Popular searches

Grow your expertise with Shopify Academy

Earn badges and stand out from the competition

Shopify Verified Skills badges prove your learning of specific topics covered in Academy courses and learning paths

Earn badges within our Fundamentals, Retail, or Storefront series.

DiscoverEarn Verified Skills Badges

Prove your abilities in specific topics covered in Shopify Academy

How to get started

1

Login with Shopify

Start learning today with your Shopify account

2

Discover courses and paths

Focus on learning topics curated for your specific needs

"Having a Shopify Academy badge really proves to our clients that we have knowledge about the platform, and it provides a lot of trust and credibility."

Left Designs

Shopify Partner

“The availability of a trained and certified talent pool does heavily influence our purchasing decisions!”

Imran Saadi

Sr. Director of Product & Engineering at Warner Bros. Entertainment

Featured courses and learning paths

Shopify Flow Fundamentals: Building Powerful Automation for a Store

Learn about the Shopify Flow interface and its core components to build powerful automations that streamline an ecommerce business.

FREE

3 Courses

Liquid Storefronts for Theme Developers Path

Learn how to use Liquid, Shopify's templating language, to optimize Shopify themes and deliver exceptional user experiences.

FREE

3 Courses

Expanding Your Shopify Business Internationally Path

Learn to guide your business through the key steps of an international expansion.

FREE

7 Courses

Navigating the Shopify Admin

A collection of interactive demos and articles that provides an overview of the capabilities of the Shopify admin. You’ll explore the features and tools that will help you maximize your success with the admin.

FREE

13 Resources

Creating a Digital Marketing Strategy Path

From unified commerce foundations to strategic seasonal campaigns, learn the essentials of marketing with Shopify to build your brand, engage your audience, and drive conversions.

FREE

6 Courses

Shopify POS Launch and Operations Path

Learn about Shopify POS launch and operations to effectively set up and manage hardware, train staff, execute operations, and optimize growth for seamless business operations.

FREE

5 Courses

Conversion Rate Optimization with Shopify

Learn how to effectively maximize your Shopify store's potential from applying CRO best practices to personalizing customer experiences.

$299

4 Courses

Education and reference resources

The resources listed below cover some of the topics within this exam

FREE

[Article] Introduction to Shopify’s Development Resources

Learn about the tools and resources available to you as a Shopify developer.

8

Introduction to POS UI Extensions

Learn how to take advantage of POS UI extensions by exploring practical applications, learning to navigate developer documentation, and gaining hands-on experience in creating innovative extensions.

FREE

40

Week 3

FREE

[Article] Selling fractional quantities

Learn how to enable fractional and non-traditional quantity sales in your Shopify store

5

Enhancing Checkout with UI Extensions

Learn how UI extensions create unique shopping experiences in the checkout.

FREE

25

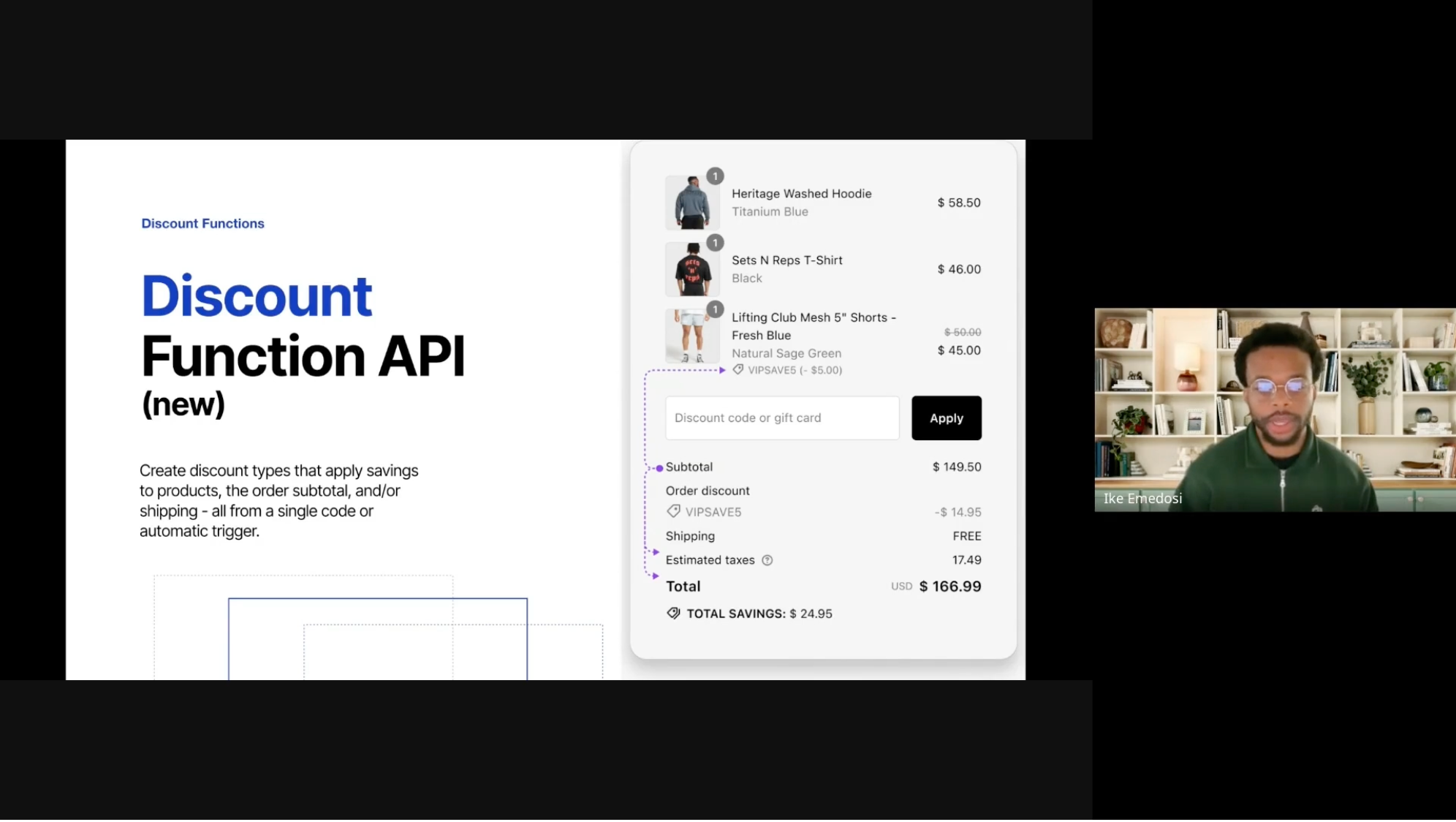

Customizing Business Logic with Shopify Functions

Learn how Shopify Functions apply unique business processes to checkout.

FREE

30

Site Audit Walkthrough

Walk through an 8 minute site audit of the 6 key areas to focus on when optimizing your ecommerce site for conversion.

FREE

10

Onsite Cart Abandonment Strategies

Learn hands-on tactics to convert more customers through abandoned cart recovery

FREE

5 min

Growing with Shopify

Recommended for merchants whose annual sales are between $100K and $1MM

FREE

[Video] Packaging 101 with Arka

Discover the best practices for packaging products to make success-oriented decisions.

20

[Article] Auditing SEO Performance

Implement regular SEO audits to measure performance, identify opportunities, and maintain visibility in search results.

5

Introduction to Headless Storefronts Solutions

Explore custom storefront solutions available to Shopify merchants, including features and benefits of Hydrogen, Oxygen, and the Storefront API.

FREE

70

Introduction to Shipping & Fulfillment with Shopify

Get a comprehensive understanding of Shopify’s shipping and fulfillment tools.

FREE

30

Introduction to Shopify

Learn about who Shopify is, our mission, core features of the platform, and how we support businesses of all sizes to start and grow.

FREE

20

Getting Started on Shop

Your customers are already on Shop, you just need to meet them there. Watch these short videos to understand how you can leverage Shop’s features to re-engage your most valuable customers.

FREE

10

How to Optimize your Page and Site Speed

Improve your page and site speed with actionable tips you can implement yourself immediately, as well as more complex strategies you can address with your developer to

FREE

20

The Value of Social Listening

Learn the value of social listening and how to leverage what you "hear" to grow your business

FREE

29 min

Week 1

FREE

Week 2

FREE

Planning for Peak Season 2024

Prepare for a successful 2024 peak holiday season and Black Friday - Cyber Monday (BFCM) with this comprehensive course packed with valuable insights and actionable tips.

