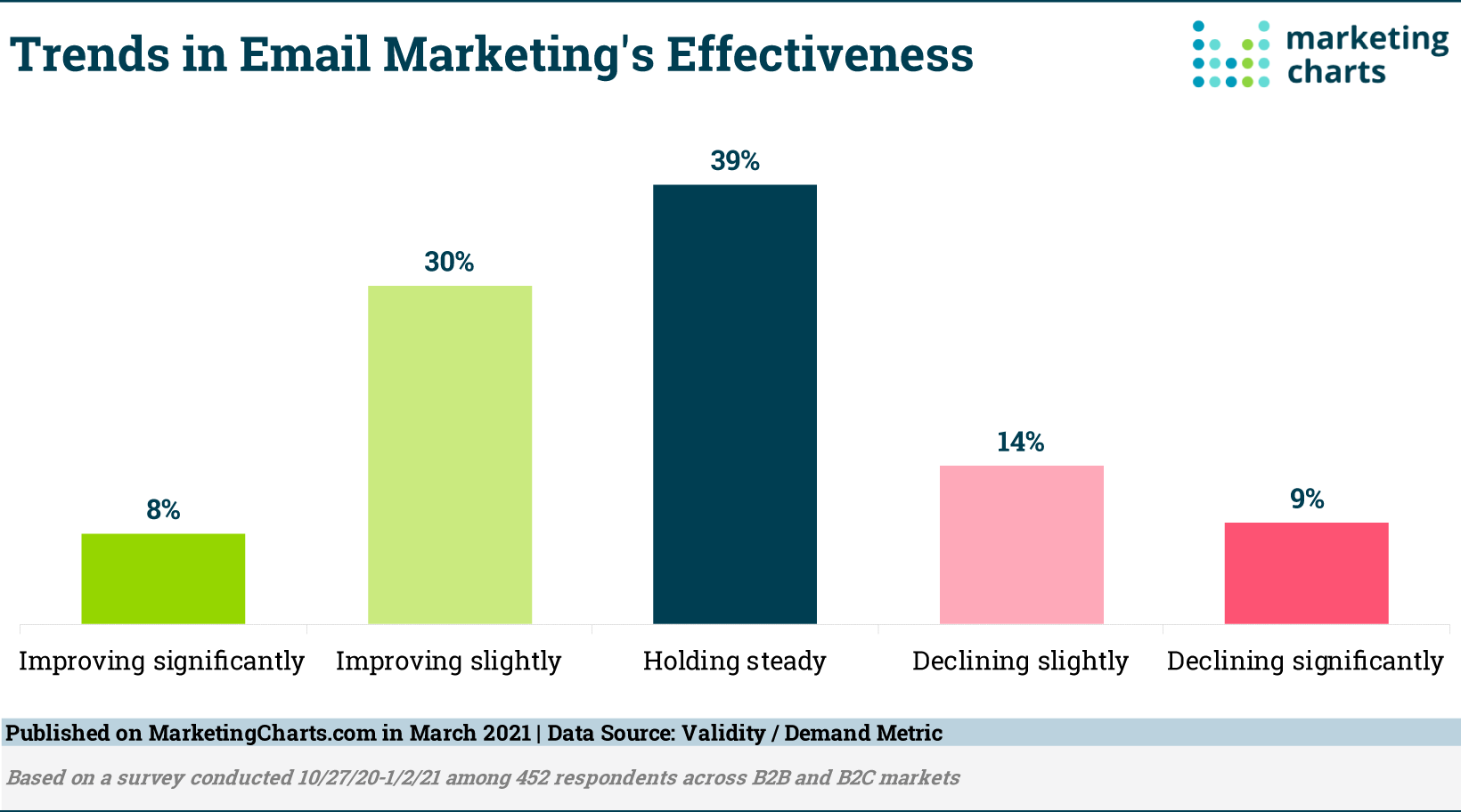

Beyond the back end of the business, there are also marketing automation trends to consider. With F&B businesses building deeper relationships with consumers, email and SMS marketing within the industry will become more important than ever.

