Shopify Tax

Don’t sweat your sales tax

Take the stress out of sales tax in the United States with automated sales tax calculations, nexus tracking, and filing prep all from within Shopify admin.

Track your liability

Oversee your current sales tax obligations and find out where you’re approaching thresholds.

Collect the right amount

Activate collection at checkout with product- and location-specific accuracy.

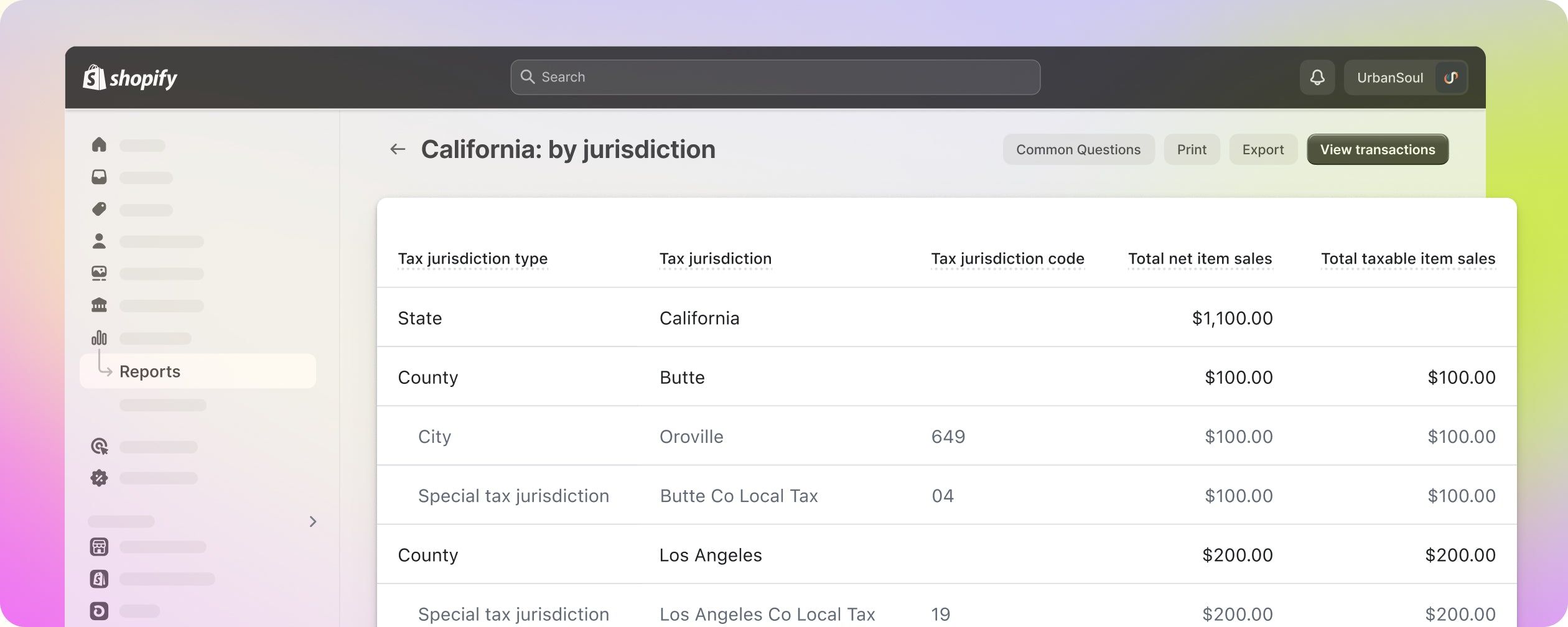

Simplify filing prep

View your sales and tax data by state, county, and local jurisdictions, making it easier to accurately file your sales tax returns.