FREE

30

Fulfillment and Order Routing

Examine factors to decide which fulfillment methods to offer for your products and orders

FREE

30

Expanding Your Developer Toolkit

This course will introduce you to more advanced or multi-function tools, commerce-pillar specific extensions, and cover how to stay up to date on product changes relevant to developers.

FREE

20

Shipping Settings and Strategies

Learn how to align business goals to fulfillment strategies

FREE

60

Shopify POS Walkthrough

Click through the Shopify POS app to learn about it's features and functionality.

FREE

Grow with Shopify POS

Learn how to grow as a Shopify Partner, with Shopify POS

FREE

[Article] Building Your SEO Strategy

Create an effective search optimization strategy tailored to your business stage, from new brands to established companies.

5

Training and Managing Staff for POS

Enhance your skills in training and managing employees effectively with Shopify POS, focusing on onboarding, continuous improvement training, and using roles and permissions.

FREE

20

Selling Shopify Series

Not currently available

[Video] Why Unified Commerce?

Physical retail is back! In store and online are now effectively one continuous experience and no longer separate lanes of business. Watch to learn more about how Shopify empowers you to make a seamless shopping experience for your customers with Unified Commerce.

4

Mastering the Art of Positioning Shopify Checkout

Learn how to promote Shopify Checkout to prospective brands

FREE

40

Square Switcher Toolkit

Resources to help Partners migrate merchants from Square to Shopify POS

FREE

Customizing Themes

Learn the fundamentals of frontend development at Shopify with an emphasis on theme development.

FREE

120

Shopify Development Fundamentals Path

Learn Shopify's framework and the necessary steps to start developing on Shopify’s platform.

FREE

4 Courses

Positioning the value of Shopify Checkout

Learn how to pitch and position Shopify Checkout and checkout extension features to prospective and existing merchants. After completing the learning path, pass a proctored assessment to earn your Positioning the Value of Shopify Checkout badge.

$149

4 Courses

B2B on Shopify: Launch and Customization

Learn how to start selling wholesale by setting up and customizing B2B features in a Shopify store. After completing the learning path, pass a proctored assessment to earn your B2B on Shopify: Launch and Customization badge.

$149

4 Courses

Selling Shopify Fundamentals

Learn how to effectively co-sell with Shopify teams from efficient prospect discovery to delivering a winning pitch. After completing the learning path, pass a proctored assessment to earn your Selling Shopify Fundamentals badge.

$149

5 Courses

Selling and Positioning Shipping Solutions on Shopify

Learn how to leverage Shopify’s shipping and fulfillment tools to enhance operational efficiency. After completing the learning path, pass a proctored assessment to earn your Selling and Positioning Shipping Solutions on Shopify badge.

$149

3 Courses

Shopify Development Fundamentals

Learn Shopify's framework and the necessary steps to start developing on Shopify’s platform. After completing the learning path, pass a proctored assessment to earn your Shopify Development Fundamentals badge.

$149

6 Courses

Expanding Your Shopify Business Internationally

Learn to guide your business through the key steps of an international expansion. After completing the learning path, pass a proctored assessment to earn your Start Here and Go Abroad – Taking Your Store International badge.

$149

8 Courses

Creating a Digital Marketing Strategy

This learning path covers essential brand marketing knowledge, including unified commerce, strategic initiatives, audience engagement, and social media growth. Explore influencer and affiliate marketing. Complete the path and pass an assessment to earn your Digital Marketing Strategy badge.

$149

7 Courses

Solution Planning Fundamentals

Learn how to analyze, visualize, and plan technical implementations with Shopify. After completing the learning path, pass a proctored assessment to earn your Solution Planning Fundamentals badge.

$149

4 Courses

Selling and Positioning Shopify Marketing Products

Learn how to effectively communicate the value of Shopify's marketing products. After completing the learning path, pass a proctored assessment to earn your Selling and Positioning Shopify Marketing Products badge.

$149

3 Courses

Marketing Fundamentals

Learn how to optimize your use of Shopify’s marketing products and products to expand your customer base, increase sales, and grow your business. After completing the learning path, pass a proctored assessment to earn your Marketing Fundamentals badge.

$149

5 Courses

Headless at Shopify for Business Consultants

Learn about Shopify’s custom storefront solutions and learn best practices to guide clients through all phases of headless implementation. Once you’ve completed this learning path, pass a proctored assessment to earn your Headless at Shopify for Business Consultants badge.

$149

3 Courses

Headless at Shopify for Developers

Understand Shopify’s custom storefront solutions and learn best practices to guide clients through all phases of headless implementation. After completing the learning path, pass a proctored assessment to earn your Headless at Shopify for Developers badge.

$249

5 Courses

Shopify POS Launch and Operations

Learn about Shopify POS launch and operations to effectively set up and manage hardware, train staff, execute operations, and optimize growth for seamless business operations. After completing the learning path, pass a proctored assessment to earn your POS Launch and Operations badge.

$149

6 Courses

Customizing the POS Experience

Learn how to design and implement personalized solutions for a business's needs using POS UI extensions.

$249

4 Courses

Positioning International Selling with Shopify

Learn how Shopify supports international selling and how you can identify and align the right merchant with the right solution. After completing the learning path, pass a proctored assessment to earn your Positioning International Selling with Shopify badge.

$149

3 Courses

Solution-Based Selling with Shopify POS

Learn ways to partner with Shopify as well as how to understand product positioning for Shopify POS. After completing the learning path, pass a proctored assessment to earn your Solution-Based Selling with Shopify POS badge.

$149

5 Courses

[Article] Using Strategic Promotions to Drive Sales and Customer Retention

5

[Article] Building Customer Loyalty Programs

5

[Article] Driving Sales with Smart Product Recommendations

5

Working with Merchants

Be prepared to work with Shopify merchants of all types.

FREE

30

Partner Marketing Toolkit

Marketing and brand guidelines

FREE

Positioning and Selling Shopify's Shipping and Fulfillment Solutions

FREE

30

Shopify POS Sales Sheet

A pdf to help Shopify Partners present Shopify POS to merchants

FREE

Learn about Shopify POS

Complete the POS learnings paths & get your Verified Skill Badge

FREE

Seasonal and Event-Based Marketing

Learn to create a holiday-specific marketing strategy that resonates with your audience by tailoring campaigns to each holiday's unique themes and understanding the psychological triggers of urgency and scarcity.

FREE

30

Build a Custom Storefront with Hydrogen

Discover how to build essential ecommerce storefront pages using Hydrogen and the Mock.shop API.

FREE

60

The Five Reasons Why Your Ecommerce Business is a Cash-Eating Monster

In this pre-recorded webinar, learn from Jason Andrew of SBO Financial on how to run a more profitable business

FREE

56 min

Search Engine Optimization

Join the Shopify Merchant Success team as they discuss tactics to improve your store’s search engine optimization (SEO)

FREE

58 min

Getting Started on Shopify Plus

Learn about Shopify Plus exclusive features, education and community resources.

FREE

30

Shipping and Fulfillment Fundamentals

Learn the art of configuring and optimizing shipping settings and strategies in Shopify to enhance operational efficiency and customer satisfaction.

FREE

3 Courses

Onboarding B2B on Shopify

Learn how to implement key B2B on Shopify features, including: companies, locations, catalogs, sales staff, and themes.

FREE

30

Sell in China with Social Media

In this pre-recorded webinar, learn tips to sell into China by leveraging their digital ecosystem and social media

FREE

60

Week 4

FREE

Build With Us: B2B

In this session, get a better understanding of B2B on Shopify and how you can expand your reach and simplify operations.

FREE

60

[Article] Navigating the Shopify Partner Ecosystem

Learn about the tools and resources available to you as a Shopify partner.

8

Introduction to custom storefronts for developers

Learn about Shopify’s headless framework, tooling, and hosting options.

FREE

45

Theme architecture with Liquid for Developers

This course introduces you to Shopify’s standard theme architecture while diving deeper into the Liquid basics learned in the previous course.

FREE

45

Developing Your International Go-to-Market Strategy

Explore how to set goals and make a plan for international expansion.

FREE

20

Researching Your International Target Market

Learn how to identify market demand when selling to a new region.

FREE

20

Fundamentals Series

Learn the essentials for success on the Shopify platform and as a Partner or developer.