As of 2021, 80% of the US population uses email—the most used channel for marketing automation worldwide (65%)—and 38% of US marketers say email marketing strategy effectiveness has continuously improved since 2020.

Remember how Olipop made $30,000 in revenue in 15 minutes after using SMS marketing? This speaks to a trend in ecommerce automation that will only grow over the next few years.

8. Going direct to consumer (D2C)

The traditional route for the food and beverage businesses has always been to set up deals with grocery or general retailers to sell their products in their stores.

But now businesses have the option to go at it themselves by selling directly to consumers (D2C) through an owned ecommerce site.

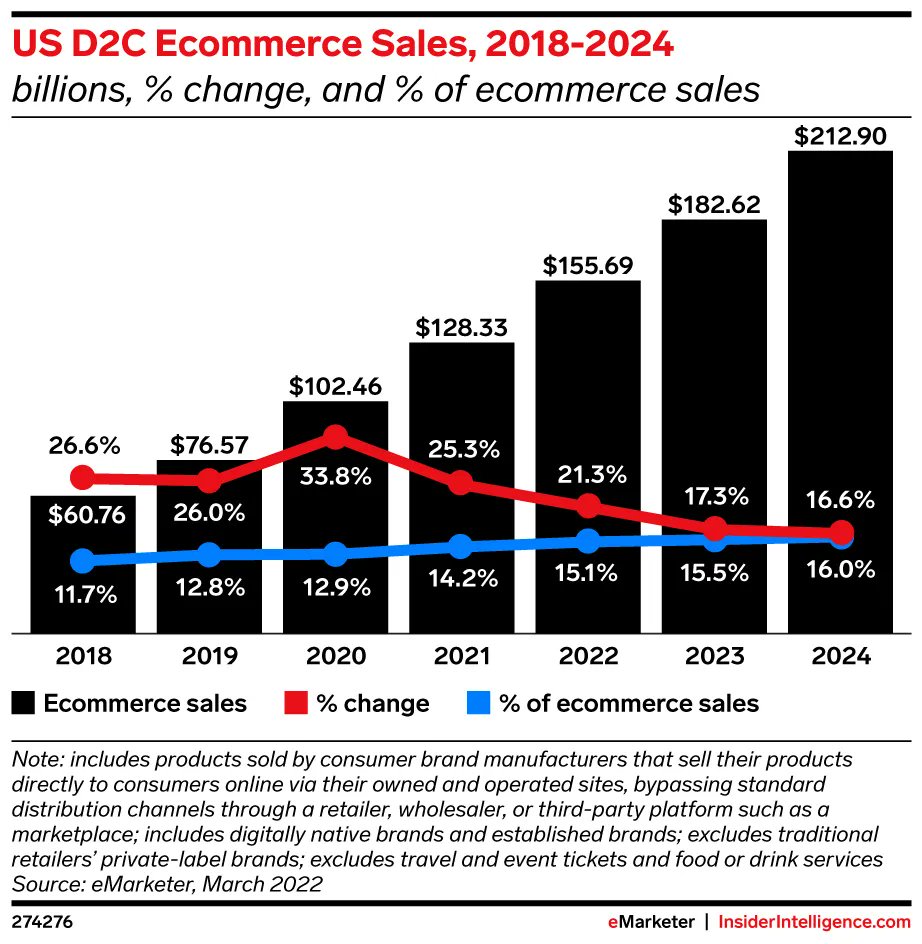

This option of going D2C is an increasing trend, where D2C ecommerce sales in the US hit $128.3 billion last year and are expected to rise to $212.9 billion in 2024.

