“‘Yes,’ he said, ‘all right. You have the western states.’”

So Phil Knight recalls Mr. Onitsuka’s words in his book, Shoe Dog. At the time, Knight had just founded his shoe reselling company, Blue Ribbon, and had just secured exclusive territory and a deal for $3,500 worth of shoes from Japanese manufacturer, Onitsuka.

Considering that he started selling shoes from the trunk of his 1964 Plymouth Valiant, he’d already come quite a long way.

Yet even Onitsuka’s promise was just the start in a long journey that would eventually turn Knight’s company from a shoe reseller named Blue Ribbon to a manufacturer and retailer, called Nike.

Image via: Tracking Board

They started in the trunk of the car in 1964… And opened its first store store in Santa Monica in 1966 … Signed their first athlete endorsement contract in 1972…

And after an IPO in 1980, Blue Ribbon and Nike officially merging in 1981, and passed $1 billion in revenue in 1986…

And within a few decades, they quickly mastered the traditional form of commerce.

After Phil Knight stepped down, and William Perez’s brief stint as Nike CEO, Vice President of Global Footwear and Co-President of the Nike Brand Mark Parker would be the next CEO. Knight says to Harvard Business Review:

“With Mark, I had a few meetings and realized that we were sort of on the same wavelength and could kind of, after all these years together, finish each other’s sentences. So I didn’t have to meet with him very often.”

Phil Knight, Founder, Nike

It’s been over a decade, and Parker has more than doubled annual revenue to over $32 billion. But there’s a recent mark on Nike’s track record. At the time of writing, Nike’s sales went down (as they predicted) — and to respond, CEO Mark Parker slashed his own salary by 71%. Their competitors are creeping up and gaining momentum (see: UnderArmour, and Adidas’s recent double in North American market share).

Juggling traditional retail while in the middle of a transition to direct-to-consumer, Parker reinforces in an earnings call in September 2017, “Our vision is for every consumer who engages with the NIKE Brand to enjoy an elevated consistent experience regardless of channel.”

In other words, they’re going to keep investing in omni-channel and exploring the fourth wave of ecommerce, and tough through the transition…

One that started shortly after Parker took the reigns.

The Heart of Nike’s Omni-channel Experience: The NikePlus Program

In March 2009, Nike announced that Jeanne P. Jackson would be the first President of Direct to Consumer for the company. Her mandate was to grow Nike-owned retail stores worldwide, affiliate retail stores, and digital commerce. She would report directly to CEO Mark Parker.

She was the perfect pick for the job — nearly a decade prior, she’d joined Walmart in 2000 to lead and operate Walmart Interactive, its global ecommerce initiative.

