Ecommerce is booming for budding business-to-business (B2B) brands. In 2024, the value of B2B ecommerce sales will reach more than $2.3 trillion in the United States, providing limitless potential for earning market share.

Buyers' habits are changing, too. Reports show that over half of B2B buyers now purchase items daily. It’s no wonder more DTC brands are looking to expand into wholesale.

Seeing this opportunity, it’s important to remain on buyers’ radars and prep your brand for a successful B2B venture. The trends below will help you to stay on top and earn more sales in 2024.

Table of contents

What happened in 2022 and 2023?

The past two years have been shaped by economic uncertainty, as consumers became more mindful of spending. Ecommerce has officially entered slow growth mode, but B2B online sales around the world have not followed the trend.

According to estimates, 17% of B2B sales will be generated digitally by the end of 2023. In contrast, the share in 2019 was 13%. As it stands, some 65% of B2B companies offered ecommerce capabilities in 2022.

The share of B2B organizations' revenue that comes from digital channels has also increased, reaching 45% in 2022, from 32% in 2020. This growth has led 44% of marketers to invest in ecommerce platforms and site features during the year, according to a recent survey.

Global markets have picked up steam in the B2B ecommerce realm, too:

- In 2022, China's online B2B market surpassed CN¥15.5 trillion (US$2.15 billion), a slight increase from ¥15.3 trillion in 2021. B2B ecommerce in China is expected to grow rapidly in the next few years, reaching ¥19.5 trillion ($2.7 billion) in market size.

- Europe also forecasts steady growth over the next few years. By 2025, the B2B ecommerce gross merchandise value (GMV) is estimated to reach more than $1.8 trillion.

- In 2023, the market size in India is expected to reach $18.2 billion by end of year. It’s expected to reach more than $60 billion by 2025. Analysts estimate a $200 billion market for online B2B marketplaces by 2030 in India.

Overall, at least half of B2B companies report doing business through marketplaces or ecommerce websites. McKinsey found that B2B ecommerce has taken the lead of the most effective sales channel, ahead of in-person sales and video conferences.

The numbers don’t lie—ecommerce is a profitable path forward for B2B organizations. And to take advantage, you’ll need to keep up with—and implement—the top trends to attract and retain your buyers. Let’s take a look.

Top B2B ecommerce trends for 2024

- More organizations will use social media

- Order fulfillment and tracking will become higher priority

- Marketplaces will become key sales channels

- Customers will be able to serve themselves

- More brands will adopt headless commerce

- Omnichannel will play a bigger role in buying decisions

- More brands will build mobile apps

- B2B organizations will become more tech-friendly

- Winners will embrace hyper-personalization

- Dynamic pricing will become more common

- Product discovery data will be essential

1. More organizations will use social media

In 2022, as much as 65% of the B2B health and beauty sector invested in digital commerce channels worldwide. Mobile app investments led the way, followed closely by social media channels.

The popularity of virtual product demonstrations is growing in B2B ecommerce. According to a US survey, 7 out of 10 professionals made purchases after seeing a presentation in the metaverse or virtual reality. Twenty-one percent said they missed the chance but were interested in trying it.

Social commerce often is considered more of a B2C marketing and sales strategy, but B2B brands increasingly are getting in on the action, too. Trends indicate that the global social commerce market is set to reach $8.5 trillion by 2030.

B2B brands are discovering that their target audience already searches for products on social media platforms. In fact, Gartner reports that B2B buyers value third-party interactions 1.4 times more than digital supplier interactions.

B2B buyers use social media to make purchase decisions in many different ways:

- To research different solutions and learn about their unique needs and problems in the early stages of the sales cycle

- To compare solutions

- To identify need-to-know information on potential solutions before finally making a purchase

Choosing the right social media platform for your B2B offerings is the key to success. Consider which platforms are most relevant to your audience. Which channel is the most conducive to engaging with your product offering?

