Fundraising to start a business can be a scary prospect for retail entrepreneurs—many founders don't know how to connect with potential investors for startup funding or how to close their first fundraising deal.

There are different types of fundraising strategies, including creating a crowdfunding campaign or approaching angel investors or venture capitalists. Here, we’ll focus specifically on tips for connecting with and building relationships with venture capitalists.

Venture capitalists (VCs) are startup funding investors who put money into a business in exchange for equity in that business. Their goal is to get a return on their investment when the business goes public or gets acquired by another company. Venture capitalists only invest in companies that have the potential to prove good returns on their investment.

Pros

- Venture capitalists not only provide funding, but also can offer expertise and mentorship to help develop a business.

- Venture capital funding gives a business immediate credibility and opens other doors to a wide network of potential future investors and partners.

Cons

- Since the venture capitalist owns a part of the company, the owner is forced to give up a portion part of their business. A VC, depending on the amount of equity granted, may have the right to make or weigh in on big decisions about the retail business.

- AVC’s priority is to do what is best for their bottom line. Sometimes that means the goals of a VC firm and of the company it is investing in become misaligned over time.

While startup funding has typically been doled out primarily to tech companies in the past, more retailers are tapping this resource. One example is jewelry brand Mejuri, which boasts two showrooms and an impressive online following. This innovative brand has raised around $5 million over three investment rounds to expand its operations—and this is just one of many upstart brands taking advantage of startup funding.

Launch Pop is a lab that helps high-potential founders launch retail brands within six months and create a strategy to reach their fundraising goals. We turned to Launch Pop’s co-founders, Eva Chan and Jane Lee, for 15 tips on successfully raising startup funding for your retail business.

Things to do before you start fundraising

Start early

If you don’t have a track record as an entrepreneur, it doesn’t mean you can’t start connecting with investors during the early stages of building your business. However, it’s a good idea to wait until you have a tangible product and some traction that shows customers are interested in your concept. Update your LinkedIn readily with new press releases or blogs—VCs actively use LinkedIn.

Also try to offer some added value when you ask a venture capitalist to meet: Can you introduce them to a great deal? Can you invite them to a dinner or a social event with founders?

Create your pitch deck

A pitch deck, or funding deck, is a presentation to show to VCs once you're ready to go after funding. Grab their attention by making your pitch deck short, sweet, and to the point.

A pitch deck can include the following information:

- The problem you’re looking to solve or the gap in the market you want to fill, accompanied by relevant information or experience. For example, Rebecca Allen started a line of nude pumps because she couldn't find a pair that matched her skin tone.

- How your product or services solves that problem or fills that gap.

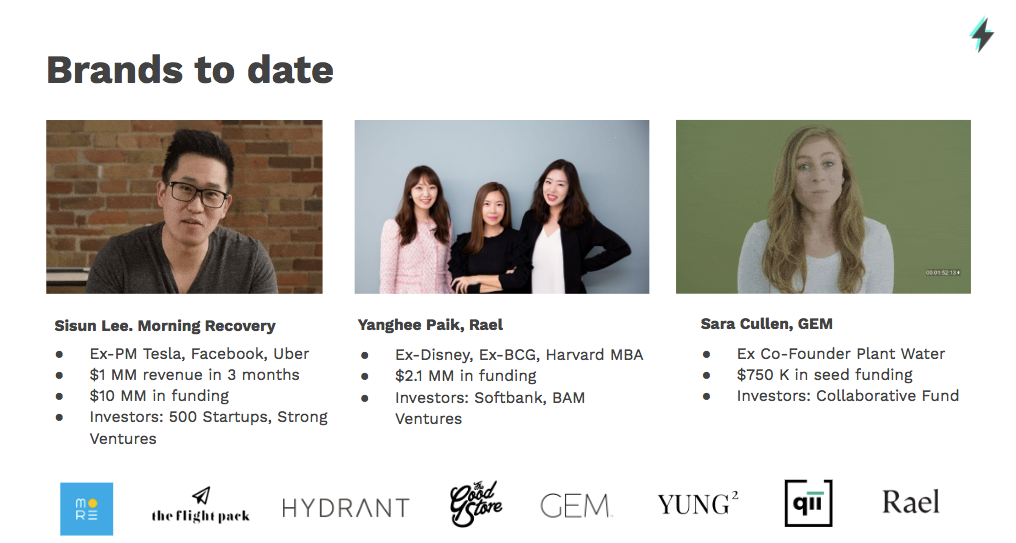

- Your traction so far. Share up to three strong case studies or numbers on engagement, retention, and testimonials. Many VCs are looking to fund startups, so don’t stress if your numbers still aren’t where you want them.

- Brief bios of team members who strengthen your product offering.