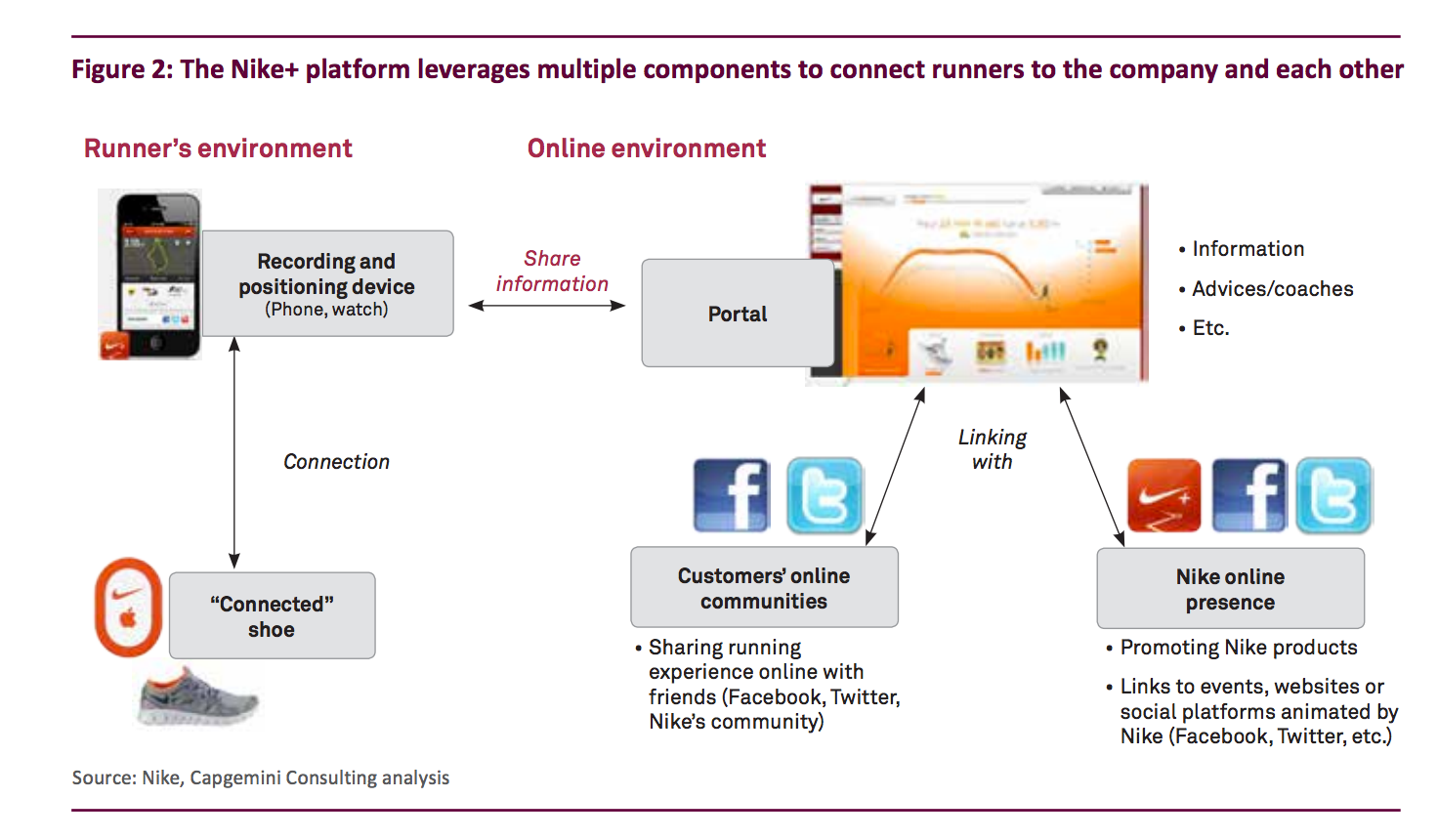

In 2006, Nike had announced a partnership with Apple called NikePlus (stylized as Nike+). Their partnership and products would enable a pair of Nike shoes to connect with an iPod, and track running distance, time, and calories burned. The data would be synced to NikePlus’s website.

It quickly grew into a community for runners to get together. In 2016, Nike expanded NikePlus to become a personalized app for all sorts of users.

At the heart of most omnichannel examples is an ecommerce retention strategy and loyalty program to tie it all together. This strategy and program are the things that can turn one-time buyers into coveted, loyal, return customers. Nike’s proposition is this expanded NikePlus program, which they describe as:

“Everything you want from Nike, all in one place. Products and events reserved for you, expert advice from the world’s greatest athletes, and your own personal Nike shop.”

Using other words, Nike describes Plus in a press release as, “Connecting Nike’s wealth of sport knowledge with its footwear and apparel offerings, Nike+ translates the ‘plus’ to ‘personal,’ providing members with customized guidance, support and a host of tailored resources that unlock the best of Nike.”

NikePlus’s onboarding involves getting to know the user well — what their favorite Nike brands are (e.g., Air Jordan, NIKEiD, Converse, etc.), what sports they like, and what types of products they’re interested in. They then deliver relevant content through a newsfeed personalized for the user.