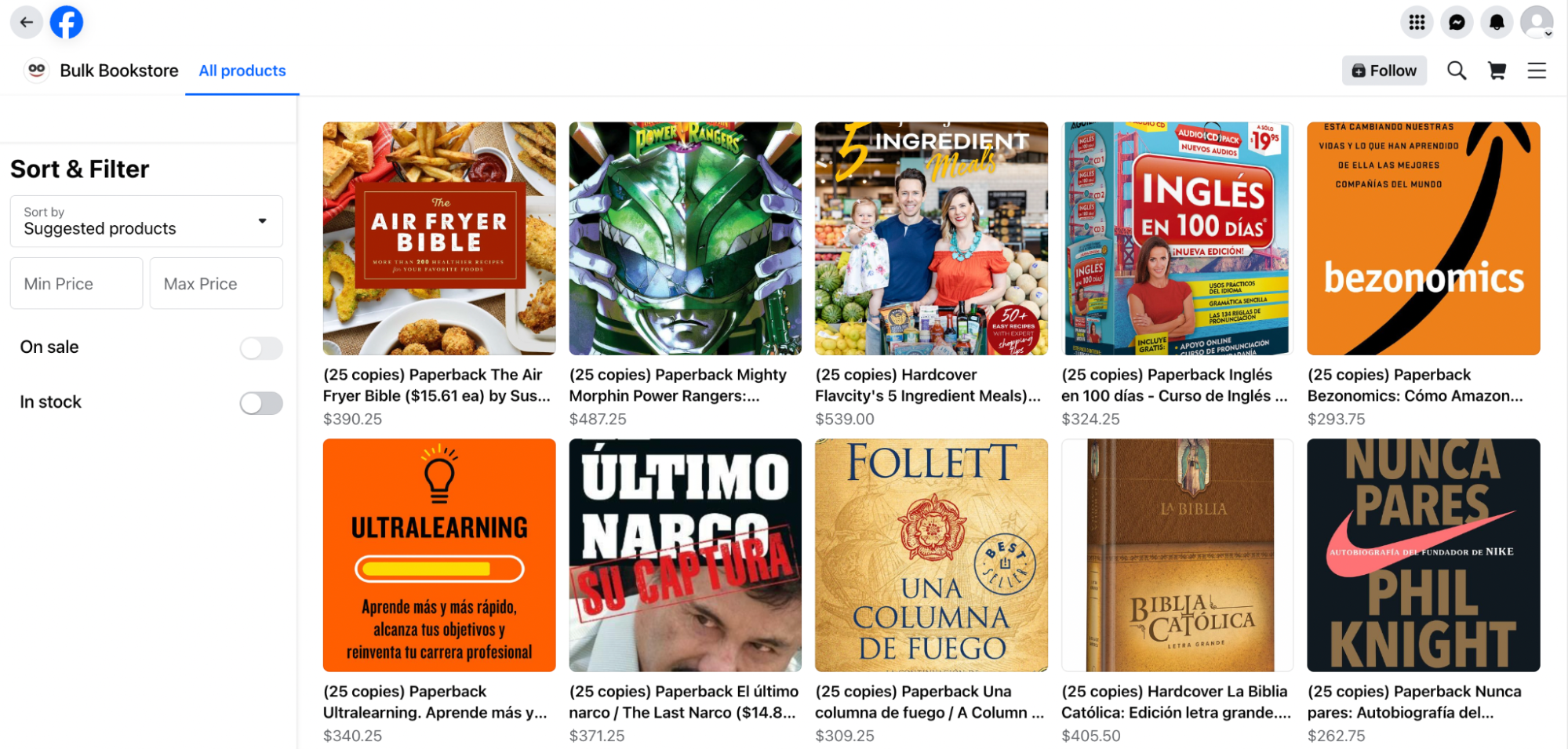

To find out, create a variety of posts—including product demo videos or customer testimonials—and see what resonates best with your target audience. When you’re ready to embrace social commerce tools, add your product catalogs to each platform to make it easier for potential customers to browse your available inventory.

Here’s a great example of a Facebook Shop catalog from wholesale book retailer Bulk Bookstore:

2. Order fulfillment and tracking will become higher priority

A 2023 survey found that, of the main challenges of the B2B customer journey, nearly 66% of B2B buyers report that order fulfillment and tracking have become more challenging.

Despite these challenges, customer expectations around order delivery time are growing higher:

- 41% of global shoppers in this survey expected to receive their online purchase within 24 hours.

- 24% of surveyed buyers reported wanting their order delivered in less than 2 hours.

The data is clear. Customer demands for speed are driving B2B commerce to optimize for faster delivery times to stay competitive. While at first glance the need for speed poses a challenge, B2B brands can use it to their advantage to appeal to more buyers.

For example, third-party logistics (3PL) streamlines the fulfillment process for B2B brands. In addition to lowering fulfillment costs, 3PLs also reduce inventory management costs.

Supply chain and labor disruptions increased through the first half of 2023. To mitigate supply chain delays and shortages, don’t wait until the last minute to order materials or goods you need for peak season––order them now.

Now is also the time to work out any kinks in your inventory management program. Does your software need updating? Do you have enough storage or warehouse space? Are you able to report in real time?

Melanie Nuce, senior vice president of innovation and partnerships at GS1 US—the B2B not-for-profit supply chain standards body—adds to this, explaining that B2B businesses should utilize a range of suppliers.

“To maximize performance, business-to-business brands will need to focus on diversifying suppliers and potentially narrowing the number of products they offer and bringing manufacturing closer to the intended destination,” she says.

3. Marketplaces will become key sales channels

B2B marketplaces are growing, with many more on the way, according to the 2023 B2B Marketplace 500 Report by Digital Commerce. In fact, B2B marketplaces currently account for 12% of all US B2B ecommerce sales.

