International selling is a business’s single greatest growth opportunity, with cross-border ecommerce increasing 344% since 2016 and totaling $1.2 trillion in 2022. But why is it so hard to capitalize on? When you sell across borders, the liability and complexity compound as you enter more geographies: you have to deal with evolving duties, taxes, and regulations per market, not to mention the risk of fraud and currency fluctuations. This makes global expansion a slow and costly endeavor that can cause brands to leave money on the table and miss opportunities for growth.

This is why leveraging a merchant of record can be a game-changer for ecommerce brands looking to expand globally. Merchant of record products offer a solution to the overwhelming financial responsibility, liability and operational work business owners face when entering new and overseas markets. Their role is to make global selling simple, so you can expand rapidly to international markets without getting into the weeds of country-level tax and regulation.

Let’s take an in-depth look at what a merchant of record is and how leveraging one can benefit your business.

What is a merchant of record (MoR)?

A merchant of record (MoR) is the company that sells products or services to the final customer, and the legal entity those customers pay when making a purchase. The MoR takes on the financial responsibility and liability of payments, billing, sales, taxes, refunds and chargebacks, and more.

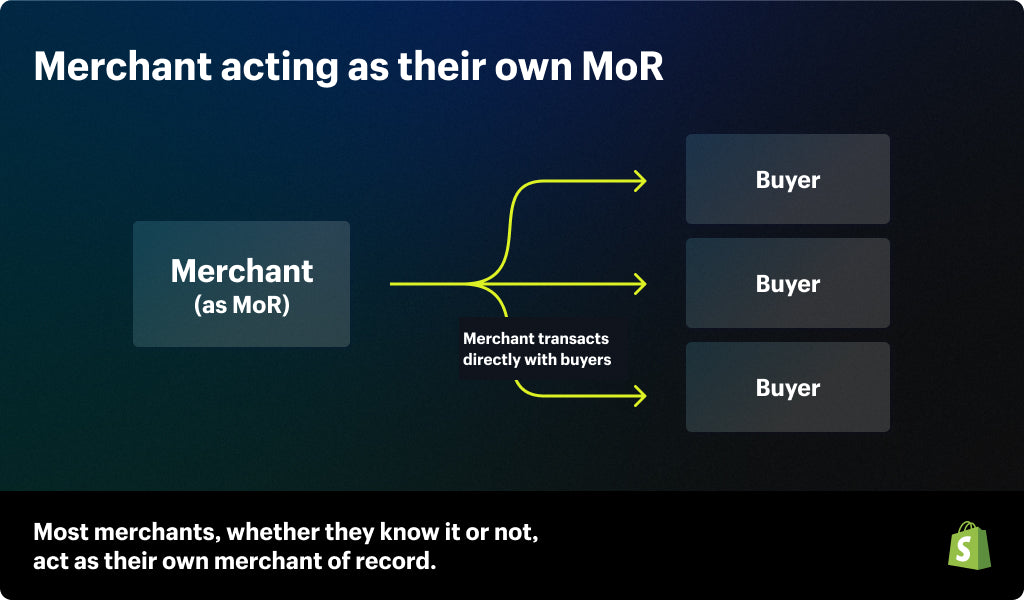

In a traditional business model, most brands act as their own MoR without even knowing the term for it, as they are solely responsible for their own sales, taxes, and refunds. As a business owner looking to expand, you can continue to act as your own MoR, but each new market will bring a whole new set of financial and legal complexity that can slow down your business. Alternatively, a third-party solution can act as an MoR on your behalf.

Put simply, an MoR handles how you, the merchant, get paid for your services/products when selling globally. Its roles include (but aren’t limited to):

-

Handling international payments

-

Maintaining merchant accounts

-

Being liable for transactions

-

Collecting and remitting sales taxes (including local taxes, if applicable)

-

Keeping up to date with local sales and tax laws

-

Managing interactions with local tax authorities

Using a third-party MoR allows you to focus on other parts of your business, like creating great products and developing marketing to drive awareness to overseas customers.

Managing your own global selling vs. using an MoR

Acting as your own MoR

An MoR solution takes on much of the complex work that comes with selling internationally. If you choose to keep these tasks in-house, you’ll be responsible for everything that must occur for a transaction to take place. This isn’t simply about receiving the money your customer owes you for purchasing your product. In global markets, being your own merchant of record also means:

-

Registering for and collecting taxes stipulated by local laws and regulations

-

Ensuring your payment methods comply with PCI’s (Payment Card Industry) data security standards

-

Processing disputes such as chargeback requests and customer refunds

-

Managing credit/debit card fees

-

Complying with local import regulations

-

Managing fraud on international orders

-

Taking on the risk of currency fluctuation on refunds

Given the intricacies, getting this set up for multiple global markets can require a significant investment of time—and don’t forget the financial costs of hiring the right personnel and tools.

