As a retail store owner, you likely have a long list of owned assets that keep the lights on—sometimes literally. Everything from store furnishings to high-grade lighting systems are investments. The section 179 tax deduction exists to write off those items and prevent businesses from ending the financial year with a higher than necessary tax bill.

But, much like any small business tax-saving tip, the Internal Revenue Service (IRS) has strict rules around how section 179 deductions can be used. This guide shares what those are, with guidance on how to claim the deduction on your store’s next tax return.

Note: This guide is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional accountant.

What is the section 179 tax deduction?

The section 179 tax deduction helps businesses claim immediate tax relief on equipment they purchase throughout the tax year.

If you’ve recently purchased a new point-of-sale (POS) system for your retail store, for example, that would qualify for a section 179 tax deduction. You’re able to claim tax incentives and recoup the full purchase price from your annual gross income—and therefore, reduce your tax liability.

Section 179 deductions are an incredibly valuable tool for small businesses to manage their cash while allowing them to continue investing in their businesses.

How does section 179 work?

Now that we know what section 179 is, let’s take a look at how it works.

Who and what qualifies?

Any company that makes business equipment purchases can claim section 179 tax deductions. Qualifying equipment for brick-and-mortar stores includes:

- Computer equipment

- Custom shelving or storage

- Visual merchandising displays

- In-store retail technology, such as security cameras or foot traffic counters

If a business wanted to renovate their storage front, they could claim costs like new flooring, custom lighting, new paint or drywall, partitions, shelves, or countertops under section 179. They could also claim replacement HVACs or a roof, as well as the installation of a new security system.

All equipment must meet the following criteria to claim tax cuts:

- Physical—not patents or copyrights

- Purchased outright—not leased or borrowed

- Not acquired from a relative, such as a sibling, spouse, or parent

💡 PRO TIP: The cost of your Shopify POS plan, apps, and hardware you purchased for your retail store qualify for Section 179 tax deductions.

Do business vehicles qualify for section 179?

You might see section 179 dubbed the “Hummer deduction,” because many business owners used the tax loophole to write off vehicle costs. The IRS subsequently tightened the criteria for claiming section 179, with some Ford SUVs, business vans used to make local deliveries, and heavy construction vehicles being amongst the few qualifying vehicles.

Usage of assets

There also are strict rules on how qualifying equipment is used. To claim a section 179 tax deduction, the equipment in question must be:

- Used for business purposes more than 50% of the time. You’re unable to claim section 179 if a mobile phone is used to take personal calls three-quarters of the time, for example.

- Actively used in this financial year. If you only started using a security system this year but you bought it back in 2020, for example, you’d claim the section 179 deduction in this year’s tax return.