FREE

Building with Shopify

Recommended for merchants whose annual sales are between $0K and $100K

FREE

Scaling with Shopify

Recommended for merchants whose annual sales are over $1MM and growing

FREE

Grow your Business with Data Analysis

Understand your customers and what motivates their behavior. Learn how to draw insights from data to better inform your business decisions.

FREE

120

User Experience and Optimization

Join the Shopify Merchant Success Team as they cover how to optimize the user experience (UX) of your store.

FREE

55 min

TikTok x Cheekbone Beauty Case Study: Optimizing Paid Campaigns on TikTok

Follow along with Plus merchant, Cheekbone Beauty, as the TikTok Creative Team conducts an audit of their current TikTok strategy.

FREE

40 min

Optimizing Site Speed for Wild Fork Foods with Diff Agency

Walk through the execution of a site speed audit with Shopify Partner DIFF.

FREE

0 hr 11 min

Branding, Positioning, and Building an Effective Online Presence

Learn to create a powerful brand identity that resonates with your audience by defining your mission, vision, and values while crafting unique value propositions and engaging storytelling.

FREE

45

How to Drive Sales With Your Customer Support Team with Gorgias

Walk through tactics to increase conversion by leveraging your support team

FREE

How to Grow a Successful B2B Business on Shopify

In this 60-minute event, you’ll learn how to successfully grow a B2B business on Shopify. Hear it live from Greg Macdonald, CEO and Founder of Bathorium, and Lizzie Scolari, Product Marketing Manager at Shopify.

FREE

58

Using the Partner Dashboard

Learn about the Partner Dashboard so you can effectively collaborate with merchants and Shopify.

FREE

15

Shopifyと共同販売活動を行う (Selling Shopify Fundamentals)

Shopifyチームとの効果的な共同販売方法を学びましょう。効率的な見込み客の発見から成功するピッチの提供までをカバーしています。学習パスを完了した後、監視付き評価に合格して「Selling Shopify Fundamentals」バッジを取得してください。

$149

5 Courses

Digital Marketing Essentials

Learn how to create effective digital marketing strategies that drive customer engagement, increase conversions, and build long-term loyalty through optimized content, email, and SMS campaigns.

FREE

65

[Article] Using AI in your SEO strategy

Use AI tools responsibly to help you be more efficient without hindering SEO ranking

5

[Video] Getting Started with POS UI Extensions: Demo

A concise walkthrough on generating and previewing a POS UI extension using the Shopify CLI tool. The process includes generating a template for the extension, configuring it through a toml file, and starting a development server to preview the extension.

4

App Surfaces Examples

Explore how apps can extend Shopify’s functionality across multiple app surfaces to improve both merchant and customer experiences.

FREE

30

Recruiting the Best Talent

In this pre-recorded webinar, learn from Steph Corker of the Corker Collective on how to recruit the best talent

FREE

32 min

Identifying Features that Customize Shopify Checkout

Learn use cases and features of checkout customization technologies.

FREE

45

Positioning the Shopify Advantage

Learn how to position Shopify as the preferred commerce platform for prospective merchants.

FREE

60

Liquid optimization for performance

This course introduces you to various tools and techniques for optimizing Liquid themes for performance.

FREE

30

Getting Started with International Selling

Dive into the fundamentals of international selling and discover global market opportunities.

FREE

25

Liquid Storefronts for Theme Developers

Learn how to use Liquid, Shopify's templating language, to optimize Shopify themes and deliver exceptional user experiences. After completing the learning path, pass a proctored assessment that tests your knowledge of the Liquid Storefronts for Theme Developers learning path content.

$249

4 Courses

Localization Strategies

Learn how to make your brand feel like it belongs across borders.

FREE

25

Pricing Your Products When Selling Cross-Border

Discover how to manage pricing and payments when selling to international customers.

FREE

15

[Video] Sneak Peek: Conversion Rate Optimization with Shopify

Learn how to improve your online store’s conversion rates through a data-driven audit that will inform a CRO roadmap and A/B tests to track success. You’ll be equipped with a DIY toolkit to develop an optimization strategy based on expert guidance and tested frameworks used by our growth experts.

1

[Video] Building with POS UI Extensions: Zapiet

Join Andy, founder of the popular POS apps Zapiet and Zapiet Eats, as he dives into their approach to app development using Shopify's POS UI Extensions. Plus, discover insider tips on developing apps with POS UI Extensions.

8

[Video] Agency Success: Scaling Success – Projects, People, Process & Profit

In the second session on agency success, Rachel, a recognized authority in scaling e-commerce agencies, shares her insights on creating scalable systems. She emphasizes the importance of project management, profitability, and effective team structures, highlighting the need for clear communication and accountability.

90

[Article] Managing inventory in the Shopify Admin

Whether you're receiving new stock, conducting an inventory audit, or holding inventory for an upcoming product launch, you can efficiently manage your inventory for all your locations from the Shopify admin.

4

ソリューションプランニングの基礎 (Solution Planning Fundamentals)

Shopifyを使用した技術的な実装の分析、可視化、計画方法を学びましょう。学習パスを完了した後、監督付きの評価に合格すると、Solution Planning Fundamentalsバッジを取得できます。

$149

2 Courses

New courses and paths

FREE

Storefront Series

FREE

Getting started with Liquid for Developers

This course introduces you to Liquid for theme development work.

FREE

45

Retail Series

FREE

Shopify POS Opportunity for Partners

A short guide outlining the opportunities Shopify Partners have, with Shopify POS

FREE

Scale Your Shipping Strategy

This course explores consumer expectations for shipping, how to develop the right shipping strategy for your business, and how to put your strategy into action.

FREE

45 mins

Step 3: Start working on your mandatory Shopify Verified Skills

FREE

How to Go Global

Product Manager Cole Atkinson teaches you how to use key Shopify products including Markets to sell cross border

FREE

25

Activating Your Partnership

Learn actionable tips and best practices to successfully complete your letter of intent requirements and graduate into the Shopify Partner Program.

FREE

25

Sell & Market Shopify POS

Resources to help you market, pitch, and sell Shopify POS to merchants.

FREE

Shopify開発の基礎 (Shopify Development Fundamentals)

Shopifyのフレームワークと、Shopifyプラットフォームで開発を始めるために必要な手順を学びましょう。学習パスを完了したら、監督付き評価に合格してShopify開発の基礎バッジを獲得しましょう。

$149

4 Courses

Getting Started Selling B2B on Shopify

Learn about the B2B commerce landscape, how to evaluate merchant fit, and strategies for crafting an effective B2B sales pitch.

FREE

60

Step 4: Learn how to co-market with Shopify

FREE

Step 5: Continue your onboarding journey

FREE

Step 2: Complete the Activating Your Partnership Course

Hit the ground running toward meeting your letter of intent requirements in this course filled with actionable tips and best practices.

FREE

Step 1: Attend the live event or watch the recording

You will receive the details and registration form via email from your partner manager. Or, ask your partner manager for a link to watch the recording.

FREE

Optimization and Growth with POS

Explore advanced strategies to optimize operations and drive business growth with Shopify POS.

FREE

60

Site Speed Optimization

Join the Shopify Merchant Success team and a Performance Expert as they discuss tactics to improve your store’s site speed