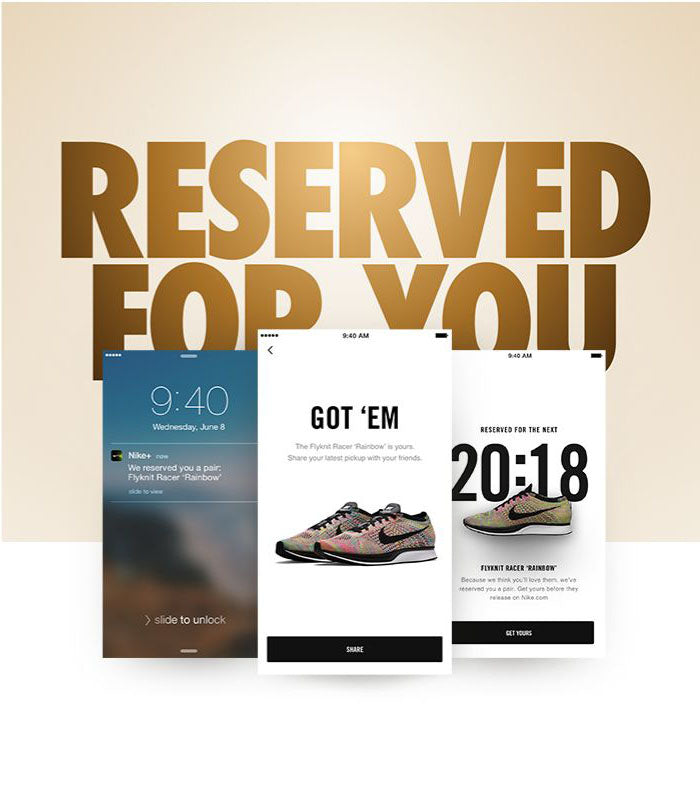

Product announcements and reservations are particularly relevant in the NikePlus program, considering how quickly their products can sell out.

More importantly, this NikePlus app serves as a gateway to connect members to the rest of the Nike app constellation — the Nike+ Run Club, Nike+ Training Club and Nike+ SNKRS apps.

Image via Capgemini: “Nike: From Separate Digital Initiatives to Firm-Level Transformation”

In an interview with CodeCommerce, Nike’s President of Direct to Consumer Heidi O'Neill said that NikePlus members are worth three times the value of an anonymous buyer (timestamp: 11:00). No surprises there.

While NikePlus’s program is sophisticated (and glitzy), its loyalty program can be fundamentally created through a combination of features and apps (probably not too dissimilar to Pura Vida bracelet’s app stack). Their reservations feature for members is similar to Evy’s Tree’s program. Their Training Club program isn’t too different from RunKeeper’s mobile app, and SNKRS’s core feature is similar to Frenzy’s Dropzone.

Despite Nike’s $98 billion market capitalization and decades of accrued brand equity, their size can be a double edged sword. They’ve got over 74,000 team members worldwide, which means they naturally can’t move as fast.

Learn more: Omnichannel vs. multichannel

That slowness in speed and learning compounds. Their company was built decades ago — which means their organizational structure isn’t quite as nimble as yours can be. And they weren’t built with technology in mind, and don’t have a technology partner to collaborate with. That means, again, they’ll have to work hard to keep up (although they can accelerate some of their progress through acquisitions, which is why UnderArmour acquired MyFitnessPal).

Plus, since they’re playing in public markets, they also have to deal with public scrutiny and perception.

Basically, if you can figure out what Nike’s doing with their omni-channel ecommerce strategy…

You can do it faster, and cheaper. As you do, you’ll be able to eventually excel and provide a better customer experience than one of the world’s best brands.

And that isn’t an end in itself — the goal is to build and retain a customer base that will want to stay with you through years of business, or even decades, like thousands have done with Nike.

Now, back to the matter at hand: Nike’s retention program, NikePlus, serves as the foundation for its omnichannel retailing strategy. Let’s unpack each of those channels further now:

A Look at Nike’s Distribution Channels

Nike is a giant. To truly have a look at their omni-channel strategy and identify which ones are important and relevant, we’ll need to take stock of their channels. Naturally, it conducts transactions through several commerce channels that we could unpack for days:

Direct to Consumer

- Nike brick and mortar stores (and Air Jordan, Converse, and Hurley stores)

- Nike factory retail outlets

- Nike’s direct-to-consumer ecommerce store (including their subbrands)

- NIKEiD ecommerce store (specifically for mass customized shoes)

Retailers

- Wholesale brick and mortar retailer partnerships (e.g., Foot Locker)

- Nike retailer boutique partnerships (e.g., Atmos, Kith, etc.)