Claiming 179 deductions

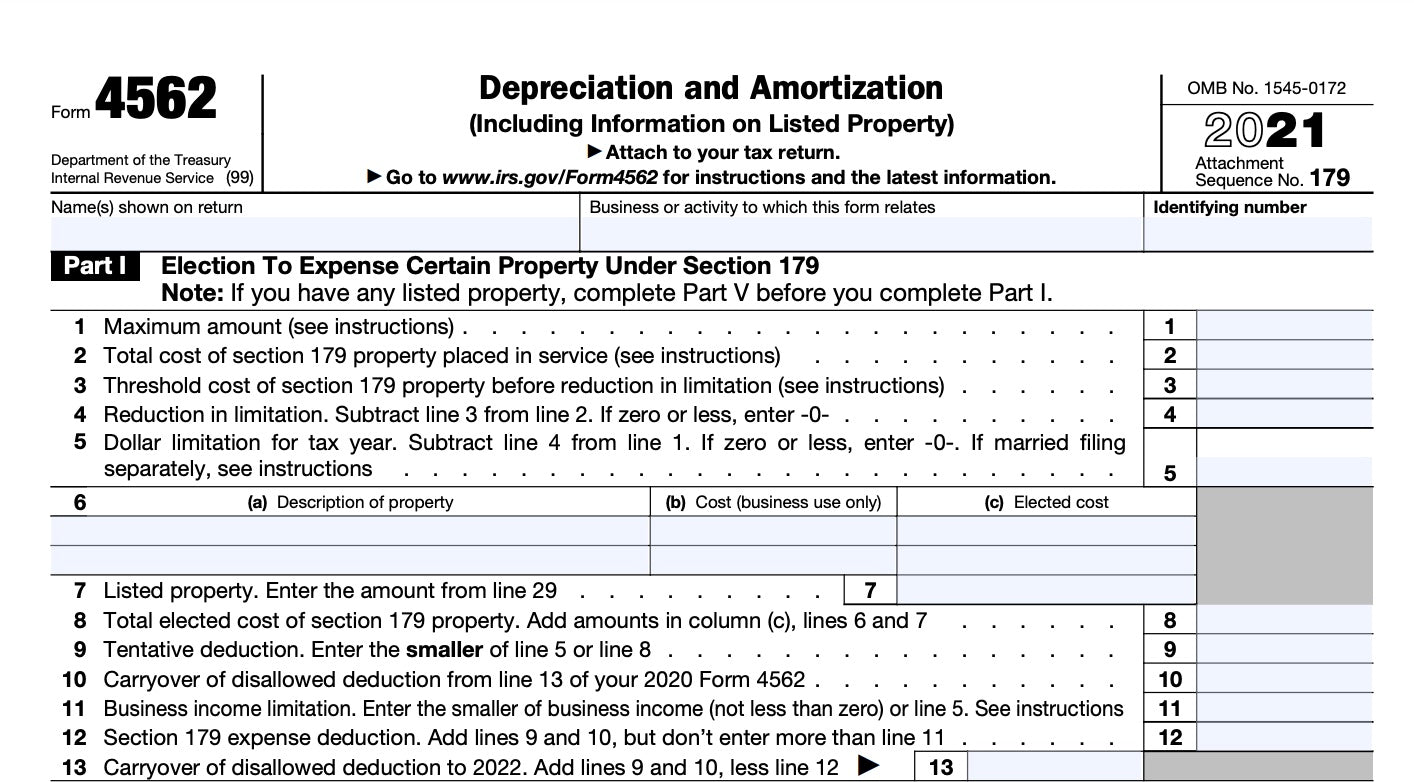

Did you make a new business purchase that meets the criteria for section 179 tax deductions? Use Form 4562 to make your claim.

Include a description of the equipment purchased, the purchase price, and how much you’re claiming.

What are the limits of section 179?

The IRS has limits on how much you’re able to deduct from your tax bill using section 179.

In 2022, the total amount you can write off using section 179 is $1.08 million. The limit on total amount of equipment purchased is $2.7 million.

Surpass this limit and the amount your store can deduct from its tax bill reduces dollar for dollar.

The difference between section 179 and bonus depreciation

Bonus depreciation is another type of tax relief for small businesses.

“Traditionally, depreciation is the matching of expenses during a particular period and spreading this out over the expected useful life of an asset,” Riley Adams of Young and the Invested explains. “This way, your books account for normal wear and tear as the asset loses its value over time.”

However, bonus depreciation is different from section 179, since it allows companies to write off 100% of the money they’ve spent on depreciating assets (such as property, machinery, or furniture), rather than 100% of the purchase price in the first year of use.

Unlike section 179, there’s no depreciation deduction limit when using this model—you’re able to write off millions using bonus depreciation. The amount you’re claiming can also be greater than your business’ income.

Section 179 deductions cannot exceed your business’ taxable income, while the bonus depreciation amount can. The depreciation can create a net loss, allowing you to offset future taxable income.

“Many types of property can qualify for either section 179 or bonus depreciation,” says Tim Yoder, Tax and Accounting Analyst at Fit Small Business. “If property qualifies for both section 179 and bonus depreciation, taxpayers should usually choose bonus depreciation, since there is no maximum limit.”

The 2017 TCJA allows an up to 100% deduction on certain items with a depreciation life of under 20 years (Section 179)🧠

— Grant Dougherty EA, MBA (@doutaxsolutions) February 9, 2022

On average, 20%-40% of a building components fall into this category💰

That’s potentially a $200,000 to $400,000 deduction on a $1 million property🤯

Claim your section 179 deduction

Section 179 tax deduction is worth looking into if you’re purchasing new equipment for business use. As a way to lower your tax liability, everything from retail technology to high-grade security systems can be written off if it qualifies for section 179 deduction.

Have more questions? The world of tax is complex. We recommend consulting a small business tax adviser when using section 179. They’ll help you find ways to make tax season less stressful—and less expensive.

Read more

- 20 Best Mobile Retail Apps to Seamlessly Run Your Store

- How to Increase productivity and identify productivity killers

- 10 Quotes to Inspire Entrepreneurs on Their Retail Journey

- Product Knowledge in Retail: Importance, Types, Training, and Improvements

- Preventing Burnout: 10 Ways to Stay Productive Without Getting Overwhelmed

- What is Retail Management? Definition, Responsibilities, and Future Outlook

- HR Chatbots: How AI Can Help Onboard and Train Your Retail Employees

- Stuck in a Rut? 5 Reasons Retailers Should Consider a Business Coach