FREE

61 min

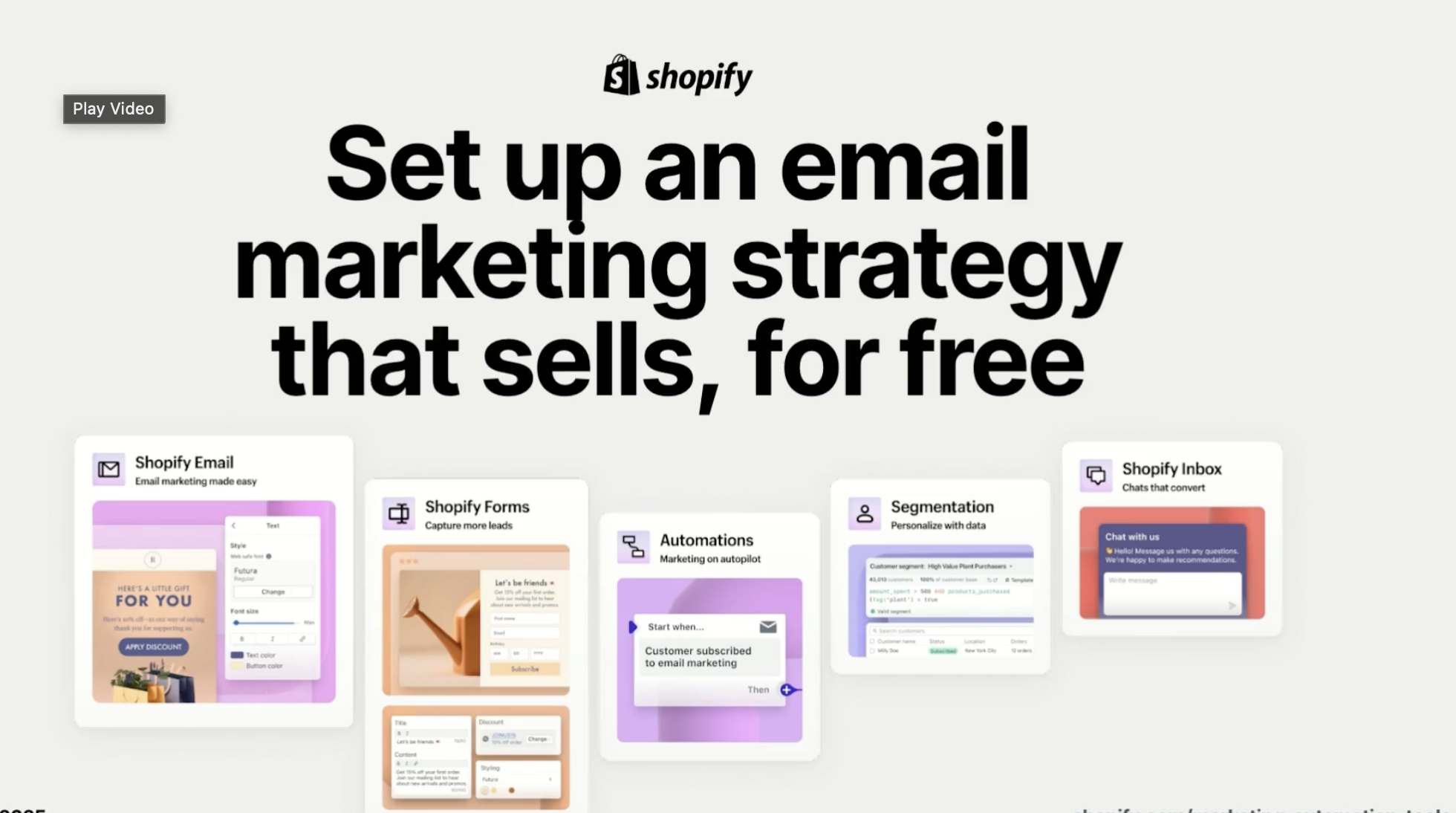

Email Marketing Strategies for Ecommerce

Use email effectively in your ecommerce marketing strategy

FREE

20

Building Custom POS Interfaces with UI Extensions

Learn how to design and develop custom POS interfaces by engaging in comprehensive, hands-on practice with UI extensions.

FREE

45

Hydrogen Best Practices

Learn best practices to optimize a custom storefront

FREE

60

Create a Diagram for an Employee Stipend Program

Work from business case to completed technical diagram.

FREE

60

[Video] Development Workflows: Partner Webinar

This webinar provides an overview of Shopify deployment methods, covering general setup best practices, staging and testing, optimizing performance, the process of pushing changes and feature updates to production, and the differences between Headed Development and Headless Development.

60

[Video] The Power of Shopify's New Customer Account Extensibility

In this exclusive Shopify webinar, join Hayward Pierce, Senior Partner Solution Engineer, and Graeme Kemp, Senior Product Manager, as they introduce Shopify's customer account extensibility. Learn how these new features can enhance the customer experience by offering personalized, self-serve functionalities.

FREE

27

Liquid to Hydrogen Migration

Learn the steps to successfully transition from a Liquid storefront to Hydrogen.

FREE

40

Co-selling with Shopify

Learn how to navigate the Shopify sales cycle and partner with key Shopify teams for successful co-selling.

FREE

60

Creating Solutions for Shopify Checkout

Learn what’s possible with customizing checkout beyond what’s available out-of-the-box. After completing the learning path, pass a proctored assessment to earn your Creating Solutions for Shopify Checkout badge.

$149

8 Courses

Introduction to Shopify Partner Program

Identify opportunities to collaborate with merchants and Shopify to grow your business as a Partner.

FREE

15

Shopify Partner Program Essentials

Begin your journey as a Shopify Partner by exploring essential courses that provide foundational knowledge for your success.

FREE

4 Courses

Solution Planning Fundamentals Path

Learn how to analyze, visualize, and plan technical implementations with Shopify.

FREE

3 Courses

Headless at Shopify for Business Consultants Path

Learn about Shopify’s custom storefront solutions and learn best practices to guide clients through all phases of headless implementation.

FREE

2 Courses

Positioning International Selling with Shopify Path

Learn how Shopify supports international selling and how you can identify and align the right merchant with the right solution.

FREE

2 Courses

Craft a Winning Shopify Value Pitch

Learn how to deliver a tailored Shopify value pitch that drives sales momentum.

FREE

60

Deciding on Your B2B Store Format

Learn about the two B2B storefront formats available on Shopify, and how to choose the right setup for specific business needs.

FREE

30

Personalizing the B2B Buying Experience

Learn how to create a personalized buying experience for wholesale customers.

FREE

30

Creating Solutions for Shopify Checkout Path

Learn what’s possible with customizing checkout beyond what’s available out-of-the-box.

FREE

7 Courses

Create a Landing Page That Converts

A great landing page helps you delight your visitors and convert them into leads.

FREE

3 mins

Extending Checkout with the Checkout Blocks App

Learn how Checkout Blocks tailors your checkout experience.

FREE

30

How to Increase Customer Conversions with Shopify POS

5 features a retailer may want to use to increase their efficiency and in-store conversion.

FREE

40

Launching on Shopify Plus

Learn how to plan and execute your migration and setup on Shopify Plus

FREE

30

Influencer and Affiliate Marketing

Explore the essentials of influencer and affiliate marketing to grow your business by identifying suitable influencers, building strong partnerships, and utilizing performance-based strategies.

FREE

30

[Video] Riess Group: Adding POS to your partner portfolio

Watch now to hear how the Riess Group transformed their partner portfolio with Shopify Point of Sale.

9

[Article] Gift Cards in the Shopify Admin

Gift cards can be added to your store from the admin just like any other product, providing a convenient option for your customers to share their enthusiasm for your brand with friends and family.

4

[Video] Sales Foundations: Pitching

Learn how to craft a winning Shopify value pitch that drives sales momentum. This series covers how to frame the challenge, why Shopify is different and how Shopify delivers value. Watch now to learn how to tailor your pitch with details about a prospects GMV, complexity and pain points.

15

[Article] Conditional Delivery Instructions Input

Read a real-world example that uses checkout UI extensions to provide a delivery instructions input at checkout.

6

[Video] Set up an email strategy that sells, for free

Get set up with the marketing automation tools available to you in Shopify. In just under an hour, our expert team will guide you through setting up a full email marketing strategy—from building your list to turning on key email automations and sending up to 10,000 emails a month for free.

45

[Article] Creating Variants in the Shopify Admin

Add Variants and Collections using the Shopify Admin.

6

Solutioning with POS UI Extensions

Learn how to develop tailored solutions using POS UI extensions to address specific business challenges.

FREE

25

Building Backend Logic for Shopify Checkout

Extend your Shopify store's checkout capabilities by mastering metafields and Shopify Functions.

FREE

Headless at Shopify for Developers Path

Understand Shopify’s custom storefront solutions and learn best practices to guide clients through all phases of headless implementation.

FREE

4 Courses

POS Hardware and Payments

Optimize the customer experience in your retail store through innovative hardware and payments solutions.

FREE

60

Storefront API Customization

Understand the purpose, structure, and capabilities of the Storefront API

FREE

60

Introduction to Storefronts

Learn about four different storefronts that all work seamlessly with and within the Shopify platform.

FREE

20

Foundations of Unified Commerce Marketing

Gain a foundational understanding of unified commerce by exploring its key components, sales channels, and performance metrics in this course.

FREE

60

Product Positioning for POS

Gain the product knowledge you need to position Shopify POS as a key part of a unified commerce approach.

FREE

30

POS Operations

Discover how to streamline your business operations and focus on business growth with Shopify POS.

FREE

50

Social Media and Content Marketing

Discover effective strategies for leveraging social media and content marketing to enhance your brand's presence and foster business growth through a well-structured content calendar.

