From showcasing your product catalog to shipping bulky orders, there are various steps in the process of selling goods to other businesses. And none of them are more important than collecting payment for the inventory you sell.

The issue? The business-to-business (B2B) payment process is vastly different from direct-to-consumer (DTC) orders.

This guide shares how to navigate the complexities of B2B payments—from the most popular payment methods to the B2B payment trends leading the industry in 2024.

What are B2B payments?

A B2B payment is the process of transferring funds between businesses for goods or services rendered. Business entities can exchange payments through a variety of methods, like bank transfers, electronic funds transfers, credit cards, or specialized B2B payment platforms.

Types of B2B payment methods

The B2B payment market is growing fast. Sales are forecasted to hit $88 trillion in 2023, growing by 26% by 2027, to $111 trillion.

One of the biggest differences between B2B and business-to-consumer (B2C) payments is the method a customer uses to pay for goods. Let’s take a look at the most popular payment methods used in B2B transactions.

Checks

Despite B2B’s seismic shift to ecommerce, buyers are still defaulting to old-school payment types. Some 40% of all B2B payments in the US are still made via check.

To pay by check, most B2B companies require an invoice. They pass this invoice to an accounts payable (AP) department, which uses a paper checkbook prefilled with their bank details.

The AP team writes the dollar amount on the check and mails it to your business. Your accounting team would take the paper check to the bank (or scan it through a mobile app, if you’re using a modern fintech bank). The buyer’s issuing bank will then release the payment into your merchant account.

However, the downside to using checks is huge—largely because paper checks risk getting lost in the mail. It’s also time consuming and involves manual labor. Customers need to receive an invoice, issue the check, and mail it to you. It’s then your job to take it to the bank.

“It’s becoming increasingly more common for people to place wholesale orders online, so I think we’ll see more and more folks moving away from paper checks and, more importantly, purchase orders—good riddance,” says Kelly Van Arsdale, co-founder and CEO of Spinnaker Chocolate.

ACH payments

Automated Clearing House (ACH) is an online network that helps businesses process large transactions. It’s the second-most-used B2B payment method, often reserved for B2B payments between businesses and bigger retailers.

There are two methods of sending a payment through the ACH network:

-

An ACH credit transfer, in which a B2B customer pushes the money from their own business account.

-

An ACH debit transfer, in which your company pulls the payment from a B2B customers’ bank account. (Theoretically speaking, this is the best way to take ACH payments, since you’re removing the reliance on your customers to send the payment.)

The downside to ACH payments is that it takes much longer to process a transaction, since payments are sent in batches throughout specific windows in the day. Plus, the ACH network is primarily available to businesses within the United States—you’ll need to find an alternative (such as wire transfers, which are quicker and easier than ACH transactions) if you process cross-border B2B payments.

Credit or debit card

Payment cards are a popular choice, but they can quickly become a problem when processing B2B orders, which are larger than DTC by nature. It’s not uncommon for wholesalers to place high-value orders on a routine basis—be that every week, month, or quarter.

Wholesalers accepting B2B payments via American Express, for example, face a 2.5% to 3.5% processing fee on each transaction. Assuming the higher rate on a $10,000 wholesale order, you’d still need to pay $350 in transaction fees—while losing out on the extra profit you’d get from selling directly to the consumer.

Wire transfer

A wire transfer electronically moves money from one business bank account to another. You’ll provide your account details—including your business name, bank account number, and routing number—for the sender (i.e., your B2B customer) to initiate the transfer.

The biggest advantage of processing B2B payments through bank transfers is that money typically arrives the same day. However, it’s exposed to human error. The onus is on your buyer to enter your payment information correctly and initiate the payment before the payment due date provided on the invoice.

How to process B2B payments online

1. Choose a B2B payment processing solution

The B2B payments landscape is vast—there are several solutions designed to facilitate online B2B transactions. If the one you’re currently using isn’t fit for your purpose, evaluate other options.

Popular B2B payment providers include:

When choosing a B2B payment processing platform, confirm it accepts your buyers’ preferred digital payment methods. Will Stewart, owner of Cedar Spring Recreation, says, “We offer multiple payment options to make it as easy as possible for our wholesalers.”

Similarly, if B2B ecommerce forms part of your international expansion plan, confirm your B2B payment processor supports cross-border transactions.

Use Shopify’s B2B ecommerce platform and get access to Shopify Payments. Accept more than 130 global currencies from a range of different payment gateways—all without investing in a separate back end from the one already powering your DTC store.

2. Set up a merchant account

A merchant account is required to handle online transactions. It’s a type of bank account that lets you accept payments in various forms, including credit and debit cards.

-

From your Shopify admin, go to Settings > Payments.

-

Activate Shopify Payments.

-

Enter the required details about your store.

-

If you’re eligible, a Shopify Balance account will be created for you.

-

Click Save.