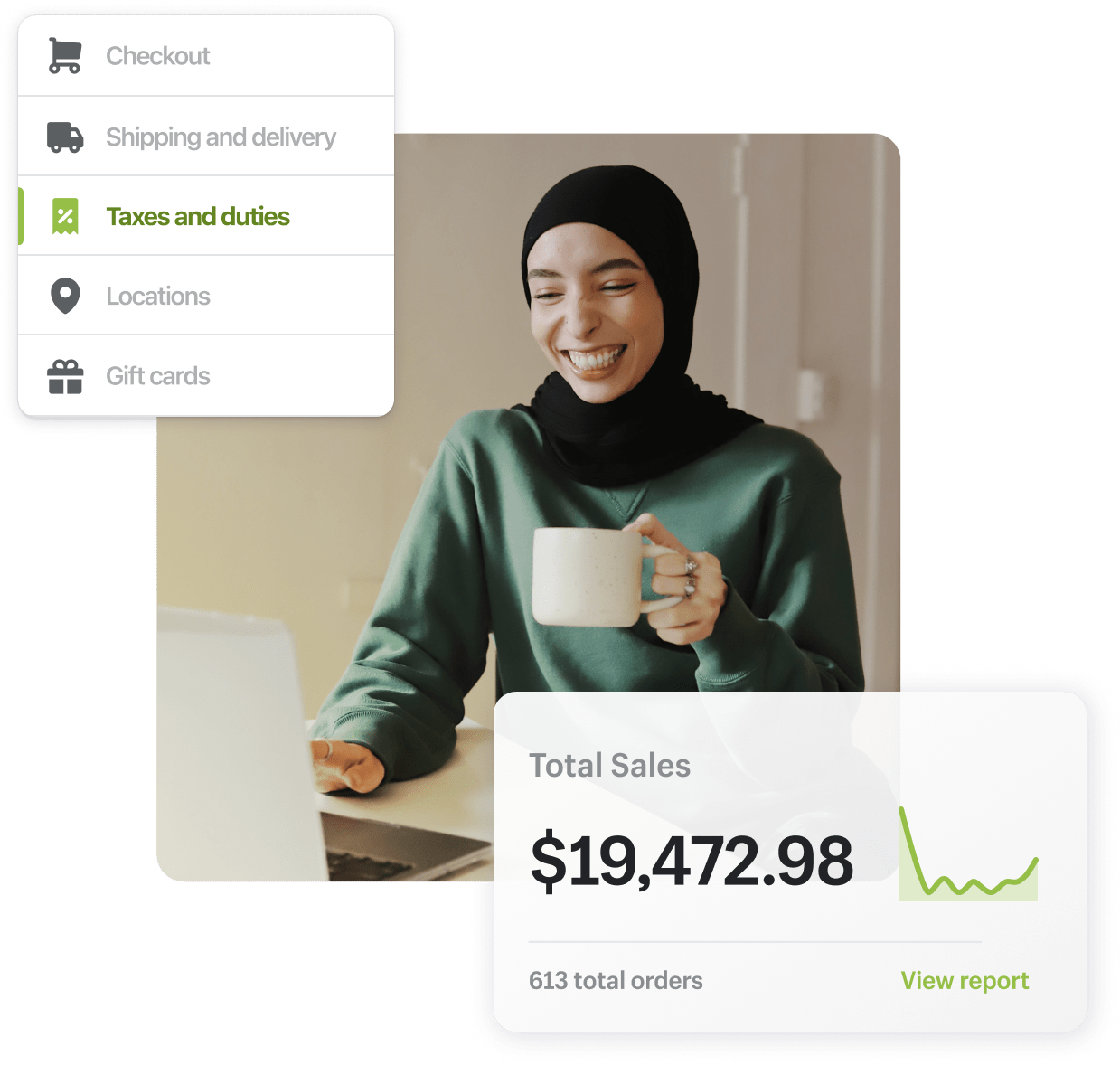

Your business. Your sales tax. Manage it all in one place.

Staying compliant begins and ends in Shopify. Track nexus, calculate taxes and manage reporting from your Shopify Admin.

Features that simplify sales tax

Sign in to your admin and access native, data-driven tax features that get more insightful with every “cha-ching.”