FREE

80

Customizing the Appearance of Shopify Checkout

Learn how to visually design your checkout with the checkout and accounts editor and Checkout Branding API.

FREE

25

Getting Started with Selling Shopify Retail

This course will teach you how to talk about Shopify POS’s features and benefits to retail merchants.

FREE

30

POS Setup and Configuration

Learn the foundational steps for selling in person with Shopify POS, including secure data migration, Shopify admin setup, app installation and configuration, and effective issue troubleshooting.

FREE

35

Analyzing the International Competitive Landscape

Explore how to assess international competition when entering a new market.

FREE

25

Marketing Your Shopify Services as a Partner

Unlock the full potential of marketing your Shopify offerings

FREE

45

Positioning the value of Shopify Checkout Path

Learn how to pitch and position Shopify Checkout and checkout extension features to prospective and existing merchants.

FREE

3 Courses

[Article] Adjust Prices with Shopify Functions and Checkout UI Extensions

Read a real-world example that uses Checkout UI extensions and Shopify Functions to adjust pricing in the cart.

11

[Video] Working with Graph QL on Shopify

This video series introduces the basic concepts of GraphQL to help developers think about finding and working with data in Shopify differently from REST API.

7

[Video] Shopify Products Marketing Journey

Join Naomi, a newly hired e-commerce marketing manager, as she transforms her skincare brand's marketing strategy using Shopify's marketing tools. Discover how she boosts conversion rates through targeted ad campaigns, influencer collaborations, and automated email sequences, setting a new benchmark for success.

3

[Video] Learn how to sell more with segmented emails

Discover how to build a great foundation for your marketing with five always-on customer segments that will deliver results, using the tools you already have in Shopify.

45

Misconceptions on ERP and Fulfillment

Learn how to select the right tools to power up your business

FREE

Identifying Fit for Shopify Checkout

Explore Shopify Checkout’s features and benefits to identify merchant fit

FREE

15

[Video] Checkout Extensibility

Shopify offers a high-converting checkout, right out of the box. Some businesses have unique needs that require extending on top of native capabilities. In this series, you’ll learn about all the available technologies to offer a unique and customized Shopify checkout experience.

10

[Article] Adding a Product in the Shopify Admin

Add products to your online or retail store with the Shopify Admin.

8

[Video] The Pathways Podcast: Leading with Checkout

Join our Shopify team to discuss how Partners and Business Consultants are able to lead with checkout when pitching and selling Shopify to new prospective brands.

30

[Video] Business Shipping Challenges: Mid-Market & Enterprise

Follow along with real Shopify merchants and get a firsthand look at their shipping challenges. This series explores common shipping issues for both mid-market and enterprise businesses and how they overcome those obstacles.

4

[Article] Implementing File Attachments with DropZone Component

This article will guide you through the process of implementing file attachment functionality within Shopify’s Customer Account and Checkout UI extensions using the new DropZone UI component.

7

Developing Apps for Shopify Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Developing Apps for Shopify learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$249

35

Planning and Implementing a Custom Storefront

Learn best practices for managing a client relationship through each phase of a custom storefront implementation on Shopify.

FREE

60

Build Black with Shopify Pathway

Welcome to the Build Black Pathway, an empowering journey designed to equip Black entrepreneurs with the essential tools to help transform their business visions into realities.

FREE

13 Courses

Developing Apps for Shopify Path

Learn the essentials of Shopify app development, from building your first functional app to successfully launching on the Shopify App Store while meeting platform standards and enhancing merchant experiences.

FREE

3 Courses

[Video] Getting Started with Building on Shopify

Follow along with an applied framework that you can apply to your own business or clients.

9

Developing Apps for Shopify

Learn the essentials of Shopify app development, from building your first functional app to successfully launching on the Shopify App Store while meeting platform standards and enhancing merchant experiences. After completing the learning path, pass a proctored assessment to earn your badge.

$249

4 Courses

App Development Fundamentals

Learn the fundamentals of Shopify app development and how to extend the platform.

FREE

35

[Video] Integration with an ERP System

In this video we’ll review a practical example of how integrating Shopify with an ERP system can enhance the efficiency of a particular task. Learn more about technical implementation planning as part of Shopify Academy’s Solution Planning Fundamentals learning path, plus earn your Shopify Verified Skill badge today.

3

[Video] Peak Season: Tips from Experts

Hear directly from experts on how to maximize this year's peak season. These seasoned partners have successfully guided countless merchants through one of the most exhilarating and busy times of the year. Watch the series to learn their top tips and strategies.

12

4 Ways to Use Shopify POS to Grow Your Partner Business

Learn from successful retail partners how to use Shopify POS to gain new clients, solve common commerce challenges, and boost your agency's growth.

FREE

POS Pro Yearly Subscription

Introduce your prospects to the new POS offer so that they can benefit, and you can close more deals.

FREE

Solution-Based Selling with Shopify POS Path

Learn ways to partner with Shopify as well as how to understand product positioning for Shopify POS.

FREE

4 Courses

EY Report: Future Proofing Retail

Share this EY unified commerce research report summary with your prospects.

FREE

Lightspeed Switcher Toolkit

Resources to help Partners migrate merchants from Lightspeed to Shopify POS

FREE

4 Strategies For Pitching and Solutioning Shopify POS

Learn from Shopify retail partners how to effectively pitch and customize Shopify POS for your clients while growing your business.

FREE

POS Partner Accelerator Webinar - Part 1

Learn from successful retail partners how to grow your business with Shopify POS

FREE

Pitching Shopify POS Video

Watch this 3 minute video to see an example of how to pitch Shopify POS, as a Partner.

FREE

Expanding your service offerings with Shopify POS

This guide will help you learn how to incorporate Shopfy POS into your existing business

FREE

Customizing the POS Experience Path

Learn how to design and implement personalized solutions for a business's needs using POS UI extensions.

FREE

3 Courses

Unified Commerce Marketing Deck

This deck provides guidelines + resources for Partners to effectively market Shopify's Unified Commerce platform to medium to large retailers.

FREE

[Video] Sales Foundations: Prospecting

Learn how to determine merchant fit, lead effective discovery, and prepare to handle some of the most common objections. This series explores three different market segments: Mid market, Large account, and Enterprise. Watch now to learn more about evaluating prospects, identify merchant challenges and priorities, and predict common objections.

12

Video: How to Earn with Shopify POS

There’s a new way to earn as a Shopify partner. We’ve introduced profit sharing.

FREE

[Video] Sneak Peek: Making an app for Shopify

Learn the essentials of Shopify app development, from building your first functional app to successfully launching on the Shopify App Store while meeting platform standards and enhancing merchant experiences. After completing the learning path, pass a proctored assessment to earn your badge.

FREE

1

[Video] Unlocking Shopify Checkout: Extensibility and the New Discount Functions Overview

Join us for a comprehensive webinar on Shopify Checkout Extensibility and the new Discount Functions. We dive into checkout customization, the future of Shopify scripts, and the advanced capabilities of Discount Functions. Learn about migration, building merchant experiences, and leveraging Shopify's powerful platform features to enhance your checkout process. Suitable for developers and merchants aiming to boost performance and scalability for high-traffic events.

FREE

25

[Video] Learn with Darryn | Internationalisation + Markets

The video discusses the importance of international expansion for e-commerce. It emphasizes the need for businesses to manage unique catalogs, currencies, and inventory across different markets, with Shopify providing tools to simplify this process. The video also touches on the significance of choosing the right domain strategy and managing multiple business entities for successful internationalization.

35

[Video] Surfaces to Create Apps For

You can create public apps to list on the Shopify App Store, or create custom ones for a single merchant. Apps interact with different areas of the shop by platform and extend its functionality.

4

[Video] Shopify Admin Essentials: A Day with Kaycee

Join Kaycee as she walks you through how she uses the Shopify admin in her day-to-day work. She oversees shipping and fulfillment, rotating products, and ensuring a seamless shopping experience for customers. Because the Shopify admin is the central hub for managing a business, she will be spending lots of time there. Join us as Kaycee takes you on a guided tour of the Shopify admin.

3

[Video] Building a custom workflow with Shopify Flow

Learn how to build a powerful custom workflow in Shopify Flow to automatically add a special welcome gift to customers who place their first order. In this video, educational expert Jan Frey from Coding with Jan demonstrates building this no-code automation, showing you how to identify new customers, tag orders, add a free item, and set up internal team notifications.

