Update: Starting now, all eligible US merchants can receive free fraud protection on Shop Pay with Shopify Protect.

Chargebacks—the reversal of a credit card payment that comes directly from the bank, rather than as a refund from the affected retailer—is a way for customers to dispute a charge on their credit card bill.

Why do chargebacks occur?

These chargebacks can be initiated for a variety of reasons, such as:

-

Item not received: At a time when supply chain and shipping delays are widespread, customers who are expecting their products to be delivered at a certain time may file a chargeback

-

Clerical error: Double-billing or an incorrect amount charged

-

An unrecognized purchase: Often happens if the business name appearing on the card statement is different from the store name

-

Customer dissatisfaction: when the buyer receives a different product than what they paid for

-

Fraud: either on the part of a bad actor buyer—so-called “friendly fraud” in which seemingly legitimate customers use their own names, addresses, and credit cards to make an online purchase with the full intention of disputing the charge with the credit card company so as to avoid paying—or when someone argues they are the victim of identity theft

On average, 2.59% of all transactions end up in a chargeback dispute, and that's the same for all credit card providers (e.g., American Express, Discover, Mastercard, and Visa). Chargebacks cost ecommerce businesses $40 billion a year.

There are good reasons why banks and card networks enforce chargeback rules. They are an important consumer protection feature, as there are some bad merchants out there who try to take advantage of consumers by sending them shoddy, illegitimate, or nonexistent products.

But if you are diligently sending your customer a bonafide product, on-time and on-brand, and they thank you for your service with a Product Not Received chargeback, then you need to make sure you win that dispute.

Because it’s not just the principle that’s at stake—it can be your business.

If you’ve already eaten the cost of advertising to acquire the purchase, plus selling and shipping it to the customer, a chargeback makes a real impact on your bottom line.

And if it’s not “friendly fraud,” chargebacks can be more than just money out of your pocket: It’s also a disappointed, rejected customer. Angry customers tend to talk about their frustrations with their friends and on their social media. This can have negative consequences for your brand reputation over time.

Credit card companies and banks all have processes in place to review chargeback attempts for validity before they proceed to grant them. If the request seems suspicious, card companies and banks might look into the claimant more carefully: Do they have a history of frequently requesting chargebacks? If so, the request might be flagged as fraudulent. These kinds of invalid requests will normally be denied before they’re ever escalated to the level of merchant notification.

Are merchants liable for chargebacks?

Unfortunately, merchants have few formal protections when it comes to chargebacks.

Most merchant’s rights regarding chargebacks are reactive and are aimed at limiting losses. Here are eight you should be aware of.

-

Chargebacks cover the purchase price only and can’t exceed the original transaction amount. In some cases, certain shipping costs and surcharges may be included in the chargeback total.

-

Chargebacks can’t cover cash-back transactions

-

The customer must try to return the merchandise prior to seeking a chargeback if the purchased item arrives after the agreed-upon delivery date

-

Many cardholder agreements mandate that the cardholder must contact the merchant and attempt to resolve the issue before filing a chargeback

-

If a customer returns an item, the card issuer must wait 15 calendar days to process a chargeback (except where waiting 15 days will exceed the chargeback filing deadline), to give merchants a window to respond

-

Most cardholder agreements require consumers to file a chargeback within a set number of days

-

In most cases, every step of the chargeback process must be completed before proceeding to arbitration

-

You, as a merchant, have the right to contest chargebacks through an arbitration process called “chargeback representment”

It is this final right—representment—that is your most important right in the chargeback process.

Of course, fighting chargebacks gives you a chance to recover lost revenue, but in some ways, it’s a secondary outcome. Because the bigger reason to fight what you believe to be fraudulent chargeback attempts is a strategic one.

When merchants give in and just accept fraudulent chargebacks because they can’t be bothered with the hassle of fighting them, it emboldens scammers and can lead to more chargebacks.

