After nearly ten straight years of net losses — 34 consecutive quarters to be exact — last May, Jones Soda did the impossible:

“Today, we are very happy to report outstanding results for the first quarter of 2016. Our case volume results are [up a] remarkable 73%, revenues [are] up 48% and we realized a net income of $49,000 for the first quarter.”

That was Jones CEO Jennifer Cue on the company’s Q1 2016 Earnings Conference Call. Technically, Jones’s income had moved into the black as of Q3 2015, but that was due to spending cuts, not increases in volume or revenue.

All that’s changed.

By the end of 2016, revenue topped $15.7 million and gross profits, $4.1 million.

The question is …

How does a once top-of-the-mountain manufacturer end up on the brink of destruction only to rise from the dead?

Even more to the point, what can your business learn from Jones’ resurrection?

The Rise and Fall of Jones Soda

Founded by Peter van Stolk in 1986, Jones Soda Co. began its life as a beverage distributor in Western Canada. Over its first decade, two moves set Jones apart from its near limitless supply of competitors.

First, the company adopted an “alternative distribution strategy” by selling uniquely flavored soda products in venues like music and clothing stores, tattoo and piercing parlors, and sporting good shops. Second, the company began featuring customer-submitted photographs on its labels as a way to create an emotional attachment to the brand.

And it worked.

In 1999, Jones began selling “My Jones” through its website to meet the growing demand of fans wanting to get around the official photo selection process. One year later and over 85% of its revenues came from the Jones Soda brand itself.

In an effort to align itself even more with its fanbase, the company moved from Canada to Seattle, Washington.

By 2005, Jones was a bonafide success. Profiles in Inc, Entrepreneur, Bloomberg News and Fast Company chronicled the company’s “30% yearly revenue growth in a flat beverage market,” major deals with distribution partners like Starbucks and Target, and $30 million in annual revenue, which was soon to reach $39 million.

At the time, one ingredient united Jones’ success: its relationship with its customers.

As Fast Company wrote:

“Virtually everything about a Jones Soda, from labels to flavors, comes from customers. That's important because ‘the reality is that consumers don't need our s***,’ van Stolk says unapologetically. The world wasn’t necessarily clamoring for another soda, even if it tastes like blue bubblegum…‘People get fired up about Jones because it's theirs.’”

The bubbles, however -- or whatever your favorite soda-related pun might be: going flat, on ice, broken bottles -- didn’t last long.

In 2007, the company announced an $11.6 million loss and in 2008 -- after another $15 million hit -- downsized 40% of its workforce.

The sudden turn was attributed to two factors: first, the “Great Recession” of 2007-2008 that left few businesses untouched and, second, a failed attempt to expand into canned-soda against competitors like Coca-Cola and Pepsi.

From 2007 to 2016, Jones would see five different CEOs come and go … all without a single profitable year:

Rising from the Dead

That was landscape Jennifer Cue inherited when she returned to Jones in 2012 to serve as CEO. Cue wasn’t a newcomer to Jones, her history with the company dated back to 1995 when she began serving on the board.

So where had they gone wrong?

“We lost our edge,” Jennifer told MyNorthwest.com shortly after her appointment:

“We got too corporate along the way. There were numerous leadership changes which were a little bit too corporate for the company. We launched a lot of different products along the way, and we lost our focus on Jones Soda."

On top of losing focus “on Jones Soda,” Jennifer also attributed overspending to the company’s near demise:

“When I came back, we were about a $17-million-in-revenue company spending $11 million before manufacturing costs and losing $7 million annually. Cuts were necessary across the board, and our expenses had to be reined in.”

Of course, the worst thing you can do as a CEO facing that kind of situation is not lead by example.

“So in addition to reducing our spending on things like marketing and advertising as well as moving our headquarters to cut the rent in half, I came in as CEO at a very low salary offset by equity. Shortly after that, the entire board took a major pay cut too.”

And that wasn’t the only way Jennifer put her money where her mouth was.

In August of 2014, she exercised options to acquire 1.8 million shares of Jones, which injected over $500,000 into the company itself.