FREE

15

[Video] Learn with Scott | Supercharge Shopify Development with AI

In this session, Scott Dixon, a partner solutions engineer at Shopify, discusses the transformative impact of AI on web development, particularly within the Shopify ecosystem. The session includes practical demonstrations of using AI for tasks such as building a spend bar and optimizing store performance. Ultimately, Scott encourages developers to embrace AI as a powerful ally in their work.

40

[Video] Agency Success: The Foundation for Scaling – Positioning, Pipeline & Pitching

In this session, Rachel, an experienced agency consultant, shares her insights on agency growth through effective positioning, pipeline management, and pitching strategies.

90

Briefing: POS Total Cost of Ownership

Leverage these resource to show your clients how Shopify POS reduces retail operation costs better than the competition.

FREE

[Video] Become a Migration Master: Accelerate the Thank You and Order Status Page Upgrade

This webinar focused on the Thank You and Order Status page upgrade, highlighting efficient techniques for migrating a larger number of merchants. The session aimed to enhance technical skills, improve support for current clients, and identify opportunities to attract new business. It served as a guide for becoming a reliable partner for merchants in their Thank You and Order Status page upgrades.

60

[Video] Sneak Peek: Shopify Flow Fundamentals

Imagine having a digital assistant working 24/7 to handle those tedious jobs, freeing you up to focus on strategic growth. That's the power of automation with Shopify Flow. Learn about the Shopify Flow Fundamentals and how to build powerful automation for your store.

FREE

2

[Article] Managing your Shopify Pipeline as a Partner

Learn how to qualify, submit, and manage Shopify leads to maximize your success in the Shopify ecosystem.

8

[Video] Shopify Flow Fundamentals

Learn about the Shopify Flow Fundamentals and how to build powerful automation for your store. You'll learn what Shopify Flow is and how to build your first flow with a pre-built template.

FREE

2

[Video] Partner Solutions: Combined Listings

In this webinar, Senior Partner Solutions Engineer Kevin Horner and special guests Wes Baker and Gemma Curl from the Shopify Combined Listings product management and development team discuss the fundamentals of the Shopify Combined Listings app. Learn how to boost conversions for merchant clients by effectively managing product models and enhancing SEO.

FREE

19

[Video] How to find success with B2B on Shopify as a Shopify Partner

Discover why partners name Shopify as their top choice for building custom B2B experiences for clients.

FREE

5

Riess Group increased deal sizes by 3-4x with Shopify POS

Riess Group, a commerce consulting agency, has had a long-standing partnership with Shopify. They boosted their deal sizes by 3-4x by incorporating Shopify POS into their service offerings.

FREE

[Video] Building with POS UI Extensions: Marsello

Join Brady, co-founder and Chief Product Officer at Marsello, as he shares how their app seamlessly connects online and in-store loyalty using Shopify’s POS UI Extensions. Plus, get insider tips on innovating with new Shopify technologies.

8

Shopify POS Demo Kit

This kit is loaded with resources and guidance to help you demo Shopify POS.

FREE

[Video] Get started with B2B on Shopify

Join fictional B2B merchants Zone Furnishings, Maison, and Home Haven as they discover how Shopify’s B2B features help improve their operations.

8

[Video] Crafting Your Campaign

This video series outlines four key steps for creating a successful marketing campaign.

12

[Video] Handling Shipping Objections

This video series tackles common objections you may hear when crafting a pitch for Shopify Shipping

6

Exploring Checkout Extensibility for Advanced Customization Needs

Learn how to position Checkout Extensibility features to merchant goals

FREE

20

[Video] International Selling: Bathorium Case Study

Join Bathorium Founder, Greg MacDonald, as he breaks down how they approach selling into new international markets and leverage Shopify’s International Selling Tools.

10

Selling and Positioning Shopify Marketing Products Path

This learning path empowers Shopify partners to understand the full spectrum of Shopify's marketing products.

FREE

2 Courses

Shipping Products Internationally

Explore how to select the right shipping strategies when fulfilling international orders.

FREE

20

B2B on Shopify: Launch and Customization Path

Learn how to start selling wholesale by setting up and customizing B2B features in a Shopify store.

FREE

3 Courses

Marketing Fundamentals Path

Learn how to optimize your use of Shopify’s marketing tools and products to expand your customer base, increase sales, and grow your business.

FREE

4 Courses

Selling Shopify Fundamentals Path

Learn how to effectively co-sell with Shopify teams from efficient prospect discovery to delivering a winning pitch.

FREE

4 Courses

Selling and Positioning Shipping Solutions on Shopify Path

Learn how to leverage Shopify’s shipping and fulfillment tools to enhance operational efficiency, reduce costs, and ensure timely delivery.

FREE

2 Courses

[Article] Strategies to accelerate the sales cycle as a Partner

Learn how to build a sustainable pipeline by focusing on different strategies to engage with prospects at the top, middle, and bottom of the funnel.

8

Shopify販売の基礎評価 (Selling Shopify Fundamentals Assessment)

このバッジを取得するには、Selling Shopify Fundamentals学習パスの内容に関する知識をテストする監視付き評価に合格する必要があります。

$149

Shopifyと共同販売活動を行う (Co-selling with Shopify)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

セールスプロスペクティングとディスカバリー (Sales Prospecting and Discovery)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

Shopifyの優位性を位置づける (Positioning the Shopify Advantage)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

勝利を掴むShopifyバリューピッチを作成する (Craft a Winning Shopify Value Pitch)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

Sales Prospecting and Discovery

Learn how to determine merchant fit, lead effective discovery, and prepare to handle some of the most common objections.

FREE

60

Selling Shopify Fundamentals Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Selling Shopify Fundamentals learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$149

Staying Engaged with Customers to Boost LTV

Leverage Shopify's email solutions, marketing tools, and automations to maintain engagement, identify high-value customer segments, and enhance retargeting strategies to boost customer lifetime value and loyalty.

FREE

20

Aligning Shopify Marketing Products to the Customer Life Cycle

Explore how Shopify’s marketing products help you find new customers and grow your business

FREE

45

Converting Site Visitors to First-Time Buyers

Learn about some of the specific challenges associated with getting potential customers to convert to first-time buyers

FREE

45

Marketing Fundamentals Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Marketing Fundamentals learning path content.

$149

Finding New Customers with Shopify

Focus on how Shopify's marketing tools can simplify the complexity of finding new customers, building brand awareness, and targeting quality leads

FREE

45

[Article] Adding Web Pixels

Learn how web pixels track user behavior and explore the two types of pixels you can set up on Shopify.

Creating a Digital Marketing Strategy Assessment

To earn this badge, pass a proctored assessment that evaluates your understanding of the Creating a Digital Marketing Strategy learning path content. We recommend completing all courses within the learning path before attempting the assessment.

$149

30

Creating an App for Shopify

Learn to create a basic Shopify App from scratch that allows merchants to create and track issues for products within their Shopify admin.

FREE

25

Visualizing Technical Solutions for Shopify

In this course we’ll create visualizations of Shopify processes, tools, and component integrations with architecture diagrams.

FREE

60

Analyzing a Business

In this course, we’ll look at how to analyze a business when planning the implementation of new software or technology.

FREE

60

Technical Implementation Planning

In this course we’ll look at the technical considerations when planning implementation with Shopify.

FREE

60

Positioning International Selling Tools & Managed Markets

Learn how to address common merchant challenges and discover how Shopify helps merchants expand and grow across borders.

FREE

60

Introduction to International Selling with Shopify

Explore the many features and benefits available to Shopify merchants with international selling tools and Managed Markets.

FREE

30

[Article] Why Automation Is Essential for Ecommerce

Discover how the power of automation in ecommerce could help you overcome scaling challenges.

8

The Anatomy of a Shopify Flow Workflow

Unlock the power of automation! Learn the core components of Shopify Flow workflows – triggers, conditions, and actions – and build automations to streamline your ecommerce operations.

FREE

30

Building a Workflow with Shopify Flow

This practical, framework-driven course empowers you to automate your ecommerce tasks and build your first Shopify Flow workflow.

FREE

45

Liquid Storefronts for Theme Developers Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Liquid Storefronts for Theme Developers learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$249

Positioning Business Growth with Marketing Products

This course will demonstrate how to introduce, position, and sell Shopify’s marketing products to merchants based on their needs and goals.

FREE

30

Introduction to Shopify’s Marketing Products

This course will highlight specific tools, features, and strategies that a Partner can highlight to add value to a typical merchant’s marketing program.