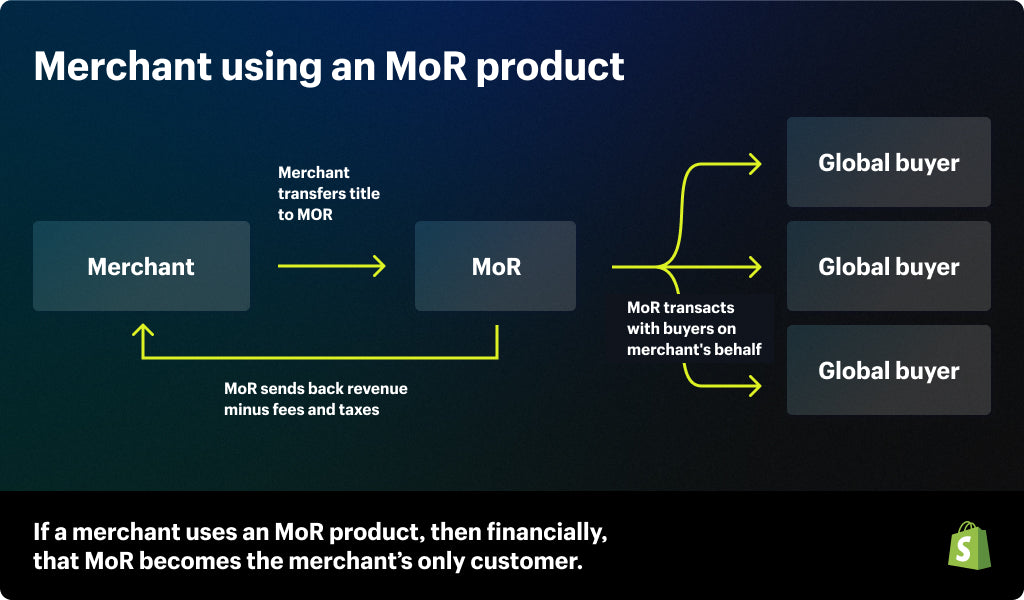

Using an MoR to sell globally

The good news is that instead of handling the complex financial responsibilities of selling internationally, you can bring in a partner to simplify the process. A third-party MoR solution sells your products on your behalf and assumes responsibility for processing payments, tax and duty compliance, and any fraud or financial risk. On paper, they become the legal sellers of your product and their company name will appear on payment transactions.

With an MoR arrangement, two transactions take place:

-

International customers buy your product via your ecommerce store. However, when they purchase, they’re officially acquiring the goods from your MoR partner, the legal seller of your product. Note: Your MoR partner does not hold any inventory—it’s simply their name on paper.

-

Upon receiving a purchase notification, your MoR partner buys the product(s) and resells it to your international customers. On your end, administratively speaking, your MoR partner is the only buyer.

MoRs are able to support this business model because they have bank accounts and entities in countries around the world. By using the MoR, you're leveraging the payment and tax infrastructure that they already set up, so you don’t have to set it up yourself. That means transactions with customers abroad are acquired locally through the MoR. Your customers won't get hit with an FX (foreign exchange) fee from their bank because they are paying a local institution in their local currency—making the transaction experience feel local.

Here’s an illustration of the process.

-

An international customer purchases from your ecommerce website.

-

MoR provider collects the payment on your behalf, including relevant taxes and duties.

-

MoR provider takes title of the items in your customer’s order.

-

The MoR provider resells the products to the end customer, prompting you, the merchant, to ship and fulfill the order.

-

The MoR provider sends back revenue to you, the merchant, for international sales, minus fees and taxes.

Working with an MoR provider is an effective way to grow internationally while significantly reducing financial liabilities. Not only do you get to maintain the buyer relationship, you also make it feel like a local purchase. Additionally, you retain full ownership and control over the customer experience, including product sourcing, product marketing, and building a relationship with your target audience—all without being the seller “on paper.”

Benefits of using an MoR

-

A lean, agile team With every new market you enter comes the labor of creating a payments infrastructure and staying up to date with the ever-changing local regulations on duty and taxes. With an MoR, you can test new markets without having to add to your workforce or devote countless hours to managing the complexity of global selling.

-

Lower operational costs Given the legalities involved in international financial transactions and payments, handling this internally often means hiring a lawyer or accountant (or both), which can be costly. An MoR service takes on these tasks, saving you from contracting additional third-party services.

-

A localized buyer experience MoR providers commonly help to localize the shopping experience by offering global buyers local currencies and payment methods. This can take brands years to achieve if they set it up for multiple markets independently.

-

Managed compliance MoR providers help to ensure compliance—not only with PCI, but also with the local laws of overseas markets, which ranks among the top expansion challenges businesses face. This can be particularly challenging as every country has its set of constantly changing regulations.

-

More time to focus on your business Leveraging an MoR frees you up, so you can focus time and energy on growing your global business however you see fit—whether that’s building your brand, sourcing products, or marketing.

When you should use an MoR

Brands looking to grow and scale in new international markets can really benefit from working with a merchant of record provider. Selling across borders means having more than one set of laws to adhere to, and managing this on your own can be a significant strain on your resources. Even worse: doing it wrong can carry repercussions.