- Ecommerce retailer partnerships (e.g., Zappos, Amazon)

- Social platform relationships (e.g., Instagram)

NikePlus’s influence is strongest in the direct to consumer stores, but it extends to Nike’s third-party retailer experiences as well. For example, in the previously mentioned CodeCommerce interview, O’Neill alluded to NikePlus members eventually being able to access Nike’s retailer inventory when third-party out of stocks happen (timestamp: 16:00).

Although they don’t have this inventory functionality live with brick-and-mortar retailers yet, they’ve got a digital version of this live with European fashion platform Zalando. Zalando’s site describes the partnership:

Nike sells its own e-commerce stock to Zalando customers without any intermediary. Nike integrates its articles to the Zalando catalogue that customers can conveniently shop in the Zalando Fashion Store, and ships the orders directly to customers, under Zalando delivery standards.

It has a similar arrangement with T Mall in China. And naturally, as they’ve expanded with platforms, Nike’s most controversial move lately was to partner up with Amazon and sell directly with them. We’ll unpack that move in a bit…

But firstly, since profit margins are higher, it’s in Nike’s best financial interest to increase direct-to-consumer sales as much as possible. Naturally, there’s a lot of tension with direct-to-consumer sales and retail partnerships (and platform partnerships — consider how Foot Locker’s stock prices decreased after Nike and Amazon announced their partnership).

Nike has a unique asset in this position — their exclusive products. While Nike offers many of their widely available products to the platforms, it still preserves its exclusives for its own direct-to-consumer channels and for its wholesale and boutique retailers (see exhibit A, Foot Locker). Quantities may vary as time goes on, but for now, this helps keep the peace.

Nike has been experimenting with their own brick-and-mortar stores, and weaving them closely in with NikePlus as well as more community experiences. Here’s their most significant recent move with brick-and-mortar and how it advances their omni-channel strategy:

The Trial Zone: How Nike’s Brick and Mortar Stores are Evolving

In my previous article on omni-channel shopping, I’d highlighted a Capgemini report which said that 57% of respondents wanted “stores to serve a higher function than simply selling the product. In China, almost 80% of consumers want other activities in a store.” Nike has quickly adapted to that in a major way…

In 2015, Nike opened their first women’s only store. When she served as Nike’s VP and GM of Nike Stores during this time, Heidi O’Neill said, “Our new King’s Road store is yet another example of our commitment to women to bring them the very best of Nike. Our women’s business has never been stronger and our deep connections with women at retail are helping fuel this growth.”

Built on a road known for its cultural heritage and forward-thinking, it’s one of many unique Nike stores tailored for specific audiences. It’s not just a store for women — The Telegraph describes the bespoke sneaker customization, the bra fitting service, and the weekly classes in detail.

More recently, Nike installed the only publicly available basketball court within four blocks in any direction of its store in the Soho district in New York City. This is particularly relevant given the density of Manhattan, for a city that describes itself as “the basketball capital of the world.”

With two NBA teams (the New York Knicks and the Brooklyn Nets), a WNBA team (New York Liberty), and the NBA headquarters located at Fifth Avenue’s Olympic Tower, that claim isn’t a stretch. Not every store gets a basketball court.

According to the Washington Post, in L.A., Nike has “found that soccer is big business. So they’ve tailored their clothing line-up to appeal to soccer enthusiasts and have added a trial zone where a shopper can put on cleats and practice kicking a ball on a strip of fake grass.” And all of these training experiences could be data driven — O’Neill mentions that the treadmills are connected to NikePlus as well (21:40).