Depending on your region or eligibility for Shopify Balance, you must also activate two-step authentication for your store.

3. Create invoices for B2B customers

Invoices display key information about a buyer’s order, including the SKU they’ve purchased, the quantity, any tax, and the final amount owed. Many retailers require the invoice before paying for goods. Their accounts receivable team will also need it to reconcile the business’s accounts.

Resolve the issue for buyers who think the absence of a supplier portal causes payment friction, with B2B on Shopify. Review draft B2B orders before invoicing for negotiated deals from the same back end that powers your DTC store.

4. Receive payment

Once you send the invoice, buyers can make a payment using their preferred method. Buyers can also sign in to their password-protected online portal to download invoices for previous orders, view their payment history, and get automated invoice reminders when their payment is due.

They’ve also got the ability to modify their order pre-shipment and pay using the credit card stored on file, removing as much friction as possible throughout the B2B buying process. Not only does this give buyers the self-serve B2B ecommerce experience they want, but it saves resources too. There’s no need for a B2B customer support rep to handle the request.

5. Reconcile and report

Shopify Balance integrates with your accounting software or ERP so you can automate reconciliation. Ensure your internal records (accounting software or ledger entries) match your bank statements. You should have a corresponding entry in your books for every transaction on your bank statement, and vice versa. Not just payments and receipts, but also bank fees, interest income, and other stuff.

6. Prevent B2B payment fraud

Online payment fraud is an issue for any ecommerce business—B2B brands included. Various studies in recent years show organizations lose between 3% and 5% of their annual revenue to fraud-related concerns, largely because brands ship items to customers with already-agreed delayed payment terms. The retailer receives their inventory and disappears before the payment date arrives.

Brands also fall victim to B2B payment fraud through:

-

Account takeovers. This happens when a company’s profile is compromised and a fraudster uses the business’s saved credit card to make fraudulent purchases. Encourage buyers to use strong passwords and enforce two-factor authentication on their account to prevent this from happening.

-

Credit card fraud. Much like end consumers, businesses are at risk of having their credit card details stolen. Scammers often use stolen credit cards to make fraudulent B2B purchases. Verify a buyer’s payment card and check that the billing address matches the cardholders before processing new B2B orders.

-

Document forging. Invoices, purchase orders, and receipts within paper-based B2B transactions can easily be forged. To alleviate this issue, encourage buyers to switch to electronic payments, where financial data is encrypted and saved with a secure paper trail.

Shopify has built-in fraud protection that verifies payment cards with a next-generation data algorithm. Plus, should B2B customers request a fraud-based chargeback, Shopify Protect covers the total order cost and chargeback fee so you don’t leak extra money through B2B payment scams.

Challenges of B2B payments

With the good comes the bad. If you’re looking to process B2B payments, here are some of the top challenges to know:

-

Manual review. Processing B2B payments involves verifying the accuracy of invoices, matching them with purchase orders, and ensuring that the goods or services were received as agreed. It’s a highly time consuming process that is prone to human error, especially when handling a large volume of transactions.

-

High cost of making payments. When it comes to business-to-business payments, there can be a lot of fees, especially for international transactions or certain payment methods. Bank transfers, international wire fees, and payment processing fees for electronic payments can add up.

-

Exchange rates. Some 90% of businesses operating internationally struggle with exchange rates. Payment value can fluctuate from the time the invoice is issued to when it is paid, affecting the actual cost of goods and services purchased.

B2B payment trends

Automate the B2B payment process

The traditional B2B payment process is time consuming. Taking paper orders, issuing invoices, and cashing checks costs time your business can’t afford to lose. Recent data shows that switching to automated payables cut accounts receivable departments’' operating costs in half and reduces manual processing by 85%.

Streamline the B2B payment process by automating as much as possible. That means:

-

Setting price lists for B2B customers. Offer bulk discounts to B2B customers with wholesale price lists. When they sign in to their online portal to reorder, their already-agreed discount is automatically deducted from their invoice.

-

Charging credit cards on file. Encourage B2B customers to store their credit card information in a secure online portal, especially for recurring payments. When payment is due, you’ll automatically charge their card on file—no payment reminders required.

-

Automating invoice reminders. If B2B buyers are hesitant to move toward online payments, create a workflow that sends automated invoice reminders as the due date approaches.

Laird Superfood took this approach when moving its wholesale channel online. The retailer used Shopify to build a password-protected online portal. Now, instead of forcing customers to contact a support rep to pay for B2B orders, they could sign in to their online account and pay when it was most convenient.

Laird’s CEP, Paul Hodge, says, “It’s fair to say that having the wholesale portal will save us the equivalent of one employee a year. That’s $50,000 to $60,000 a year, and covers the cost of Shopify several times over.”

Whole portals

Business customers are looking to get the DTC treatment. They want the option to log in to their online portal and view assigned payment terms, tax exemptions, and purchase history, plus make payments without having to talk to a representative.