Much of the B2B marketplace evolution is due to the accelerated changes in buyer preferences. Only five years ago, there were 75 total B2B marketplaces, but experts predict a growth of 750 or more by 2025, based on projections from the same report.

The report reveals that 60% of businesses have adopted B2B marketplaces, with B2B buyers conducting roughly a quarter of their transactions through these platforms.

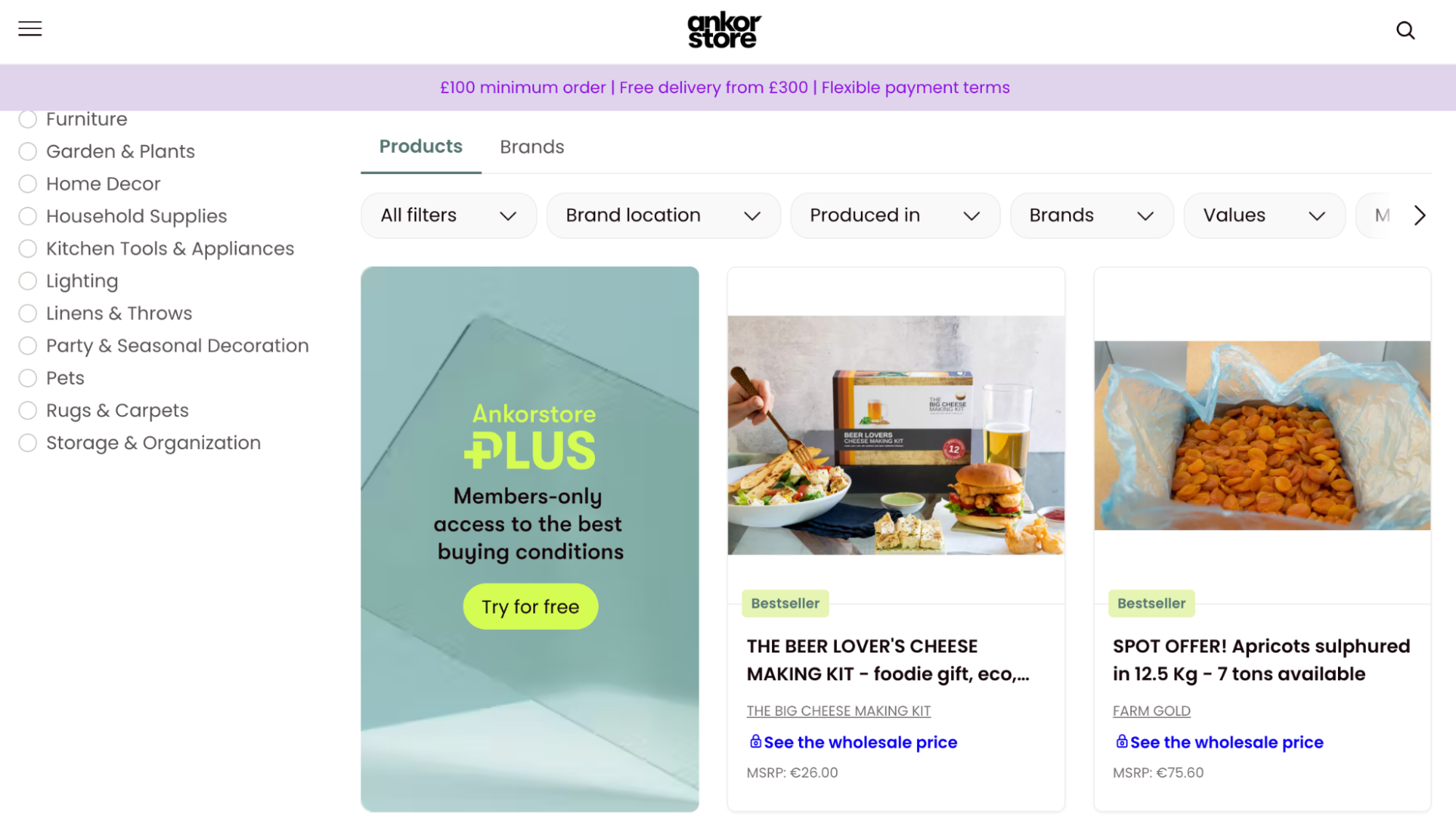

Location also influences this growing B2B landscape. While Germany serves as the European hub for emerging B2B ecommerce firms, it's the French platform Ankorstore that claims the spotlight for highest funding.

Securing $423 million in funding as of May 2022, the Paris-based marketplace—founded in 2019—connects retailers and independent brands across more than 20 countries.

Company-owned or third-party marketplaces are major business hubs. Last year, McKinsey saw an 8% surge in the use of company-owned marketplaces. Noticeably, 40% of the top-performing companies capitalize on third-party marketplaces for sales, a stark contrast to the 27% of underperforming companies doing the same.

