Shopify Capital

Business funding,

pay as you sell

Take control of your business with founder-friendly capital. Boost your cash flow, keep bestsellers stocked, invest in paid marketing, and more.

Available in select countries. Offers to apply do not guarantee financing. All financing through Shopify Capital is issued by WebBank in the United States.

Powering businesses like yours

$5.1B+ funded

to Shopify merchants

Up to $2M offers

if eligible, with options to renew1

0% equity

no stake taken—ever

Made for entrepreneurs at any stage

Apply online, hassle-free

100% online. Minimal paperwork. No hard credit checks.

Get funds in days, not weeks

If approved, receive funding in as quick as two business days.

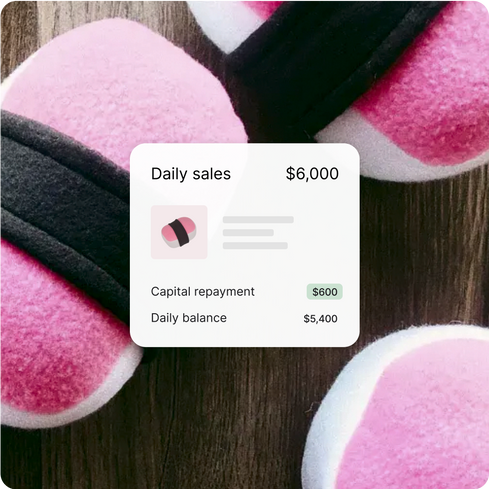

Pay as your business scales

Automatically make payments as a percentage of your daily sales.2

Funding that flexes to your business’s everyday needs

Make your next move with funding as agile as your business. From inventory and marketing to payroll and more—use your funds, your way.

Stock up with inventory financing

Keep bestsellers in stock, lock-in bulk discounts, explore a new product line, and gain more control of today's unpredictable supply chain.

Power brand love with marketing financing

Optimize for SEO, collab with influencers, launch a rewards or referral program, and stay competitive all year long with paid marketing on social, search, and more.

Hire an A-list team with payroll funding

Bring on experts and contractors, compete for top talent, promote your best employees, and explore new ways to foster your team's professional growth.

Business funding the way it should be

| Features | Shopify Capital | Traditional loans |

|---|---|---|

| Funds deposited directly into your account | Shopify Capital | Traditional loans |

| Real-time offers based on your sales(funding up to $2M) | Shopify Capital | Traditional loans |

| No personal credit checks, no compounding interest, no surprises | Shopify Capital | Traditional loans |

| Hassle-free, online application | Shopify Capital | Traditional loans |

| Funding in as quick as two business days if approved | Shopify Capital | Traditional loans |

| Top-up and renew early | Shopify Capital | Traditional loans |

| Flexible, automated payments from your store’s sales | Shopify Capital | Traditional loans |

| Fully integrated solution, so you can run your business from one place | Shopify Capital | Traditional loans |

Renewing Capital

Keep the momentum going

Want more? You could be eligible for additional funding before you’ve fully paid back the current round. Payments won't start until you pay off your balance. No double charges—period.

We used Shopify Capital to experiment with ads. It gave us the confidence to expand our digital eyewear presence.

Shopify Capital

Own your business’s journey

From startup to scale up, now’s the time to unlock new opportunities for your business.

Resources

Growth at scale

Discover how Hell Babes used funding through Shopify Capital to accelerate growth.

Cash flow calculator

Get a full understanding of your business cash flow in five minutes or less.

Support

Learn more about funding your business through Shopify Capital.

Recommended for you

Turn everyday business purchases into cashback rewards with the pay-in-full card designed for entrepreneurs.

Shopify BalanceManage all your business funds from Shopify Balance, a free financial account built into your store’s admin.

Shopify Bill PayEasily pay, schedule, and manage expenses from the same platform where you run your store.

Frequently asked questions

- Available in select countries. Offers to apply do not guarantee financing. All financing through Shopify Capital is issued by WebBank in the United States. Financing through Shopify Capital is either in the form of a merchant cash advance (MCA) or loan depending on location.

- 1Amounts presented are in USD. Offers for eligible merchants are made in their local currency.

- 2Shopify Capital loans must be paid in full within 18 months, and two minimum payments apply within the first two 6 month periods.