Over the following years, that number would rise to $680,000:

“I want to go big, but I want it to be the right kind of big. So we put into place things like a variable commission program for our sales team and started tying the company’s performance to the employees’ own bottom lines.”

In other words, Jennifer infused Jones with a fresh spirit of entrepreneurship. This didn’t just mean getting lean on expenses; it also meant investing heavily in surrounding herself with the right people.

One of those right people was Cassie Smith, Jones’ ecommerce manager and “ops ninja.”

Jones’ Move to Shopify

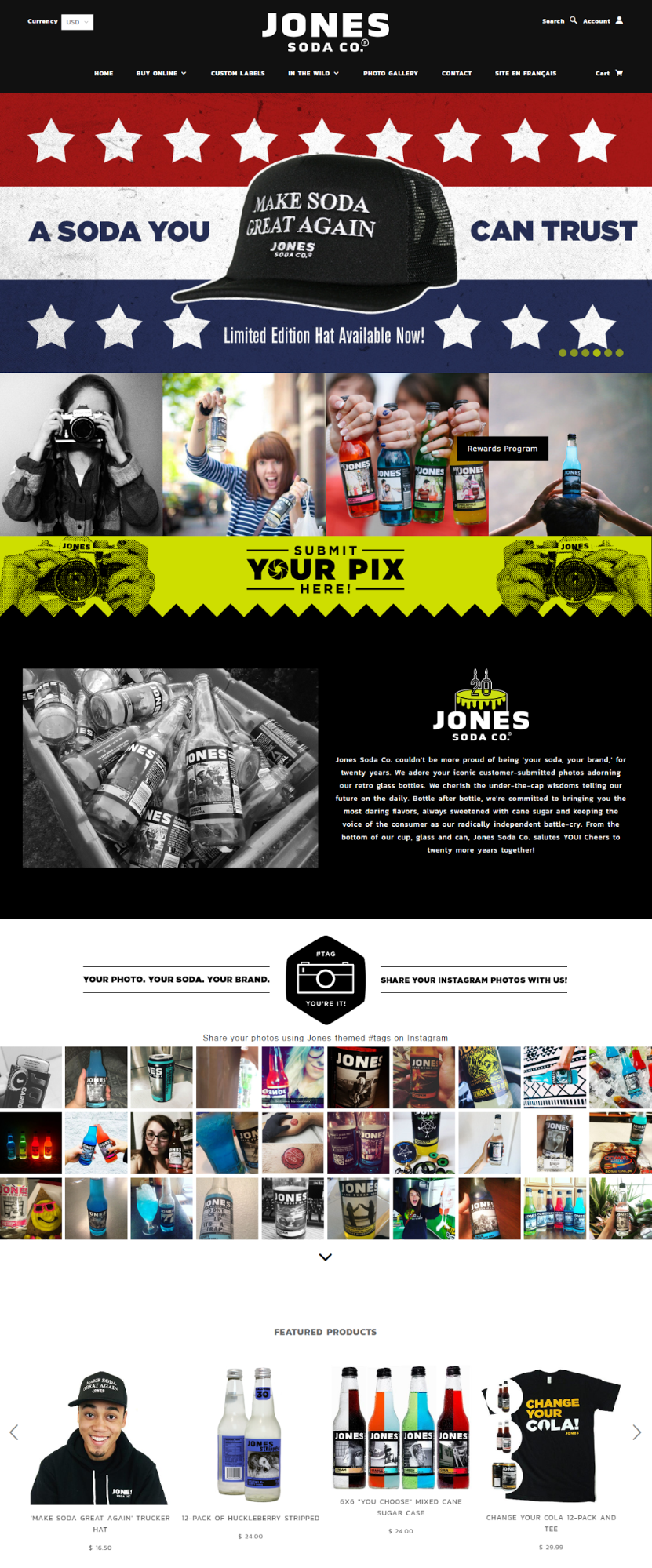

If lean entrepreneurship describes Jennifer’s approach — an approach that was officially enshrined into Jones’ mission statement last year, “We create innovative products that celebrate the individuality of our consumers and ourselves in a responsible and profitable way.” — then Cassie was the perfect fit.