There’s a trend here. Half of all companies either already operate their own marketplace or have plans to establish one. Sector-specific marketplaces are another arena where top performers excel.

Globally, 88% of respondents to the McKinsey survey sell through third-party platforms like Amazon, a figure that increases to 97% in India and 93% in the United States. Certain industries—notably consumer and retail at 92%, and technology, media, and telecom at 90%—dominate these third-party spaces.

If your business is a top performer in market share, you're 24% more likely to have your own marketplace, especially if you're operating in emerging markets like Brazil and India.

Western Europe and East Asia present untapped potential for B2B marketplaces, with notably low usage of owned marketplaces. This poses an opportunity for companies to become early adopters and gain a competitive edge. After all, share winners don't just join marketplaces—they strategize.

Plus, early adopter companies will be more inclined—and better positioned—to customize their tactical approach for each platform, whether by offering unique products, running targeted experiments, or setting specific terms and conditions.

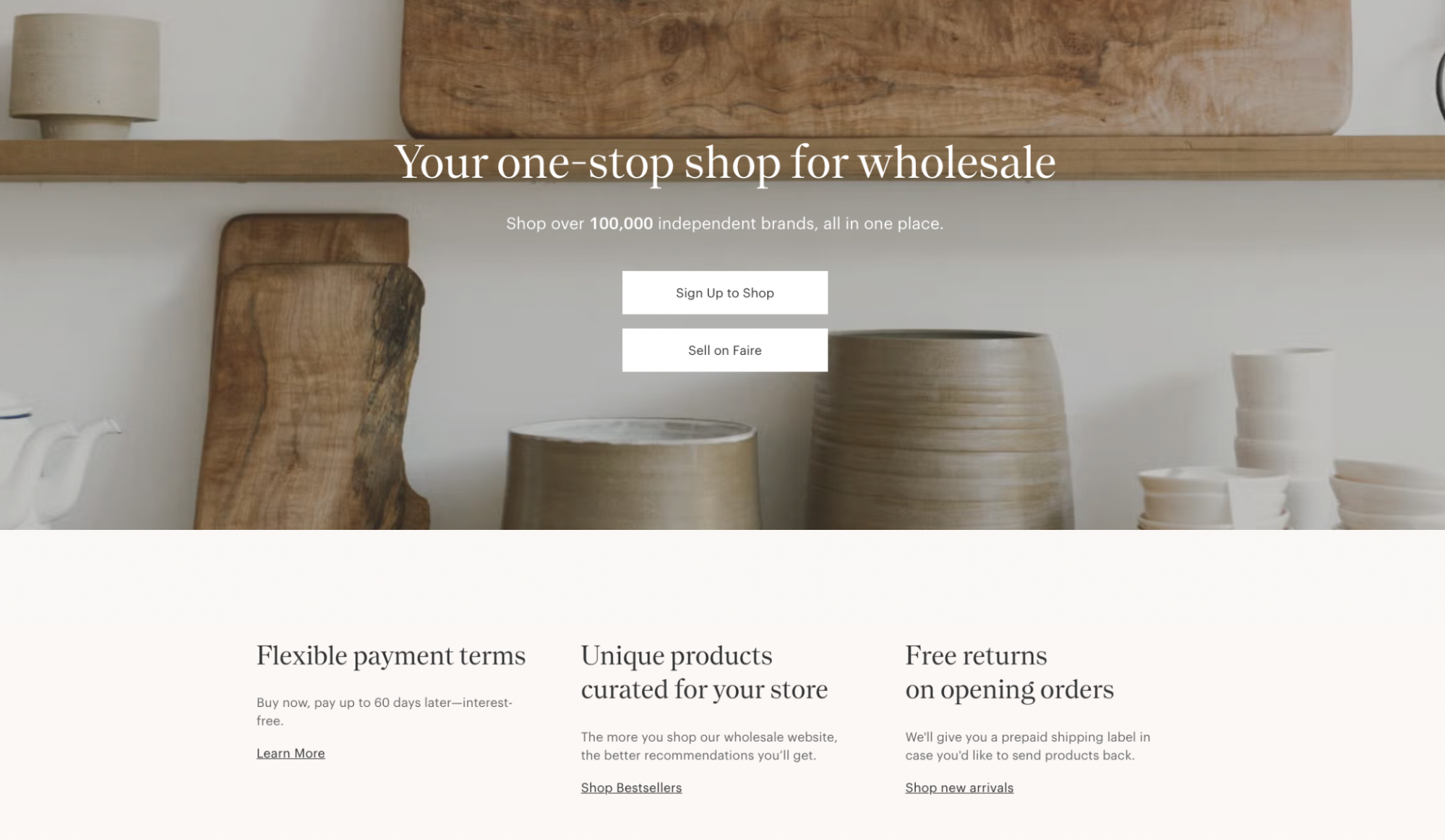

For example, consider the wholesale marketplace Faire. Over the past year, they reported the number of businesses using their platform increased by about 45%. Some of their more notable partnerships include brands like YMI Jeans, Skinny Confidential, and Sugarfina.

