Shopify Tax Platform

Sales tax compliance

without compromise

Connect your preferred sales tax service to Shopify, so you can stay compliant with the solution that’s best for your business.

Don’t have a Shopify store? Start a free trial

Remove the sales tax roadblock

Move to Shopify without the cost and risk of managing multiple sales tax solutions.

Keep your favorite tax service

Shopify is partnering with a growing list of trusted tax partners, so you can bring the solution you know and trust or choose a service that’s best for your business’ unique needs.

Use Shopify’s checkout with

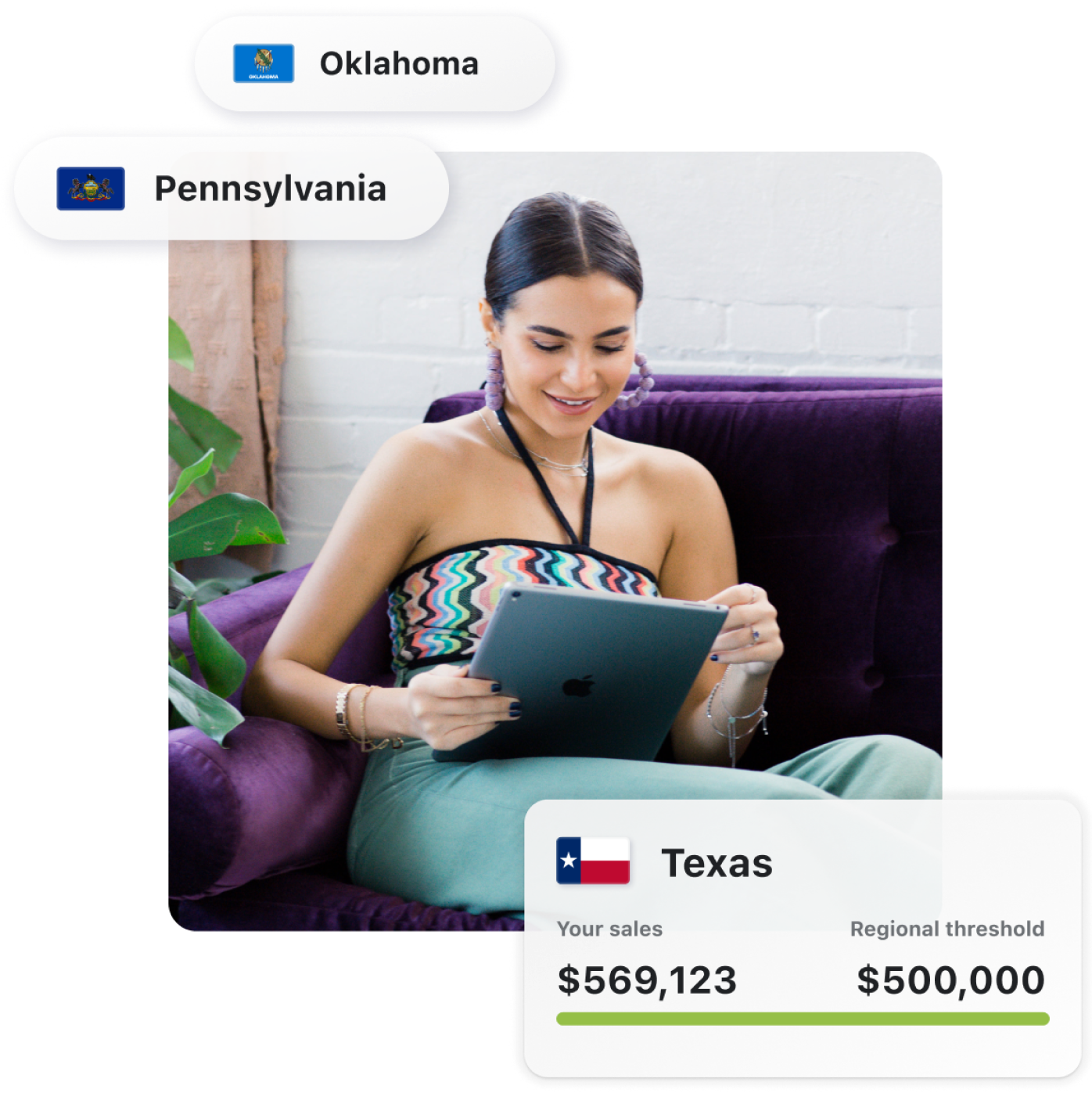

embedded tax calculations

Combine the world’s best-converting checkout* with hyper-accurate tax calculations, exemption management, and insights.

Give your team a break from

all the overhead

Handle all your sales tax needs in a single place. No more reconciling accounts or managing workflows across different platforms.

*Based on a study completed in April 2023 in partnership with a Big Three global management consulting company.

Shopify Tax Platform partners

We're collaborating with the most trusted sales tax services to build long-term integrations you can rely on. More partners coming soon.

Vertex

Vertex, Inc. provides trusted and accurate, global indirect tax and compliance solutions for Shopify businesses. With Vertex, retailers can transact, comply, and grow with confidence by automating tax determination for sales and seller’s use tax (SUT), goods and services (GST), and value-added tax (VAT) for B2B and B2C sales.

Avalara

Avalara helps businesses of all sizes and industries get tax compliance right, delivering cloud-based compliance solutions including tax calculation, tax returns filing and remittance, and exemption document management for various transaction taxes. Our Avalara for Shopify integration supports global tax calculation, like U.S. sales tax and VAT, enhanced international selling capabilities, and aggregates transaction data from multiple channels.

US only

Shopify Tax

Shopify Tax streamlines sales tax compliance in the US, saving businesses time and money. Get address-based rate calculations, nexus tracking, and detailed reports, all integrated directly into Shopify.Disclaimer:

International businesses are eligible to use Shopify Tax to manage their US sales tax needs. Page is in English only.