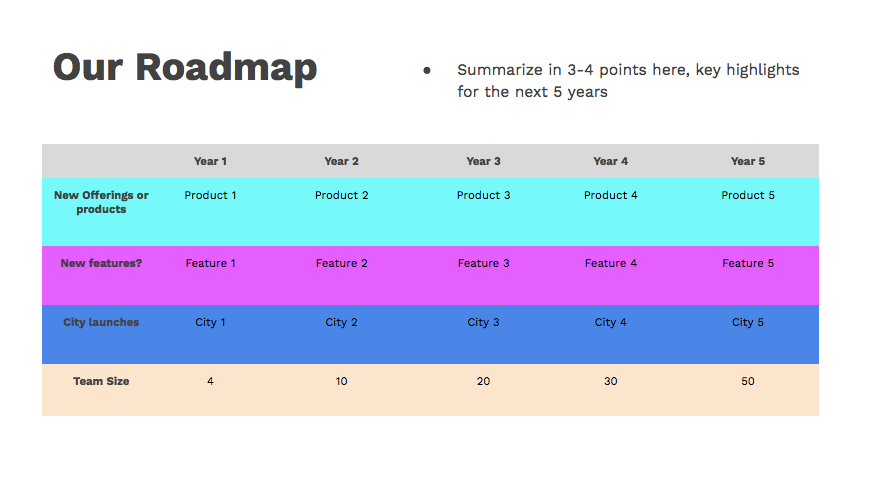

- A breakdown of your five-year plan. This can be a simple table, with columns for five years and rows showing different areas of your business, such as team count, new product offerings, city launches, customer growth, and annual revenue targets.

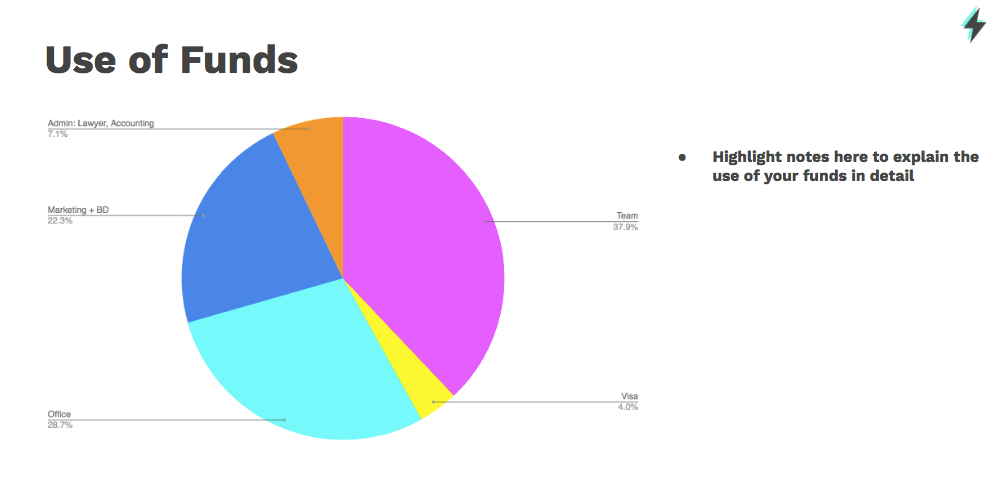

- The amount of money you want to raise, and a breakdown of how you plan to use the funds.

- Your founder’s contact email, phone number, and LinkedIn profile.

Don’t put your financials in your deck. Protect your numbers: If the deck is compelling enough, financials can come later during due diligence.

Draft your non-disclosure agreement

A non-disclosure agreement (NDA) is a legal contract that ensures your material, knowledge, and information stay between you and your potential VC. Upon signing an NDA, the VC is agreeing to keep your sensitive data confidential.

“More and more investors are hesitant to sign NDAs, because they see and deal with so many companies that may be similar to each other,” says Chan.

Venture firms look at many pitch decks and businesses. The chance that an entrepreneur’s idea isn’t completely original is common. If a VC signs an NDA and later invests in a company that is considered competition, they run the risk of getting sued or in trouble. In some cases, an NDA can limit the VC from accepting pitches from companies in the same market.

One way to work around this and make sure you’re still protecting yourself and your retail business is to share just enough to give a potential investor the information necessary to consider you. Avoid sharing trade secrets, proprietary technology, or deep details about your company’s playbook.

Know your story

VCs invest in people—they want to know you’re passionate, determined, and won’t give up.

Make sure you have a compelling founder story that shows you're ready to put in the hard work and demonstrates your commitment.

Create a list of potential venture capitalists

When formulating a list of target VCs, do your research and find investors who demonstrate an interest in your industry and align with your company profile.

LinkedIn and AngelList are great places to start prospecting. If you know a specific firm you'd like to target, you can search its business page and see who its partners are.

How to connect with potential investors

Use LinkedIn

VCs actively use LinkedIn and are very responsive to messages, especially if you have a robust profile. After you've identified VCs interested in your category, try to connect by sending a personalized message with your invitation.