Brands like Shopify are following suit by trying to digitize more of the wholesale process. Shopify’s recent rollout of Shop Cash rewards to shift attention back to our Shop app represents another strategic move in light of these trends.

4. Customers will be able to serve themselves

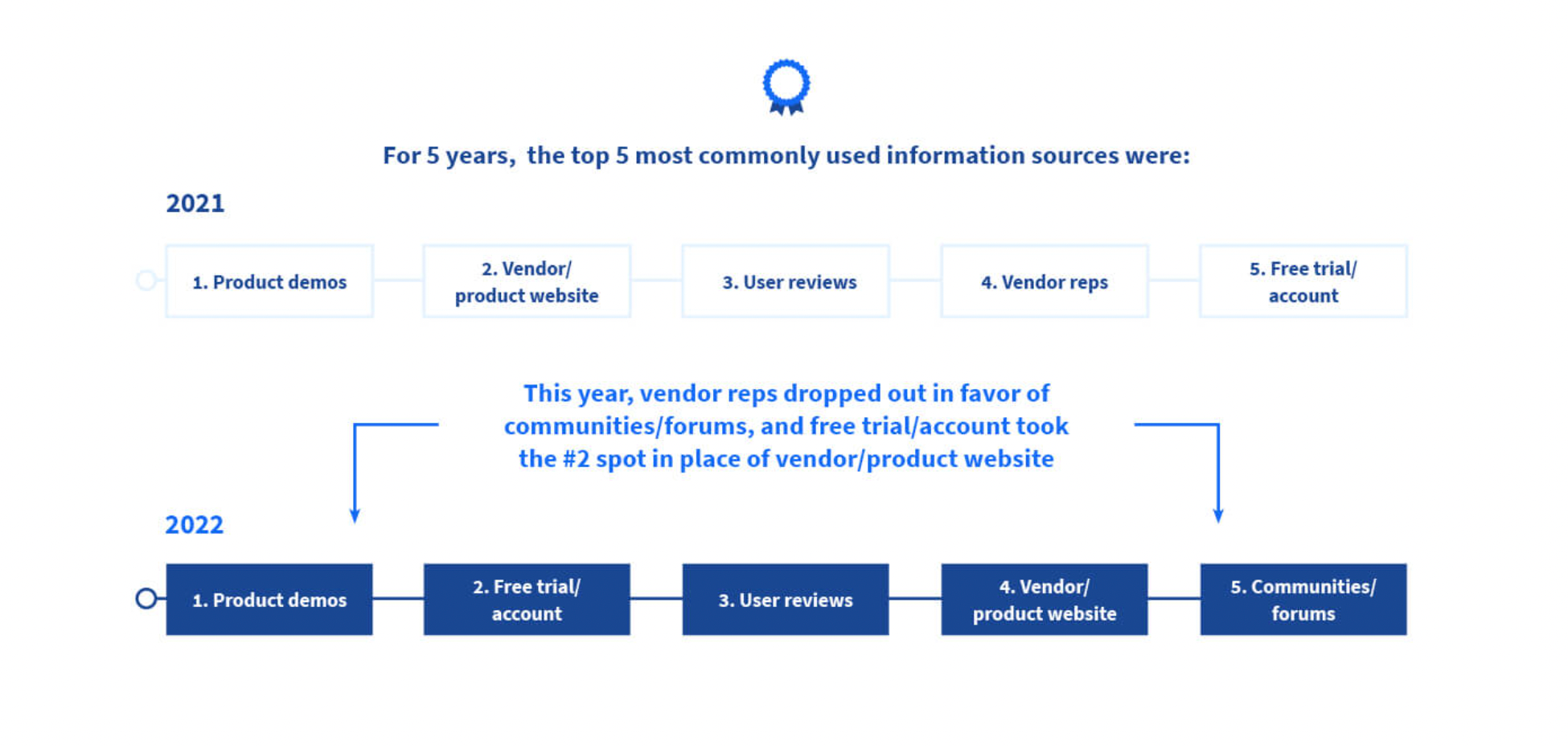

According to TrustRadius’s latest 2023 annual report, self-service portals are table stakes for B2B businesses—as the portals are now a fundamental buyer expectation when making purchasing decisions.

Self-serve has been at the forefront of the customer experience for a while now. Buyers in 2021 wanted to self-serve 87% of their buying journey, while in 2023 nearly all buyers want to self-educate and manage their own buying experience.

Notably, vendor sales reps were the second-most preferred information source for buyers in 2023. In 2022, they didn’t even make the top five.