McKinsey & Company’s most recent consumer goods success model suggests brands adopt D2C to acquire better customer data and test new sales opportunities. To do that, brands must consider these six factors:

- Commitment to D2C

- Be ahead of the curve with resources and investment

- Attract and retain digital talent

- Resolve tension between D2C and retail partner objectives (if applicable)

- Articulate a bold customer experience vision and strive toward it

- Go beyond the transaction, building customer lifetime value

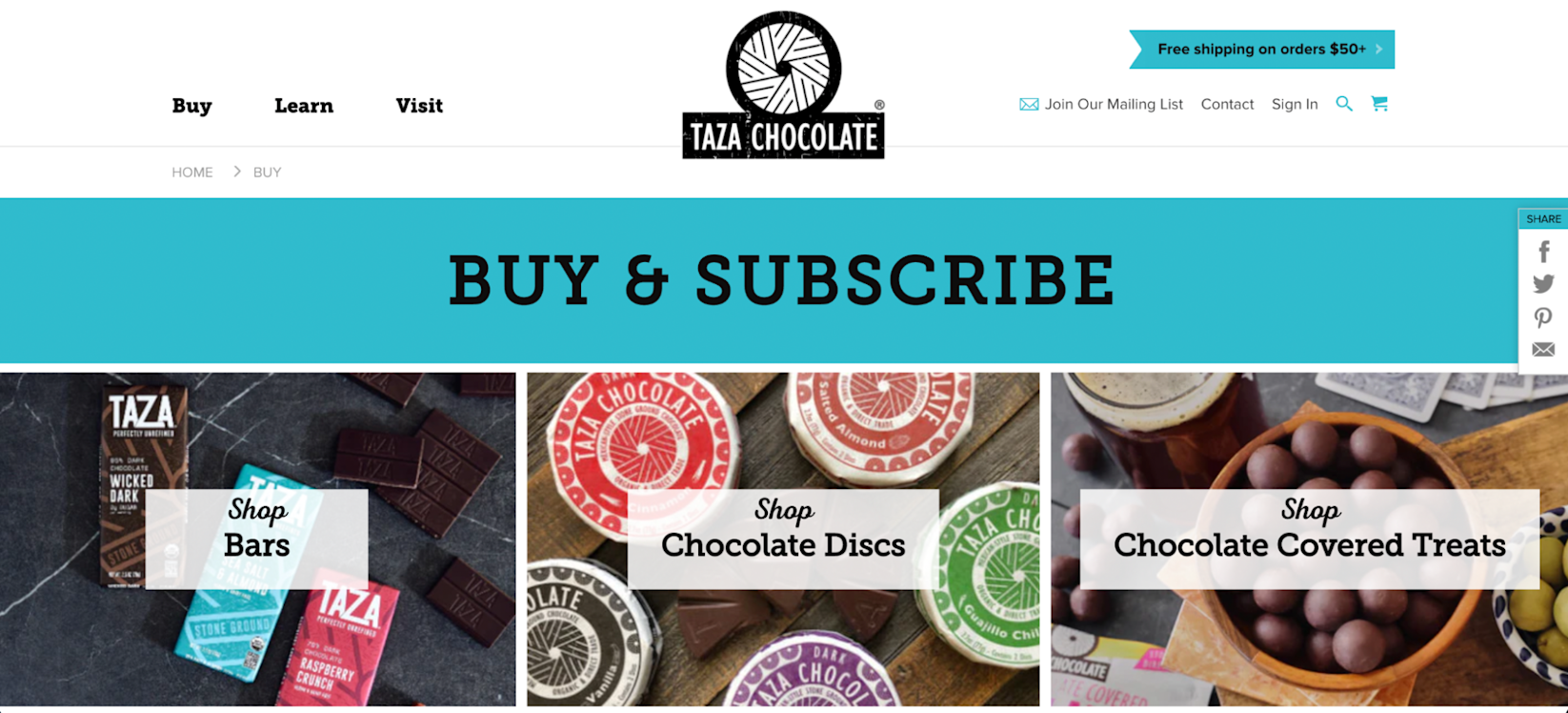

Plenty of brands already mentioned in this guide use the D2C approach to ecommerce sales, but another example is Taza Chocolate:

As the name suggests, Taza Chocolate sells chocolate-based treats directly to consumers, through one-off purchases or a subscription model.