Create a quick intro

Once you’ve connected on LinkedIn, send a more detailed message within 24 hours, capturing the VC’s attention. Something like: “I would love to tell you more about my company, [Your Company Name], which was recently featured in Forbes [insert link]. I’ve grown our sales revenue from 0K to 150K in 10 months and am ready to scale.”

Be straightforward and share data that your contacts can skim. End your message by saying something like, “If you’re interested in learning more, I’d be happy to send you an email with additional information. What's the best way to reach you?”

When you send a follow-up email, keep the subject line direct, for example, “[Your Company Name] — Raising $.”

You can attach your pitch deck to the email and lead with a quick intro reiterating who you are and what your business is all about. It’s also a good idea to write something like, “Thanks for connecting with me on LinkedIn and providing me with your email address” as a reminder of your initial conversation.

In the body of an email, you can highlight:

- Your founders (with links to their LinkedIn profiles)

- Your company bio or elevator pitch

- One good, recent mention of your business in the press

- Your business model: What type of product will you sell, how will you sell it, and how will you make money?

- Your track record: What have you accomplished over the past year?

- Your vision: Based on your track record, how do you want to grow? Mention short-term and long-term goals—and don’t be afraid to think big. Investors like when founders think about de-risking the company through offering multiple revenue streams that will ultimately grow the business.

Start with warm contacts

Who are you connected to on LinkedIn or through other networks? Who is a second or third-degree connection you can ask to introduce you to a VC you’d like to get in touch with? Referrals are always better than a cold email to a complete stranger.

Approach cold contacts

Cold contacts are investors you have never spoken to and have no common connections with. Message them with a compelling introduction. If you don’t get their attention on LinkedIn, try emailing or calling them directly and ask to be connected. Investment funds are always looking for great companies to invest in, so the response rate can be high if your introduction is solid.

Follow up and follow through

Don’t be afraid to be persistent. If you don’t get a response after you’ve sent your first email, send another one. Use the same email thread, but change the subject line to include the words “Follow Up.” If they don’t respond, try again with a different angle.

Once you’ve made a connection, Chan and Lee recommend finding a way to meet with VCs in person to work on building relationships.

We hosted a private dinner with VCs that cost around $3,000 at a hotel. The experience was memorable, and it helped VCs understand that we’re serious founders who want to make things happen,” says Chan.

You could focus a dinner around a particular topic or theme (ecommerce, for example) and invite other founders you know to contribute and help offset the cost. You can break the ice with a few prompts by asking founders and VCs to introduce themselves and share one or two things about what they’re currently working on and a few less serious details.

“An interesting fact is asking people what their first job was growing up and the first music album they bought,” says Chan.

Closing your startup funding round

Investors experience FOMO

Investors never want to miss out on a hot opportunity. Once you have one VC onboard, others will start wanting a piece of the pie.

Provide VCs with a timeline—“I have goals to fundraise by X date for X reason”—and explain the strategic reasoning for those goals.

Setting a timeline can also help you be more disciplined: Fundraising is a full-time job. For example, if you give yourself a maximum of two months to raise a round of funding, you can work backward to create a game plan for building relationships and finding strategic partners.

Set a goal to meet a certain number of VCs in your category. You might make connections along the way that don’t convert to investor relationships, but networking is key: People talk, and you never know when your name will come up in conversation and with whom.

Don’t drop names

Keep all of your offers confidential. Not sharing the names of current investors with potential investors is a tactic that will create urgency and curiosity.

Instead of dropping names, share the amount investors have committed to date. This can help you ask the right questions when speaking to additional VCs. It can also help you lean into conversations you’re afraid of, like how much money you’re hoping to raise in total and the amount you’ve raised so far. It’s OK to set your raise amount conservatively and receive more interest than expected.

Lean forward

Know what you want and don’t be afraid to ask for it. "We think fundraising is the most significant exercise to test our self-worth," says Chan.

Get it In writing—fast

It’s all talk until it’s written down in a legal document and the money is in the bank. Keep this in mind and sign term sheets—the legal documents that make an investment official—fast.

Term sheets establish what type of and how many shares are given to an investor and how much each share costs. They also outline all the fine details that protect both parties. For example: Does the VC have a board seat? Do they have the right to ask for information on how things are going from a growth perspective and what some of your bottlenecks are?

“The whole premise is to have an exchange of information so help and support can be provided sooner rather than later,” says Chan.

Investors might ask you additional questions for due diligence. This means they want to ensure you’re operating and have built a sturdy structure.