Self-service commerce, a solution designed to erase obstacles and streamline the buying process, takes many forms:

- Subscriptions

- AI-assisted interactions

- Customer communities

- Help centers

- Customer portals

It’s why global retailers like Walmart continue to release self-serve tools for brands and customers alike. Most recently, the company’s first-ever seller summit highlighted their list of newly released tools that give a glimpse into the future of digital commerce:

-

Brand Shops: These are dedicated digital storefronts that allow brands to design their own curated pages on Walmart's platform. Brands can build “Brand Shelves” to feature specific assortments of products or roll out seasonal collections as a way to enhance product discoverability and improve the customer experience.

- Walmart.com reimagined for item discovery: The website was redesigned to promote item discovery through personalized content, seasonal relevance, and regional merchandising. The goal is to make Walmart the go-to destination for several categories by blending digital and physical retail.

Self-service platforms not only remove the need for manual sales interventions but also improve the accuracy of transactions. This efficiency shortens your sales cycles, broadening the market that your business can target effectively.

5, More brands will adopt headless commerce

A whopping $1.65 billion in funding went into headless technologies in 2020–2021, according to Forbes, with the numbers for 2022 still pending.

The urgency to adopt headless technology is, in large part, a proactive mood. About 74% of organizations surveyed by Commercetools state that not keeping up with modern commerce solutions can negatively impact their business.

Headless architecture is a game-changer, especially for B2B companies. It separates the front-end experience from the back-end infrastructure, helping businesses offer the freedom of customization to their clients.

A compelling 80% of businesses lacking a headless setup today plan to adopt one within the next two years. But it's not just about jumping on the bandwagon—the benefits are undeniable.

Companies with headless setups are 77% more likely to expand into new channels, a rate significantly higher than their non-headless counterparts, at 54%.

However, the perks hardly end there. Headless architecture delivers:

- Full customization: Tailor your digital storefront without back-end hassles.

- Faster load times: Slow websites mean slower sales.

- Reduced IT dependency: Eliminate the need for constant back-end updates.

- Rapid scaling: Adapt and grow without technological constraints.

- Quicker market entry: Time is money, and headless connects you with customers faster.

Companies are already reporting a higher ROI from their headless infrastructure. Among companies with headless architecture, 77% agree that it powers quicker storefront changes—a necessity in just about any industry. On the other hand, around 34% of businesses report it takes weeks or months to update their digital storefronts, a lag that headless architecture eliminates.

Sustainable clothing brand Allbirds uses a headless architecture to allow more functionality and flexibility across their site. By going headless, Allbirds balanced speed and customization, ensuring that each visitor enjoyed a smooth, fast, and personalized journey through the brand's digital assets.

This strategic decision paid off in more ways than one: Allbirds successfully bypassed the headaches and costs that often come with complicated back-end systems. Now, when a customer lands on any Allbirds asset online, they get to enjoy a nearly flawless interface that aligns with the Allbirds brand.

6. Omnichannel will play a bigger role in buying decisions

Some 83% of buyers prefer ordering or paying through digital commerce, and 72% are eager to purchase across channels. With data like this, your business should be all in on omnichannel experiences.

The largest share winners of 2022’s B2B landscape didn't stick to one channel—about 38% of them introduced new channels. On top of that, 37% ramped up experimentation to identify the most effective sales avenues. As an example, the resale marketplace StockX is already experimenting with physical retail by opening its first “shoppable experience” in New York City.

Per McKinsey’s research, the number of sales channels that shoppers use throughout the buying journey has doubled, from five in 2016 to 10 in 2022—and the landscape will only continue to evolve. Today’s 2023 buyers are increasingly leaning into digital technologies earlier in the sales process.

Buyers today are actively evaluating suppliers through modern digital technologies, including mobile apps, social media, and even texting. But in the midst of these changes, businesses often underperform in digital channels, thanks to gaps in execution and talent.

It’s why businesses must address weaknesses head-on with initiations like acquiring in-house channel expertise. Staying competitive requires that businesses constantly revisit and reevaluate their performance across all channels.

An omnichannel world demands excelling in multiple channels, including in-person, hybrid, inside sales, digital self-serve, and marketplaces—especially during uncertain economic times in which a poor customer experience may lead to a lost sale.

The takeaway here is twofold. Businesses need to embrace being omnipresent by existing—and excelling—in as many marketing channels as possible.

7. More brands will build mobile apps

In lieu of replicating the B2C experience, 2024 will result in more B2B ecommerce apps entering the mobile app market.

In 2022, mobile retail ecommerce spending in the United States surpassed $387 billion. The latest survey shows that more than 70% of B2B health and beauty businesses invested in mobile apps in the same year.

Mobile shopping apps are no longer a novelty—especially for fashion brands and retailers. The pandemic era has only helped to accelerate this trend. In just the past year, according to Glossy, brands like Muji, Grailed, and Kenny Flowers, along with retail platforms like NewStore, have shifted their focus to app development.