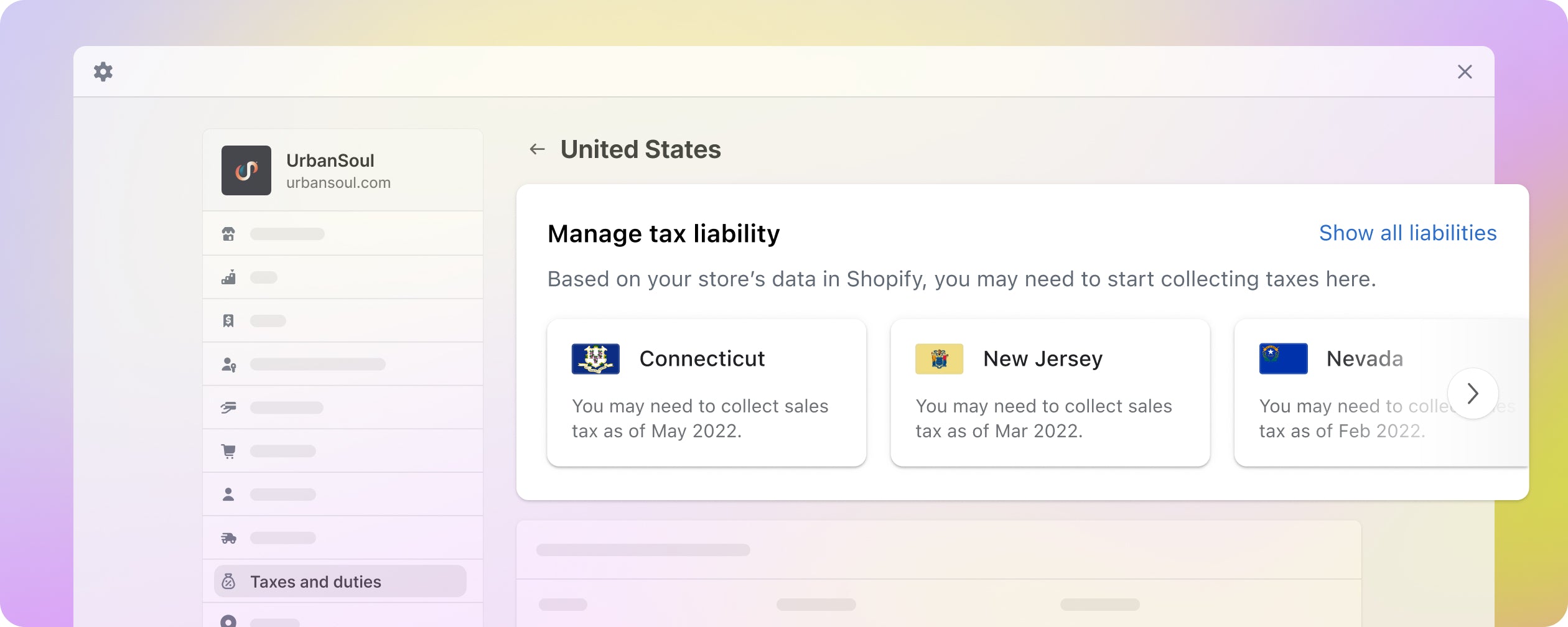

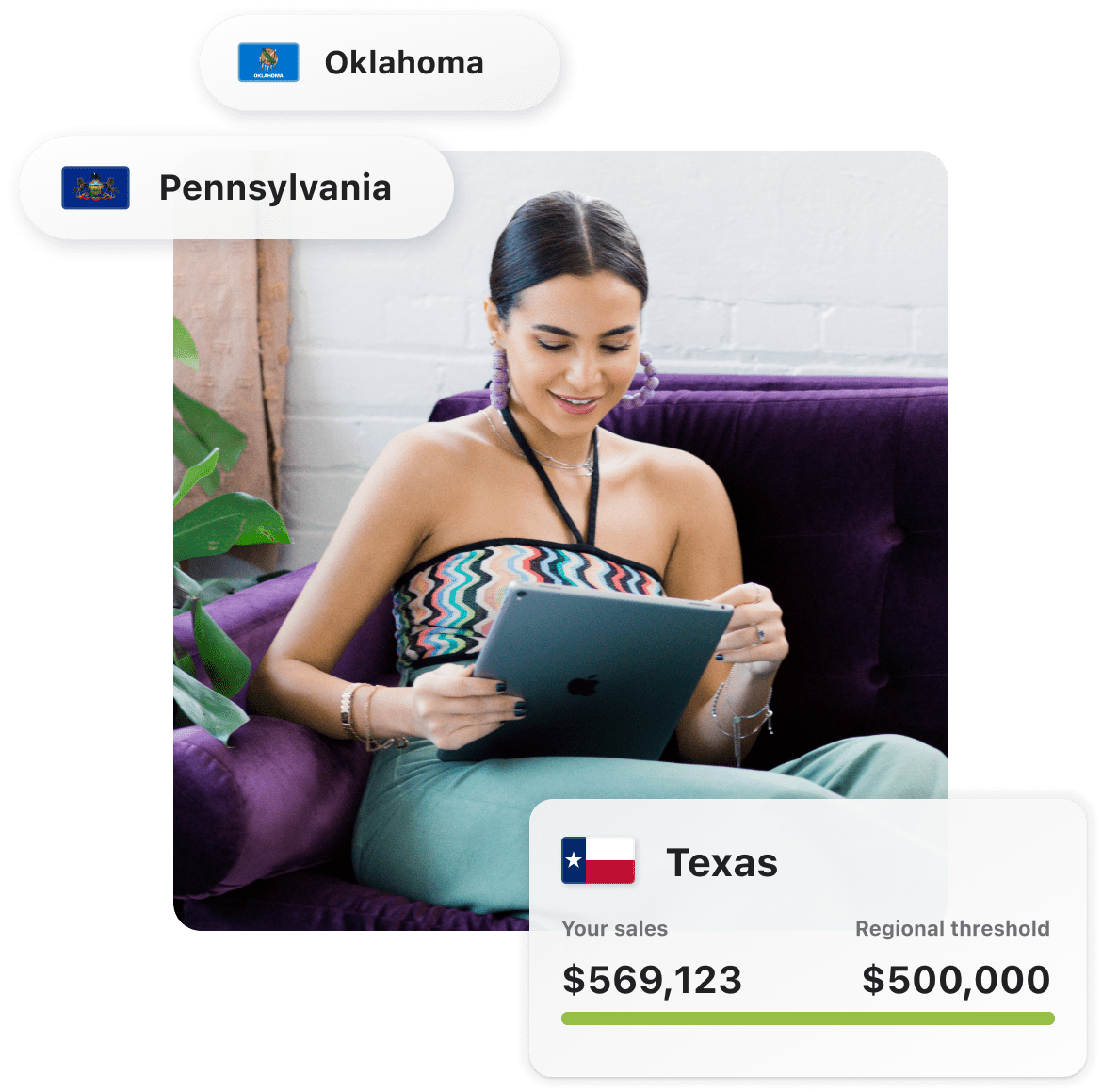

Sales tax insights

Know where you’re liable with a state-by-state overview of your current sales tax obligations. Sales tax insights also reveal where you’re approaching tax thresholds, allowing your business to plan and prepare accordingly.