Quartz describes how this basketball court works:

“Cameras are set up all around the basketball court to capture the action from different angles. A camera beside the treadmill records a customer’s gait during a run, allowing a Nike staff member to analyze the results and recommend the best sneaker. And that customer can later access the footage through his online Nike account and share it on social media.”

Image via: Nike

Nike pairs its data-driven method with a localized approach to brick-and-mortar stores. In 2016, President of Direct-to-Commerce (and Jackson’s successor, O’Neill’s predecessor) Christiana Shi says in an interview with BrandChannel, “Our employment strategy is to hire 80 percent, and in some cases 100 percent, of our ‘athletes’ [workers] from within a five-mile radius of the store.”

In other words, the Trial Zone aspires to provide an experience not unlike going to the gym or the movies. If Nike has it their way, people can show up simply to run, play basketball or soccer, or train. There are a few interesting points to consider here:

- Members can access community events at the Trial Zone, or other Nike stores, through NikePlus.

- Aside from generating brand equity through these experiences, Nike also collects a ton of data to understand members better and make them more aware of things they might want to buy. If NikePlus members want to revisit their performance data, they have to do it through the NikePlus app.

- Of course, naturally, many of Nike’s brick-and-mortar stores already integrate heavily with their website. For example, Nike displays items and informs visitors that they can only buy them online, either at NIKEiD or at the Nike ecommerce store. But the Trial Zone is the next evolution of simply promoting exclusive items across channels…

- Nike wants to localize each brick-and-mortar store and tailor each one to the community surrounding it (e.g., with the most popular sport in the area, quotes from local coaches or athletes, etc.).

- It’s generating data to create personalized experiences for NikePlus members. And through the app, NikePlus members can reserve and buy items, or ask Nike team members for help, wherever they have their access to their mobile phone and data. In other words, they can buy anything, anywhere.

The point is it does all these things in one single, elegant, stroke…

And that Nike is prepared to take the risk that some of this isn’t going to work, and might even fall flat on its face. (For example, even though Nordstrom gets a lot of things right, people got creeped out by surveillance. Nike’s new store has infinitely more methods of capturing data, but in much more transparent ways than Nordstrom.)

As Quartz reports, “Nike plans to roll out successful elements of the Soho store through the rest of its retail fleet, which includes about 1,000 locations worldwide.”

Naturally, that means they’re expecting there will be some unsuccessful elements of this store. Perhaps it’s called the Trial Zone not only because it’s a great place for people to train and test their limits (e.g., time trials, etc.), but also because it’s a place for Nike to test their omni-channel experiments.

Image via: Orkiv

You may not have the budget to lease a five-story, 55,000-square-foot, brick-and-mortar store, but that’s beside the point…

You must have the curiosity and willingness to experiment with online-to-offline commerce. Sure, you’ll learn from some of your failures, but with each experiment you’re also investing in ideas that could be the future of your omni-channel ecommerce strategy.

Naturally, the brick-and-mortar experience will attract foot traffic and publicity. Some new visitors will turn into buyers, and some of them will turn into customers. But what about people who might not wander into the store, or sign up for NikePlus? How will Nike continue to acquire more customers or re-activate ones that might’ve left through their digital channels?

Platform Agnostic: How Nike Plays on Even Ground with Amazon and Instagram

Nike’s brand is aspirational. Their mission statement is, “To bring inspiration and innovation to every athlete* in the world,” with the clause that, “*If you have a body, you are an athlete.”

That explains why it doesn’t sell just anywhere — it’s very protective of its brand and how visitors, buyers, and customers experience it. And for a decade, it rebuffed Amazon’s advances…

Then, in June 2017, Nike announced a partnership to sell directly with Amazon. That probably shouldn’t have surprised everyone as much as it did — considering that Nike has been working with Alibaba's TMall and Zalando for over five years. More impressively, despite the fact that Nike didn’t sell officially directly through Amazon prior to the announcement…

Nike was the #1 clothing brand selling on Amazon.