“The direct-to-consumer (D2C) industry in the consumer packaged goods (CPG) space is just getting started and is significantly behind the D2C leaders in the fashion space,” says Matt Weidle, Business Development Manager at Buyer’s Guide, a leading consumer product review site.

“Nike's direct-to-consumer business model has already resulted in over $9 billion in revenue. Manufacturers of consumer packaged goods (CPG) should investigate how consumers normally purchase their products and brands, as well as how the attributes of their items would affect online fulfillment.

“To combat the danger of disruptors and to alleviate margin pressure from retailers, many CPG companies will go direct to consumers in the coming years.”

The direct-to-consumer (D2C) industry in the consumer packaged goods (CPG) space is just getting started

9. Social commerce

Another trending area related to D2C selling is using social media to make those sales—i.e., social commerce. In 2022, social commerce sales in the US have been estimated to be $51.8 billion and are expected to increase by 180%, to $145.2 billion, by 2028.

These figures are due to the introduction of in-app shopping functionality to popular social media platforms such as Facebook, Instagram, and TikTok since 2020.

Even within those two years, advancements in shopping features have improved, including the ability to “shop” through posts (where the brand has tagged a product from its shop in the photo or video).

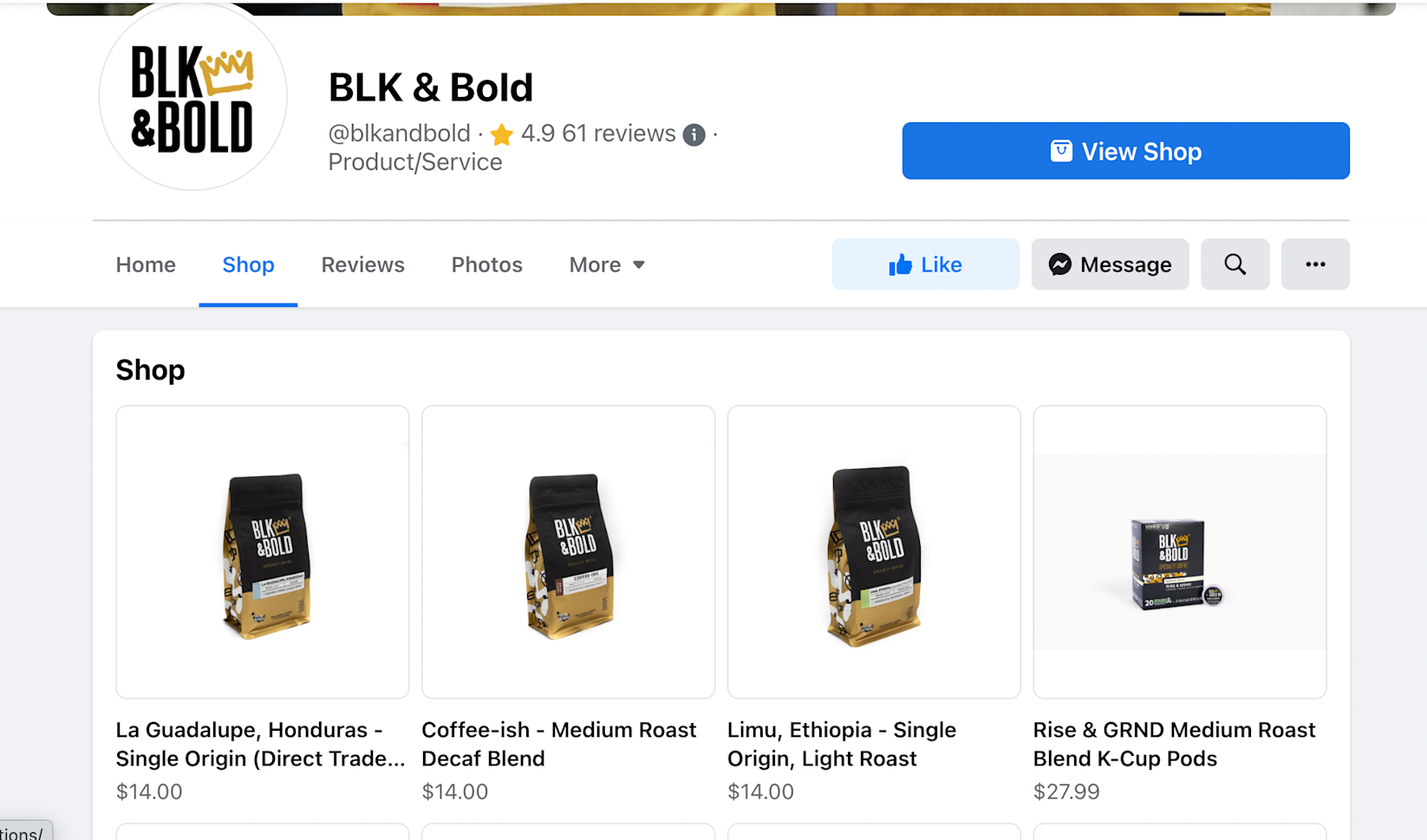

The BLK & Bold coffee brand also uses this strategy to attract more customers and increase online sales:

This method allows customers to buy from the brand without having to leave the social media platform (which introduces friction and increases the likelihood of abandoning the sale).

The social commerce method is a great way for small Food & Beverage brands to scale their audiences—with over half of the world’s population using social media platforms, there are more opportunities than ever to reach your customers where they are.

10. Omnichannel experiences

The final trend to look out for in F&B ecommerce growth is creating omnichannel experiences for your customers. Building an omnichannel strategy speaks to many of the trends already covered on this list, but it’s about building a relationship with your customer no matter what channel they use to interact with your brand.