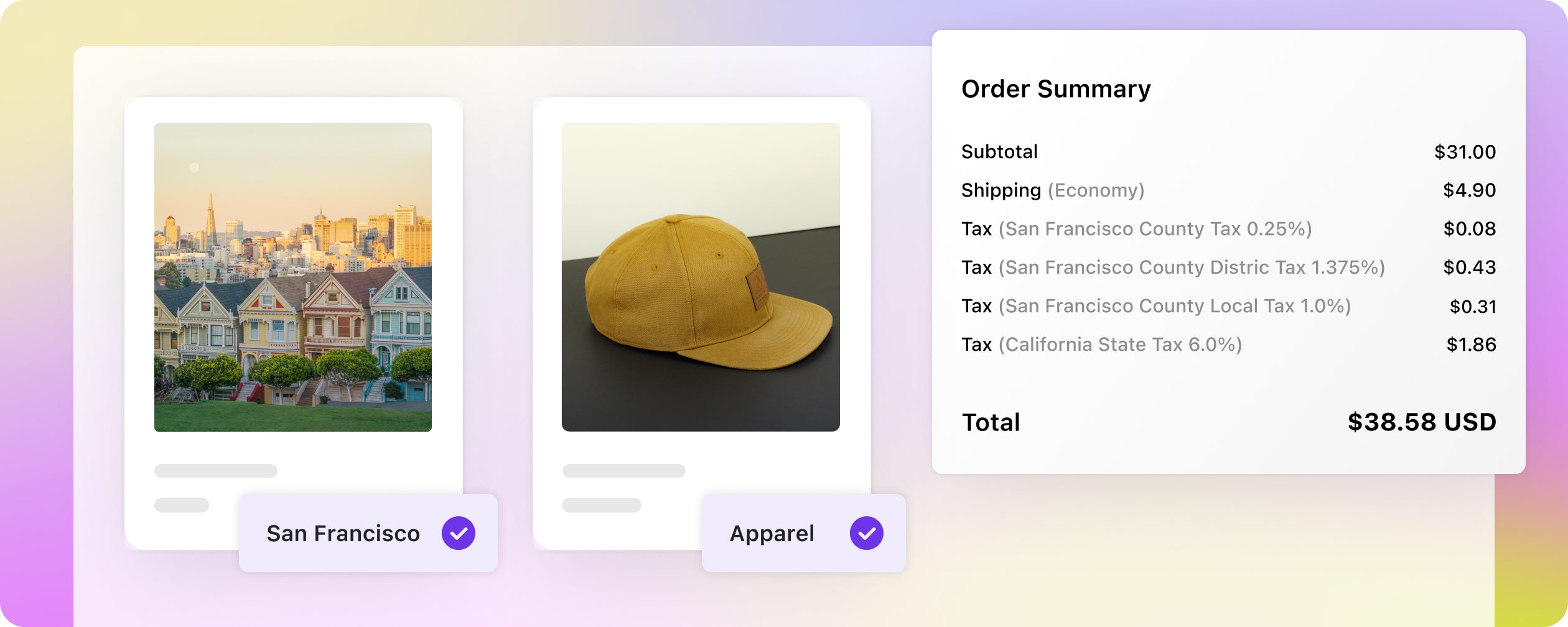

Tax rates with rooftop precision

Apply the right taxes at the right time, with calculations based on the buyer’s precise address (also known as rooftop accuracy). Shopify deciphers the 11,000+ United States sales tax jurisdictions, so you don’t have to.