Here are some signs you may be ready for an MoR solution:

-

You’ve already achieved product-market fit domestically and domestic growth has slowed.

-

You’re receiving organic traffic from international consumers, indicating there’s potentially untapped demand for your products in other markets.

-

You’ve started selling in one or a few international markets, but conversion in those markets is low.

-

You’ve started selling in one or a few international markets, and buyers are unhappy about surprise fees at delivery.

-

Navigating country-by-country taxes and regulations is weighing down your team; you want to diversify revenue streams while maintaining a small and agile team, all without increasing overhead.

-

You’re considering opening a physical presence in a new market and you want a fast, low-risk way to test that market before making an investment decision.

Managed Markets: The simplest way to go global with Shopify

To help make global selling simple for merchants, Shopify launched Managed Markets, a fully integrated merchant of record product (currently in early access for US merchants).

Available on all Shopify plans, it facilitates expansion into more than 150 markets by breaking down the most common barriers to international growth: international taxes, country-specific regulations, duties and import taxes, and shipping and fulfillment.

Managed Markets offers merchants:

-

End-to-end managed liability

-

Enter new markets at lightning speed while Shopify handles tax complexity per market.

-

Comply with worldwide import restrictions with automated restrictions management, so global buyers view only products they are allowed to purchase in their region.

-

Tap into multiple fraud platforms that ensure you’re protected if card fraud occurs on international orders.

-

Get guaranteed exchange rates for refunds to avoid currency fluctuation risk

-

-

Optimized shipping and fulfillment

-

Access affordable express shipping rates and ship anywhere in the world in one to five days.

-

Collect duties upfront to get rid of surprise fees at delivery with delivery duty paid (DDP) labels and customs documentation that's easy to manage from your admin.

-

Manage your international fulfillment through Shopify or work with our certified partners to fulfill and deliver orders.

-

-

Great customer experiences, everywhere

-

Offer local currency, and popular payment methods to optimize conversion.

-

Access many more out-of-the-box localization tools that come with Shopify's international sales tools.

-

Managed Markets is suitable for businesses of all sizes, so whether you’re a small brand embarking on your first expansion or an established enterprise optimizing conversion in markets you’re already selling to, it’s an ideal solution for every step of your global growth journey. Read more about eligibility requirements to use Managed Markets in the Shopify Help Center.

Why brands choose Managed Markets from Shopify

-

It's easy: Managed Markets removes much of the financial and legal hassle that gets in the way of brands’ global expansion, allowing brands to focus on selling instead of administration and accounting.

-

It's accessible: Managed Markets provides tools previously reserved for enterprise business, right in your Shopify admin. Regardless of which Shopify plan you’re on, global sales are now within reach.

-

It's fast: Managed Markets is a self-serve product within the Shopify admin. A brand can sell into 150 markets overnight; no need to negotiate multi-year contracts or rely on external IT teams to perform integrations with your ecommerce store.

International expansion is an untapped opportunity for a lot of merchants, but the risk and additional expense can be a major deterrent. Thankfully, MoR solutions are ready to take much of that complexity off your hands.

Products like Managed Markets benefit businesses expanding across borders—especially those entering new foreign markets—by offering lower costs, reduced risk, and just-like-local transactions around the world. This way, you can focus on what you do best: creating valuable products and unforgettable buying experiences for customers everywhere.

Merchant of record FAQ

-

What is the difference between a merchant of record and a seller of record? The main difference between a merchant of record and a seller of record lies in their roles. MoR service providers act as the middleman on paper to sell your product. Even though their names appear on bank statements, payment transactions can be traced back to you, the original merchant. On the other hand, sellers of record own the legal rights to sell your products under their name, and for legal purposes, are the original seller.

-

What is the difference between a merchant of record and a payment service provider? PSPs, also known as payment processors, only handle the processing of payments between you and your buyers—i.e., facilitating the transfer of money from their bank accounts into yours. They’re not responsible for anything related to the processing of orders, such as sales compliance, value-added tax collection, disputes, etc. With a PSP, you would still be financially liable. On the other hand, an MoR service provider manages the entire process of an order being placed, including financial transactions. In short, an MoR does everything a PSP does and lots more.

-

Is Shopify a merchant of record? As an ecommerce platform, Shopify itself isn’t a merchant of record. Managed Markets from Shopify is a white label solution that allows merchants to access MoR features natively within their admin. That means merchants using Managed Markets manage everything natively within Shopify and don’t require integrations or interactions with external IT teams. To read more about how Managed Markets is powered, go to the Shopify Help Center.

Read more

- Rebound Growth Hacks: How Cryptocurrency Could Impact your Business

- Rebound Growth Hacks: Designing an Authentic Experience For Your Customers

- Rebound Growth Hacks: Why Your ‘Company Culture’ is Critical to Business Success

- Rebound Growth Hacks: How Brand Storytelling Can Fuel Ecommerce Success

- Growth Strategies from 17 Enterprise Executives & $276.96 Billion