As of 2021, 39% of consumers in the US were more favorable to omnichannel marketing approaches.

Part of the reason for omnichannel preference is generational consumer behavior changes. McKinsey & Company reports, “Most Gen Z consumers don’t even think in terms of traditional channel boundaries, our research shows, and they increasingly evaluate brands and retailers on the seamlessness of their experience.”

Online shopping for many of these customers is not about a one-stop shop. Ecommerce businesses should therefore be prepared to offer customers consistent, personalized communication on each channel they choose.

Retailers are personalizing these experiences to foster deeper relationships with customers. “Personalizing the experience puts customers at the heart of your business,” says Maria Shriver, CEO and founder of MOSH.

“From consideration to promoting your brand, it’s vital to tailor the steps people go through across the lifespan of the relationship. And this involves a seamless online sales channel, active social media engagement, brand experiences, and collecting customer feedback on which types of products they might like to purchase from you in the future.

“But most importantly, personalizing your direct outreach efforts. Customers who receive an email or message from your brand wishing them a happy birthday know you care about more than just their business.”

11. Ecommerce investments and partnerships

Food and beverage companies, in particular, can take advantage of using extra sensory experiences (taste and smell) that other types of verticals don’t get to offer.

At the end of 2021, global ecommerce sales hit nearly $5 trillion. The percentage of retail sales that were ecommerce grew from 18% to 19.5%, with that figure projected to rise to over 21% by 2024. More and more people have turned to ecommerce to get the things they need, and now that they’ve tried shopping online, they like it.

The old value-creation model for CPG companies partnered with grocers to gain distribution. But with the rise of e-marketplaces and the squeeze of mass merchants, successful brands want to invest in all growth channels and embrace digital sales.