Third-party sellers had made Nike the most popular brand selling on Amazon. The experience wasn’t very good though, considering that pricing and variants weren’t very consistent. Nike partnered up with Amazon to better control that experience. Fortune reports:

“While Nike is one of the top selling brands on Amazon, until now the athletic wear maker's products have only been available via third-party vendors on its market places. The proliferation of third-party sellers on the site has weakened many top brands' control of pricing and distribution, prompting them to take a risk and sell directly on Amazon. The Wall Street Journal this week reported that in exchange for selling directly on Amazon.com, Nike won concessions from the online retailer to more strictly police counterfeits and restrict unsanctioned sales. Nike is the top selling brand on Amazon, according to Morgan Stanley.”

Learn more: Get omnichannel marketing ideas to connect with customers—without being creepy.

As I mentioned earlier, naturally, Nike isn’t giving up access to its best products to Amazon quite yet. Barrons writes, “the company is likely to only provide Amazon with a limited assortment of styles and not much ‘premium’ product. Nike follows this strategy with Zappos, which is owned by Amazon.”

You don’t have to sell everything on every single channel, because each channel has a varying degree of effectiveness (depending on your objectives). I’d touched on this topic when writing about multi-channel ecommerce strategy. My colleague Nick also wrote about how L’Occitane used this tactic in-depth selling an exclusive Mother’s Day collection of beauty products directly on Facebook.

Naturally, the most clear option is to identify the highest value (i.e., most exclusive, or most demanded) products, bundles, or collections and use them wisely. This might be to acquire customers at your own site, or to spread a bit of love with retail partners and platforms (and gain negotiating power and ensuing publicity).

When Nike acquires more buyers through Amazon, some of them will join NikePlus. Other ones, curious to explore new styles or customizations through NIKEiD, will visit Nike’s direct to consumer site. And Amazon becomes not just a method for generating more sales and increasing revenue, but acquiring members for NikePlus and turning them into returning customers.

That’s the same idea for Instagram. According to Bloomberg, “Luca Solca, analyst at Exane BNP Paribas, says selling through social media is a way of circumventing wholesale partners such as department stores, and taking more control of their distribution. Nike's initiative highlights this idea, as it is aimed at selling athletic gear directly to customers.”

Although naturally social platforms will start taking a percentage of sales as pilot programs take off, it might still be cheaper — and more filtered, and focused — than traditional brick and mortar wholesale retailers.

Final Thoughts

For some of you, comparing yourself to a near-hundred billion dollar company is ridiculous. (For others, it seems obvious — who else would you aim for?)

Just keep in mind that Knight started the company selling sneakers out of the back of his car. You’re much further along than he was at that stage.

And they started out from a very different place and understanding of commerce. Juggling their businesses while investing in innovation is no easy task.

At the end of the day, even though you might not work alongside 73,999 people, you’re working with a close team. You started out selling online. With strong infrastructure, you can move faster, get on the same page, and hash ideas out more effectively. And, if you’re smart, you work with technology partners to make sure that you can stay on the edge of innovation, while your team focuses on your core business and customer experience.

Nike has cashflow constraints at scale. They have the spotlight of publicity and public trading, and they’re still willing to fail and ignore external expectations. You have less to lose, and so much more to gain. Now is the perfect time to move forward.

Read more

- How L’Occitane Used Shopify Plus to Launch a Facebook Sales Channel in Just 42 Days

- How Two Military Wives Grew Their Remote Manufacturing Company 1,273%

- TULA, With Traffic Up 198% and Transactions Up 407%, Gives Thanks

- How an Indian Retail Conglomerate Sells Across Global Online Marketplaces

- Want to Get on Shark Tank? Shopify Plus Merchants Share How to Be Selected & Kill It Under Pressure

- A “Golden” Opportunity: How Activewear Brand Rhone Disrupted Itself Two Years After Launching

- How Bohemia 4X’d Sales After Migrating & Supports the Survival of Artisan Crafts

- How This Lifeguard is Disrupting Women’s Athletic Swimwear

- How the Next Great American Sport Is Growing 2,700% with Generous Surprises & On-Demand Delivery

- How Nestlé Is Using Shopify Plus to Target Millennials by Making Adulthood Suck Less