In Jennifer’s words, “Cassie breathes this in managing her online business. She wants growth but is incredibly effective at making sure it’s profitable too. She’s young, she’s learning, and she’s brilliant.”

Kind sentiments, certainly, but talk to Cassie and while profitability tops her list of reasons why Jones decided to move from Magento to Shopify…the real pain was something a bit more pointed:

I just wanted to print some damn postage and stop getting calls from people who couldn’t use the site.

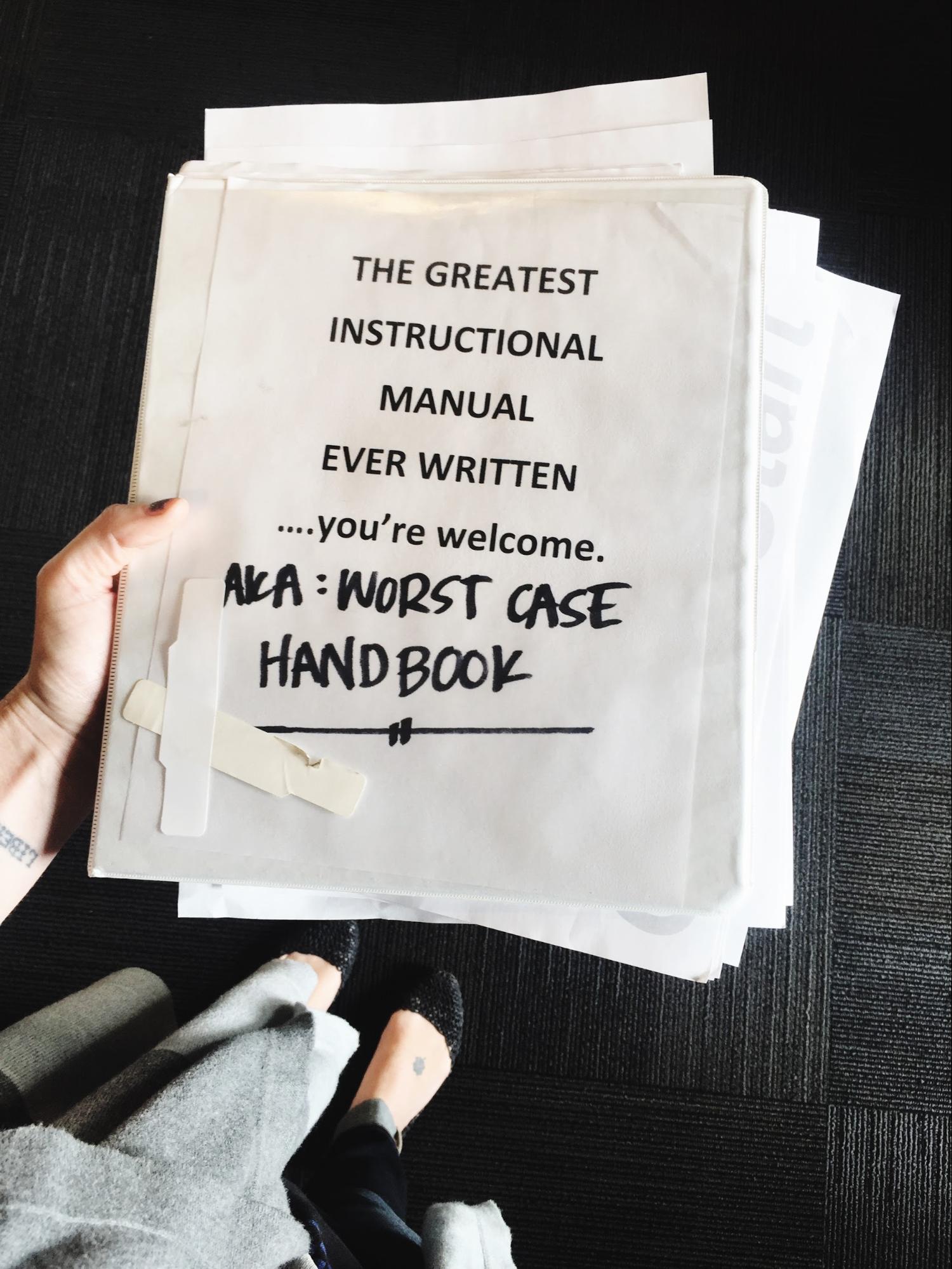

“I used to have to print out all the orders manually and retype them somewhere else, which is where our old-school instruction manual came from. Plus the old site hadn’t been updated since 2007. It was old as hell.”

