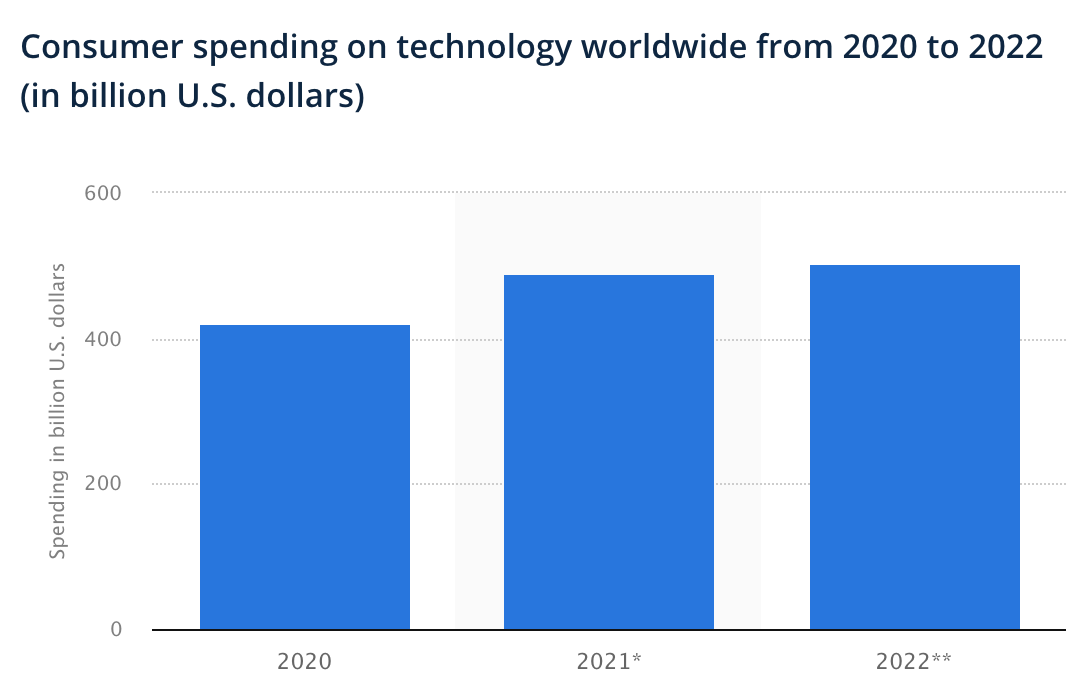

Spending on consumer electronics is soaring––it’s up by 20% since 2020. Looking ahead to 2023, this growth is unlikely to slow down. Many consumers view gadgets as a necessity and are keen to tap into new technology when it becomes available.

But as demand increases, so does competition. To stay ahead of the curve, brands must tap into consumer preferences and innovate new features. Before Q1 kicks off, check out the state of the market in 2022 and the consumer electronics trends likely to shape 2023.

Consumer electronics ecommerce market in 2022

Consumer electronics covers a broad range of devices and appliances designed for personal use. Consumer electronics products are often specifically made for:

-

Entertainment

-

Communication

-

Information

The future of consumer electronics is becoming increasingly close to IT as a result of the internet of things (IoT), which is bringing more connected devices to the market. Today’s electronic devices are increasingly more accessible, more widely available, cheaper, and diverse in features.

Included within the consumer electronics market are:

-

Desktops

-

Laptops

-

Home appliances

-

Smartphones

-

Smart TV sets

-

Games consoles

-

Wearables

-

AR (augmented reality) and VR (virtual reality)

By the end of 2022, consumers worldwide are forecasted to spend $505 billion on technology––close to a 20% increase since 2020.

One of the largest markets for consumer electronics is in the United States, with annual consumer spending of several hundred billion dollars.

In 2021, smartphone sales, the largest consumer electronics sector, recorded a revenue of $481 billion. This is expected to increase to over $500 billion by 2026.

Sales of tablet devices, on the other hand, are decreasing. They hit 168 million in 2021––a steep reduction from the peak of 230 million in 2014.

As consumers seek out new experiences, sales of other consumer tech devices like AR/VR headsets and gaming consoles are also rising.

Wearable devices are a popular newcomer to the consumer tech market. Including smart watches, wearables, and fitness trackers, they’ve been well received by consumers. By the end of 2022, the wearables market is forecasted to ship around 490 million units by 2023––an increase of 80% since 2020.

In today’s consumer electronics market, the leading tech titans are Apple and Samsung. The iPhone, Apple’s signature device, is the business’s most profitable product, and made up 47% of Apple’s total revenue in the fourth quarter of the company’s fiscal year 2022.