“At S’wheat, we use Shopify to create custom orders, as it allows us to invoice the customer with a direct link to Shopify checkout,” says Sophie Gibson, PR and communications at S’wheat. “It also allows our international customers to pay via card payments, which is quicker and easier than international BACS payments.”

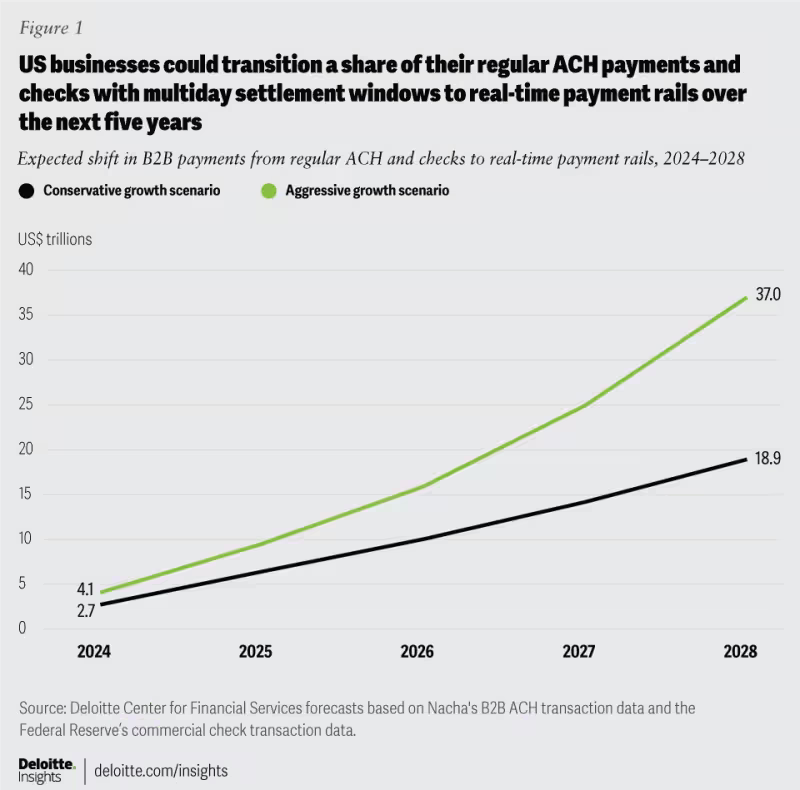

Real-time payments and credit decisioning

Some 83% of B2B buyers consider a smooth payment and checkout experience a top priority. That’s why Deloitte reports that the biggest innovation in B2B payments is real-time payments (RTPs). The firm predicts that real-time payments could replace more than $18.9 trillion in ACH and check-based B2B payments in the US by 2028.

Image source: Deloitte.

Real-time payments are instant payments that are processed immediately. Unlike traditional payment systems, which can take days to transfer funds, and only Monday through Friday RTPs transfer funds in seconds, 24/7. Two RTP networks you can use in the US are The Clearing House and FedNow Service.

Take the stress out of complex B2B payments

Regardless of the sales channels you’re using to connect with B2B customers, one thing’s for certain: you need to offer B2B payment functionality that business customers are already accustomed to using.

That said, you don’t need to let inefficient payment cycles cause operational headaches within your business. Use Shopify’s B2B ecommerce platform to accept credit card payments from B2B customers, automatically assign wholesale price lists to retail customers, and set flexible payment terms for your business buyers, so you have more time to do what you do best: scale.

Read more

- B2B Ecommerce: Everything You Need to Know to Get Started

- B2B Ecommerce: Why Taking Your B2B Business Online is a Smart Strategy to Scale

- 12 B2B Ecommerce Trends To Shape Your Business in 2023

- What Is Wholesale B2B and How To Sell To Customers in 2023

- B2B Marketplaces: What They Are, How to Succeed, and 8 Marketplaces to Consider

- Find the perfect domain name

- Website Builder 2024: Create a Website in Minutes

B2B payments FAQ

What are B2B transactions?

B2B transactions happen when a business purchases something from another business. Part of the transaction includes exchanging money for goods or services—also referred to as a B2B payment.

What payment method is most commonly used by B2B?

Paper check is the most popular payment method used in B2B. Data shows 40% of all business transactions are made via check.

Does Stripe do B2B payments?

Stripe facilitates B2B payments through its payment processing platform. Extra features that come with its B2B offering include invoicing, automated sales taxes, and custom due dates.

Which is the best B2B payment platform?

Shopify Payments is one of the best B2B payment solutions for both B2B and B2C orders. Accept more than 130 currencies, use built-in risk analysis, and allow customers to pay with a variety of payment methods—including Apple Pay, PayPal, and credit card—through your ecommerce back end.

Additional research by Michael Keenan