These apps aren’t just digital storefronts—they’re also vital tools for communicating real-time inventory and gathering customer feedback, which is particularly crucial when companies around the world are still dealing with supply chain disruptions.

Mobile apps position B2B businesses to sell their products or services uniquely, with the use of tools like:

- Push notifications

- In-app ads

- SMS notifications

- Integrations with social channels

As a result, B2B businesses can reach out to audiences they may not have previously accessed. Stephan Schambach, CEO of NewStore, reports a surge in brand adoption of mobile apps. In 2023, over 30 brands like Rebecca Taylor and Golden Goose began using NewStore's newly launched app platform.

As a result, these brands tripled their site engagement rates and quadrupled customer lifetime value, on average. Embracing mobile app platforms is helping brands tackle inventory challenges, enhance in-store experiences, and fortify customer loyalty.

Much like B2C businesses, there’s untapped mobile app potential for B2B businesses to gain visibility into customer behavior, order history, upselling, and real-time engagement.

8. B2B organizations will become more tech-friendly

Even when the economy stumbles, market leaders can’t waver when deploying competitive tech. In fact, winning market leaders are 55% more likely to plan the integration of sophisticated sales technology, from tools that suggest the next best steps to features that keep existing customers from leaving.

On top of that, automation represents an undeniable competitive advantage commonly associated with B2C that’s proving vital in B2B sectors as well. The numbers don't lie: 64% of market leaders use chatbots, compared to a mere 42% among those trailing in market share.

Market leaders see the adoption of technology as a must-have because it propels them toward growth and prepares them to weather economic ups and downs.

9. Winners will embrace hyper-personalization

Top-performing B2B companies are proactively mastering the art of hyper-personalization. Unlike generic account-based marketing, hyper-personalization tailors unique messages to individual decision-makers based on a variety of factors, like past interactions with your brand and predictive analytics.