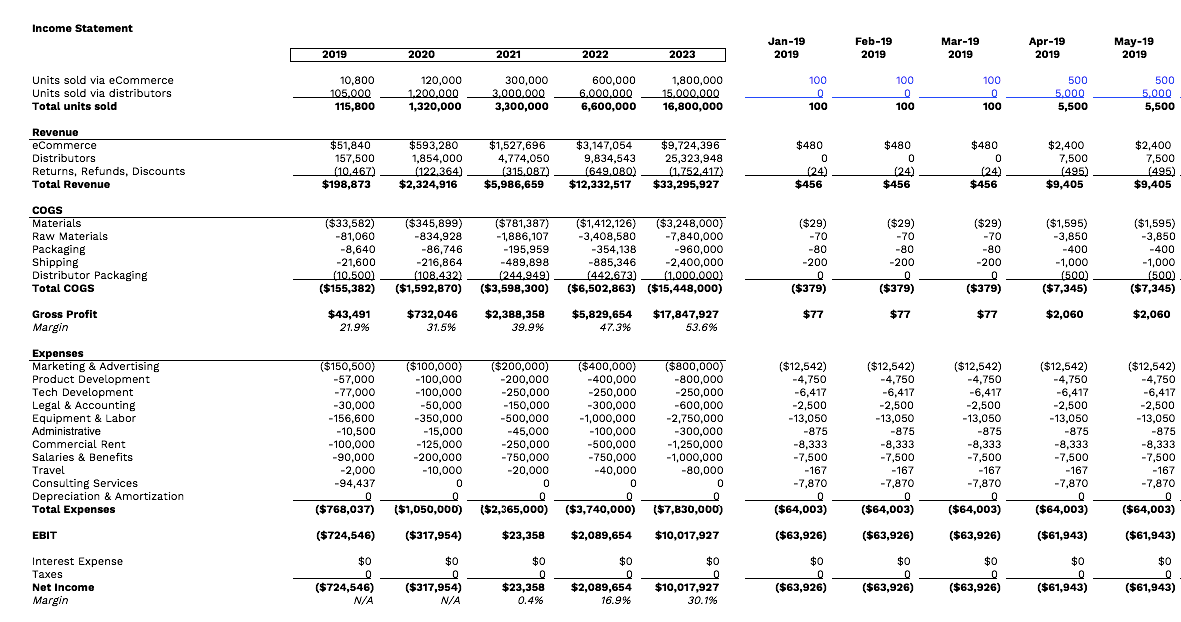

Have your monthly and annual financial statements ready, make sure you’re incorporated, and, if you have a co-founder, make sure your founder agreements are done. VCs will ask for your financials and projections, so be prepared to show investors your revenue projections for the next three to five years, as well as your forecasted operating expenses and a breakdown of your anticipated annual net profit based on these numbers.

It’s important to illustrate growth over time, and you need to be able to explain the assumptions made for future years. VCs will want to know how you arrived at your numbers.

Tackle startup funding in rounds

Fundraising can be a full-time job, and it affects your day-to-day operations. You may need to do multiple rounds of fundraising, depending on your needs.

“Urgency comes when the company is about to run out of money or the company reaches another stage of growth that requires more money in order to support the growth,” says Chan.

As your retail business grows, you may need more money to buy inventory, apply the best marketing tools to develop marketing campaigns, or open more stores in new cities. Whatever your needs are at the time, do your best to keep the process short and impactful.

Wrapping up: Moving forward with startup funding for your retail business

Now that you have a better handle on the process, you can move forward with seeking startup funding for your own retail enterprise. Just remember: Networking and creating human connections can help you through this process.

Have you successfully raised funding for your retail business? Tell us about it in the comments below.

Read more

- Weekend Sales Events: How to Get Organized for Markets, Fairs, and Festivals

- Making the Leap to Retail: Why These Online Brands are Investing in In-Person Sales

- Small Storefront, Big Impact: Distinguish Your Brand with a Pop-Up Store at Expos

- Deals on Wheels: Why More Retailers Are Taking to the Streets

- Retailers, Here's Why Having a Brick-and-Mortar Store is a Competitive Advantage

- 3 Questions Every Merchant Needs to Ask Themselves When Planning a Pop-Up

Retail startup funding FAQ

How do retail stores get funding?

Which funding is best for startups?

What are examples of start up funding?

- Seed Funding: Seed funding is the initial capital used to start a business, usually provided by founders, family and friends, angel investors, or venture capitalists.

- Venture Capital: Venture capital is a type of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth.

- Angel Investors: Angel investors are wealthy individuals who provide capital for a business start-up in exchange for convertible debt or ownership equity.

- Crowdfunding: Crowdfunding is the practice of funding a project or venture by raising small amounts of money from a large number of people, typically via the Internet.

- Bank Loans: Bank loans are a type of debt financing in which a bank lends money to a business in exchange for repayment, typically with interest, at a later date.

- Government Grants: Government grants are funds provided by a government agency to businesses or organizations. These grants are typically awarded to organizations that demonstrate a need and a potential to benefit the public in some way.