When it comes to smartphone vendor share, Apple is the second largest smartphone vendor in the world, following Samsung. Thanks to the release of the Apple Watch, it’s also leading the wearable market.

Worldwide, Samsung Electronics is the biggest consumer electronics manufacturer and leads both the television and smartphone markets.

So where does this leave consumer electronics in 2023?

Some of the biggest consumer technology trends to look out for in 2023 include:

-

Use of domestics robots

-

Increase of home smart goods

-

Higher demand for sustainable tech

-

Rise in popularity of beauty devices

-

Increasing interest in AR/VR-enabled devices

Consumer electronics trends to watch in 2023 (and how to make them work for your business)

See how these tech trends are shaping 2023 and how you can tap into them.

1. Increased smart home adoption

Smart home integration is becoming increasingly popular––the market is expected to reach $205 billion by 2026.

Smart devices are items used in everyday life that are made intelligent through computing techniques like machine learning, which are then networked to form the internet of things.

They’re usually connected through laptops, smartphones, and tablets, making it easier for users to integrate all their devices.

Smart home technology lets users integrate different functions including:

-

Music playing

-

Temperature controls

-

Light controls

-

Security

According to MediaPost, 15% of global households are predicted to have a smart home device installed by 2023. Plus, 69% of households in the US already have at least one smart device. The increase in purchasing of smart devices is driving the growth of the smart homes market.

It’s estimated the global smart homes market will have grown from $76.95 billion in 2021 to $91.79 billion by the end of 2022, at a compound annual growth rate (CAGR) of around 19%.

What’s driving this growth? Better cross-device integrations. Previously, limited integrations prevented consumers from having a truly streamlined smart home setup. But now, brands and different device types connect more easily.

For example, Matter, a smart home OS created by Apple, Amazon, and Google, aims to link smart devices from all brands to help consumers build a smart ecosystem with all their devices. Using this tech, smart home devices should be better connected and integrated than before.

2. More people to experiment with VR/AR and the internet of senses

Virtual reality is already encouraging people to experiment with gamified workouts and other interactions like virtual clothing and makeup try-ons. Traditionally, these experiences have been focused on seeing and hearing.

But looking ahead to the future, AR/VR providers will begin to engage people through other senses, like touch, taste, and smell. These experiences will become increasingly real and interactive.

For example, Crazy Kung Fu, an AR game on the Oculus App Lab, lets Quest players fight a wooden training dummy using Kung Fu moves.

The physical AR experience has players using their full upper body to block and avoid spinning wooden arms.

Another videogame, Phasmophobia, revolves around players hunting ghosts with the frightening addition that users can feel themselves being touched by spirits if they wear a haptic suit.

The growth of the metaverse will also encourage more people to test out augmented reality next year.

3. Rise of robots at home

Domestic help in the form of at-home robots has been steadily growing over the past few years. In 2023 and beyond, they’re set to continue rising in popularity. According to the International Federation of Robotic report, unit sales of service robots for domestic tasks are expected to reach 48.6 million units by 2023.

The rise in automation of household appliances and the increase in labor costs in developed nations are some of the biggest influencing factors. A cleaning robot costs around $25,000 and is a one-time investment––much less than the $27,000 average annual cost of a domestic employee.

Cost efficiency and reliable cleaning are fueling the growth of at-home robots. Plus, with the growing smart home ecosystem, robotics are predicted to play an important role.

New features like voice recognition and human behavior sensors are boosting customer confidence and fueling robot use for household chores like laundry and cleaning. Robotic vacuum cleaners and floor cleaners remain the most popular domestic robots.

Looking ahead to 2023 and beyond, brands are developing smaller and more advanced robots to clean narrow corners at home. Businesses are setting up advanced features like laser-based functionality to map out the floor layout.

One example is iRobot’s Roomba i7+, which can map out the floor and recognize voice commands.

Dubbed an “Alexa on wheels,” with Astra, Amazon is launching what’s thought to be the first general-purpose home robot. The home assistant comes to find users when they have calls or alerts, provides entertainment, and even has a personality.

Other robotics companies are developing devices powered by artificial intelligence and controllable from a mobile app.

4. Increase in popularity of health and beauty electronic devices

Another growing consumer electronics segment to watch in 2023 is health and beauty devices. As a result of beauty salon shutdowns during the pandemic, consumers turned to at-home beauty treatments, which fueled the growth of beauty devices.

The global beauty devices market was valued at $120 billion in 2021 in terms of revenue, showing a CAGR of 5.8% during the forecast period (2022 to 2030).

