Shopify Balance

- No monthly, account, or transfer fees1

- No minimum balance

- $0 ATM fees charged by Shopify1

- Skip the paperwork and sign up online in minutes

- Get paid as fast as the next business day3

- Automatically set aside sales tax

- Manage your money and business from one place

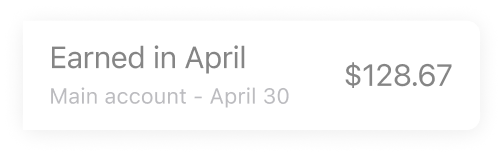

- Earn up to $2,000 cashback every year