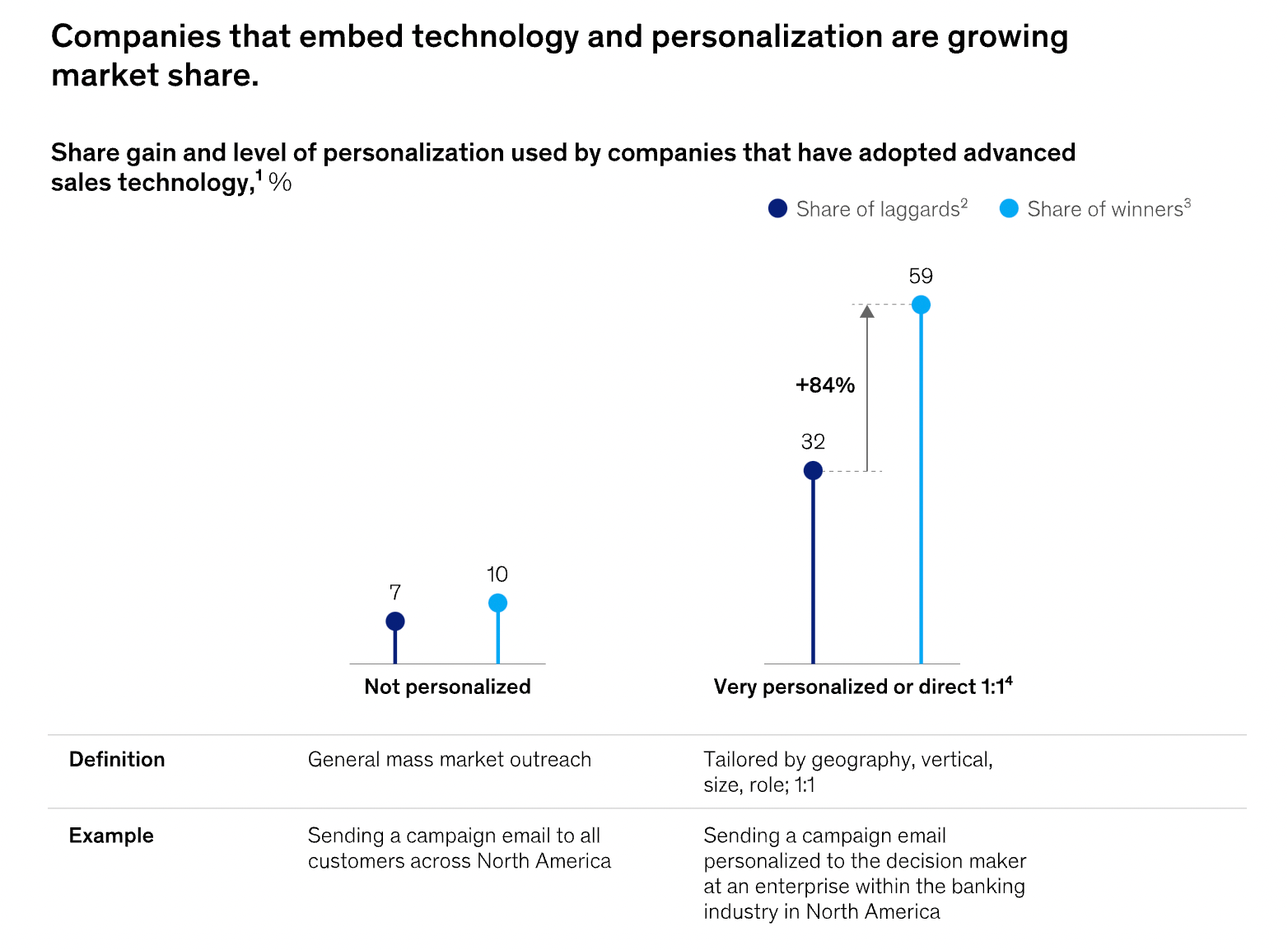

The use of analytics in crafting highly personalized customer interactions isn't just an option—it's a distinguishing feature of winning B2B firms across industries. Forget the myth that personalization is only for B2C—B2B leaders are also using advanced strategies like predictive analytics to meet individual customer needs before they even realize they have them. The gains speak for themselves. Companies that effectively use one-to-one personalization report a 77% increase in market share, according to McKinsey.

The impact of investing in personalization technologies is direct and significant. It's telling that 59% of companies that saw over 10% growth in market share also adopted new sales technologies like chatbots. In contrast, only 32% of companies experiencing more than a 5% drop in market share made similar technological advances.

10. Dynamic pricing will become more common

It’s the beginning of the end for the era of static pricing. B2B companies are embracing dynamic pricing strategies, shifting from a one-size-fits-all approach to a flexible, data-driven model.

That’s because the next-generation B2B buyer expects the same kind of pricing transparency and flexibility they get in B2C markets.

As vertical B2B marketplaces gain popularity, they're not just connecting buyers and sellers—they're reshaping expectations around pricing. In 2023, digital commerce platforms make up 45% of organizations' revenue, a significant jump from 36% in 2019. Buyers now want an array of options, from shipping to features—but above all, they want competitive pricing.

Today's B2B marketplaces can handle dynamic pricing alongside custom orders and complex requests. Buyers are looking for more than just relationships, seeking efficiency and the best value for their money.

The art of dynamic pricing isn't one-dimensional. Algorithms now adjust pricing based on a mix of factors, including competition, supply and demand, and even time. From cost-plus pricing to value-based models, vendors now use diverse strategies to remain competitive and maximize their margins.

For instance, adjusting prices on slow-selling items can help clear out inventory, while timely discounts can boost demand for popular products. It's not just about reacting to the market; it's about proactively shaping buyer behavior.

11. Product discovery data will be essential

The days when business buyers relied solely on trade shows and catalogs are gone. B2B buyers are paying attention to personalized recommendations, proving the vital role of data-driven discovery in influencing purchases.

B2B organizations will begin leaning more on quality data. Today’s buyer expects product, pricing, inventory and shipping information to be accurate across all channels. Organizations will pivot toward modular and API-first solutions with flexible data models, so they can better access product discovery data.

This way, you can understand what customers see , what they add to shopping lists, and how they behave. Understanding their shopping journey data will become invaluable for offering personalized experiences without hassle.

This isn't confined to your owned channels. Product discovery data is as crucial on third-party marketplaces as it is on your own platform. Omnichannel isn't just a buzzword, it's the only way to meet today's customers where they are. The studies vary, but, on average, it takes anywhere between 8 and 10 touchpoints with B2B buyers before landing a sale.

Data shouldn't just influence your decisions, it should drive them. Market leaders use product discovery data to forecast demand, streamline inventory, and even inform product development.

B2B sales growth opportunities outweigh the costs

The sales growth opportunity of ecommerce may now outweigh related potential costs for B2B businesses, and we’re seeing meaningful movement to reflect that. The number of B2B decision-makers willing to spend as much as $10 million or more on an ecommerce transaction has increased by 83%.

This trend holds particularly true in China, India, and the United States, as well as in global energy and materials (GEM), telecommunications, media and technology, and advanced industries sectors.

As we head deeper into 2024, keep these B2B ecommerce trends in mind, and begin implementing the ones most aligned with your product offerings. Staying on top of new marketing strategies and tactics keeps your business at the forefront of customers’ minds.

And we’re here to help at every step of the way. Whether you’re hoping to keep your ecommerce site up to date or build the best B2B commerce experience around, we’re committed to helping make every commerce moment a great one. With Shopify as your B2B ecommerce platform, you’ll be ready to take on whatever challenges or trends come your way.

Get in touch with us and learn more about how we can help.