FREE

15

Build Black with Shopify Pathway

FREE

BAS - Trial, Shopify Admin, Tasks

How to set up a trial at Shopify, Navigating the Shopify Admin, and Beginning Build a store (BAS) tasks.

FREE

BAS - Products & Collections

Learn all about products & collections

FREE

BAS - Themes

Learn how to add and edit your theme in Shopify

FREE

BAS - Adding Pages, Policy Pages, Menus & Navigation

Learn about adding and editing your pages, policy pages and menu's.

FREE

BAS - Shipping

Learn about setting up shipping and an introduction to Shopify Shipping.

FREE

BAS - Pricing, Payments and Security

Learn about Shopify's Pricing, Payments and Security features.

FREE

Marketing and Apps 101

Learn about Shopify's Marketing Tools and Apps.

FREE

Marketing and Apps 102

Learn about Shopify Apps, Sales Channels, and Reports.

FREE

Marketing and Apps 103

Learn about Search Engine Optimization and Blogs

FREE

Why Shopify 101: Point of Sale & Mobile Responsiveness

An introduction to Point of Sale and Mobile Responsiveness

FREE

Why Shopify 102: Introduction to Financial Services

An Introduction to Shopify's Financial Services - Capital, Credit and Balance.

FREE

Shopify Support & Continued Learning

Learn how to get in touch with Shopify Support and further your learning

FREE

Shopify POS Launch and Operations Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Shopify POS Launch and Operations learning path content.

$149

B2B on Shopify: Launch and Customization Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the B2B on Shopify Launch and Customization learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$149

40

Headless at Shopify for Developers Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Headless at Shopify for Developers learning path content.

$249

[Demo] Managing Products in the Shopify Admin

Learn how to manage products, collections, and inventory in the Shopify admin, including product variants and metaobjects.

FREE

5

[Demo] Customers and orders in the Shopify Admin

Discover how to manage customers, orders, and segments in the Shopify admin to improve sales.

FREE

5

[Article] Setting up Sales Channels for Social Media in the Shopify Admin

Learn how to reach more customers by adding social media sales channels to your store.

4

[Article] Creating a Draft Order in the Shopify Admin

Discover how to create and manage draft orders and send invoices to customers.

4

[Article] Setting up Role Based Access Controls in the Shopify Admin

Discover how to manage user permissions using role-based access controls in the Shopify admin.

4

[Article] Creating Metaobjects and Metafields in the Shopify Admin

Learn to create metaobjects and use metafields to customize product information in your Shopify store.

5

[Demo] Sales Channels, Marketing, and Discounts in the Shopify Admin

Explore how to expand your reach using sales channels, marketing campaigns, and discounts in the Shopify admin.

FREE

5

[Demo] Finance and Analytics in the Shopify Admin

Understand how to use financial data and analytics tools in the Shopify admin to inform your business decisions.

FREE

5

[Demo] Introduction to the Shopify Admin

Take a guided tour of the Shopify admin to learn how to navigate the platform and its key features.

FREE

5

テーマをカスタマイズする (Customizing Themes)

この入門コースは、Shopifyでのテーマの開発のジャーニーを開始するためのものです。

FREE

Shopifyでの開発 (Developing on Shopify)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。

FREE

30

Shopifyのデータモデルの紹介と応用 (Exploring and Extending Shopify’s Data Model)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

40

Shopifyとの統合 (Integrating with Shopify)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

30

Integrating with Shopify

In this course we’ll cover the fundamentals of backend development at Shopify with an emphasis on APIs and webhooks, GraphQL, and common surfaces for custom apps.

FREE

120

Developing on Shopify

This course will introduce you to the Shopify platform, explain how it’s different from other commerce platforms, and give you examples of what’s possible as a Shopify developer.

FREE

60

Exploring and Extending Shopify’s Data Model

This course will introduce you to Shopify’s data model and custom data objects.

FREE

90

Shopify Development Fundamentals Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Shopify Development Fundamentals learning path content.

$149

Creating Solutions for Shopify Checkout Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Creating Solutions for Shopify Checkout learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$149

30

Selling and Positioning Shopify Marketing Products Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Selling and Positioning Shopify Marketing Products learning path content.

$149

Expanding Your Shopify Business Internationally Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Expanding Your Shopify Business Internationally learning path content. We recommend that you complete all the courses in the learning path prior to attempting the assessment.

$149

40

Positioning the Value of Shopify Checkout Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Positioning the Value of Shopify Checkout learning path content.

$149

Craft the POS Solution

Learn to craft a solution that meets merchant needs and sets them up for continued success.

FREE

30

Pitch to Win for POS

Learn how to identify retail opportunities and craft a winning pitch.

FREE

30

POS for Partners

Learn about partnering with Shopify to offer your clients retail solutions.

FREE

30

Customizing the POS Experience Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Customizing the POS Experience learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$249

45

Shopify POS Solution-Based Selling Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Shopify POS Solution-Based Selling learning path content.

$149

Headless at Shopify for Business Consultants Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Headless at Shopify for Business Consultants learning path content.

$149

Positioning International Selling with Shopify Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Positioning International Selling with Shopify learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$149

ビジネスの分析 (Analyzing a Business)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

Shopify向け技術ソリューションの可視化 (Visualizing Technical Solutions)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

Selling and Positioning Shipping Solutions on Shopify Assessment

This assessment tests your knowledge of Selling and Positioning Shipping Solutions on Shopify learning path content.

$149

Solution Planning Fundamentals Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Solution Planning Fundamentals learning path content.

$149

CRO Analysis and Optimization

Learn how to analyze your Shopify store using reports and create a CRO roadmap.

Not currently available

45

CRO Implementation and Testing

Learn how to apply testing methodologies to create data-driven improvements that will help increase your conversion rates.

Not currently available

45

CRO Targeting and Personalization

Learn how to improve conversion rates by personalizing the customer experience using techniques such as customized landing pages and targeted messaging.

Not currently available

45

CRO Overview and Best Practices

Learn how to apply CRO best practices and understand visitor intent to effectively drive conversions.

Not currently available

35

Shopify販売の基礎評価 (Selling Shopify Fundamentals Assessment)

このバッジを取得するには、Selling Shopify Fundamentals学習パスの内容に関する知識をテストする監視付き評価に合格する必要があります。

$149

Shopifyと共同販売活動を行う (Co-selling with Shopify)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

セールスプロスペクティングとディスカバリー (Sales Prospecting and Discovery)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

Shopifyの優位性を位置づける (Positioning the Shopify Advantage)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

勝利を掴むShopifyバリューピッチを作成する (Craft a Winning Shopify Value Pitch)

この入門コースは、Shopifyでの開発のジャーニーを開始するためのものです。このコースを完了すると、以下の目的のためのツールと知識を身につけることができます。

FREE

60

Sales Prospecting and Discovery

Learn how to determine merchant fit, lead effective discovery, and prepare to handle some of the most common objections.

FREE

60

Selling Shopify Fundamentals Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Selling Shopify Fundamentals learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$149

Positioning the Shopify Advantage

Learn how to position Shopify as the preferred commerce platform for prospective merchants.

FREE

60

Craft a Winning Shopify Value Pitch

Learn how to deliver a tailored Shopify value pitch that drives sales momentum.

FREE

60

Co-selling with Shopify

Learn how to navigate the Shopify sales cycle and partner with key Shopify teams for successful co-selling.

FREE

60

Staying Engaged with Customers to Boost LTV

Leverage Shopify's email solutions, marketing tools, and automations to maintain engagement, identify high-value customer segments, and enhance retargeting strategies to boost customer lifetime value and loyalty.

FREE

20

Aligning Shopify Marketing Products to the Customer Life Cycle

Explore how Shopify’s marketing products help you find new customers and grow your business

FREE

45

Converting Site Visitors to First-Time Buyers

Learn about some of the specific challenges associated with getting potential customers to convert to first-time buyers

FREE

45

Marketing Fundamentals Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Marketing Fundamentals learning path content.

$149

Finding New Customers with Shopify

Focus on how Shopify's marketing tools can simplify the complexity of finding new customers, building brand awareness, and targeting quality leads

FREE

45

Create a Diagram for an Employee Stipend Program

Work from business case to completed technical diagram.

FREE

60

Extending Checkout with the Checkout Blocks App

Learn how Checkout Blocks tailors your checkout experience.

FREE

30

Identifying Features that Customize Shopify Checkout

Learn use cases and features of checkout customization technologies.

FREE

45

Customizing Business Logic with Shopify Functions

Learn how Shopify Functions apply unique business processes to checkout.