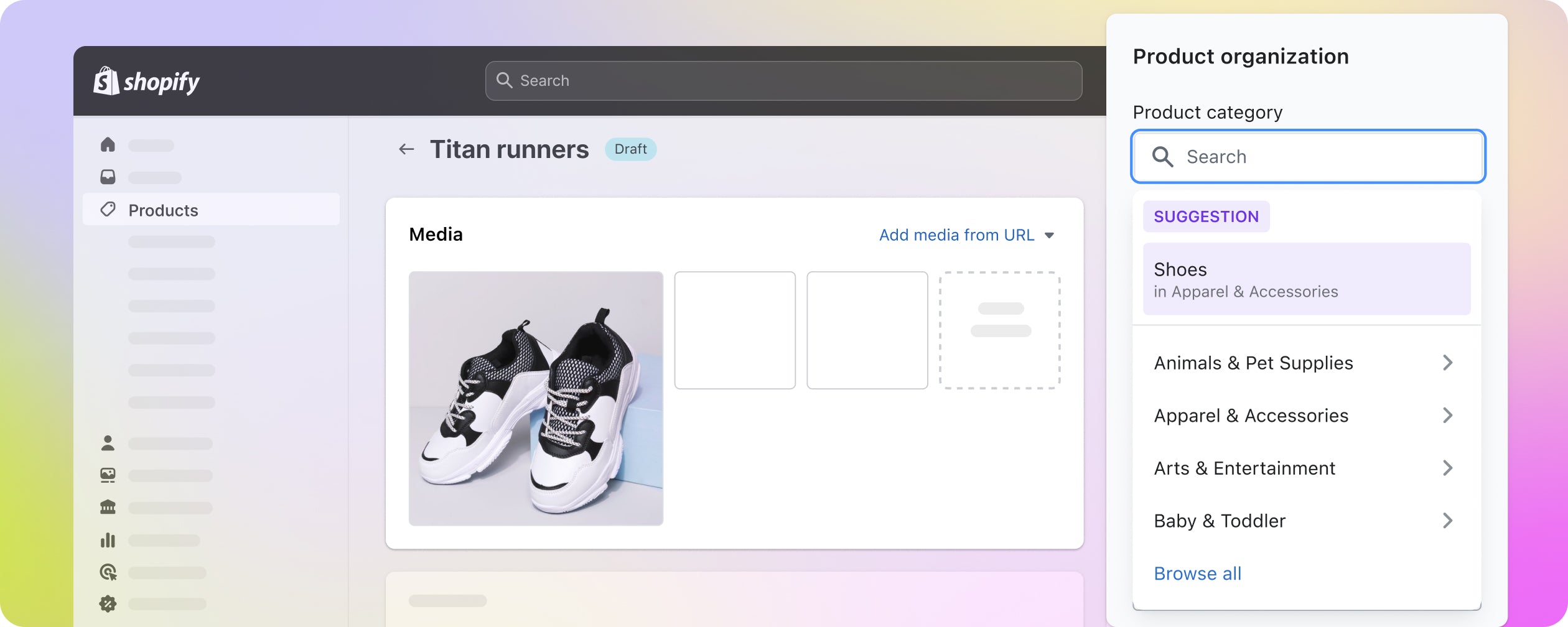

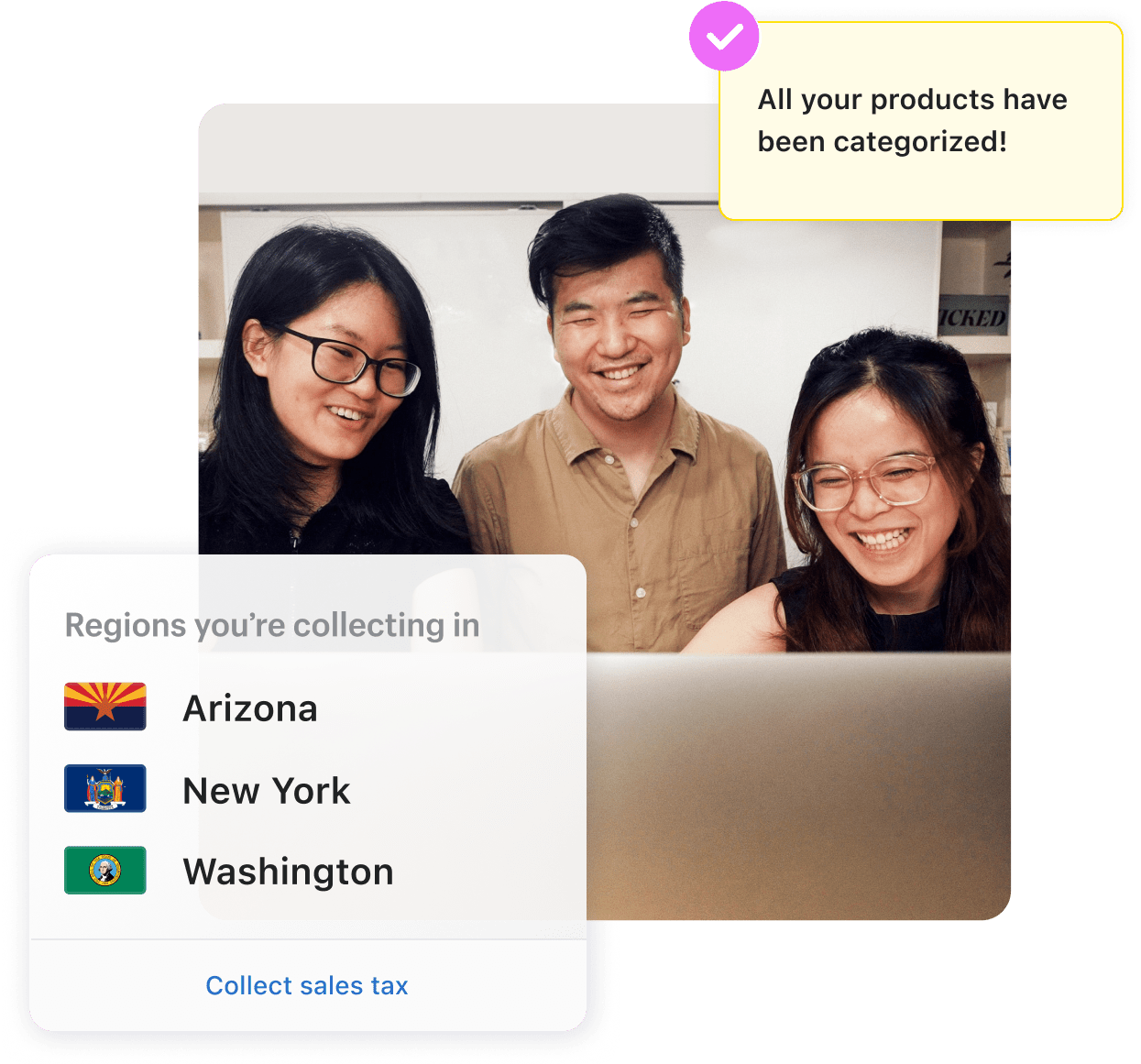

Product categorization

Be sure you’re collecting the right rates by categorizing every product you sell. Not sure which to choose? Shopify helps you through the process by suggesting the categories that best fit your products.

Enhanced sales tax reports

View your sales and tax data by state, county, and local jurisdictions, making it easier to accurately file your sales tax returns.

Sales tax insights

Know where you’re liable with a state-by-state overview of your current sales tax obligations. Sales tax insights also reveal where you’re approaching tax thresholds, allowing your business to plan and prepare accordingly.

Tax rates with rooftop precision

Apply the right taxes at the right time, with calculations based on the buyer’s precise address (also known as rooftop accuracy). Shopify deciphers the 11,000+ United States sales tax jurisdictions, so you don’t have to.

Product categorization

Be sure you’re collecting the right rates by categorizing every product you sell. Not sure which to choose? Shopify helps you through the process by suggesting the categories that best fit your products.

Enhanced sales tax reports

View your sales and tax data by state, county, and local jurisdictions, making it easier to accurately file your sales tax returns.

Rate updates are worry-free

Stop wading through never-ending tax rate changes (or worrying about the ones you haven’t caught). Categorize your products once, and Shopify will handle any necessary updates thereafter.

Valuable information is delivered to you

You’ll be notified of significant changes in the tax world that impact your business, and receive guidance to take action when you need to.

This is 100 times better. Previously, to sort through all the data, I had created a custom spreadsheet and formulas to spit out the data that the state of Illinois needs. With this report, that's no longer necessary. I just pull up the Illinois Department of Revenue site in a new browser tab and copy the numbers. Takes 15 minutes max.

- Connect Roasters

- Caleb Benoit — Founder, Connect Roasters

Spend less time keeping up with sales tax, and more on the things that matter

Let’s face it: with thousands of different rates and regulations across 11,000+ jurisdictions, sales tax in the United States is complicated and time consuming. Shopify Tax simplifies tax compliance, so you can focus on what’s really important—in your business, and in your life.

Frequently asked questions

Go from taxing to relaxing

Shopify has the sales tax accuracy, reporting, and insights you need to feel calm and collected at tax time.