Moreover, Cassie’s team felt constrained by what they couldn’t do in the old system:

We could have spent a bunch of money building a script to get our shipping station and website to talk to each other. But at the end of the day, our website itself still sucked.

Amidst those pains, in December of 2015, Cassie discovered their contract with Magento was up at the start 2016. They had all of four weeks to go from board approval to live website:

“It was terrifying. I knew some basic HTML from back in the MySpace days, but I wouldn’t call myself a developer by any means. But we set about the project. I cobbled together what I could — taking my laptop home with me at night and on the weekends — and leaned on our Merchant Success Manager, Cassidy Traver, to do the rest.”

When the fateful day came, the Jones ops team was ready:

As Cassie puts it: “I love my in-house developer Jordan, but with Shopify I didn’t have to use him to make changes. I could do it myself, and that felt freeing.”

The same freedom Cassie experienced from technology getting out of the way, Jones’ visitors experienced too. The new site gave control back to their customers, made buying and interacting easier, and ended the “Help me! I can’t find what I’m looking for” calls.

Best of all, the romance between Jones and Shopify hasn’t stopped:

“I fell in love with the Shopify app structure. Implementing doesn’t require a big commitment or custom build, so we can experiment a ton and launch almost immediately.”

“Our most recent contest with Microsoft grew our email list by 40% and took just a few hours to set up using Shopify, Jotform, and MailChimp. I feel a lot of its success rests on the freedom we have to play. That freedom didn’t exist before.”

Cassie Smith, Jones Soda Ecommerce Manager

Back to What Worked

Today, Jones Soda has returned to the root of its success: customers.

In fact, being customer centric extends from the way it creates new products — like Nuka-Cola Quantum in celebration of Fallout 4 — to how the team talks about buyer personas in their marketing: “the people are the flavors.”

That same focus even extends to practical considerations like shipping liquids in glass.

To do that, Cassie’s team found what she calls the “magical number” of cubic size to weight, built “one badass box,” and have developed “intimate personal relationships with carriers so that customers feel confident and are quick to forgive when breakage happens.”

After 34 straight quarters without a profit and $58 million in losses, Jones Soda did the impossible.

How?

By going back to what works for all businesses. As Jennifer Cue puts it:

You don’t have to spend your way to success. You just have to love the people you serve.

Read more

- How Bohemia 4X’d Sales After Migrating & Supports the Survival of Artisan Crafts

- After 10X Holiday Ecommerce Growth, Blenders Eyes More This Black Friday

- How Laird Superfood Is Using the Shopify Plus Wholesale Channel to Increase Sales 550%

- How a South Korean Entrepreneur Uses Homemade Cookies to Grow a Little Girl’s Fashion Brand 50% Every Month

- [Case Study] How Lauren James Co. Used Shopify Plus to Rapidly Grow Brand Awareness & Sales

- How Discount Hockey Lifted Mobile Conversions 26% and Uses Shopify Plus to Sell On & Off the Ice

- Why Marshawn Lynch Chose Shopify Plus to Power His Flagship Store Two Days Before Retiring from the NFL

- How a Wilted Bouquet Sparked a Romance & Business That Delivers Roses That Last All Year

- How to Optimize Your Mobile Checkout Flow

Want that same freedom?

Come experience the speed, security, and support that over 400,000 merchants already trust.

By putting control back in the hands of merchants, marketers, and managers, Shopify empowers you to drive growth, boost revenue, and delight customers.

Find out what happens when technology gets out of the way so you can ...

Build your business,

instead of worrying about your website.