FREE

30

Enhancing Checkout with UI Extensions

Learn how UI extensions create unique shopping experiences in the checkout.

FREE

25

Customizing the Appearance of Shopify Checkout

Learn how to visually design your checkout with the checkout and accounts editor and Checkout Branding API.

FREE

25

[Article] Adding Web Pixels

Learn how web pixels track user behavior and explore the two types of pixels you can set up on Shopify.

Branding, Positioning, and Building an Effective Online Presence

Learn to create a powerful brand identity that resonates with your audience by defining your mission, vision, and values while crafting unique value propositions and engaging storytelling.

FREE

45

Creating a Digital Marketing Strategy Assessment

To earn this badge, pass a proctored assessment that evaluates your understanding of the Creating a Digital Marketing Strategy learning path content. We recommend completing all courses within the learning path before attempting the assessment.

$149

30

Influencer and Affiliate Marketing

Explore the essentials of influencer and affiliate marketing to grow your business by identifying suitable influencers, building strong partnerships, and utilizing performance-based strategies.

FREE

30

Social Media and Content Marketing

Discover effective strategies for leveraging social media and content marketing to enhance your brand's presence and foster business growth through a well-structured content calendar.

FREE

80

Digital Marketing Essentials

Learn how to create effective digital marketing strategies that drive customer engagement, increase conversions, and build long-term loyalty through optimized content, email, and SMS campaigns.

FREE

65

Foundations of Unified Commerce Marketing

Gain a foundational understanding of unified commerce by exploring its key components, sales channels, and performance metrics in this course.

FREE

60

Seasonal and Event-Based Marketing

Learn to create a holiday-specific marketing strategy that resonates with your audience by tailoring campaigns to each holiday's unique themes and understanding the psychological triggers of urgency and scarcity.

FREE

30

Using the Partner Dashboard

Learn about the Partner Dashboard so you can effectively collaborate with merchants and Shopify.

FREE

15

Working with Merchants

Be prepared to work with Shopify merchants of all types.

FREE

30

Introduction to Shopify Partner Program

Identify opportunities to collaborate with merchants and Shopify to grow your business as a Partner.

FREE

15

Introduction to Shopify

Learn about who Shopify is, our mission, core features of the platform, and how we support businesses of all sizes to start and grow.

FREE

20

App Surfaces Examples

Explore how apps can extend Shopify’s functionality across multiple app surfaces to improve both merchant and customer experiences.

FREE

30

App Development Fundamentals

Learn the fundamentals of Shopify app development and how to extend the platform.

FREE

35

Creating an App for Shopify

Learn to create a basic Shopify App from scratch that allows merchants to create and track issues for products within their Shopify admin.

FREE

25

Developing Apps for Shopify Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Developing Apps for Shopify learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$249

35

Visualizing Technical Solutions for Shopify

In this course we’ll create visualizations of Shopify processes, tools, and component integrations with architecture diagrams.

FREE

60

Analyzing a Business

In this course, we’ll look at how to analyze a business when planning the implementation of new software or technology.

FREE

60

Technical Implementation Planning

In this course we’ll look at the technical considerations when planning implementation with Shopify.

FREE

60

Positioning International Selling Tools & Managed Markets

Learn how to address common merchant challenges and discover how Shopify helps merchants expand and grow across borders.

FREE

60

Introduction to International Selling with Shopify

Explore the many features and benefits available to Shopify merchants with international selling tools and Managed Markets.

FREE

30

[Article] Why Automation Is Essential for Ecommerce

Discover how the power of automation in ecommerce could help you overcome scaling challenges.

8

The Anatomy of a Shopify Flow Workflow

Unlock the power of automation! Learn the core components of Shopify Flow workflows – triggers, conditions, and actions – and build automations to streamline your ecommerce operations.

FREE

30

Building a Workflow with Shopify Flow

This practical, framework-driven course empowers you to automate your ecommerce tasks and build your first Shopify Flow workflow.

FREE

45

Liquid optimization for performance

This course introduces you to various tools and techniques for optimizing Liquid themes for performance.

FREE

30

Getting started with Liquid for Developers

This course introduces you to Liquid for theme development work.

FREE

45

Theme architecture with Liquid for Developers

This course introduces you to Shopify’s standard theme architecture while diving deeper into the Liquid basics learned in the previous course.

FREE

45

Liquid Storefronts for Theme Developers Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Liquid Storefronts for Theme Developers learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$249

Positioning Business Growth with Marketing Products

This course will demonstrate how to introduce, position, and sell Shopify’s marketing products to merchants based on their needs and goals.

FREE

30

Introduction to Shopify’s Marketing Products

This course will highlight specific tools, features, and strategies that a Partner can highlight to add value to a typical merchant’s marketing program.

FREE

15

POS Operations

Discover how to streamline your business operations and focus on business growth with Shopify POS.

FREE

50

Training and Managing Staff for POS

Enhance your skills in training and managing employees effectively with Shopify POS, focusing on onboarding, continuous improvement training, and using roles and permissions.

FREE

20

POS Hardware and Payments

Optimize the customer experience in your retail store through innovative hardware and payments solutions.

FREE

60

Optimization and Growth with POS

Explore advanced strategies to optimize operations and drive business growth with Shopify POS.

FREE

60

POS Setup and Configuration

Learn the foundational steps for selling in person with Shopify POS, including secure data migration, Shopify admin setup, app installation and configuration, and effective issue troubleshooting.

FREE

35

Build Black with Shopify Pathway

FREE

BAS - Trial, Shopify Admin, Tasks

How to set up a trial at Shopify, Navigating the Shopify Admin, and Beginning Build a store (BAS) tasks.

FREE

BAS - Products & Collections

Learn all about products & collections

FREE

BAS - Themes

Learn how to add and edit your theme in Shopify

FREE

BAS - Adding Pages, Policy Pages, Menus & Navigation

Learn about adding and editing your pages, policy pages and menu's.

FREE

BAS - Shipping

Learn about setting up shipping and an introduction to Shopify Shipping.

FREE

BAS - Pricing, Payments and Security

Learn about Shopify's Pricing, Payments and Security features.

FREE

Marketing and Apps 101

Learn about Shopify's Marketing Tools and Apps.

FREE

Marketing and Apps 102

Learn about Shopify Apps, Sales Channels, and Reports.

FREE

Marketing and Apps 103

Learn about Search Engine Optimization and Blogs

FREE

Why Shopify 101: Point of Sale & Mobile Responsiveness

An introduction to Point of Sale and Mobile Responsiveness

FREE

Why Shopify 102: Introduction to Financial Services

An Introduction to Shopify's Financial Services - Capital, Credit and Balance.

FREE

Shopify Support & Continued Learning

Learn how to get in touch with Shopify Support and further your learning

FREE

POS Hardware and Payments

Optimize the customer experience in your retail store through innovative hardware and payments solutions.

FREE

60

Shopify POS Launch and Operations Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the Shopify POS Launch and Operations learning path content.

$149

Optimization and Growth with POS

Explore advanced strategies to optimize operations and drive business growth with Shopify POS.

FREE

60

POS Operations

Discover how to streamline your business operations and focus on business growth with Shopify POS.

FREE

50

Training and Managing Staff for POS

Enhance your skills in training and managing employees effectively with Shopify POS, focusing on onboarding, continuous improvement training, and using roles and permissions.

FREE

20

POS Setup and Configuration

Learn the foundational steps for selling in person with Shopify POS, including secure data migration, Shopify admin setup, app installation and configuration, and effective issue troubleshooting.

FREE

35

Introduction to Shipping & Fulfillment with Shopify

Get a comprehensive understanding of Shopify’s shipping and fulfillment tools.

FREE

30

Shipping Settings and Strategies

Learn how to align business goals to fulfillment strategies

FREE

60

Fulfillment and Order Routing

Examine factors to decide which fulfillment methods to offer for your products and orders

FREE

30

Onboarding B2B on Shopify

Learn how to implement key B2B on Shopify features, including: companies, locations, catalogs, sales staff, and themes.

FREE

30

Deciding on Your B2B Store Format

Learn about the two B2B storefront formats available on Shopify, and how to choose the right setup for specific business needs.

FREE

30

B2B on Shopify: Launch and Customization Assessment

To earn this badge, pass a proctored assessment that tests your knowledge of the B2B on Shopify Launch and Customization learning path content. We recommend you complete all the courses in the learning path prior to attempting the assessment.

$149

40

Personalizing the B2B Buying Experience