Giants like Nestlé are shifting their budgets to digital channels. During 2020, 47% of Nestlé’s total media spend was on digital channels, compared to 41% in 2019. Smaller brands must find their best fit distribution channels.

In McKinsey’s new model for consumer goods success, the research firm outlined four commercial capabilities CPG manufacturers must adopt:

- Revenue growth management (RGM). CPGs must connect the levers of RGM (pricing, assortment. promotion, and trade investment) to the brand’s expansion and activation strategy.

- Emarketplace management. CPG players must partner with developer teams to produce the right assets at POS and manage daily technical execution.

- Omnichannel and D2C. CPG brands will want to adopt the D2C business model to acquire customer data and test new opportunities. They’ll also want to succeed at managing both online and brick-and-mortar stores, given the two- to three-percentage-point share increase online retail will gain post-pandemic.

- Data management. CPG brands will want to become experts in retailers’ big data, demonstrating expertise in insight generation, analytics, and ROI tracking.

It’s clear CPG is entering a new era. Successful companies will get on the right side of these trends to strengthen their brand and focus on relevant marketing and selling across all growth channels.

What was the impact of COVID on the food and beverage industry?

For the past 40 years, leading to the 2008–2009 financial crisis, CPGs generated the highest returns to shareholders across many industries, including food and beverage.

The category was led by giants like Coca-Cola, Doritos, Crest, and Lipton. These brands relied on mass-market appeal, partnerships, and brick-and-mortar channels for distribution and had relentless dominance over smaller brands.

But times are changing, and a new model for the consumer goods industry is popping up. Before the COVID-19 crisis, large CPG brands in the US lost market share at a rate of 1.5% per year between 2017 and 2019. Smaller brands grew 1.7% in that same period.

The pandemic amplified this trend, creating a new model for consumer goods success. More food shoppers are turning to ecommerce to discover and purchase CPG goods.

A recent survey by McKinsey & Company showed that 76% of respondents switched either to a new brand or a new way of shopping during the pandemic, and 66% of those respondents are expected to stick with those new brands.

The shift has allowed smaller food and beverage brands to thrive, such as:

- Keto snack retailer Love Good Fats

- Vegan, allergen-free cookie brand Partake

- Cult matcha brand Cha Cha Matcha

With the good comes some bad. The pandemic has also impacted the CPG industry negatively:

- The CPG food-and-beverage industry was hit with distribution and staffing shortages this past year. Reuters reports that the problem continues to this day. Distributors have had to raise their prices from $7,000 to up to $22,000 for shipping goods coast to coast.

- More than 120,000 CPG positions are being left unfilled. The National Grocers Association reports that many grocery stores are operating with only 50% of their staff.

- Despite the high demand for CPGs, supply chain challenges and inflation threaten the success of food and beverage retail brands. Global supply chain disruption may linger for years, according to a survey from US supply chain executives from Carl Marks Advisors. More than half of executives expect supply chains to normalize by the first half of 2024.

Small brands are eating up food ecommerce market share

CPG players that are nimble and respond to market changes will be able to take advantage of changing consumer habits.

Smaller brands that prosper will win through relevance-led brand building, actively leveraging commercial levers, and marketing with the consumer in mind. By adopting the food ecommerce trends above, you’ll be well over the $100 million barrier and beyond.

Read More

- What Game Designers Can Teach You About Influencing Buying Behavior

- Social Commerce Strategy: Improve Your Social Selling With These 9 Best Practices

- The Giving Economy: How Consumers Are Paying It Forward to Retailers

- Millennials are Changing the Face of Luxury Ecommerce

- New York Fashion Week 2020 Trends: Sustainability, Made-to-Order and Off-Runway

- Where Global Business is Going in the Wake of COVID-19

- Choosing Between Headless Commerce vs Traditional Commerce

- 15 Fitness Ecommerce Websites: Beyond Bodies into Growing Global Brands