Currently, the hair removal device category holds the majority of the global beauty devices market, accounting for a 20% share, in terms of value, followed by cleansing and acne device segments.

Consumers are showing increasing preferences for at-home beauty devices that are portable and easy to use. As new pandemic-inspired at-home beauty routines remain, these beauty devices continue to experience increased demand.

Shopify merchant CurrentBody is one example of a beauty device brand that offers consumers an extensive catalog of home beauty devices, as well as expert advice. As the only niche beauty brand focused exclusively on electronic beauty devices, they offer consumers a varied product line including devices for neck wrinkles, back hair, and acne.

Brands that want to tap into this growing market should aim to address all consumer concerns surrounding the side effects of the devices. For instance, consumers often express concerns about excessive swelling, blistering, and burns.

To educate potential shoppers about the use of the brand’s beauty devices, it created a content hub, CurrentBody Editorial. Using video, blog content, customer reviews, and interactive multimedia, it offers step-by-step use instructions, demonstrations, and opportunities to ask questions of the device manufacturer.

Consumers search for sustainable tech

As consumers become increasingly aware of the environmental impact of their tech purchases, they’re demanding brands manufacture and ship devices in a more sustainable way.

For years customers have shown their willingness to buy from purpose-driven brands. In the past six years, there’s been a 71% increase in online searches globally for “sustainable goods,” especially in high-income countries like the United Kingdom, the United States, and Canada.

Our survey found that 44% of customers chose to buy from brands that have a clear commitment to sustainability, while 41% chose to buy from brands that have a clear commitment to social causes. Overall, the consumers we surveyed want brands to have “actions that match their values.”

As a result, 53% of companies made improved sustainability one of their top priorities for 2022––this trend is likely to develop further into 2023 and beyond.

Merchants are also considering the social impacts of doing business, like the fair treatment of factory and fulfillment workers. A quarter of merchants surveyed say one of their biggest supply-chain-related concerns is ensuring manufacturing partners employ ethical and fair labor practices.

More than one-third report taking a more holistic approach to sustainability in the year ahead, and distancing themselves from partners that are unwilling to meet their sustainability standards.

How does this drive for sustainability translate into consumer tech?

Gaming hardware brand Razer published a statement highlighting its plans to go green, complete with a plan to switch to renewable energy, become carbon neutral, and use recycled or recyclable materials in all of its products.

Razer also sold a stuffed animal version of its snake logo to raise money for the planting of roughly half a million trees and released a limited-edition apparel line made from reclaimed ocean plastics.

To reduce environmental impact, the brand adopted sustainable product design, manufacturing, and fulfillment.

Brands are also focusing on manufacturing devices with sustainable materials. For instance, HP’s Elite Dragonfly laptop was the first computer to be made with recycled plastic speakers. Instead of generating more waste materials or sending more plastic to the ocean or landfill, brands can stand out from competitors by using recycled materials to manufacture products.

Globally, countries and states are beginning to pass laws to ensure brands recycle packaging.

For instance, in 2020, California passed a bill requiring that all post-consumer plastic recycled content must be made with post-consumer recycled or reprocessed plastic at a rate of at least 50% by 2030.

In the future, the development of blockchain technology will provide consumers with even more avenues to trace the origins of their goods with greater accuracy. Forward-thinking brands are getting ahead of the conversation, with 41% planning to be more transparent about their social impact’s vision, goals, and progress, according to our research.

Looking ahead to 2023 and beyond, consumer electronics retailers will need to comply with more stringent human rights and environmental regulations, including extended producer responsibility measures, which seek to manage and reduce consumer waste.

Shopify Agency Partners with consumer electronics experience

Where are consumer electronics heading in 2023?

The widespread use of consumer electronics had never been greater. Thanks to pandemic-inspired routines and innovative tech advances, the demand for devices is continually growing. From domestic robots to beauty devices, never before have people been so dependent on gadgets as part of their everyday life.

In 2023, figure out your target audience’s demands and tap into the consumer electronics trends that make the most sense for your business. Then see how your audience responds and adjust your strategy accordingly.

Consumer electronics trends FAQ

What are the current trends in electronics?

The leading current trends in consumer electronics include:

-

Smart home integrations

-

Rise in use of AR/VR devices

-

Increase in demand for domestic robots

-

More people using health and beauty electronic devices

-

Consumers purchasing sustainable tech

Is the consumer electronics industry growing?

The consumer electronics industry is growing. At the end of 2022, consumers worldwide are forecasted to spend $505 billion on electronics––close to a 20% increase since 2020.

Who is the market leader in consumer electronics?

The market leaders in consumer electronics are Apple, Microsoft, Sony, and Samsung.