Yes, fighting a chargeback takes time and effort. You’ll need to gather documents to show evidence that the original transaction was legitimate. But doing so will save you time and effort in the future, as you face fewer and fewer chargebacks.

Strategically, having a reputation as a merchant who pushes back on chargeback claims will discourage would-be fraudsters from being so eager to file a chargeback. Likewise, it will make legitimate customers more likely just to ask for a refund if doing so is faster, easier, and more effective than going to all the trouble of a disputed chargeback.

Disputing chargebacks also sends a powerful message to banks. Merchants who consistently dispute chargebacks will incentivize banks to not rubber-stamp chargebacks but instead do their due diligence. This would have the knock-on effect of making the system fairer for everyone, while simultaneously managing risk, incurring fewer costs for merchants, and lowering overall levels of fraud in the system.

How to avoid chargebacks before they happen

The truth of the matter is that, in most cases, banks tend to favor their cardholder over the business owner in chargeback disputes. This is why it’s vital for merchants to have purchases and transactions well-documented and in strict accordance with the rules set forth by the card networks.

But what are your options for avoiding chargebacks before they happen?

Follow these general steps to prevent chargebacks and time-wasting inquiries:

-

Investigate suspicious orders before you fulfill them

-

Inform customers upfront about your store's policies

-

Make sure the pictures and descriptions of your products or services are clear and accurate

-

Have a clear return policy and make it easy to find on your store

-

Make sure your billing statement text is easily recognizable to your customers. Use your store's name or domain name so that the customer can recognize it on their credit card bill.

-

Send e-receipts upon payment to remind your customers what they paid for

-

Make sure you give refunds as soon as possible

-

If a double-charge happens accidentally, then refund the second charge right away and contact your customer directly to let them know what happened

-

Respond to customers quickly if they have any problems

-

If you ship physical goods to the United States, the United Kingdom, or Canada, then consider only shipping products to orders that pass an AVS check. You could also contact the customer before shipping to an address that doesn’t pass an AVS check.

-

Ship products as soon as possible after you collect payment for an order

-

Estimate shipping and delivery dates as accurately as you can

-

If shipping is delayed, then contact your customer and let them know what's happening with their order

-

Once a package has shipped, keep your customers updated throughout the shipping process. Use online tracking and delivery confirmation if you can, especially if you tie in with the parcel delivery service.

-

If you’re shipping physical goods, then make sure that you pack and ship your products in a way that protects them from being damaged in transit

-

Respond quickly to your customers and replace defective or damaged products

-

If you offer subscription-based services, add a subscription cancellation policy on your store

-

When a customer asks you to do so, cancel their subscription immediately and provide them with a confirmation of the cancellation

-

Make it clear on your subscriptions sign-up page that your customers are agreeing to a recurring charge, and send them a reminder before each charge

If your store is powered by Shopify, fraud protection tools come out of the box, including:

-

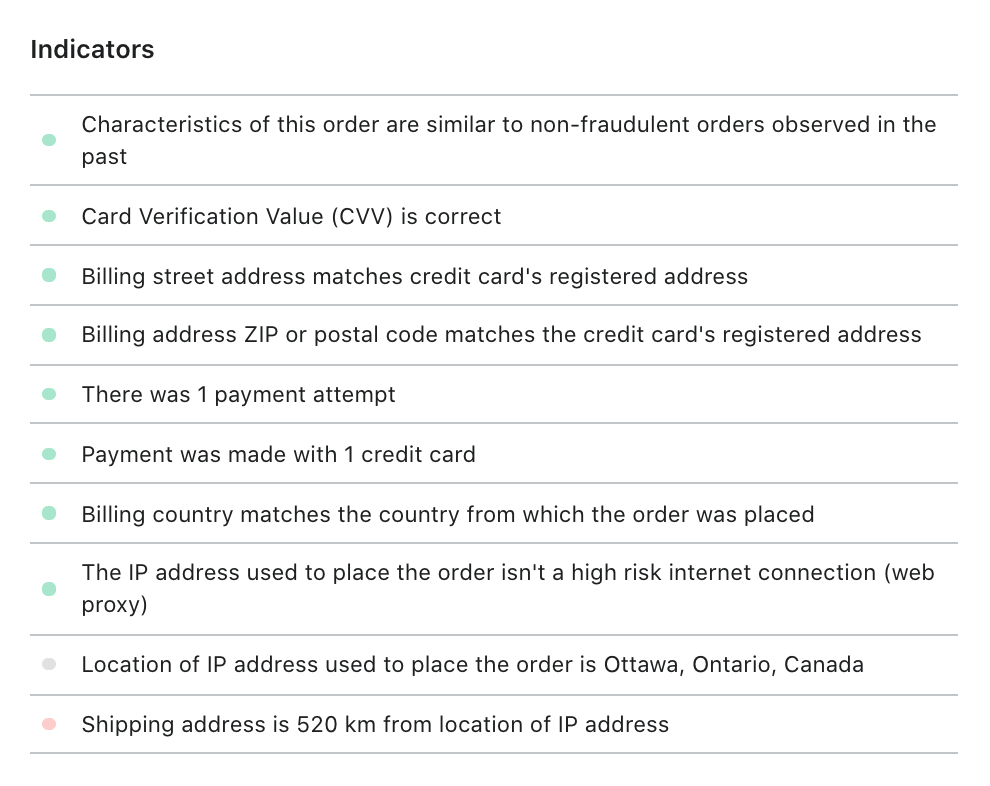

Risk analysis indicators: Every order comes with a list of indicators to help you investigate orders that you think might be fraudulent, based on different behavior types.

-

Support for third-party fraud apps: You can find fraud prevention apps in the Shopify Certified App store. These partners help Shopify brands like CurrentBody, Urban Industry, and iDrinkCoffee reduce the likelihood of false positives while protecting against bad actors. The results include up to 75% reduction in fraud attempts and close to 30% increase in sales.

-

Fraud recommendations: Based on machine learning, if an order has a medium or a high risk of a chargeback due to fraud, then it's flagged on the Orders page with a warning symbol next to the order number. You can then attempt to verify the order, cancel the order, or refund the order.

-

Fraud protect: After Fraud Protect is activated, online orders processed through Shopify Payments are analyzed and classified as either "protected" or "not protected". You pay a fee on each protected order, and Shopify guarantees the payment. You don't have to do anything if there’s a fraudulent chargeback on a protected order. Shopify reimburses the chargeback amount to you and handles the chargeback process for you.

Lastly, fast fulfillment also brings down chargeback rates. If you choose the Shopify Fulfillment Network for the logistics of storing and shipping your product, you can bet that your chargeback rates will fall, too, because we’ll get your stuff out the door fast.

How to address chargebacks once they happen

No matter how diligent you are about following the steps above, you’ll eventually face at least some chargebacks. So how should you deal with them when they happen?

One way is to make sure you have an ironclad series of records demonstrating that the purchases in question were legitimate. Part of why we designed Shopify Payments to work seamlessly with other services, like Shop App and Shopify Shipping, was so that it could stitch together checkout, receipts, shipping, and package tracking all into one place.

And because Shopify Payments comes with Automatic Dispute Resolution, it pulls together a complete picture of every transaction and helps you win more disputes more often.

Shopify Payments works tightly with the rest of your Shopify services to make sure you have the best chances of winning. Our Automatic Dispute Response, done by combining Shopify Payments and Shopify Shipping, will boost your win rate from a 20% baseline to a 37% win rate: 17% of disputes flipping from a loss to a win. That’s nearly twice as many wins: an 85% relative improvement, with hardly any work required from you. In fact, Shopify Payments wins 45% more chargeback disputes than its competitors.